EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Digital tax strategy

What EY can do for you

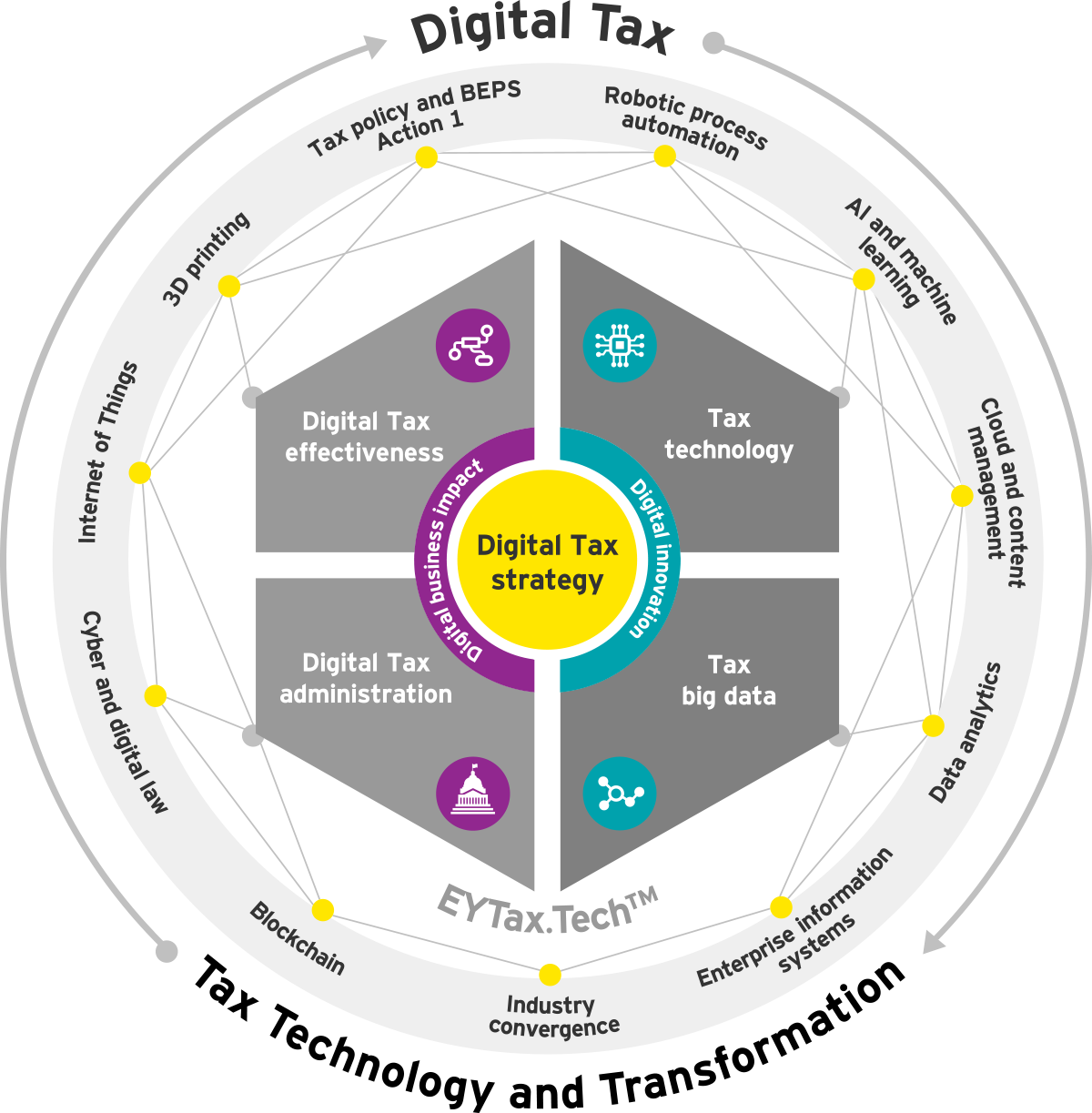

Digital tax strategy takes an in-depth look at tax from different angles including a tax department’s fundamental operations. This is illustrated below through four primary quadrants that highlight the relevant connected operations: digital tax effectiveness, digital tax administration services, tax technology and tax big data.

These four areas are enabled through our various connected solutions and teams as well as in an overarching approach that connects them to business transformation.

EY Tax Technology and Transformation practice and EY Global Innovation teams help bring our digital tax strategy to life. They’re focused on the current and future state of technology and innovation in tax, and on effecting the changes in the tax function to keep pace with changes in the landscape.

How EY can help

-

Our digital tax effectiveness team can help you build a tax strategy that supports your digital ambitions and protects your investment. Find out how.

Read more -

Our digital law team can help you identify risks and meet challenges in data and cyber, digital IP, digital regulatory law and e-commerce law. Learn how.

Read more -

Our digital tax administration services can help you close any readiness gap and prepare for, implement and manage new reporting demands. Learn more.

Read more -

Our data analytics professionals can help you manage and leverage big data to gain better visibility into your tax obligations. Find out how.

Read more

The team

Our latest thinking

How generative AI might help tax functions tackle challenges

GenAI can automate tasks, summarize information and provide insights, but it needs a person’s input to optimize the technology. Learn more.

How artificial intelligence can augment a people-centered workforce

AI is disrupting approaches to talent strategy, risk and resilience. Learn why it’s crucial to blend operational gains with a people-first mindset.

Three steps tax teams should take to prepare for quantum computing

How can tax functions prepare for quantum computing that can revolutionize tax modeling, audit resolution and fraud detection. Learn more.