EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

- Council Directive (EU) 2020/284 (Directive) alongside Council Regulation (EU) 2020/283 introduces new record-keeping and reporting obligations for payment service providers (PSPs) providing payment services within the EU as of 1 January 2024.

- The new rules are set to combat VAT fraud by enabling the national tax authorities to carry out controls.

- The PSPs will be required to keep records of and report data on cross-border payments that fall within the scope of the obligations defined by the Directive.

- The data collected by the various Member States will then be exchanged between them and centralized in a European database: Central Electronic System of Payment information, i.e., CESOP.

Who is in the scope?

In order to define the personal scope of the new obligations, reference is made to Art. 243a of the Directive 2015/2366 (PSD2). Accordingly, the PSPs in scope can be split into four categories as follows:

- credit institutions, which cover banks established in Europe as well as European branches of credit institutions that have their head office outside the EU

- e-money institutions, which can cover a broad range of payment service providers providing electronic payment services such as electronic wallet providers and electronic voucher/card providers

- payment institutions, which can cover a broad range of companies providing payment services including issuing of credit/debit cards, acquiring the payment transaction, processing of payments, initiation of payments, etc.

- post-office giro institutions that provide payment services

Non-exhaustive examples of PSPs in scope:

- banks

- three-party card scheme providers

- e-money and e-wallet providers

- commercial acquirers

- money transfer operators

- credit or debit card issuers

- payment processors

- payment collectors

- marketplaces

What is in the scope?

Cross-border payments – both intra-EU and "one leg out" payment transactions – are in scope.

This includes the following:

- credit transfers

- direct debits

- card payments (both credit and debit)

- money remittance

- e-money

- e-voucher

- payment refunds

The following are excluded from the scope:

- payment initiation

- account information

- paper-based vouchers and payment in cash cheques

- payment methods with limited use

Record-keeping and reporting responsibilities

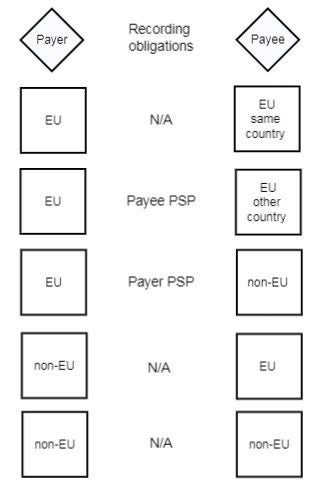

The obligation for PSPs to keep records of cross-border payments and to report them quarterly in an XML format to the tax authorities can be presented by reference to the location of the payee:

- If the payment is to a payee in the EU, the recording obligations lie down on the PSP of the payee

- If the payment is from a payer in the EU to a payee in a non-EU country, the recording obligations lie down on the PSP of the payer

PSPs will need to make a return of data on cross-border payments every quarter. The declaration to the tax administration is required to be filed by the end of the month following the end of the quarter. For example, a PSP should submit a return to each tax administration for the first quarter of 2024 by 30 April 2024.

A PSP is required to make a return to every Member State where the Payee or the Payor are located if it provides payments falling within the scope of the reporting obligation.

For example, a PSP established in Luxembourg may provide payment services to payees in Luxembourg, Belgium, France and Germany. In such cases, the PSP will need to submit returns in each of these three countries.

Returns should be made electronically and in a specified XML format. A detailed user guide for PSPs has already been published by the European Commission in 2022.

Currently, the tax administrations are in the process of setting up the required IT infrastructure to validate and accept returns from PSPs.

Record-keeping trigger and data recording

The obligation for PSPs to keep records of cross-border payments is triggered as soon as a PSP provides payment services for more than 25 cross-border payments in a calendar quarter to the same payee, irrespective of the transaction amount.

Under the new Directive, it is required that all data pertaining to the payment are kept for a minimum period of three calendar years.

The following data is concerned:

- identifier of PSP, e.g., BIC

- name or business name of the payee

- if available, any VAT identification number or other national tax number of the payee

- if available, the address of the payee

- identifier of payee's location, e.g., IBAN or other identifiers

- transaction date, time, amount, and currency

What’s next?

The transposing of the Directive into the Luxembourgish legislative framework is still ongoing but is not expected to diverge from the current Directive wording.

The entry into force of the new reporting obligation is as of 1 January 2024.

Therefore, for the concerned business, it would be of utmost importance to start the implementation of the new technical IT solutions, in order to comply with the mandatory XML quarterly reporting deadline, i.e., 30 April 2024.

Challenges to the industry fall across most functions of impacted organizations, and include:

- customer relations and information

- static and dynamic customer data to be collected and maintained

- identification and management of differences of interpretations and laws between countries

- impact on the organization with the appointment of accountable persons and definition of new roles

- drafting of procedures and testing of processes

- impact on ERP and core banking platforms

- definition of new reporting and exchange infrastructure

- awareness and training of persons, as well as

- oversight controls and impact on risk and compliance functions.

EY has developed a global tool to assist PSPs in fulfilling their reporting obligation in the various EU Member States. We will be pleased to assist you in identifying your reporting obligations and navigating with you through a more and more complex regulatory landscape.

Summary

Council Directive (EU) 2020/284 (Directive) alongside Council Regulation (EU) 2020/283 introduces new record-keeping and reporting obligations for payment service providers (PSPs) providing payment services within the EU as of 1 January 2024.