EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can Help

-

Discover M&A advisory services from EY when you buy and integrate. We help enable strategic growth through integrated mergers and acquisitions, joint ventures and alliances.

Read more -

Our divestiture services can help you with portfolio management to improve value from carve-out, spin-off or joint venture. Get in touch today.

Read more

- Be aware of emerging disruptive new opportunities:

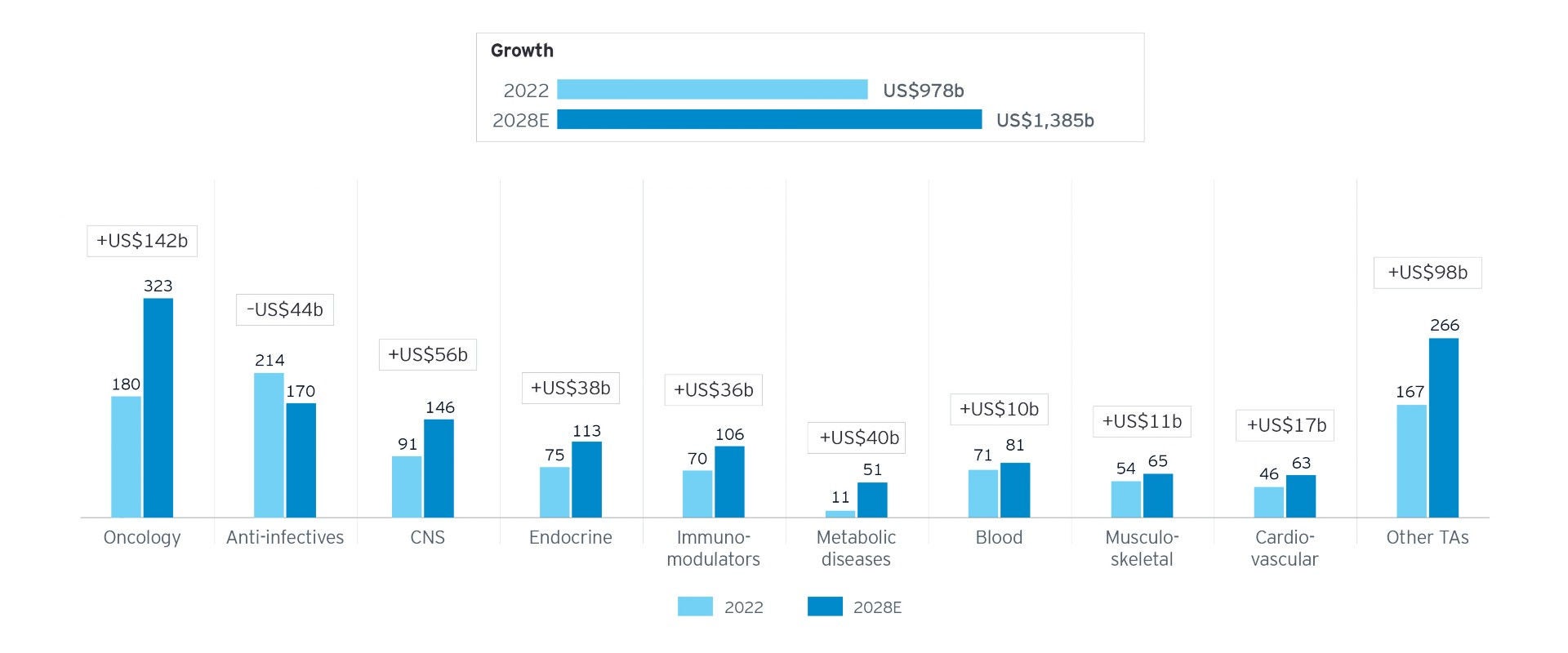

Companies also need to maintain awareness of game-changing innovations that can disrupt the market. GLP-1 receptor agonists have become one of the most prominent of these recent breakthroughs since trial data has increasingly validated the effectiveness of these drugs to control obesity and improve cardiovascular and metabolic health. The high prevalence and unmet need means that the endocrine and metabolic therapeutic areas are forecast to grow US$78 billion in the next five years; the size of this opportunity could see pharma companies rethinking their strategies and directing Firepower towards the space.

- Find the right balance between acquisitions and partnership:

Alliances and partnerships have become a major part of biopharma companies’ innovation strategies. Companies have often used alliances to investigate innovative clinical technology platforms; cell and gene therapy, antibody-drug conjugates (ADCs), and digital technologies have been among the five highest-value areas for alliance investment since 2020. Once these major opportunities begin to translate into commercial realities, companies will be willing to deploy serious Firepower in their direction. In 2023, the ADC market has clearly reached this tipping point. But while other new modalities are still maturing, companies need a mix of alliances and other investments alongside M&A to ensure they have access to new innovations.

- Build the right execution strategies to deliver valuer from M&A:

The challenge of M&A is not only to do the right deals, but to “do the deals right.” To ensure their M&A strategies create value, companies need to get their execution right.

Though every deal brings unique opportunities and challenges, we can identify four ways in which companies can realize, preserve, and enable value through M&A:

- Follow strategy-driven discipline – Successful M&A begins with identifying the target best fits with the acquirer’s growth strategy.

- Perform due diligence and synergy estimation – Two key factors often observed in failed M&A transactions are the underestimation of costs and overestimation of synergies. Careful focus is needed in regulatory, safety and quality standards compliance, as well as potential consolidation in R&D.

- Execute effective M&A integration – It is important for the integration program to promote efficient decision-making and rapid execution. Companies can clearly define how they plan to achieve synergies and how the combined business will be run to enhance value.

- Develop robust M&A processes and roadmaps for the future – Active buyers establish strong foundational capabilities to sustain consistent, repeatable M&A activity, developing playbooks and building teams of highly skilled M&A professionals to execute future transactions.

Looking ahead to 2024, we can confidently predict a major ongoing investment in dealmaking on the part of the life sciences industry. As biopharma and MedTech companies look to navigate a period of ongoing global disruption, investment in external innovation will be a strategic necessity. As our analysis shows, the key challenge will be not only doing the right deals but having the right expertise and execution to extract value from those deals and thus secure future growth.