The path to greater risk intelligence in customer journeys is best taken via a phased approach that progresses along a series of maturity milestones — from proof of viability to advanced self-service models.

Conclusion

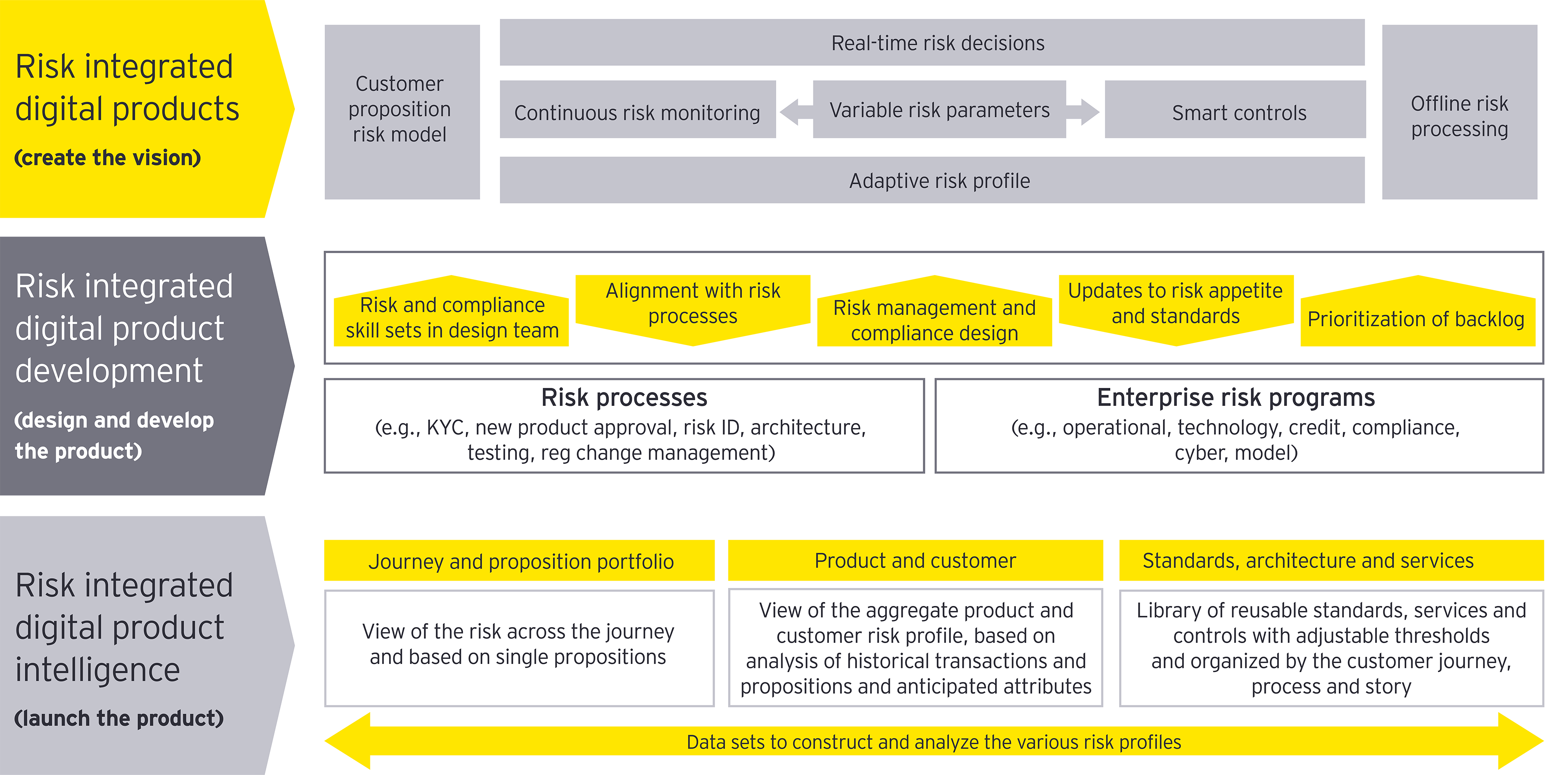

Whichever specific path that firms choose for the evolution into maturity, we believe financial services firms must embrace four key imperatives to effectively and efficiently manage the risk of change initiatives and product development. These steps, which are necessary to instill risk management by design capabilities, are

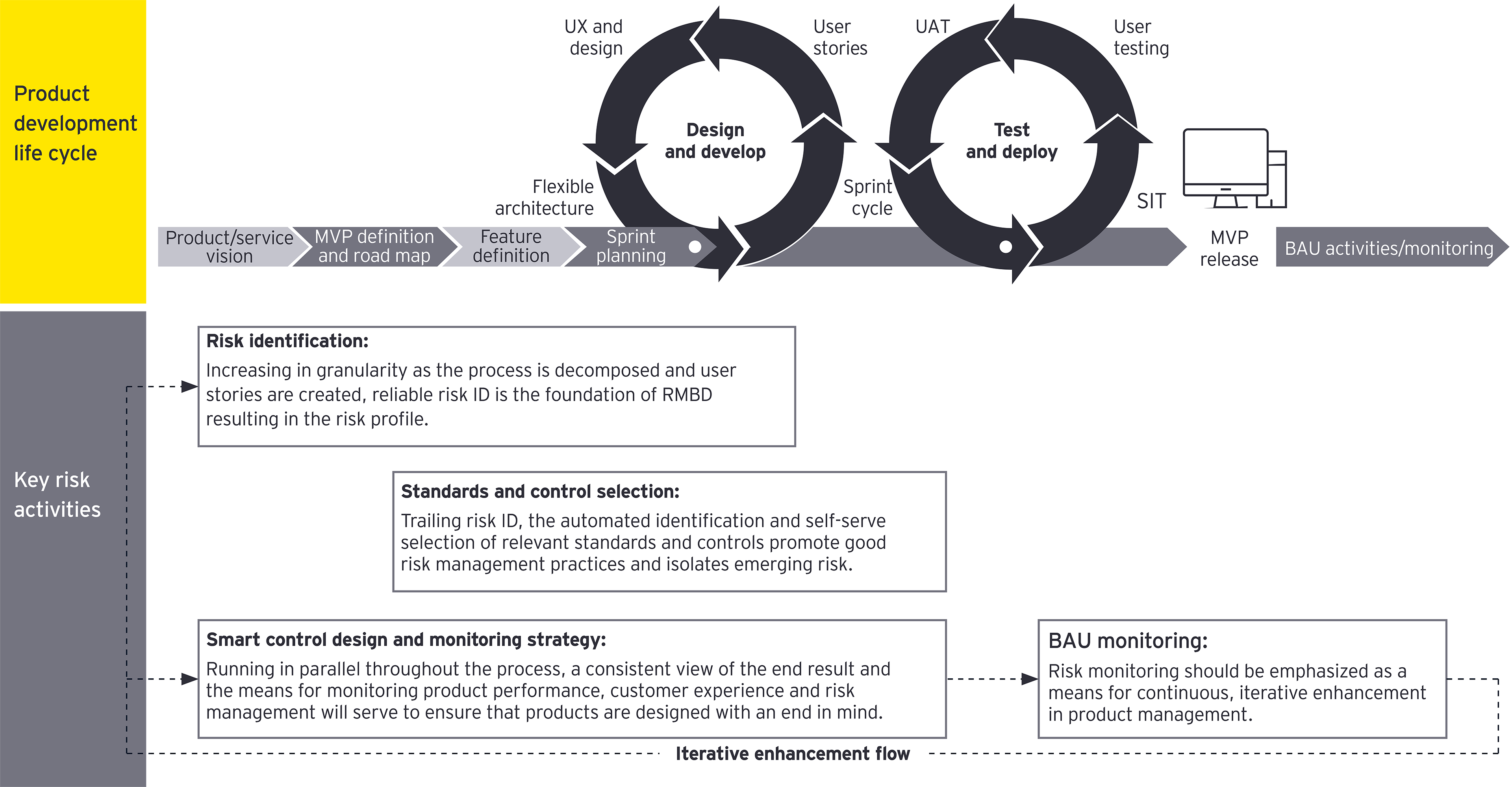

- Enable the culture and operating model to embed risk management through every stage of the product development life cycle, from initial vision to ongoing monitoring.

- Train risk professionals on product development and agile concepts, while training product teams on risk and controls concepts.

- Design repeatable processes to identify risks and evaluate controls, with an eye to defining a long-term strategy for risk management’s role and ability to focus on risk monitoring, especially relative to emerging risks.

- Develop or leverage integrated and dynamic risk solutions (refer to the prior section for a full list) that increase transparency of risks and controls for products and enable self-service decision-making.

This report was co-authored by Jay K. Shirazi, Managing Director, Financial Services Organization Ernst & Young LLP.

Summary

As financial services firms think differently about their customer relationships and digital offerings, they must also think differently about risk management’s role in designing, building and monitoring them. The business and customers alike stand to benefit when greater risk intelligence is built directly into products and across every step of the customer journey.