Before the COVID-19 pandemic unleashed its unprecedented impact on economies and societies, consumer behaviors were already shifting. Digitalization was reimagining how consumers live, work, play and consume, evidenced by the rapid rise of e-commerce in the Asia-Pacific region.

The COVID-19 pandemic accelerated some of these changes that were underway, leading consumers to reprioritize what they value. Arguably, it is no longer just about what they buy but also how they want to live their lives. That means consumer companies need to understand what is driving consumer lifestyles and ultimately, use these insights to make bolder plans to get ahead of change.

To be fair, many consumer companies did pivot to cater to shifting consumer demands during the last 18 months of the pandemic. However, the consumers that companies adapted to serve during the pandemic may not be the same consumers who will make them profitable in the future.

Having said that, certain pandemic-induced traits may persist. For example, companies that offered the supply and price stability needed by consumers during the earlier pandemic period are more likely to be rewarded with consumer stickiness than those that chose to pass on the higher costs to consumers.

Many consumers, particularly in the Asia-Pacific region, appear to be turning into COVID-19 anxiety “long haulers”, as indicated by real-time global consumer sentiment tracked by the EY Future Consumer Index, which surveyed more than 5,500 respondents across six Asia-Pacific countries — China, India, Indonesia, Japan, Australia and New Zealand — from among 20 countries in total.

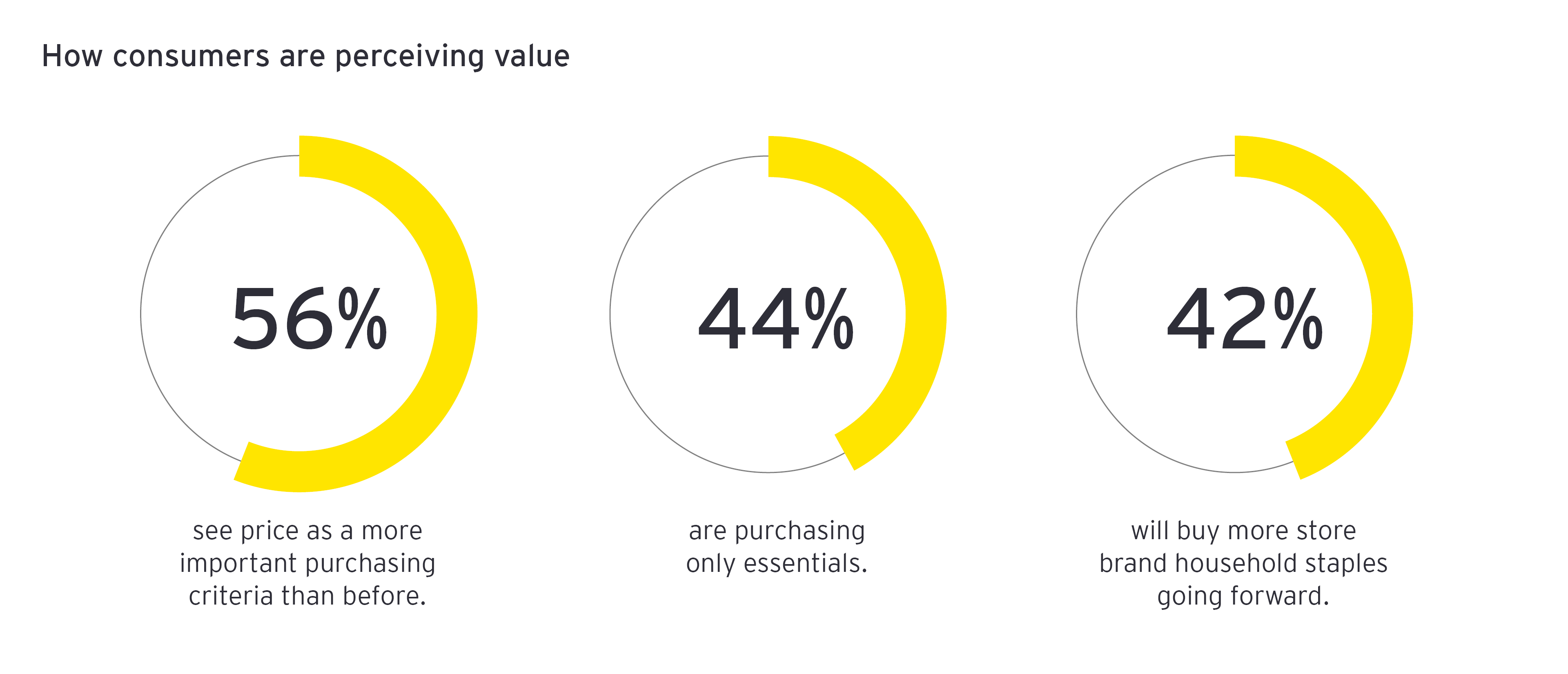

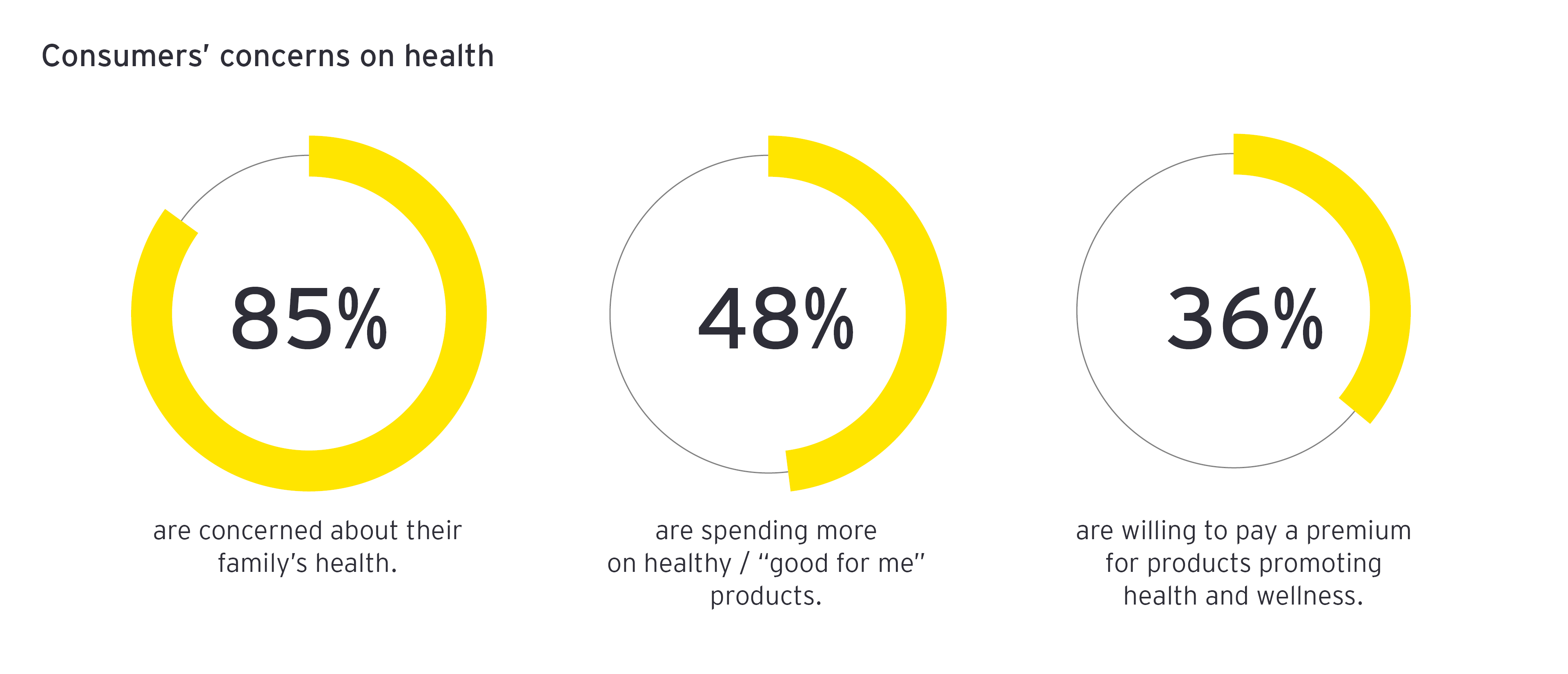

Of the Asia-Pacific consumers surveyed in the May 2021 edition, 85% express concerns over health. With regard to pandemic-related caution in their spending behavior, 44% say they are purchasing only essentials and about two-thirds say they are thinking more carefully about how they spend money.