Winning over consumers will require education, sales and marketing that is targeted, personalized, and that drives home energy transition benefits. And the reward for businesses that invest in this differentiation is significant.

Key questions for:

- Energy providers: How can we tailor experiences and move away from a one-size-fits-all approach to consumers?

- Real estate and property managers: How can we make it easier for people in diverse circumstances, including those living in community housing, renters and those running small businesses, to access clean energy solutions that fit their needs?

- Retail and consumer products companies: How can we partner with other organizations to help consumers understand different clean energy solutions and make better choices that fit their lifestyle?

- Government: What funding options, incentives or education programs can help address the barriers that low-income consumers face when trying to be more sustainable?

3. Value the energy intangibles

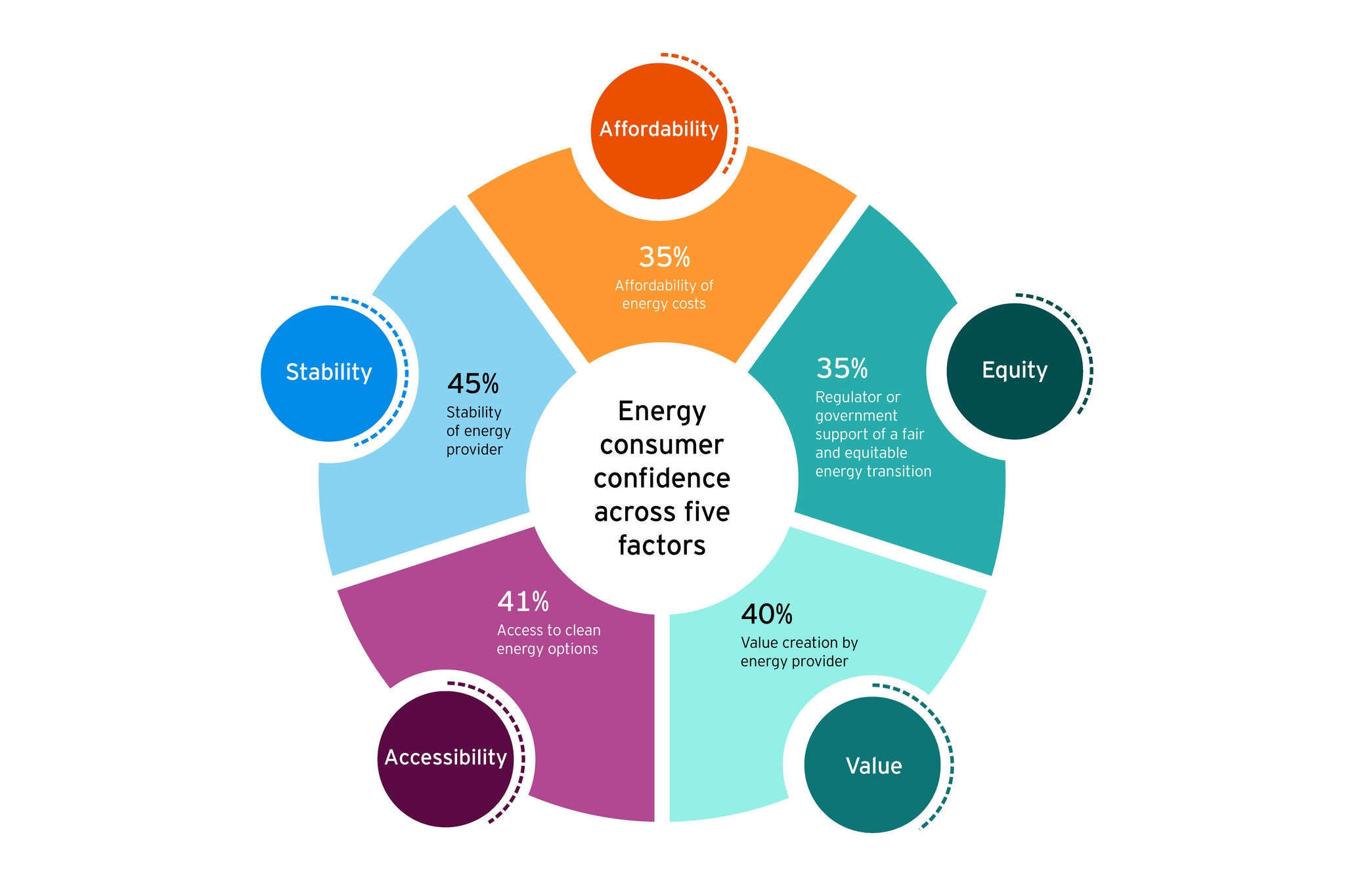

The Netherlands’ ability to inspire consumer confidence while still accelerating clean energy highlights the importance of emphasizing the broader benefits of the energy transition, beyond the basics of reliability and safety. Showing how renewables and greener solutions can deliver other important consumer intangibles, including community and social impact, choice, convenience and comfort, could be a game changer in winning consumer confidence in the energy transition. But it won’t be easy in an industry where much of the investment is in infrastructure that is largely invisible to consumers. We’ll need to see a united effort from businesses, government and community organizations to reframe messaging and inspire consumer confidence. Organizations that master this can also create differentiated value propositions and new revenue opportunities.

Key questions for:

- Energy providers: How can we build more sophisticated marketing and sales campaigns that highlight the energy intangibles that matter to consumers?

- Infrastructure developers: What opportunities exist to expand consumer and community engagement early in large infrastructure projects to ensure clean energy investments deliver personal value?

- Technology companies: How can new business models (e.g., virtual peer-to-peer energy trading communities) engage consumers and create new types of value?

- Government: How can communications and awareness campaigns put the spotlight on the economic and social benefits of the energy transition?

4. Master behavioral science

People can be paradoxes. According to EY research, about half of us think it’s okay to offset our positive energy actions with negative ones. For example, consumers who purchase smart thermostats to save energy may end up using more because it’s easier to adjust heating or cooling to make their homes more comfortable.4 It’s called the rebound effect, and it highlights a key flaw in current communications and engagement. Focusing purely on sustainability messaging or price, without considering behavioral science, isn’t enough to drive positive consumer changes and build confidence in the energy transition.

Behavioral science is a growing focus for academic research and it is integral to many industries, helping tap into values to influence consumers’ actions. It’s also key to many public health messages, including during the COVID-19 pandemic. The most successful campaigns to encourage people to stay home, social distance, wear masks and get vaccinated appealed at an emotional level, created personal accountability, communicated desired behavior change and linked it to good citizenship.

Adopting these approaches can help providers, government and other stakeholders create more compelling experiences, supported by agile feedback loops that evaluate results and drive improvements.

Key questions for:

- Energy providers: What consumer insights, skills and collaborations can help build behavioral science capabilities into solution design, marketing, sales and customer service?

- Academia: How can our research insights be directly applied to drive long-lasting sustainable consumer behaviors?

- Technology companies: How can our wealth of consumer data and behavioral insights help shape sustainable behaviors?

- Government: What policy approaches can enable an energy ecosystem to share consumer data to help deliver sustainability outcomes while addressing security and privacy concerns?

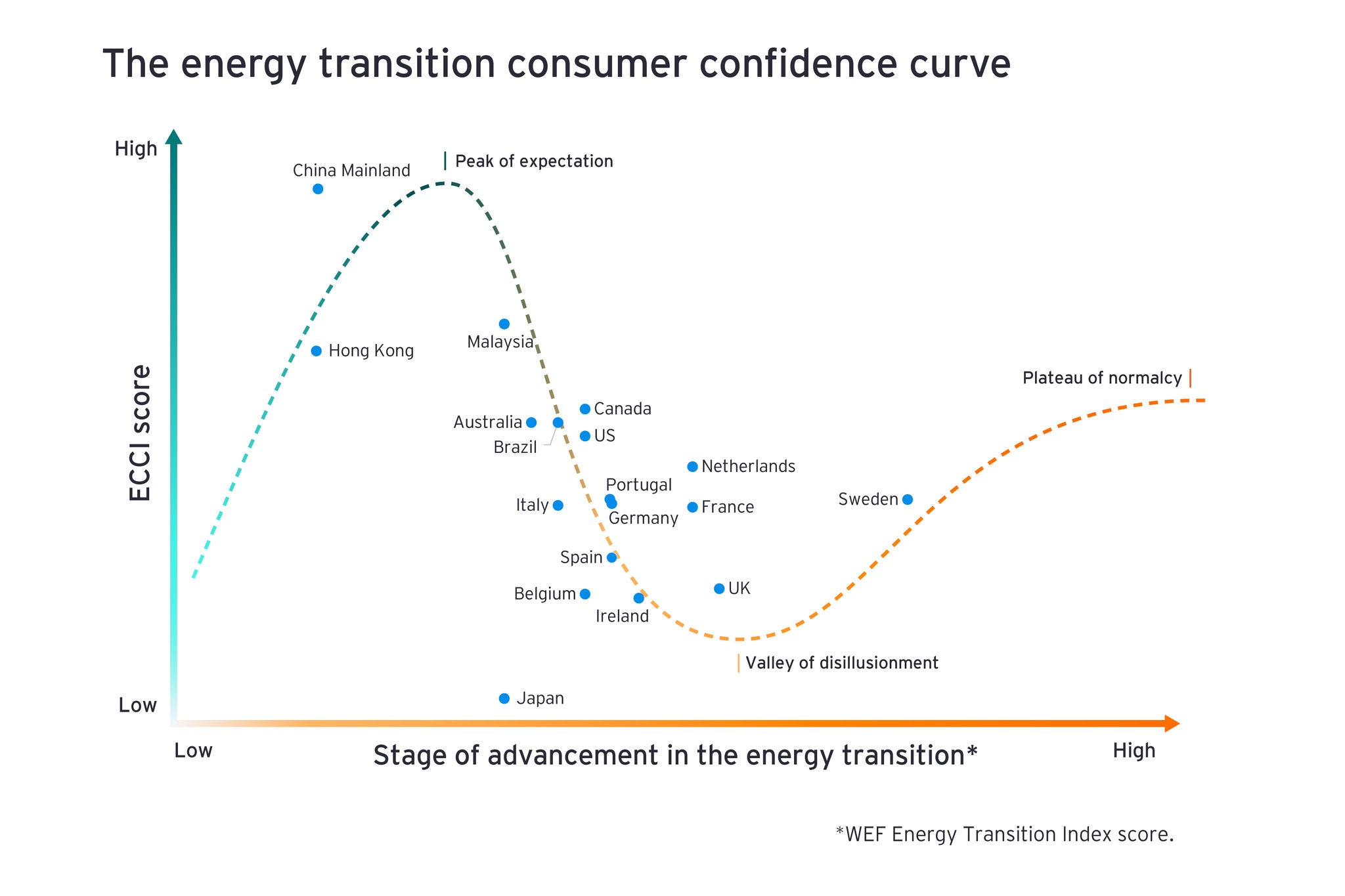

Counteracting a crisis of consumer confidence

The ECCI should sound alarm bells around our ability to meet climate targets. Even soaring investment in clean energy infrastructure won’t pave the way to a new energy future if consumers aren’t convinced that the journey will yield benefits. The success of the energy transition will require a concerted cross-sector, cross-government effort — and it depends on rebuilding consumer confidence now.