EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can Help

-

EY sustainable finance teams helps financial services companies define sustainability goals that create value and make a measurable difference. Learn more.

Read more

Needless to say, the reality is more complex: decarbonization is everybody’s business. Each group influences the others, creating blockages and feedback loops. Collective action can cancel out individual choices. Citizens can exert influence over companies and governments, but those institutions also have significant power to frame and reframe the debate. Looking ahead, innovations in the metaverse, 3D printing and bioscience are likely to have a profound impact on the nature of consumption.

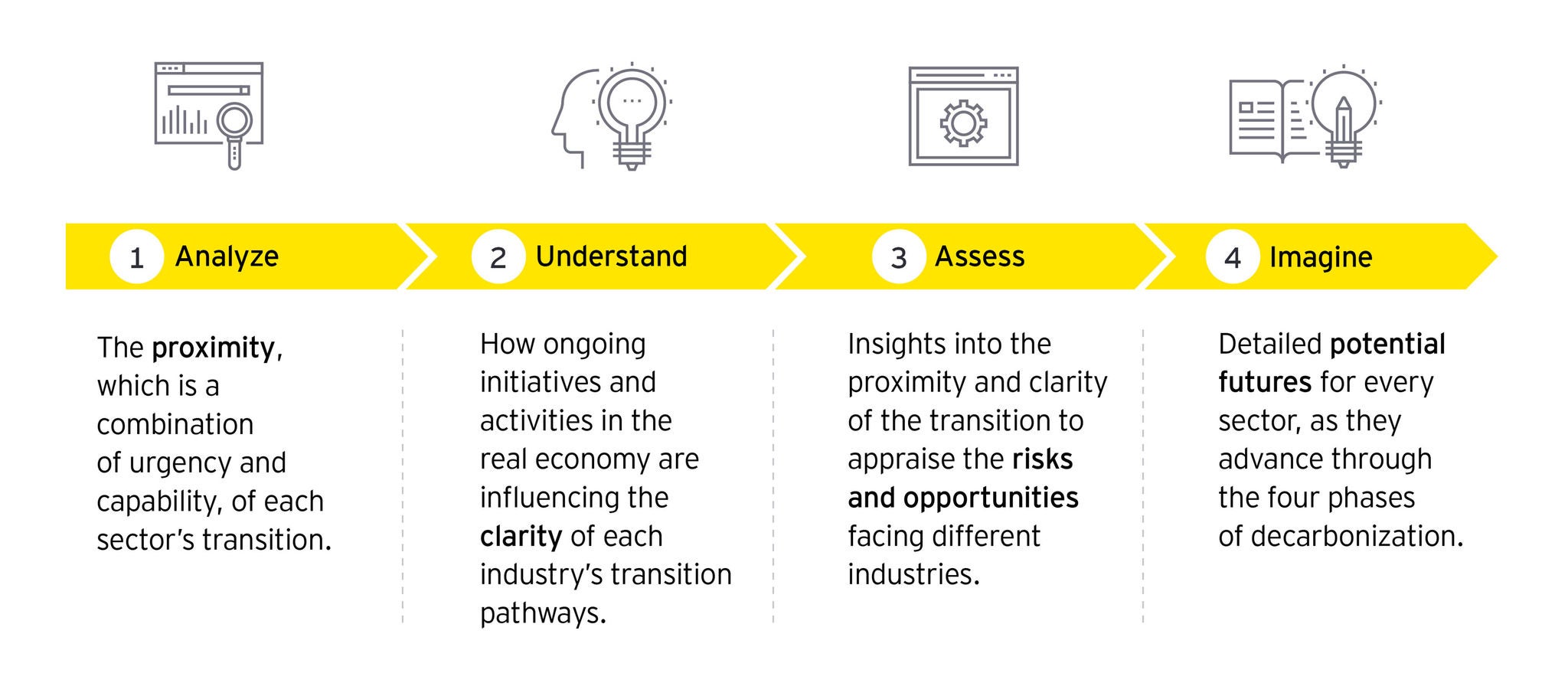

Stage two: Understand

Understand how ongoing initiatives and activities in the real economy are influencing the clarity of each industry’s transition pathways.

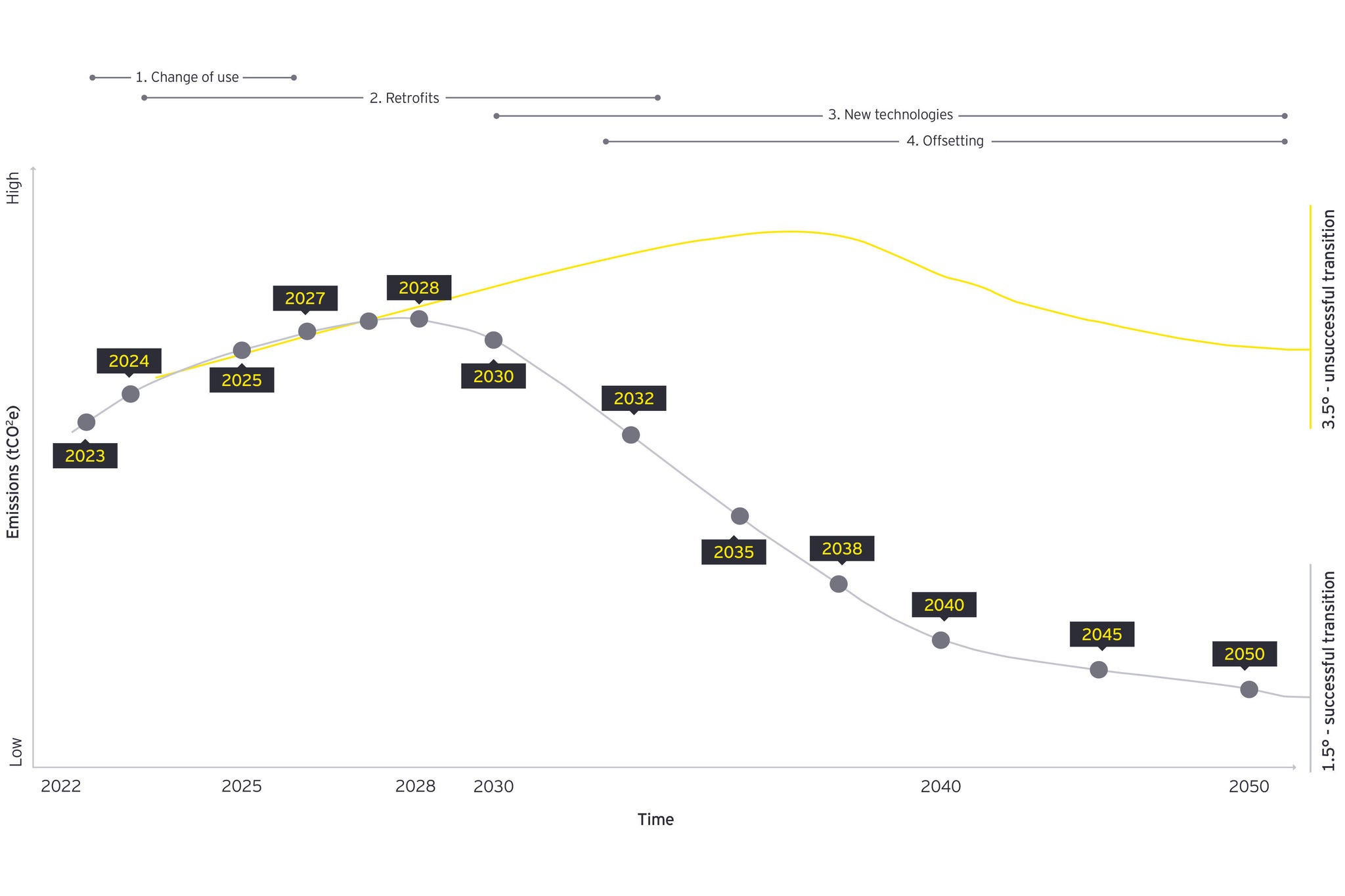

Looking across all sectors, we typically observe four potential phases of decarbonization:

- Changing the use of existing assets, resources and approaches – for example, by reducing usage intensity or shortening supply chains.

- Retrofitting existing assets and resources with mitigating technologies that improve energy efficiency – for example, by converting buildings primary energy source to solar power.

- Developing new technologies that entirely alter assets or ways of working – for example, through carbon capture and storage, or by harnessing new sustainable forms of propulsion.

- Offsetting residual emissions or pollution that cannot be eliminated by stages one through three.

In many cases, industry bodies have an important role to play in articulating the stages of decarbonization and setting common transition standards or timelines. Not every industry will need to follow all four phases, or to follow them in order. It may be appropriate to use offsetting alongside the other phases, to accelerate decarbonization while implementing changes of use, retrofitting and new technologies. However, firms must not use over-reliance on offsets to avoid permanent decarbonization, and should always ensure that offsets are of sufficient quality.