EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can Help

-

Discover how EY's NextWave platform can help transform how your company manages, integrates & leverages data from IoT devices to improve performance.

Read more

4. A smart grid

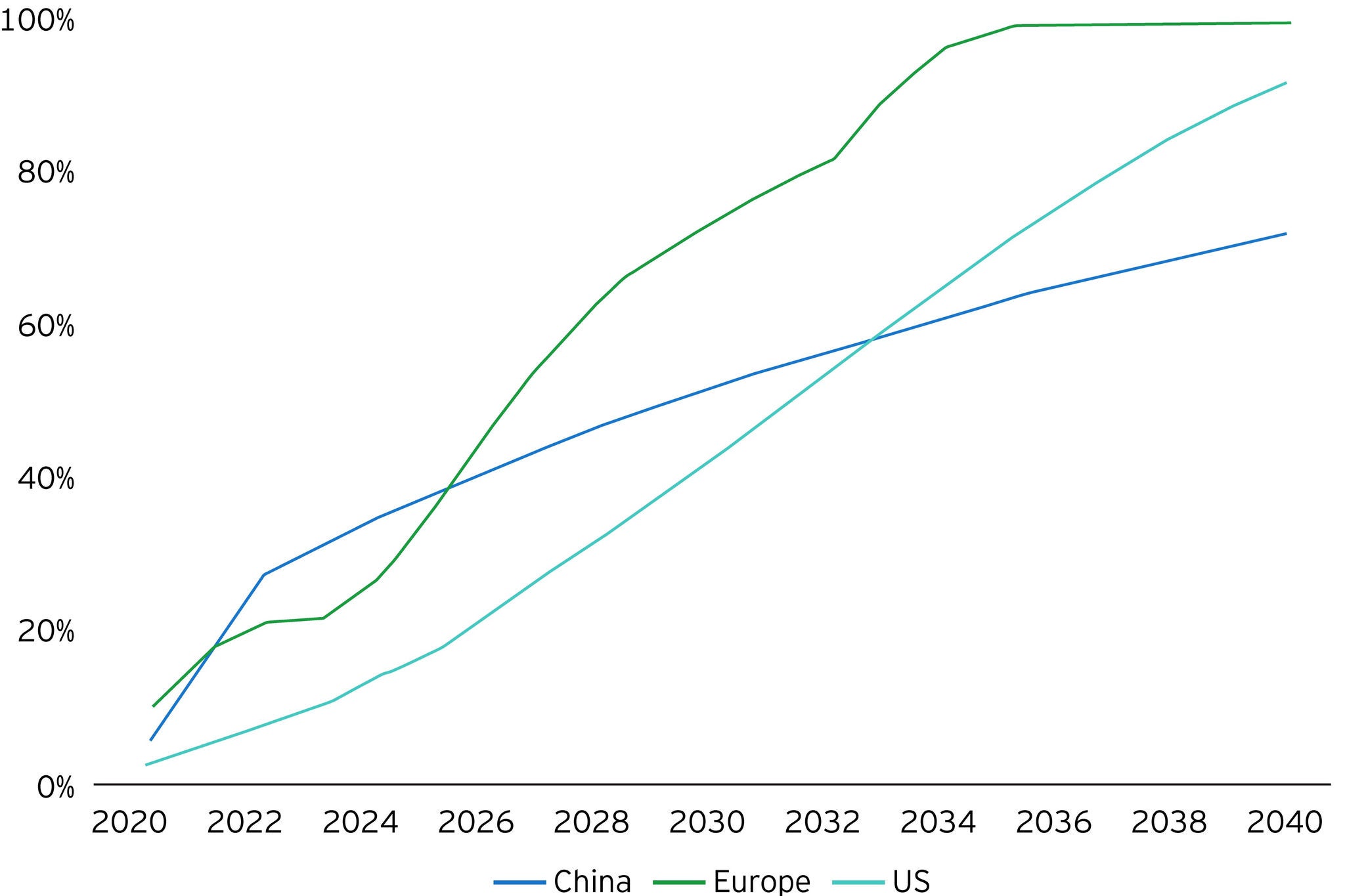

The more charging infrastructure we install, the greater the demands on the electricity grid. Once EV stock exceeds 20% of electricity demand, the need for grid upgrades becomes significant.15

But EVs can become a resource for grid stability rather than a challenge to it. They can be integrated with smart grid technologies to better manage energy demand and lessen the risk of overloading transformers or transmission lines. Existing solutions include time-of-use tariffs to incentivize EV owners to charge their vehicles at off-peak hours16 , demand-response mechanisms and bidirectional charging.

Vehicle-to-grid (V2G) technology is the next evolution. Though still at an early stage of development, it allows the grid to push and pull energy to and from connected vehicles if demand threatens supply. A recent study by IRENA indicates that V2G could reduce the cost of grid reinforcement by 10%.17

Utilities must play a critical role in ensuring that EVs are integrated. Grid forecasts for EV integration can estimate the impact of future additional loads. And coordinated plans for grid expansion and enhancement, and digital technologies for two-way communications and pricing between EVs and grids, will further support integration.

5. Digitization

Millions of EVs will generate masses of data — a new challenge in road transport. Data storage, ownership, usage and regulation must be resolved to allow enhanced eMobility services and monetization.

The ecosystem connects EVs and chargers with energy, buildings and corporate infrastructure. It bulges with data, which can give truer assessments of infrastructure needs. It can support better understanding of grid networks and inform decisions to integrate renewables. On the customer side, data can be used to tailor products and services around unique needs.

Data, once converted into a digital format, allows EV drivers to benefit from interoperability. It means they can connect wirelessly, roam and pay to charge in a safe, easy and convenient way, which builds customer confidence and advocacy for EVs. However, greater interoperability depends on open connected platforms for data sharing, as well as fair and transparent data access requirements. This will mean adopting and harmonizing open protocols to support interconnections between EVs, charge point operators (CPOs) and eMobility service providers. And for that, the ecosystem of players must put aside competition in the interests of the common goal.

6. Skilled labor

As one powertrain gives way to another, the transition is forecast to create more jobs than it displaces. In the US, a net gain of two million jobs would be realized in 2035 if all new car and truck sales were electric.18 Similarly, approximately 1.1 million permanent jobs would be created if the entire European fleet were electric.19

However, the skills and competencies required in EV manufacture are significantly different from those demanded by ICE. Failure to attract and retain staff, and to provide adequate training, will impact production lines and the availability of vehicles.

On the road to an all-EV lineup, many automakers are committing to safeguard jobs and upskill staff. Some team with technology partners, universities, community colleges and learning platforms to create tailored training pathways. However, governments must get behind the skills transition too, with investment in apprenticeships and recognized qualifications for electric powertrains.