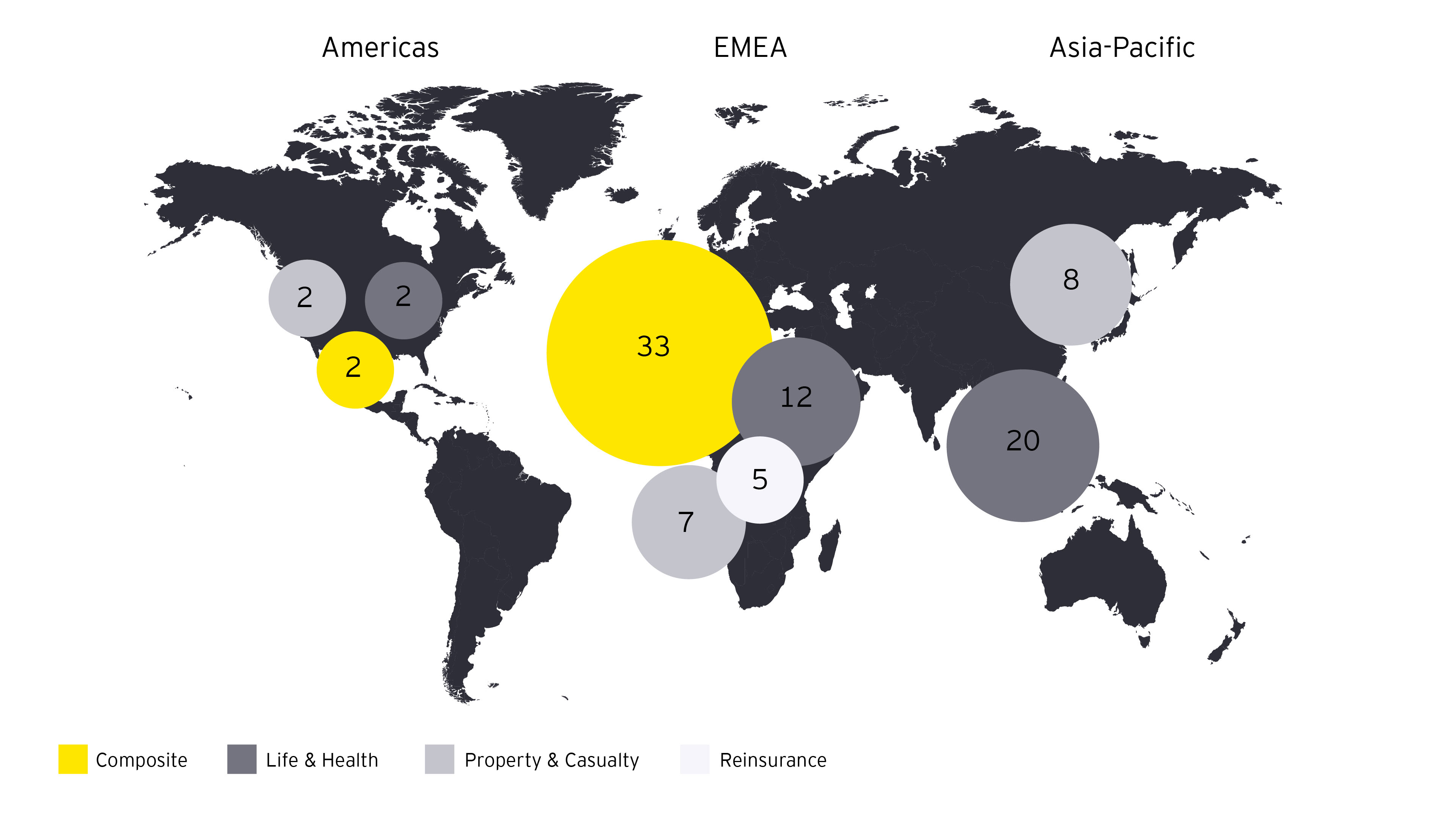

Responses by region and type of insurance company

Source: EY Global IFRS 17 KPIs Survey

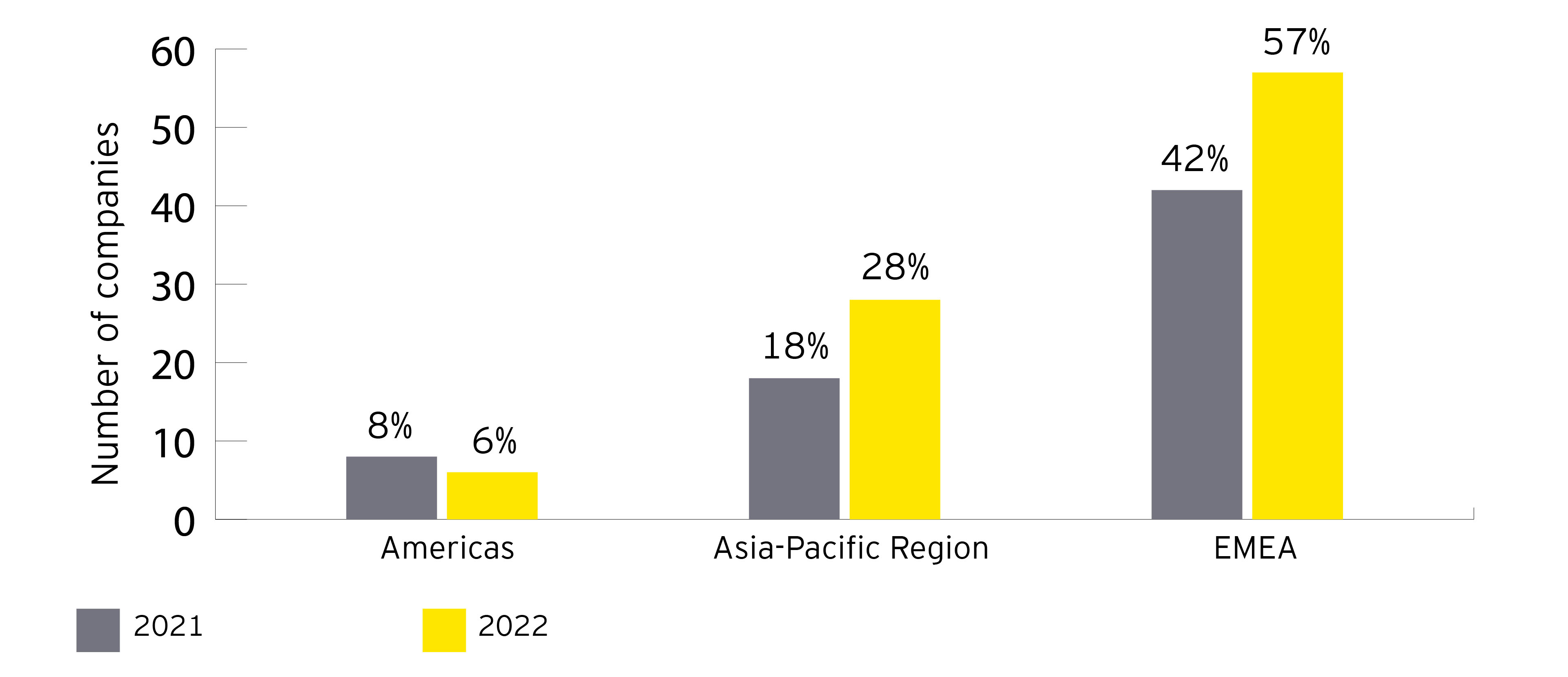

Geographic development (comparison 2021 to 2022)

Source: EY Global IFRS 17 KPIs Survey

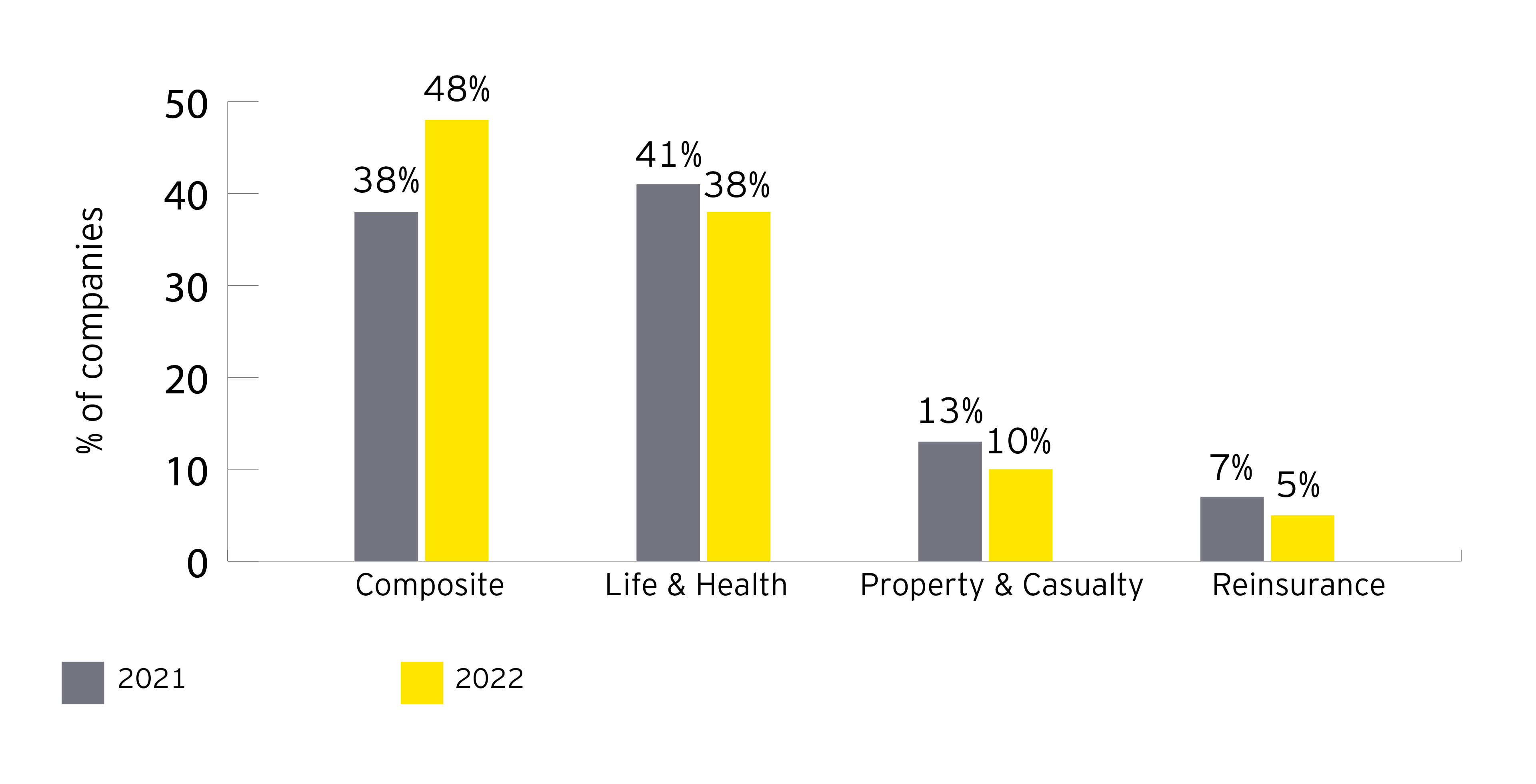

Type of insurance company (comparison 2021 to 2022)

Source: EY Global IFRS 17 KPIs Survey

Across the insurance industry, senior finance and accounting executives have invested significant time, energy, and resources in the run-up to the final implementation of IFRS 17. With 2023 now almost upon us, the latest instalment of our ongoing research series into IFRS 17 preparations reveals where insurers of all types and sizes stand. The good news is that considerable progress has been made, especially relative to identifying the right key performance indicators (KPIs) to report. However, most firms are still sorting out the many important details.

As insurers have known for some time, IFRS 17 and 9 will impact KPIs on various levels. What has only recently become clear is just how tricky it will be to define and calculate those KPIs in ways that are clear and useful to investors, analysts and other industry stakeholders. Indeed, communication has moved up the IFRS 17 agenda, as insurers must have credible narratives around not just what they are reporting but why they chose these specific KPIs and how they derived them.

We believe such transparent communication will be beneficial to all stakeholders, though it may require more upfront work. Furthermore, the new accounting standards provide a strong foundation for more streamlined and insightful financial performance management, which both internal and external stakeholders will greatly value from.

The five IFRS 17 KPIs findings you should know:

1. Preparations for IFRS 17 have advanced, but much work remains to be done, particularly for mid-sized carriers

Overall, KPIs impact assessments have advanced but are far from complete. Asian insurers in particular lag their European counterparts. Small firms have increased their preparations, but appear to be waiting on larger firms to set the tone, particularly through their round of communications in Q4 2022 and early 2023.

2. There is growing consensus around KPIs, but uncertainty remains around key definitions and calculations

Insurers are focused on establishing the right KPIs – typically, operating profit (OP) at the group level and return on equity (RoE). However, while the definitions of operating profit and RoE are becoming more consistent, there are still wide ranges of practices being considered.

For operating profit, our results show a clear trend toward including core items around insurance and investment business, namely, insurance service result, insurance finance result and investment result. For RoE, we see definitions mainly coalescing around dividing either net profit or total comprehensive income by shareholders equity. In this year’s survey, we also spotted a shift away from incorporating Contractual Service Margin (CSM) information into RoE.

While there is some inconsistency in how firms will determine operating profit, many analysts and investors may seek to recalculate that figure in a consistent manner based on the disclosed P&L line items. Here again, smaller players seem to be in wait-and-see mode, expecting larger firms to clarify a workable path forward.

3. While KPIs remain the same, there will be significant changes to how they are derived

Value of new business (VNB) will remain a key metric for L&H insurers. Historically, this was through a VNB market consistent embedded value (MCEV) metric, but we see a move towards the use of new business CSM. The survey results indicate that VNB MCEV is still an important metric for some Asian and African companies. Given the similar aim of these two metrics, it will be interesting to see how long MCEV remains given the mandatory disclosure of new business CSM under IFRS.

For P&C, combined ratio (CR), gross written premiums (GWP) and operating profit are expected to be the key metrics, though there are details to be worked out. For instance, for the combined ratio, there’s a clear trend toward using insurance revenues as the denominator, but greater divergence for the numerator. The general trend is toward not excluding Insurance finance income and expenses (IFIE) and including insurance service expenses (ISE). In these cases, insurers will need to determine which expenses to include. Our survey results show that some companies consider including other non-attributable expenses (either select or all) next to insurance service expenses.

Some P&C companies will continue to use GWP as a non-GAAP volume/sales metric, likely using existing mechanics to derive the disclosure. There are questions around the future of GWP, given the introduction of insurance revenue as a potential alternative for non-life topline growth.

4. Investment-related metrics are becoming more prominent

ROI, assets under management (AUM) and investment results are the top three choices for KPIs to disclose when looking at investment performance. ROI seems particularly important for most insurers, as it incorporates realized and unrealized gains and losses through the profit-and-loss in relation to invested assets. There is a mix of practices being considered for AUM disclosure, with combinations of book and market values being considered. The final decision will be driven by the type of business and the underlying measurement model being applied.

5. Insurers largely recognize the implications and advantage of IFRS 17 on internal reporting, performance management and management incentives

The industry has grown more comfortable about the use of IFRS 17 for internal reporting. But other frameworks (including own economic and regulatory views) also remain key, even if some companies give future IFRS accounting more prominence. Pure financial measures – premiums, predicted claims volumes, acquisition costs, and risk margins – will remain important, even as some firms shift away from the frameworks of the past.

Internal management reporting of IFRS 17 will take on greater importance for insurers in the months and years to come, particularly once implementation is completed. While many executives like IFRS 17 and 9 for internal steering and performance frameworks, there are additional benefits from looking at regulatory frameworks and some firms also intend to keep their own economic frameworks. Different frameworks do not necessarily compete but serve to provide different views on performance.

On the other hand, the use of IFRS enables companies to streamline internal reporting processes and more directly align performance measurement to external reporting. There is clear value in eliminating the noise between external targets and internal measures of performance.

Recommended actions:

Our recommendations from the inaugural KPIs survey remain important, so insurers should familiarize themselves with them. Taking one step further, firms should:

- Manage investor and analyst expectations by framing your bottom-line numbers in terms of market expectations and standards.

- Explore the impact of IFRS 17 on business planning, steering, and budgeting, and define the links to performance monitoring and measurement.

- Monitor the market and keep on top of what your peers are doing to identify converging views on key metrics.

This article is co-authored by Brian Edey, EY EMEIA IFRS 17 Leader.

Related articles

Summary

The central objective of the investor story and transparent communications is to help capital markets understand how your company is performing and how it’s positioned for an era of ongoing change in insurance. Getting this right is crucial in minimizing future uncertainty and ambiguity. We would be delighted to share more detailed survey findings, and discuss the unique impacts and opportunities presented by IFRS.