EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Link Area Header

-

Discover how EY's digital transformation teams can help your business evolve quickly to seize opportunities and mitigate risks. Find out more.

Read more

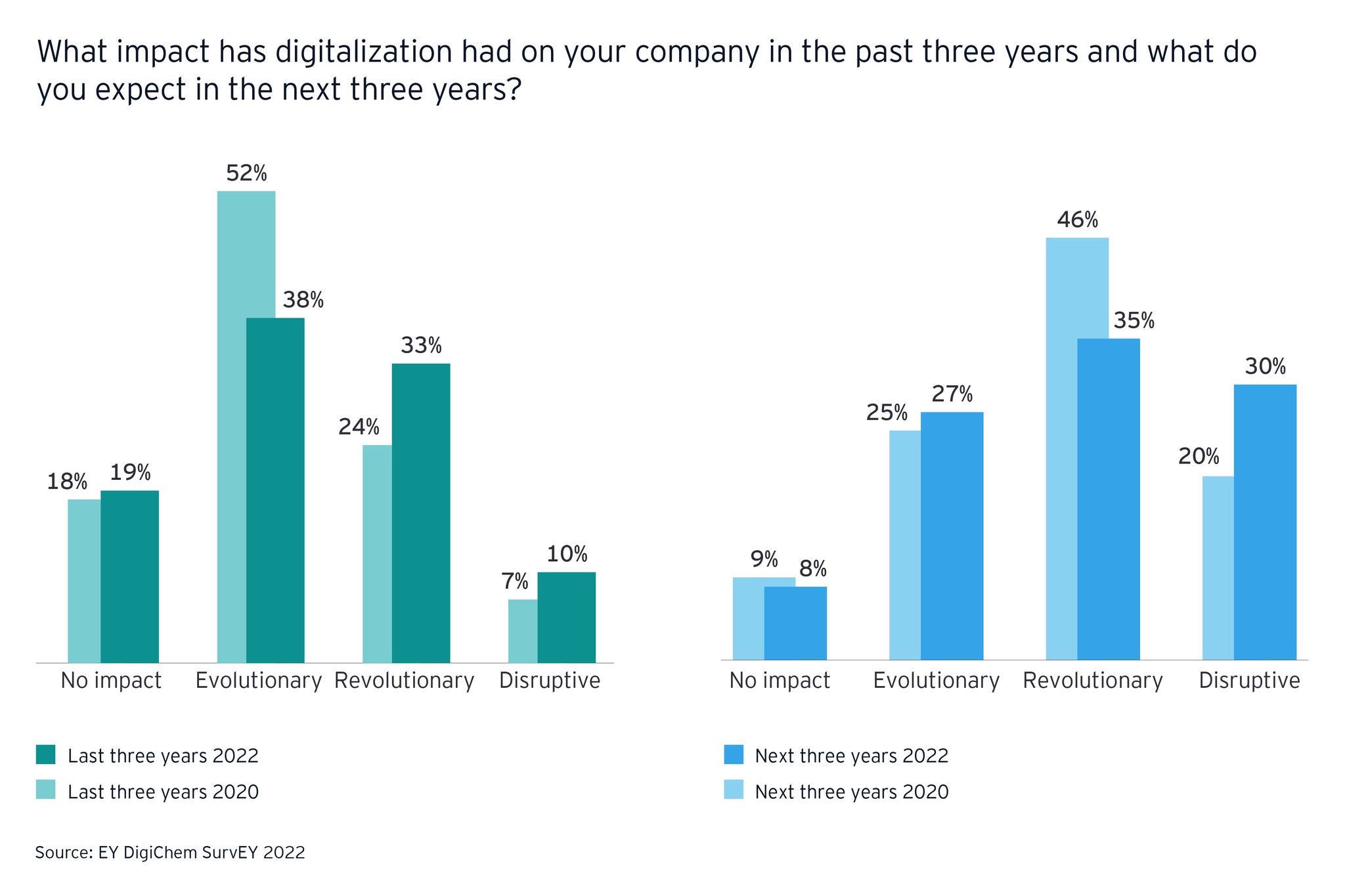

This pace of digitalization is expected to continue as more than 65% of chemical players expect digitalization to impact their business in a more revolutionary or disruptive way.

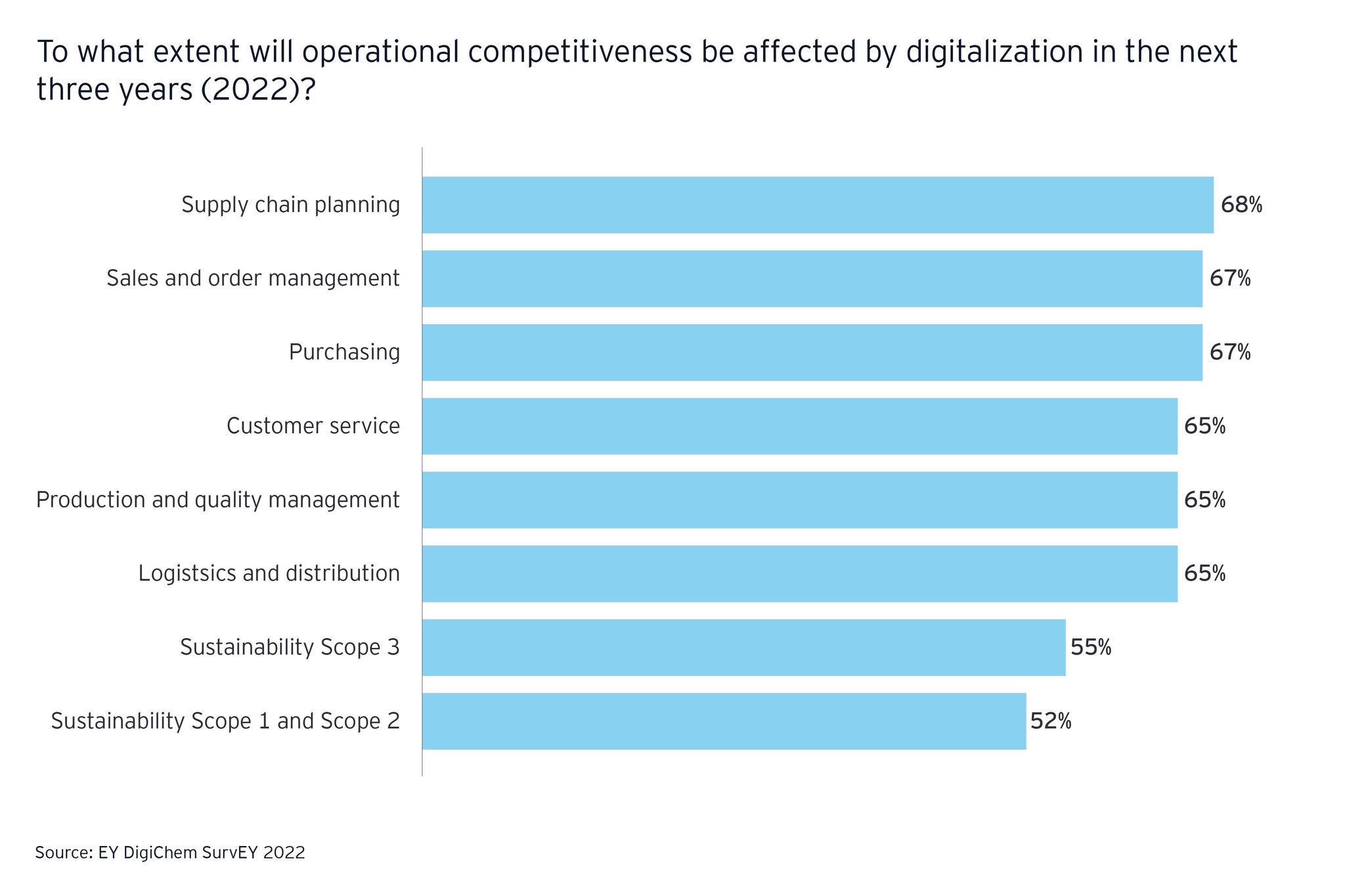

Digitalization must be embedded across functional areas

As the need for an online model rose — for business operations as well as customer interaction — chemical players witnessed the maximum progress in digitalization of administrative functions and customer interface since 2020. Further, with technologies such as automated chemical synthesis, digital tools are expected to be increasingly leveraged for developing new products and services with 80% of chemical players leaning in that direction.

1. Digitalization to develop resilient supply chains

With the recent geopolitical disruption and fluctuating fuel prices, supply chain constraints have emerged as a key challenge for the global chemicals industry. Considering the volatility, it remains a key application area that reaps huge benefits from digitalization — almost 60% of respondents reported that digitalization has highly impacted their supply chain planning in the past three years, and more than two-thirds of survey respondents believe a similar impact would continue over the next three years. As the need for more resilient supply chain networks increased chemical players see value in leveraging digital tools for demand estimation, tracing raw material to sources, real-time tracking of orders, automation at warehouses and ports for sorting and safety and optimizing supply networks.