Tax Compliance Reminder

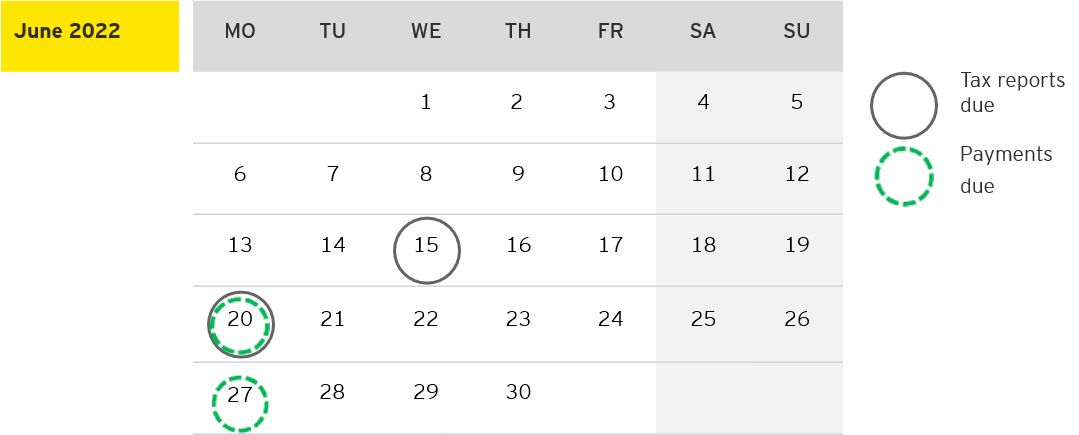

We bring to your attention a summary of the monthly compliance obligations for companies doing business in Kazakhstan - "Taxpayer Calendar", June 2022.

Tax reports due

| Deadline for submission |

Name of report | Tax period |

| 15 June | Excise duty declaration | April |

| 20 June | Application on import of goods and payment of indirect taxes | May |

Payments due

| Deadline for payment | Name of payment | Period for which payments are due |

| 20 June | Excise duty | May |

| 20 June | Import VAT on goods (imported to Kazakhstan from Eurasian Economic Union countries) | May |

| 27 June | Corporate income tax withheld at the source of payment made to residents | May |

| 27 June | Corporate income tax withheld at the source of payment made to non-residents | May |

| 27 June | VAT self-charged on services provided by unregistered non-residents | May |

| 27 June | Advance payment of corporate income tax | June |

| 27 June | Individual income tax withheld at the source of payment | May |

| 27 June | Individual income tax withheld at the source of payments made to non-resident employees of non-resident legal entities without permanent establishment in the Republic of Kazakhstan | May |

| 27 June | Pension fund contributions withheld at the source of payment to local employees as well as individuals from civil legal nature agreements | May |

| 27 June | Social tax for local and foreign employees | May |

| 27 June | Social contributions to the State fund of social insurance | May |

| 27 June | Obligatory social medical insurance contributions to the State fund of social medical insurance | May |

| 27 June | Employees obligatory social medical insurance contributions to the State fund of social medical insurance to local employees as well as individuals from civil legal nature agreements | May |

Other reports due

Kazakhstan legislation stipulates other types of reports (e.g. statistical reports, reports of taxpayers, which are subject to monitoring, etc.) due for filing with the appropriate authorities. There are also other tax payments to the budget with specific payment and filing deadlines. The volume and content of the reports and payment deadlines are determined depending upon the activities performed by an entity. Please contact EY if you require information on other types of reports.