Chapter 1

FDI in Europe: historically weak, internationally strong

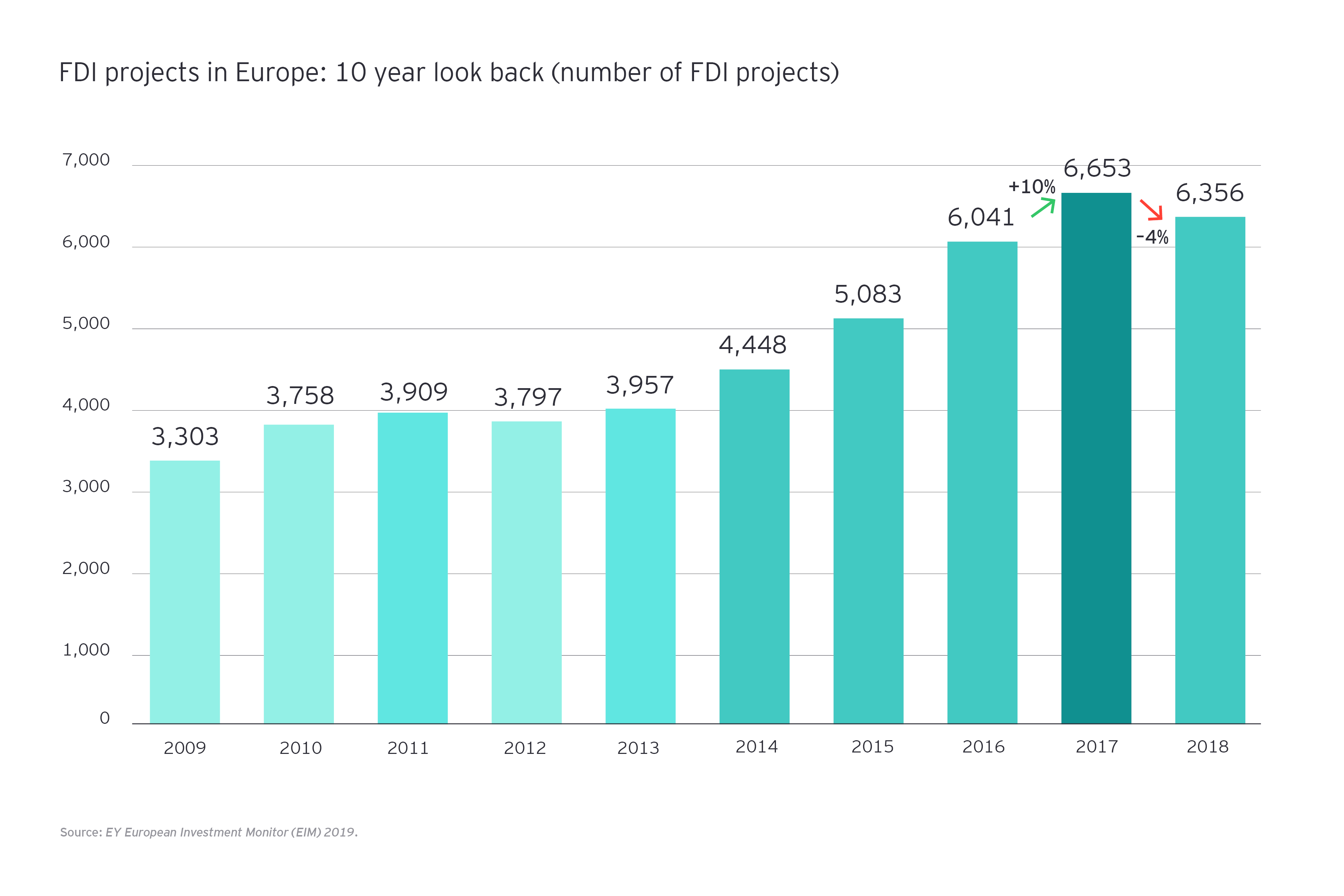

FDI into Europe remains high, but declines for the first time in six years.

In total, businesses from around the world completed 6,356 projects in Europe last year, a 4% annual decline over 2017. The downturn was caused by a 13% decrease in FDI in Europe’s two largest economies – Germany and the UK – which together account for around one third of FDI.

Surveyed businesses say Brexit is the number one risk to Europe’s attractiveness, with political instability in the EU second, the rise in populist and protectionist feelings third, and global political uncertainty fourth.

FDI growth stalled in France in 2018 following two years of huge gains. On the other end of the spectrum, investments in Spain, Poland and Ireland increased by more than 30%.

FDI in 2018

6,356FDI projects were secured in Europe in 2018 – a 4% annual decrease.

Despite the annual decrease, FDI in Europe is still at its second highest level since EY began compiling this data in 2000, and the number of FDI projects completed in 2018 is still 5% higher than in 2016, which was a record high at the time.

Growth prospects and global trade are major causes of concern

Declining economic growth across Europe undoubtedly contributed to the annual slowdown. GDP growth decelerated to 1.8% last year from 2.4% in 2017. FDI remained primarily driven by intra-European investment. FDI projects within Europe decreased slightly by 2%, whereas non-European FDI into Europe declined by 8%.

The rising tide of global protectionism is making its mark. The US-China trade war grabbed the headlines last year, but European exporters continued to suffer from rising trade barriers around the world.

Factors outside Europe also impacted investment. Weak economic growth in the US coupled with tax reform in late 2017 caused US investment in Europe to only increase by 3% last year, down from an average of 8% in the previous four years. The US is Europe’s largest investor – accounting for 22% of FDI in 2018 – so any dip has a significant impact.

China’s economy grew by 6.6% in 2018, the slowest rate in almost three decades, and Japan’s by only 0.7%, compared with 1.9% in 2017.

Businesses with a European presence are less deterred by the growing economic and political headwinds than those without.

There is a growing divide in sentiment towards Europe between companies with and without a European footprint. Surveyed businesses without European operations that rank it as one of their top three investment destinations fell from 62% to 51% this year. In contrast, sentiment did not dip at all among those already present in Europe.

In short, businesses with a European presence are less deterred by the growing economic and political headwinds than those without.

Still, despite Brexit, Europe fares well on the global stage

Prolonged uncertainty about the UK’s future relationship with the EU following the Brexit vote is undoubtedly denting FDI in the country, and, in certain sectors, its close trading partners. The future economic and political relationship between Europe and the UK remains in doubt, Europe economic growth forecasts are languid, and populism continues to gain momentum.

But investors still look fondly on Europe

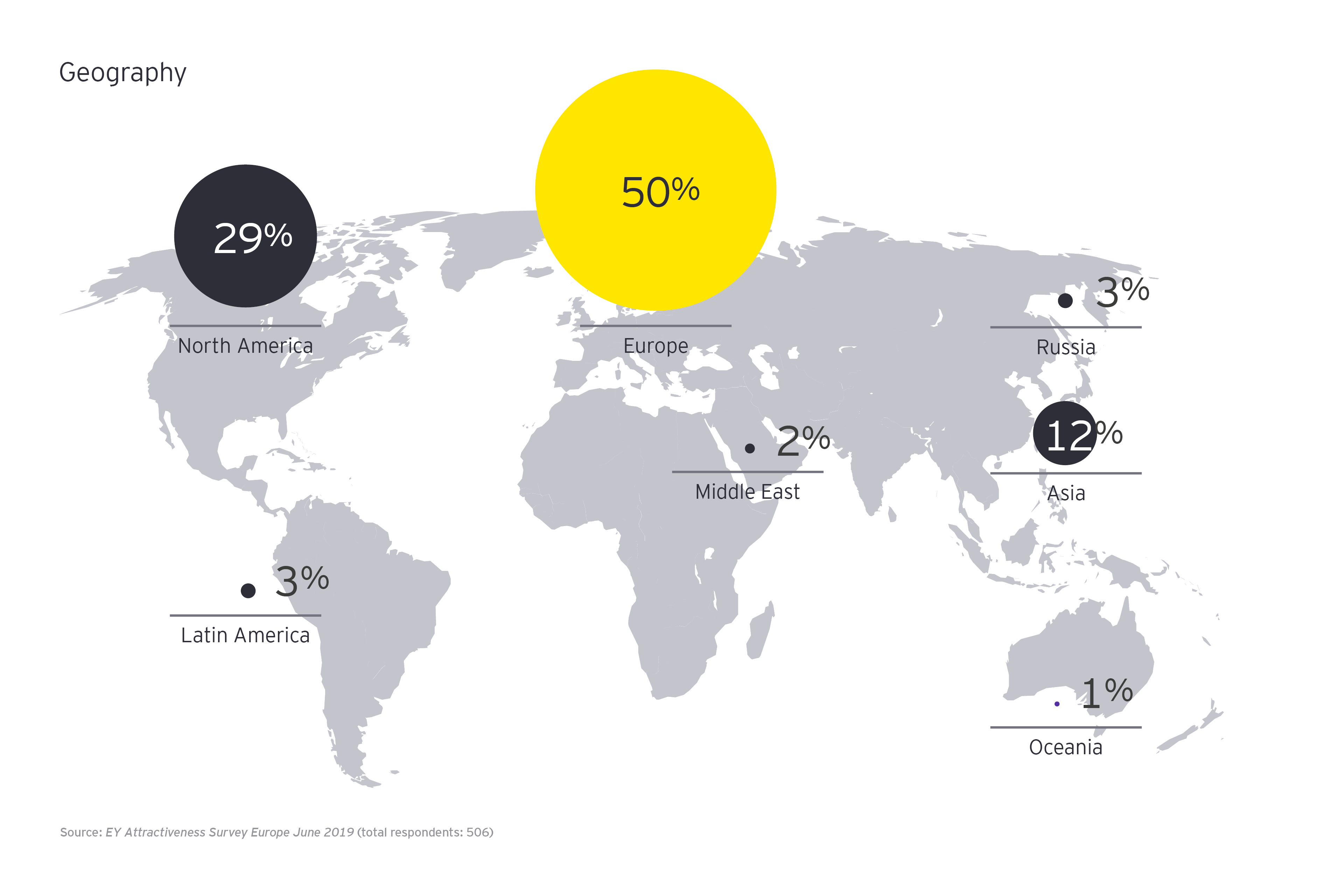

Tellingly, 56% of surveyed businesses cite Western Europe as one of their top three regions globally in which to establish operations, a marginal increase on 53% last year. In parallel our sample see Central and Eastern Europe (CEE) as the second most attractive region globally.

Despite economic and political headwinds, the sheer size and diversity of Europe’s economy makes its attractiveness resilient.

Read more commentary from EY professionals: Redefining success for Europe by playing to our strengths

Chapter 2

Which countries are winning the battle for FDI?

2018 saw sharp declines in FDI in major European economies, while Spain, Belgium, Poland, Turkey and Ireland play catch up.

Countries: the mighty fall, the challengers rise

Top 10 FDI European destination countries

Rank |

Country |

2017 |

2018 |

Change 17/18 |

Market share 2018 |

1 |

UK |

1 205 |

1 054 |

-13% |

17% |

2 |

France |

1 019 |

1 027 |

1% |

16% |

3 |

Germany |

1 124 |

973 |

-13% |

15% |

4 |

Spain |

237 |

314 |

32% |

5% |

5 |

Belgium |

215 |

278 |

29% |

4% |

6 |

Poland |

197 |

272 |

38% |

4% |

7 |

Turkey |

229 |

261 |

14% |

4% |

8 |

Netherlands |

339 |

229 |

* |

4% |

9 |

Russia |

238 |

211 |

-11% |

3% |

10 |

Ireland |

135 |

205 |

52% |

3% |

Source: EY European Investment Monitor (EIM) 2019

*Due to a change in methodology in The Netherlands in 2017, the 229 FDI projects reported for 2018 actually compare with 224 FDI projects in 2017.

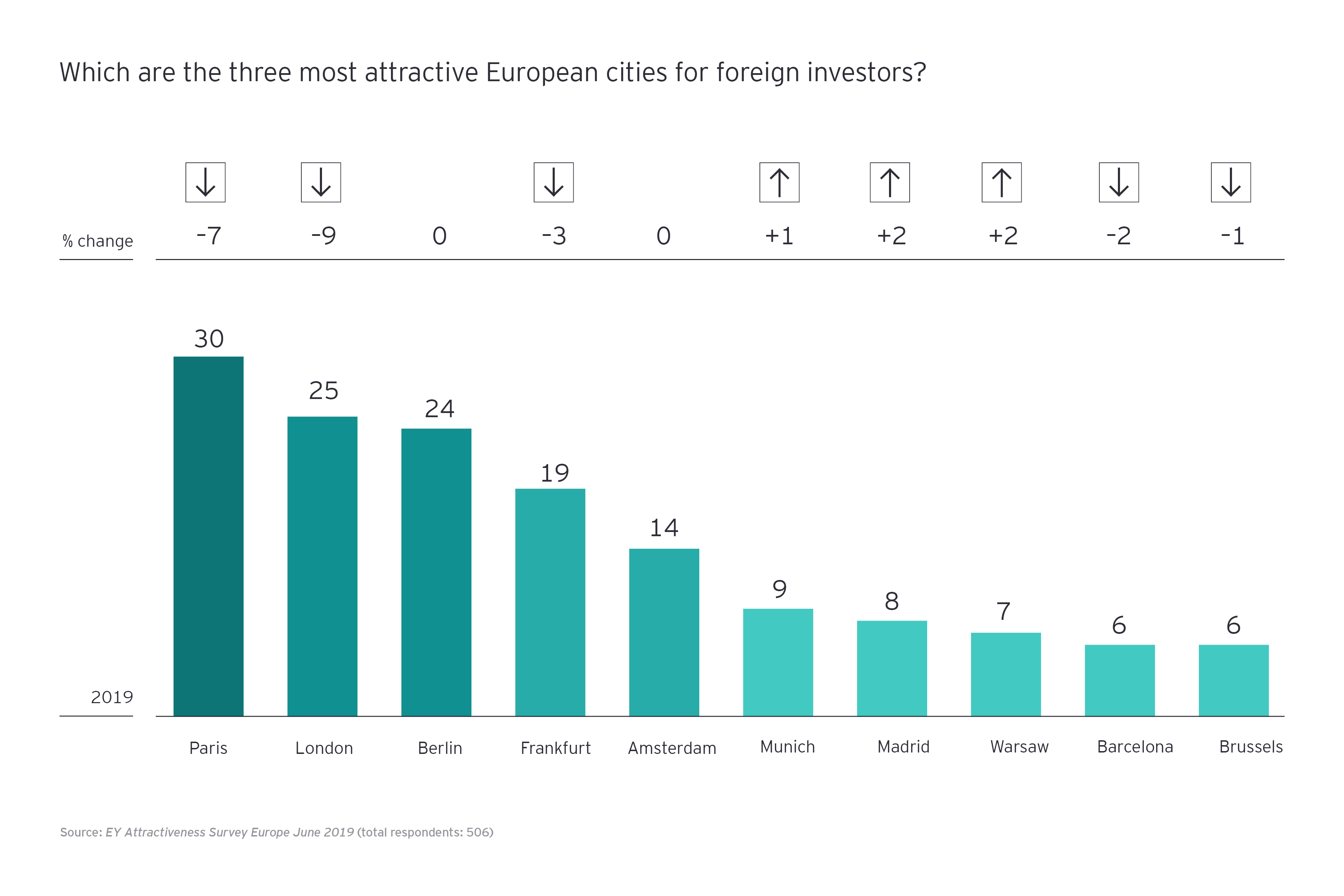

Europe’s tech and power hubs: Paris and London lose their shine

Global companies seek out global cities where businesses, policymakers, universities and the financial community have created effective business ecosystems.

Paris and London are still the most attractive cities for investment, but only just.

The attractiveness of both has declined significantly in the last 12 months. 30% of businesses say Paris is one of the three most attractive European cities for investment, compared with 37% last year, while only 25% put London in the top-three, compared with 34% last year – putting it only 1% ahead of Berlin, where last year it was 10% ahead.

Competition between European cities for investment has never been more equal, or intense.

Brexit is undoubtedly to blame for the decrease in London’s attractiveness, while the gilets jaunes (yellow vests) movement raises questions about France’s ability to enact reforms necessary to boost its business attractiveness. German cities are primed to benefit most. Indeed Berlin, Frankfurt and Munich rank third, fourth and sixth for attractiveness.

The story is different in the technology sector though, where London is – still – considered most vibrant.

When asked which cities have the best chance of producing the next technology giant, it ranks fourth globally behind only San Francisco (and the wider Silicon Valley), Shanghai and Beijing. Berlin ranks seventh globally and second in Europe, while Paris ranks twelfth globally and third in Europe.

Paris and London are still the most attractive cities for investment, but only just.

Sectors and activities: concerns over short-term growth and value-add investment for the long term

Headquarters and sales-oriented FDI tumbles

Sales and marketing projects dropped 11% to 2,511 in 2018. Historically, sales and marketing make up the largest component of Europe’s FDI, accounting for 43% of all projects in the last five years, so a decrease materially impacts FDI totals.

The number of headquarters established in Europe fell by an even greater amount, plummeting 23% year-on-year to 285 projects.

The decline in both types of FDI reflects businesses’ concerns about political uncertainty and declining demand for their goods and services in Europe, which is in turn caused by downbeat economic growth prospects.

Industrial FDI resists, R&D grows

Supply chain reorganization strategies started two years ago across Europe maintained a high level of FDI in logistics projects (+5%).

The number of new manufacturing FDI projects in Europe decreased though, albeit to a lesser extent. 1,869 projects were established in 2018, a 6% annual decline, and the result of a combination of weakening economic growth prospects and uncertainty about the UK’s trading relationship with the EU. Tellingly, manufacturing FDI nosedived 35% in the UK.

On a more positive note, R&D FDI increased 16% to 605 projects in 2018, underpinned by a 45% surge in digital R&D projects across Europe. Indeed, last year 27% of all new R&D FDI projects were initiated by companies in the digital sector.

R&D FDI grows

45%increase in digital R&D projects in Europe in 2018.

Europe confirms its ‘digital’ attractiveness

In 2018, for the sixth consecutive year, Europe’s digital sector attracted more FDI than any other industry, with FDI projects increasing by 5%. FDI in Europe’s digital sector is driven by US business, which was responsible for 37% of 2018’s digital FDI projects.

FDI in the business services sector – historically Europe’s second largest for FDI – posted a significant 18% annual decline. Project numbers fell in Germany, France and the UK – its top three destination countries.

In contrast, FDI was strong in Europe’s traditional industrial sectors. The combined number of FDI projects in transport, machinery and chemicals increased 4% to 1,729 projects in 2018.

Chapter 3

The global uncertainties limiting European growth

Faced with a downturn in growth expectations, businesses are throttling back on FDI globally, including in Europe.

Only 27% of those we surveyed plan to establish or expand operations in Europe in 2019, significantly less than 35% last year, and investment plans now stand at a seven-year low.

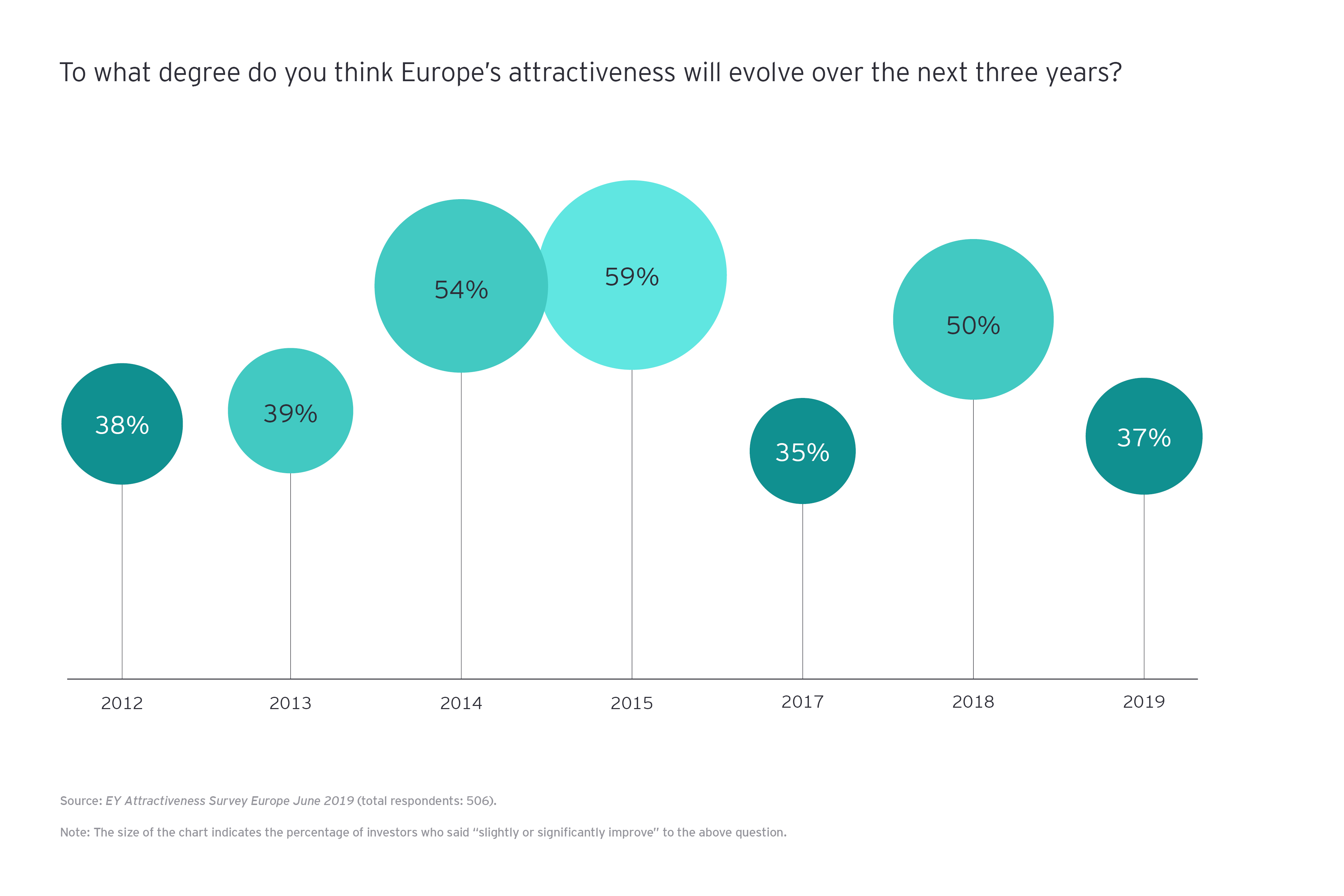

An imminent recovery in investment attractiveness looks unlikely

Only 37% of surveyed businesses expect an improvement in Europe’s attractiveness in the next three years, significantly less than 50% last year.

The decrease is primarily caused by decelerating manufacturing and supply chain FDI plans, perhaps announcing the end of a supply chain reorganization cycle: only 10% of businesses plan to invest in manufacturing, supply chain and logistics projects this year, compared with 16% last year.

Brexit aside, declining investment plans are undoubtedly a result of a weak economic outlook across Europe and political uncertainty.

Furthermore, continuing US-China trade tensions, tighter credit controls in China and more restrictive monetary policy in many large economies has dampened the outlook for global economic growth. The IMF predicted 3.3% global GDP growth in April 2019, a significant decrease on the 3.9% predicted 12 months earlier.

Brexit plagues Europe’s attractiveness, not just the UK’s

At the time of our 2018 report, Brexit was certainly on businesses’ minds, but most expected a smoother, more orderly transition to Europe’s new political and economic relationship with the UK. Fast forward 12 months and turmoil ensues.

Survey participants are unsurprisingly alarmed. Some 38% cite Brexit as a top-three risk to Europe’s attractiveness in the next three years – a significant increase on 30% last year – making Brexit the most significant risk to Europe’s attractiveness. Last year it was only the fourth most important.

Brexit’s effect

38%of survey participants see Brexit as a top-three risk to Europe’s attractiveness in the next three years.

A no-deal Brexit would mainly harm Europe’s attractiveness because of its impact on trade between the UK and the rest of Europe, and the correlation between trade and cross-border investment. It would not only introduce tariffs on UK exports to the EU, but also non-tariff frictions related to product standards, documentary requirements and border delays.

Brexit will also damage Europe’s attractiveness in other ways

The UK appeals to companies because of the abundance and mobility of its skilled labor, but this could be compromised if Brexit reduces immigration. More fundamentally, it exposes weaknesses in the very institutions holding Europe together which have made it such an attractive investment destination in the last ten years.

US tax competitiveness will continue to bite

At first glance, US tax reform is impacting investment.

The reforms, introduced in December 2017, cut corporate tax rates from 35% to 21% and give global companies a one-time special rate of 15.5% on repatriation of profits earned abroad.

The impact of tax reform on the US’ attractiveness is hard to isolate because businesses consider a number of factors when making investment decisions. Indeed, any increase in positive investment sentiment to the US due to tax reforms may be undermined by decelerating economic growth. However, 38% of survey respondents say North America is one of their top-three places to establish operations, a four-point annual increase.

Given the size of the US economy, tax reform could also materially impact FDI in Europe. But while it may cause multinationals to repatriate European earnings to the US, a material shift of job-creating FDI from Europe to the US is unlikely.

The European Union must step up its global game

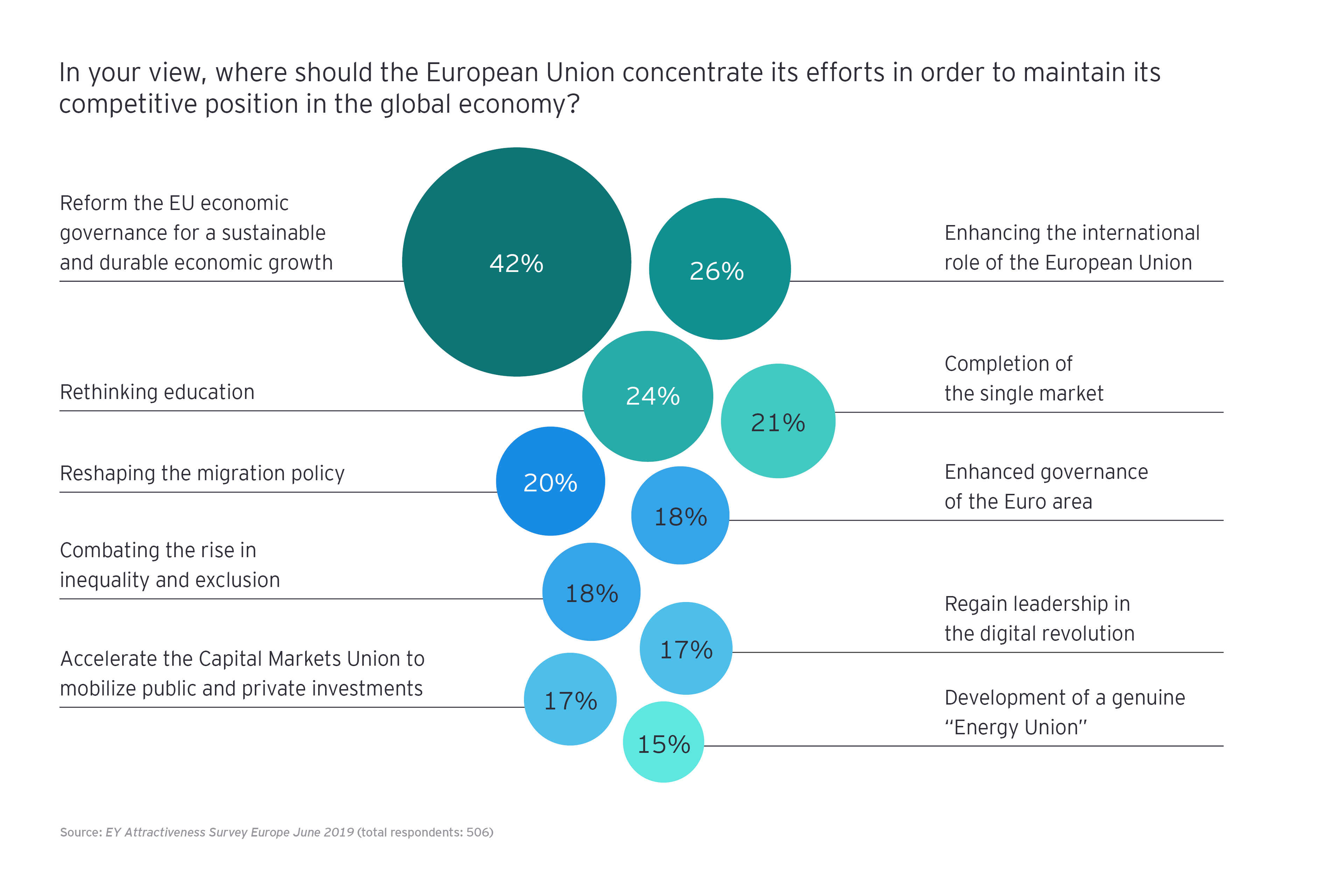

Our survey insists, however, that the EU needs to work on key fundamentals to remain a priority destination for entrepreneurs and global firms, and retain talent and capital.

According to 42% of surveyed businesses, its top priority should be reforming economic governance to achieve sustainable economic growth. And 32% add that it should enhance its international role. It needs to play a more structured, active role within its borders to avoid future situations such as Brexit, and put its political mouth where its economic weight is to act as a global power in the battle with the US, China and Russia.

Top priority

42%of survey participants believe the EU’s top priority should be reforming economic governance.

Read more commentary from EY professionals: Priorities for Europe’s newly elected officials: perspectives from EY’s people in Europe.

Chapter 4

Talent, trade, technology and tax: Europe’s roaring four Ts

How can Europe maintain its attractiveness and competitiveness on the global stage?

1. Talent: Plan for tomorrow’s skills today

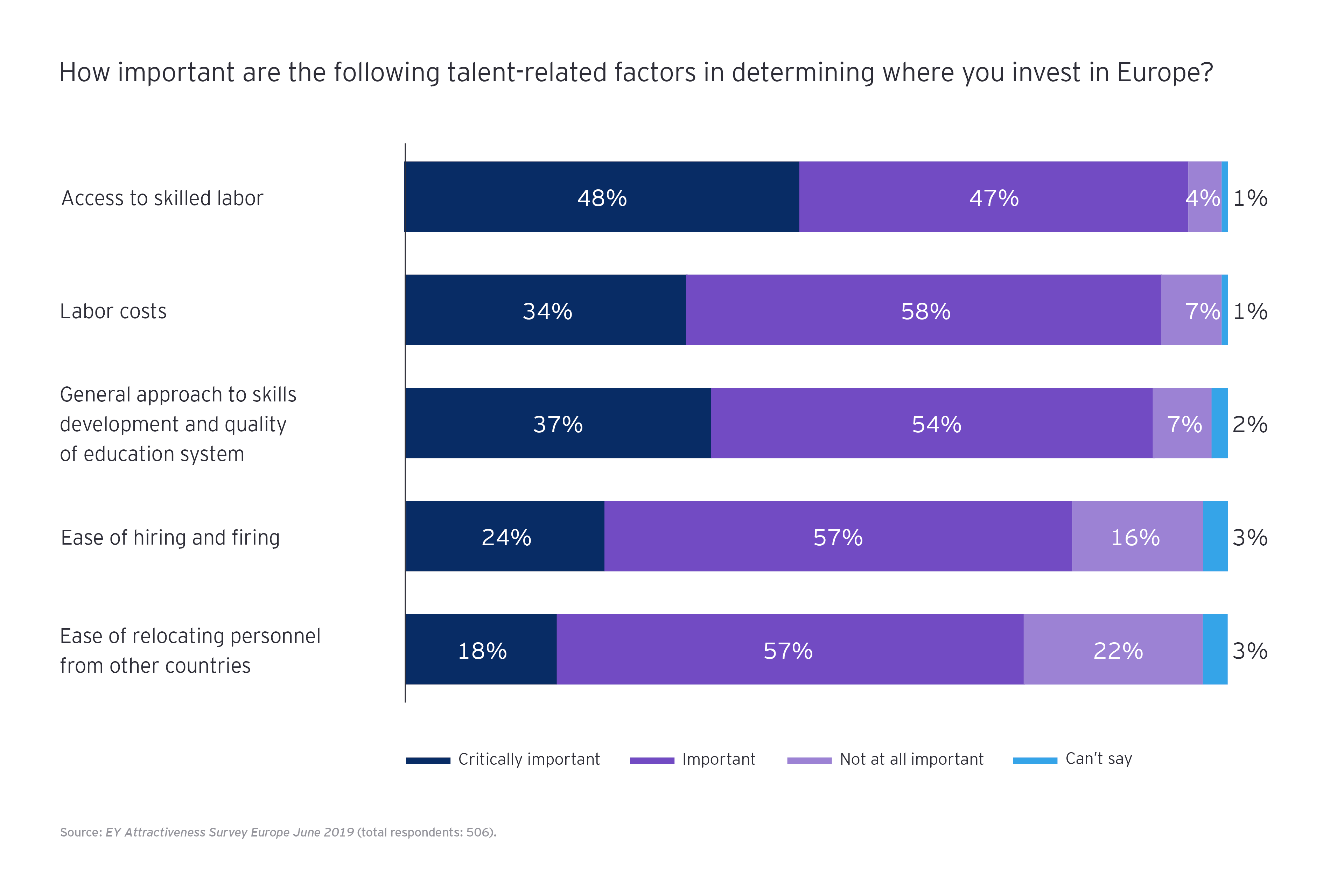

Skills shortages are undermining business performance in Europe.

Almost three-quarters of European businesses say skills shortages are damaging productivity and profitability, and two-thirds say it damages top-line growth.

48% of businesses say access to skilled labor is critically important in determining where they invest in Europe. To mitigate this, businesses must evaluate which skills they will need in future and communicate this to government. This is not a one-off process. As business models evolve and new technologies emerge, the required human skills change too.

Boosting Europe’s digital talent

Tellingly, 52% of surveyed businesses say the availability of a workforce with technology skills is ‘critically important’ in determining where they invest in Europe, and 42% say it is ‘important’. This makes technology skills the most important factor determining where businesses invest and, consequently, an area where the EU can cement its digital competitiveness.

Europeans are gradually improving their digital skills, but large gaps still exist, especially in cyber security, AI and robotics, and big data and analytics.

In parallel, more than eight out of 10 businesses say a strong network of technology start-ups and research institutions, regulatory support and availability of capital is important in determining where investment is allocated.

By making improvements in these areas, the EU can boost its overall competitiveness, attract more FDI, and ultimately increase long-term economic growth and employment in all sectors.

Related article

2. Trade: Fight the good fight

The EU has a vital role to play in stemming the rising tide of protectionism around the world. It must impose retaliatory tariffs where appropriate, but its underlying objective must continue to be to remove, not introduce, trade barriers, and strike a careful balance between preserving security and regulatory standards and creating an open trading environment.

Indeed, Europe’s historic success in attracting FDI has underpinned its creation of a free trade environment. The Single Market and Customs Union enable tariff-free trade on goods and services between Member States, and its trade agreements with more than 70 non-EU countries enable seamless trade with major countries around the world.

But Brexit now genuinely imperils its attractiveness because the threat of the UK leaving without a trade deal is very real. The US-China trade dispute represents a threat to Europe and beyond if protectionism escalates to a global level, and the EU must work closely with its trading partners – including the US – to curb protectionist rhetoric and remove trade barriers.

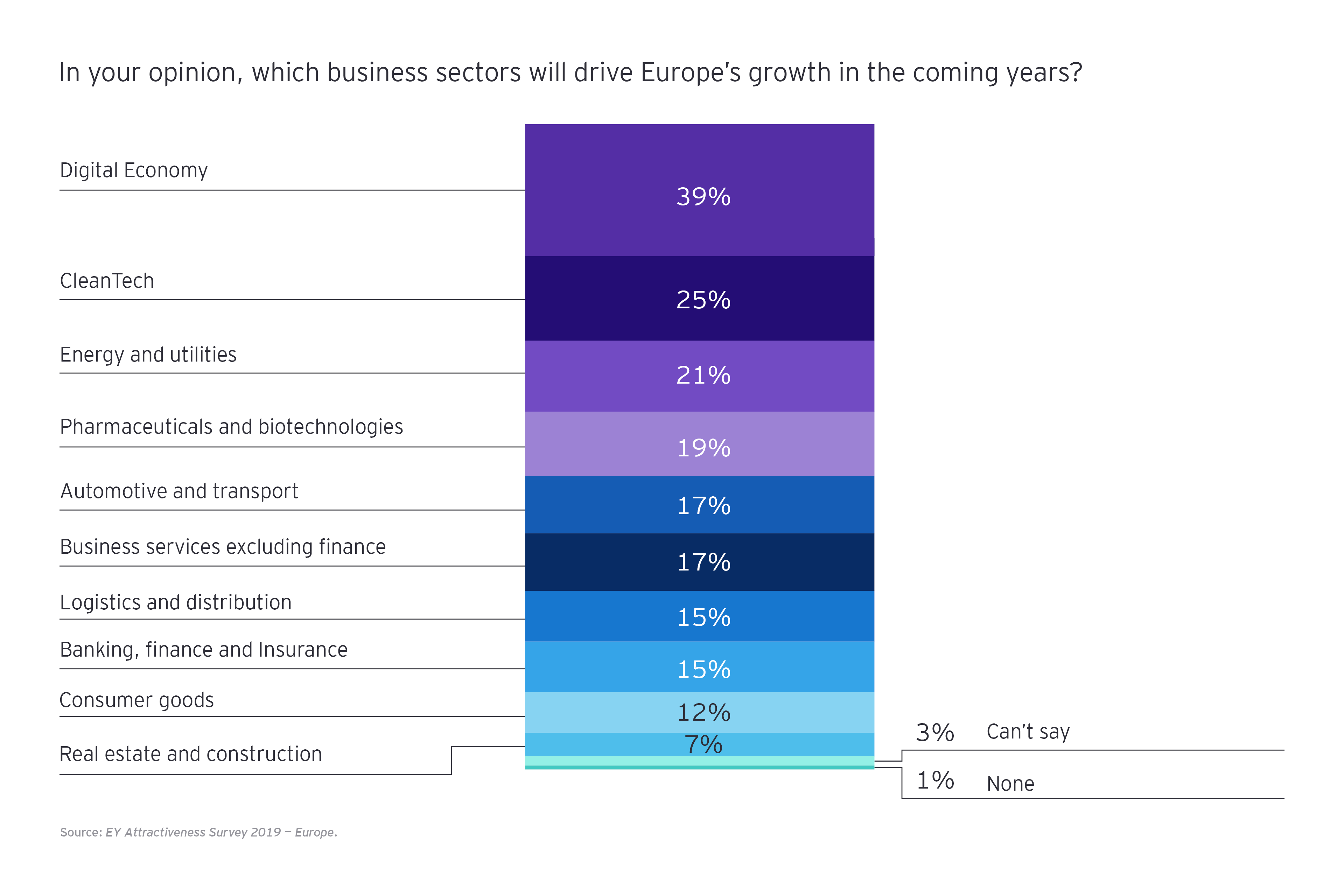

3. Technology: Digital is the new normal

Europe’s technology sector is growing. The number of digital FDI projects grew 5% in 2018 – a record high. In fact, our survey findings warranted a focused study to explore the topic in more detail: EY European Attractiveness Survey: Technology, May 2019.

Technology’s importance in driving wider economic growth is not lost on survey participants who rank digital first for its potential to drive future economic growth across Europe. CleanTech ranks second and energy and utilities third.

Related article

No room for complacency on infrastructure and regulations

Continued investment in Europe’s technology sector is not certain. It needs a robust digital infrastructure – particularly fast and reliable connectivity – to enhance its attractiveness.

It also needs to be careful with the business environment it creates for companies. For example Europe’s data privacy regulation (GDPR), introduced in May 2018, places greater restrictions on handling personal data, and the EU has imposed significant fines on large technology companies for regulatory breaches. Then there is the Digital Services Tax, which numerous technology companies say will harm investment. Also, Europe is not home to technology giants in the same way as the US, China or Japan. More fundamentally, there are concerns that its lack of digital skills, especially compared with the US, might stall technology investment.

Individually, these issues might not dampen investment to any great extent, but together, they may cause some businesses to think twice about investing.

4. Tax: A stable Europe is an attractive Europe

Businesses favor investing in countries with stable, predictable tax regimes, and this is in fact more important than the tax rates themselves, let alone specific rebates and incentives, in determining where businesses invest.

41% of surveyed businesses say a stable tax regime is a ‘critically important’ factor determining where they invest in Europe, and 52% say stability is ‘important’. Fewer (36%) say the cost of employment taxes is ‘critically important’, and only 24% say corporate tax rates.

From the Digital Services Tax to the Financial Transaction Tax, a number of new tax regimes are being introduced across Europe to keep pace with rapidly changing business models and technologies, and its tax system will need to continue to evolve. As it does, changes must be signposted well in advance so businesses have enough time to plan and adjust.

The EU and national governments can also bolster digital competitiveness in a other ways

Our data provides some useful guidance. For example, 86% of surveyed businesses say the degree of protection of IP rights is an ‘important’ or ‘critically important’ factor in determining where they invest.

Remain competitive globally

The US federal tax overhaul in 2017 reduces US federal corporate income tax to 21% from 35% and was expected to increase US investment attractiveness overall and lead to repatriation of almost US$2b of assets held overseas by US multinational companies. According to the United Nations Conference on Trade and Development, almost 50% of the world’s FDI stock could be affected. There remains a question, though, as to whether tax reforms will prompt businesses, whether in the US or overseas, to increase investment in real, job-creating assets.

Read more commentary from EY professionals: The roaring ‘4 Ts’: how to preserve Europe’s investment appeal.

Summary

Foreign direct investment into Europe declined in 2018, but a focus on talent, trade, technology and tax – especially in the digital arena – will strengthen its attractiveness, competitiveness and long-term growth prospects.