EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

IPO destination services

What EY can do for you

We help you evaluate your options for an IPO or secondary listing. We then help you analyze and select the right listing location and stock exchange.

If you have decided to go public, you can choose from more than 100 stock exchanges and listing options worldwide. The right destination is not necessarily in the country where your company is incorporated. It may be where investors best understand your sector or where you are investing to make your brand better known.

The benefit of our large global network is that we usually have an experienced professional working in the relevant geographic market. These practical connections in different markets are invaluable. Meet our team.

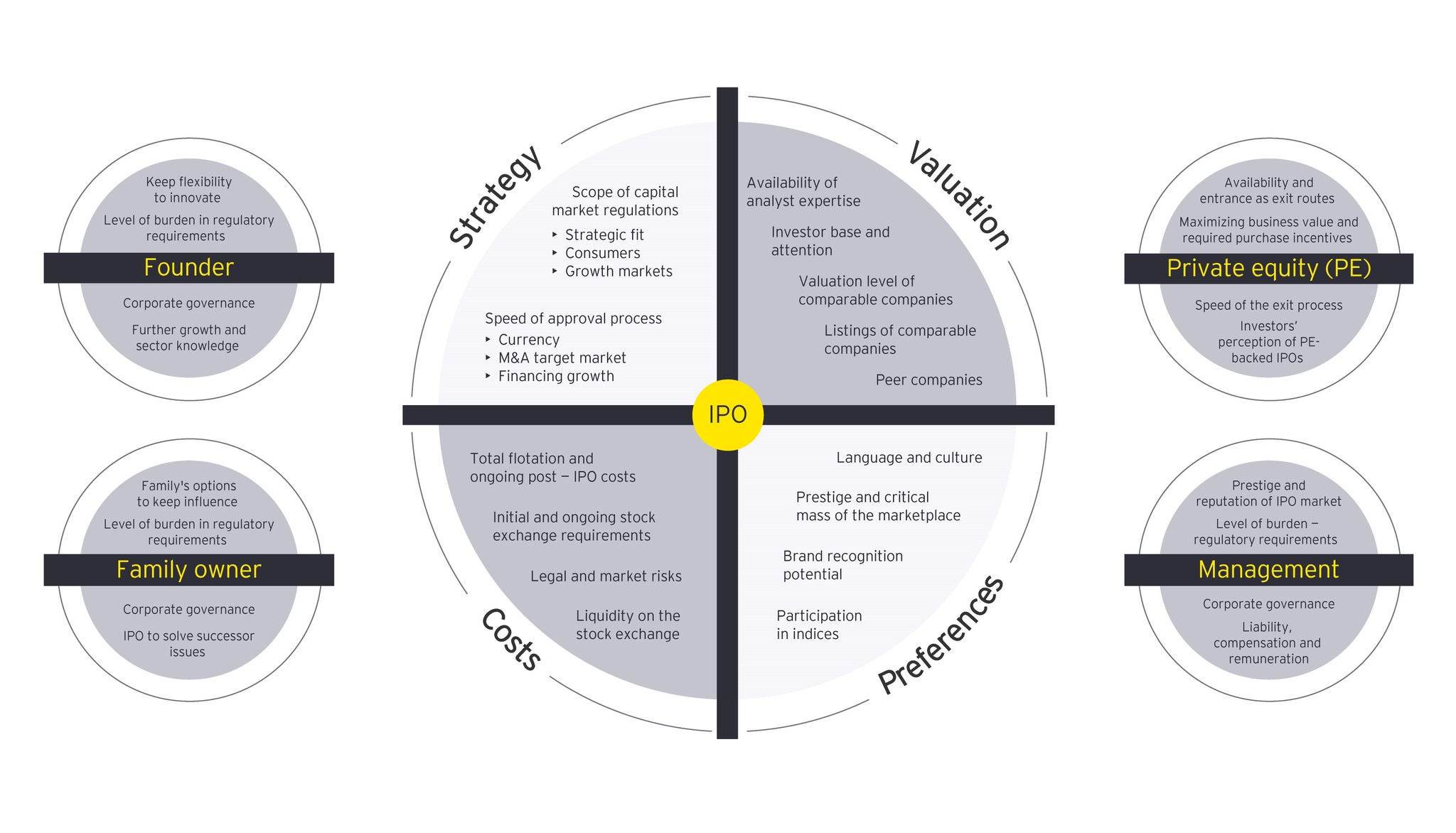

Our experience tells us that there are four main factors that need to be considered:

- Your strategic goals and motivations for going public

- Factors relevant to your company’s valuation

- Shareholder preferences

- Initial and ongoing costs

The regulatory context is also important. Our tools help you compare the rules for listing and ongoing requirements of different exchanges.

We evaluate your company’s legal and tax structures, plus management structure, accounting policies and your approach to investor relations. We help you take the right actions to comply with relevant rules.

Explore our IPO services and insights

The team

Our latest thinking

2025 Global IPO market key highlights and 2026 outlook

The EY Global IPO Trends covers news and insights on the global IPO market for 2025 and an outlook for 2026. Learn more.

Why successful investors focus on sustainability pre- and post-IPO

An EU directive will soon obligate companies to adopt an ESG strategy. In anticipation, pre-IPO candidates should articulate their position. Learn more.

How ESG disclosures impact IPO valuation

IPO valuation is positively impacted by robust ESG disclosure practices.

How an IPO can strengthen family businesses for generations to come

EY Private Perspectives: family businesses should consider opening doors to new sources of capital in order to build a long-lasting legacy.

How we celebrate the world’s most visionary entrepreneurs

EY World Entrepreneur Of The Year™ is the ultimate global competition for entrepreneurs. Learn more.

How equity management can maintain intergenerational ownership

In this webcast, panelists discuss how raising new capital can be used to strengthen the business for generations to come.

Are you exploring the future or just visiting?

Our 2021 Global Private Equity Survey shows that private equity firms navigated the challenges of 2020 relatively well, but they can’t stop now.

How to give an IPO the best chance of long-term success

When becoming a public company, there are strategic considerations before, during and post-IPO. Preparing for an IPO involves deciding on a market, fine-tuning business plans and setting expectations for the public.