EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

In brief

Part 1: On the side of foreign investors

Part 2: Building Trust

Part 3: Facilitating investment – Perfect match

Part 4: A "mission" to raise the bar for Vietnam

Part 1: On the side of foreign investors

Exploring uncharted water

The first Law on Foreign Investment was passed in December 1987, one year after "Doi Moi”, creating a legal foundation for foreign capital flows into the Vietnamese market. The first-ever investment license was granted to a foreign joint venture in 1988.

The initial direct capital set the course for an impressive journey that made Vietnam a top destination for foreign investors. Since then, 34.527 FDI projects in diverse sectors have brought in a total registered capital of US$408.1 billion by the end of 2021, according to the Ministry of Planning and Investment.

EY Vietnam entered the country just four years after it officially opened up to foreign capital inflows. At the time, Vietnam GDP per capita was only around US$363 (1992), one of the lowest in all of Southeast Asia. The country was struggling with a significant trade deficit and depended heavily on the public sector while the private sector was still in its infancy stages of development, under US embargo. The Vietnamese market was nearly unknown to global investors at the time.

Audit team in Ho Chi Minh city, 1999

However, Vietnam had many advantages over its South East Asian nations such as its stable political system, strategic location and its young workforce. In particular, the country's leaders outlined a vision to bring the economy on par with some of the most developed countries in the region and the world.

In these early days, the concept of the independent audit was still unfamiliar and related regulations had yet to appear in the country. EY Vietnam was one of the first to provide audit services pursuant to international financial reporting standards. Our services were chosen by early foreign investors such as BP, Coca-Cola, ABB, Shell and Hewlett Packard.

A meeting between local regulators and Founding Partners at the Hanoi Opera House, 1993

The assurance services of EY Vietnam helped enhance the trustworthiness of financial reporting and disclosure, contributing to the country’s economic growth. In addition, recommendations from the audit feam, the added values, also helped businesses to strengthen their internal control systems, compliance and somehow improved business process, financial management and other activities. This is EY Vietnam’s key contribution to the development of FDI community in Vietnam in the early days.

Not only providing assurance services for the FDI sector at the dawn of foreign investment in Vietnam, EY Vietnam has also assisted non-governmental organizations (NGOs) by providing financial reports. This has helped meet the large unmet need for transparency and quality information among donors and other stakeholders. In many cases, the firm was a sponsor for a significant number of NGOs projects through its audit services, an effort to join hand to support vulnerable communities.

Apart from its services for FDI enterprises and NGOs, EY Vietnam professionals have also been pioneers in bringing global auditing knowledge and best practices to Vietnam. Since entering the market in 1992, a group of more than 10 EY Vietnam members have been doing research and translation on audit and economic terminologies, which was the first steps, paving the way for audit law development.

On 29 January 1994, two years after EY Vietnam was established, the Government issued Decree No.07-CP on independent auditing in the national economy to serve as the highest legal basis for independent audit activities. This was followed by 3 Decrees, 16 Decisions and Circulars, creating a legal framework for independent audit activities in Vietnam. Between 1999 and 2005, the Ministry of Finance issued a system of 37 Vietnamese standards on auditing and professional ethics standards for independent auditing activities. Vietnam has been gradually improving its legal framework for independent audit to catch up with international practices while molding it to local economic conditions.

EY Vietnam experts receiving their ACCA certificates, 2017

EY Vietnam Partners were awarded the Minister of Finance’s Certificates of Merit, October 2020

Along with these improvements in audit policy, Vietnam Association of Certified Public Accountants (VACPA) was established on 13 May 2005. The Government authorized the association to draft and update audit standards, review auditors, organize training to disseminate best practices and support the Ministry of Finance in organizing examinations and issuing auditor’s certificates. EY Vietnam has played an active role in the majority of the organization’s activities. Cuong Dinh Tran and Thanh Thai Nguyen (currently VACPA Vice President) – both EY Vietnam Partners – have been serving as major figures in the organization.

In 2011, the National Assembly passed the Law on Independent Audit. This is the highest legal document on independent audit in Vietnam, enhancing the position of independent audits and putting the profession on track to sustainable development.

It is fair to say that in the past 30 years, information disclosure and transparency have improved remarkably at business organizations. To a great extent, this was a result of a maturing independent audit profession and enhanced legal supervision. A healthy investment environment supported by independent audits lead to capital market growth and improved the effectiveness of Government management and business activities. EY Vietnam is proud of its contributions to these remarkable achievements via policy consultation and human resources training.

Coca-Cola Vietnam Limited Liability Company (Coca-Cola Vietnam) was one of the first FDI pioneers that EY Vietnam has provided services for, mainly in assurance and tax, when they set foot in the market. Building on more than 100 years of global relations between the two corporations, the professionalism and expertise of EY Vietnam's staff solidified Coca-Cola Vietnam’s trust and proved instrumental in retaining them as a faithful client in Vietnam until today.

I have had the opportunity to work with EY Vietnam for more than 15 years now, as Chief Financial Officer (CFO) of Coca-Cola Vietnam and many other organizations later on. We have always put great stock in the quality of services at EY Vietnam and in the expertise of their audit managers and advisors. We have always had faith in their professional advice and could rely on their support in good times and bad. Working in other international organizations after Coca-Cola Vietnam, we have also been relying on EY for a wide variety of services like M&A, due diligence and transaction advisory, other than tax and audit. We have been great partners for the past 15 years.

In addition to Assurance services, EY also provides tax advisory and legal services for FDI enterprises to open local branches and comply with local regulations. Thanks to the support, advice and connections of EY Vietnam, FDI enterprises could keep pace with market developments, stay compliant, grow and contribute to the state budget.

As a "bridge" between regulators and multinational corporations, EY Vietnam has been cooperating with the Foreign Investment Agency of the Ministry of Planning and Investment, Vietnam's Association of Foreign Invested enterprises, and Vietnam CFO Club to organize various seminars and conference on tax and investment policies for investors in Hanoi, Ho Chi Minh City and key provinces like Hai Phong, Bac Ninh, Vinh Phuc, Dong Nai, Hung Yen and many others.

EY Vietnam has also been actively supporting regulators with policy recommendations and advisory adopting best practices from developed markets. These contributions of EY Vietnam and other organizations have partially helped close loopholes and create a comprehensive regulatory framework accommodating Vietnam’s unique requirements as well as international practices.

In addition, EY Vietnam has long been promoting the Vietnamese market to potential overseas investors. This helped Vietnam tap into global capital flows to feed its economic development and acquire advanced technologies. Meanwhile, EY professionals have been promoting Vietnam as a promising investment destination in their regular keynote speeches at major forums and seminars on tax and investment in Vietnam and abroad, in Singapore, Japan, Korea and Hong Kong.

A workshop on M&A implementation in South Korea in 2018

EY Vietnam experts attending the AOTCA Tax Conference in Japan, 2015

Motivation and trust

In November 2005, the National Assembly adopted the Law on Investment, replacing the Law on Vietnam Investment and Foreign Investment. The new legislation created a more level playing field for domestic and foreign businesses and reinforced Vietnam’s appeal to foreign investors. Reassured by Vietnam’s admission to the World Trade Organization (WTO) in 2007, FDI continued to flow into the market. Billion-dollar projects were no longer rare, with Intel, Posco, Samsung, Formosa, LG and many others setting foot in the market.

The cooperation between EY Vietnam and Samsung Electronics Vietnam Company Limited (Samsung Vietnam) is a good example of its close relations with foreign corporations. Samsung Vietnam is the largest FDI enterprise in the country, with a total registered capital of all projects, worth US$18 billion by 2021. EY Vietnam has been working together with Samsung since it established its first smartphone plant in Bac Ninh and grew into the premier foreign investor in Vietnam.

Samsung Vietnam's manufacturing plants in Bac Ninh, Thai Nguyen, and Ho Chi Minh City have sent powerful ripples across the world, drawing along hundreds of component manufacturers and service suppliers from its supply base in Vietnam and other countries. With the unprecedented scale of its investment in Vietnam, Samsung Vietnam needs top-range support from consulting firm who masters the local market knowledge and best practices, to keep on top of domestic and international developments.

In addition to advising Samsung Vietnam on tax, legal and operational matters, EY Vietnam has proactively appeared in their ruling dialogues with the government on investment and tax policies, incentives and crucial mechanisms. These dialogues have laid a solid foundation for Samsung to flourish in Vietnam in the long haul.

EY has been helping us since Samsung entered Vietnam in 2009, supporting us with information and consultancy on investment, tax accounting and tax matters. As the largest conglomerate in Vietnam, it is essential that we stay updated on government policies and every market movement. EY has always helped us maintain a reliable communication channel with government stakeholders. I believe this collaboration will continue to be a resounding success for both Samsung and EY.

Japan is the country providing the second largest FDI in Vietnam. According to data from the Foreign Investment Agency of the MPI, Japan has disbursed a total investment of nearly US$64.2 billion as of 20 November 2021. Japanese companies accounted for one of the key client groups among EY Vietnam clients thanks to its exceptional services and unwavering support throughout their development.

EY Vietnam supported the Ministry of Planning and Investment in hosting a dialogue between Vietnamese Prime Minister Pham Minh Chinh and Japanese investors in Tokyo, Japan, November 2021

Mitsubishi Corporation (Vietnam) Co., Ltd is a typical example of large Japanese industrial and technological corporation operating in Vietnam. Out of its diverse global portfolio, Mitsubishi Vietnam focuses on automotive, electronics, elevators and commerce. Beyond its respectable 25 years of experience in automotive manufacturing with a factory in Southern Vietnam, the company also plans to establish new production projects while also promoting its consumer finance business.

EY Vietnam has contributed a great part to the continuous growth and development of Mitsubishi in Vietnam. With the firm’s support in understanding the policy landscape in automobile, finance and consumer credit, as well as in dialogues with the government and other authorities such as the Ministry of Industry and Trade, the Ministry of Finance and the State Bank of Vietnam, Mitsubishi Corporation (Vietnam) leaders have made many strategic decisions that set the foundation for its future growth.

I clearly remember in early 1990s when I first visited Ho Chi Minh city on a business trip, there was already a magnificent EY office on our way from Tan Son Nhat airport to the city center. Since then, Mitsubishi Corporation in Vietnam has been getting in touch with EY Vietnam in many fields such automobile, elevator, and many other manufacturing sectors through our joint ventures, as well as through your regular advisory services in our administration work in accounting, especially in your professional advices in taxation. We have been, and definitely will be very much satisfied with your prominent specialty and profession in your services represented by the entire EY Vietnam team.

Foreign Investment Agency - Ministry of Planning and Investment and EY Vietnam signed a Memorandum of Understanding on investment promotion in Vietnam in 2021

Looking beyond Asia, Vietnam has always been at the forefront of capital inflows from Europe and the US. A notable European enterprise betting on Vietnam from the early days is Piaggio Vietnam Co., Ltd (Piaggio Vietnam), part of Piaggio Group, the Italian premium scooter manufacturer of Piaggio and Vespa. After 15 years, Piaggio Vietnam has become one of the largest motorcycle manufacturers in Vietnam, with ambitious investment plans to turn the country into its global production hub.

In addition to providing exceptional tax advisory services, EY Vietnam has also supported Piaggio to connect with Vietnamese regulatory agencies. These communication channels helped Piaggio participate in policy advisory and the creation of a more conducive environment for growth and development. These relations empowered Piaggio and other European corporations to contribute to the overall development of the Vietnamese economy.

Over the past decade, Piaggio Vietnam and EY have built and nurtured an enduring partnership where we are part of each other’s daily operations and stood by each other at many strategic turning points of our organizations. Of the many distinguished qualities of EY Vietnam, the first I would like to highlight is their customer-oriented culture. We see many EY Vietnam con sultants now as part of our team as they have always carefully listened to our needs and supported us through thick and thin. Their extensive knowledge of Vietnam and robust sense of business makes them a force to be reckoned with. Last but not least, their worldwide presence makes EY the right partner for multinational companies such as Piaggio Vietnam and Piaggio Asia. EY Vietnam has certainly left their mark on Piaggio Vietnam’s journey and I am grateful for their contributions.

EY Vietnam receiving the 2021 Golden Dragon Award from the Vietnam Economic Times

We have been working closely with foreign corporations from before they laid their first brick in Vietnam. We stood by them through their ups and downs, faced down their challenges with them. Together, we overcame market volatility and every difficult business challenges threw their way. This is our link with our clients, forged in the fire of their growth in Vietnam.

The deeper Vietnam integrates into the regional and world economy, the more attractive it becomes to foreign investors. The country has signed and entered into dozens of new-generation free trade agreements such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the European Union-Vietnam Free Trade Agreement (EVFTA), and the United Kingdom-Vietnam Free Trade Agreement (UKVFTA). These agreements have been likened to "expressways" to transport "Made in Vietnam" goods and services to markets around the world. Through its system of bilateral and multilateral agreements, Vietnamese products have been exported to 55 countries, accounting for two-thirds of the world's GDP and three-quarters of the global population.

Grasping and leveraging FTAs is far from easy. With local experience and global knowledge, we have been supporting multinational corporations so that they can make the most effective use of the preferential tariff treatments, trade facilitation measures, protections for investors as well as intellectual property rights in trade pacts Vietnam has signed.

For this, EY Vietnam has proactively connected with EY region to provide more diversed services to help foreign investors optimize benefits from tax incentives under Vietnam’s FTAs while mitigating potential risks.

Vietnam-India Investment Seminar in Ho Chi Minh City, hosted by EY Vietnam, April 2021

Sharing and solution

As the FDI sector continued to grow and became an important part of the economy, the demand for trade in goods and services within multinational corporations has also increased. This has elevated the risk of falling afoul of transfer pricing regulations, which is a relatively new issue in Vietnam, both in terms of regulatory practices and practical application.

In 2010, the Ministry of Finance issued Circular No. 66/2010/TT-BTC (Circular 66) revoking Circular No. 117/2005/TT-BTC and providing guidelines on transfer pricing and related issues. Circular 66 came at a time when transfer pricing was making headlines in Vietnam. It was frequently discussed at the National Assembly as more and more FDI enterprises kept expanding production and business despite reporting operating losses for several consecutive years. Since then, Vietnamese tax authorities have strengthened inspections and transfer pricing audits, creating a major concern for FDI businesses.

Annual transfer pricing seminars, organized by EY Vietnam

Joining the global movement against transfer pricing, in July 2017, Vietnam joined the Base Erosion and Profit Shifting Inclusive Framework (BEPS). To close potential loopholes in the domestic tax system and improve tax compliance, the country has also adopted the Law on Tax Administration. Effective since July 2020, this law contains several articles and provisions on transfer pricing.

Furthermore, the Government has also issued Decree No. 132/2020/ND-CP (Decree 132) on tax administration for companies having transactions with related parties, including content consistent with BEPS-related guidelines and recommendations published by the Organization for Economic Cooperation and Development (OECD).

Under Vietnam’s prevailing tax laws, enterprises are obliged to: (1) analyze, determine and declare transfer pricing according to the principles of "independent transaction" and the "nature of transaction, operation, decision on tax obligations”; (2) prepare a three-tier compliance documentation before finalizing corporate income tax; and (3) provide documents and explanations at the request of tax authorities.

To help businesses understand and comply with regulatory changes, more than 10 years ago, EY Vietnam set up a transfer pricing advisory team. Going from a few full-time employees in 2010, the team is now more than 65 employees, including domestic and foreign experts.

Transfer pricing is currently one of the biggest headaches, not only for the Government but also for the FDI business community. Without effective management tools, transfer pricing has been a contentious topic between regulators and foreign investors. As an expert trusted by both sides, we have been supporting businesses to work out solutions that align with both their local and international reporting obligations.

EY Vietnam has hosted training courses and seminars to help FDI corporations understand local regulations, their compliance obligations, tax administration trends in Vietnam and other countries, as well as the benefits of effective transfer pricing regulations. These events aim to fill the substantial unmet need among FDI enterprises and support them in taking the right steps for compliance.

EY Vietnam's leadership and experts are also in regular discussions with tax authorities. By sharing policy recommendations and their experience, the firm has contributed to the development of laws in line with international practices as well as actionable tax regulations. In addition, EY Vietnam has provided advisory on the frameworks to enforce these obligations and to ensure that the correct tax charge is issued to enterprises involved in transfer pricing in Vietnam.

As a reliable partner, EY Vietnam leads the way for clients and brings added value to their ventures. As a result, the firm is a trusted advisor regarding tax and transfer pricing to the foreign business community in Vietnam.

Countries around the world are tightening their hold on transfer pricing, not only in respect of cross-border transactions but also those taking place within the country. Going forward, on one hand, we will continue promoting premium consulting services for FDI corporations to help businesses mitigate risks and enhance performance. On the other hand, we will carry on with our seminars to help local businesses come to grips with tax regulations. We will also be supporting the review of risk assessment, structuring and implementation of pricing policies while compiling compliance documentation for related party transactions taking place in Vietnam.

Part 2

Building trust

State-owned enterprise reform | Refining the institutional framework | Carrying the torch in GPS

State-owned enterprise reform

The reform of state-owned enterprises (SOEs) is a long journey that started with a pilot equitization program in the 1990s. The primary goal of this reform is to enhance the operating performance and management of public assets.

The reform started tentatively. The first authoritative document issued by the Council of Ministers (now the Government) in 1990 was Decision No. 143/HDBT dated 10 May 1990, which selected a number of small and medium-sized SOEs for pilot transformation into joint-stock companies.

After the successful pilot, the government decided to broaden reforms between 1988 and 2002. EY Vietnam has been involved since this stage of the program to improve the performance of SOEs

During this period, EY Vietnam’s engagement with the Government and Public Sector (GPS) was led by leading experts in Vietnam and across the region, including Cuong Dinh Tran, Gerard Holtzer, Tom Chong, Thanh Thai Nguyen and many others.

With a team of international SOE reform veterans, EY Vietnam implemented a series of large-scale projects valued at tens of millions of US dollars.

A workshop organized by EY Vietnam under a large-scale project

EY Vietnam assessed the financial health, competitiveness, operating performance, governance, economic viability and strategic role of SOEs undergoing reforms. Afterwards, the firm helped these SOEs prepare action plans to restructure operations, improve governance and implement investment and transformation projects.

Throughout the project, EY Vietnam also submitted policy recommendations to the government to enhance the operating performance of SOEs.

In addition to this diagnostic audit project funded by the Miyazawa Foundation, EY Vietnam also facilitated the SOE reform process through a series of projects supporting Initial Public Offering (IPO) readiness. SOEs from various industries benefited from EY Vietnam, including banking, insurance, telecommunications, infrastructure and construction.

The SOE restructurings and reforms reached their peak in 2003-2010 when larger and more complex public conglomerates came on the agenda. At the time, the Vietnamese economy achieved several breakthroughs, setting the stage for accelerated SOEs reforms and legal improvements.

Vietnam’s integration into the world economy was deepened by its entry into the World Trade Organization (WTO) in 2007 and participation in numerous free trade agreements. This boosted economic growth and fueled the country’s determination to integrate into the world economy. This, in turn, required stronger SOE reforms to create a more level playing field for all economic actors.

More than a year after Vietnam’s accession to the WTO, Southeast Asia was shaken by the world economic crisis stemming from a sharp downturn in the US financial market in 2008. Unfortunately, Vietnam was not beyond the reach of this crisis. As the world and Vietnam's growth slumped, Vietnamese regulators had to rethink policies to ensure continued development. In particular, they needed to find policies that would help businesses recover while leveling the playing field for the different sectors and allowing Vietnam to continue its globalization journey.

The period of 2010 to 2017 saw Vietnam rise from the group of low-income countries, a significant milestone in its development. At the same time, however, the country could no longer rely on funding from international organizations and needed to be self-reliant as it pursued globalization. To develop, Vietnam has built a regulatory system that is attractive enough for international investors.

Throughout this transition rife in domestic and foreign economic events, EY Vietnam continued supporting the government in creating more open and even-handed policies to strengthen linkages between the public and private sectors. The firm was involved in the formulation of SOE supervision and open-door investment policies, among many others.

The technical training on budget building and short-term cash flow forecast under the project on building the biding criteria for MIS System - SOEs as well as strengthening financial supervision at SOEs

In the GPS, we focus on supporting the Government and SOEs during the country’s transformation. With a motivation to develop a sustainable business model, our Government & Public Sector has always been working to be a trusted advisor for state authorities, international donors and SOEs.

EY Vietnam is determined to continue supporting SOEs to improve their governance to international standards and tap into capital markets. Between 2008 and 2017, EY Vietnam was one of the two international consulting firms regularly invited to participate in the project series funded by the Asian Development Bank (ADB). These programs focused on improving SOE governance to integrate into and operate more effectively in the international market.

Through projects funded by the ADB, EY Vietnam conducted the assessment of several SOEs and corporations of strategic significance in Vietnam’s SOE reform roadmap. Based on its findings, the firm also consulted these SOEs on restructuring and improving their corporate governance. The projects’ deliverables also served as input for the formation of new policy lines for the next stage of the reform.

Conducting state-owned enterprises' reform and corporate governance enhancement projects while Vietnam has been integrating deeply into the global economy requires well-versed expertise, not only global best practices but also Vietnamese economic context. EY Vietnam, with a team of international SOE reform veterans, has always been our trusted partner on numerous SOEs related projects. Those projects proved to be instrumental in improving the level playing field for the country.

In addition to sharpening their competitive edge, EY Vietnam was also instrumental in developing the internal audit ordinance of SOEs and regulatory authorities in 2010. It was picked by the Ministry of Transport for the purpose, beginning a partnership that remains strong to this day.

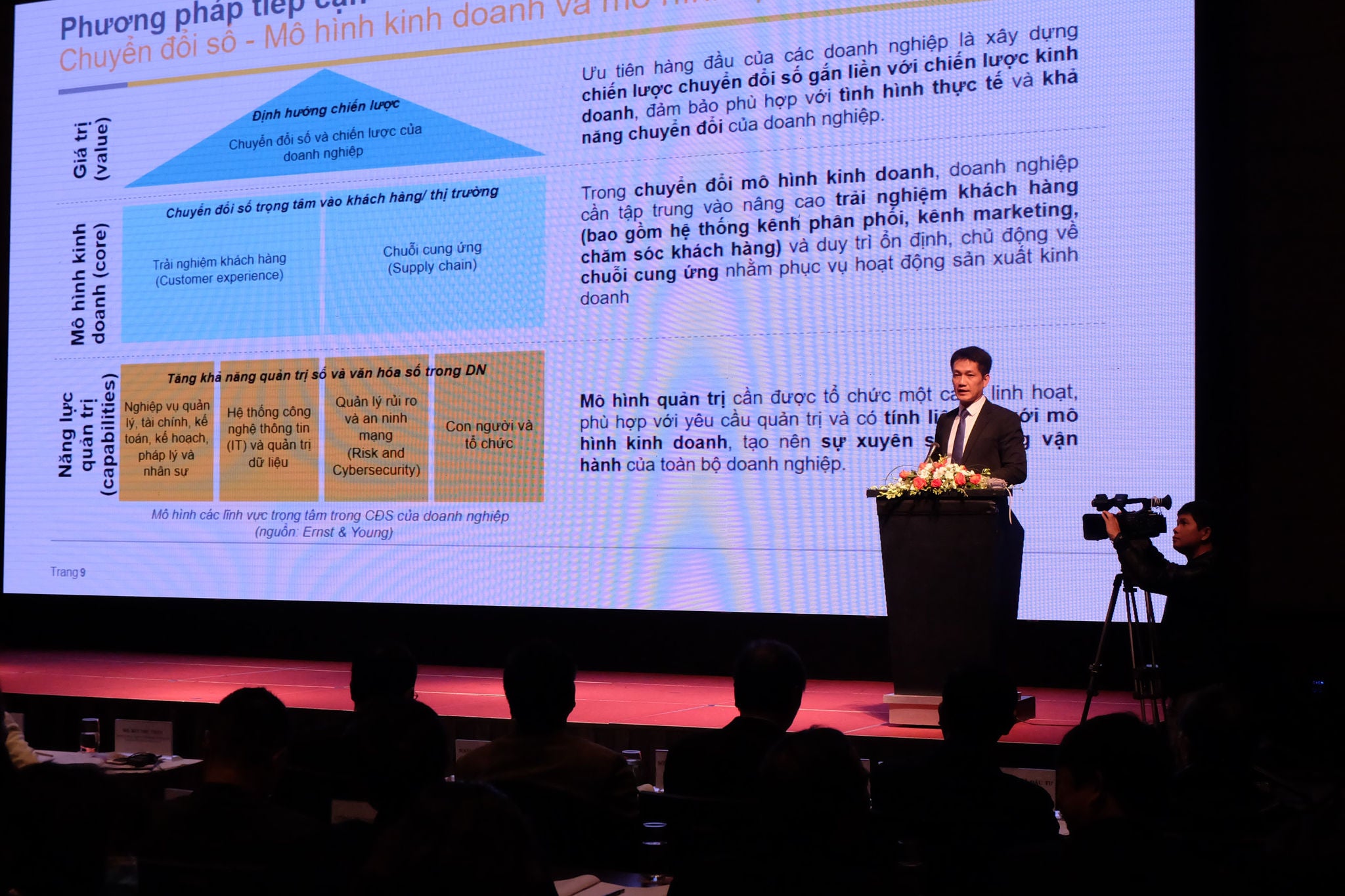

Since 2011, not only has EY Vietnam supported the government in reforming and restructuring SOEs, it also worked with many of these companies on strategy and operation transformation programs. EY Vietnam has provided consultancy in many fields, including strategic and organizational models, IT systems, risk management, internal control and people.

During this tumultuous period, EY Vietnam has lived up to the name of the global consulting firm in its work with state-owned groups and corporations. It has implemented high-caliber strategy formulation projects that affected not only the businesses but also the country’s economy. These large-scale projects included strategic consultancy for Vietnam Posts and Telecommunications Group (VNPT), Vietnam Mobile Telecom Services One Member Limited Liability Company (Mobifone) and Vietnam Oil and Gas Group (PVN) as well as model building projects for Military Telecommunications & Industry Corporation (Viettel) and The Vietnam National Textile and Garment Group (Vinatex).

SOEs are unique and are very different from private enterprises. They are bound by an incomplete legal framework fraught with inconsistencies. They must strike a balance between economic and social objectives. They are far more restricted than private firms when it comes to dealing with strategic problems. With our local experience combined with the GPS knowledge of EY’s regional team, EY Vietnam has successfully supported not only SOE restructuring projects but also many digital transformation projects.

Petrovietnam and EY Vietnam signing the consultancy contract for the former’s Digital Transformation Strategy (2021)

MobiFone and EY Vietnam signing the Construction Project Development Strategy to 2025 with vision to 2030, Hanoi 2021

Refining the institutional framework

In addition to supporting the SOEs reform, EY Vietnam continues to work closely with state authorities, including the Ministry of Finance and the State Bank, on projects related to legal reform and the development of legal mechanisms approaching international standards.

EY Vietnam is also an active participant in building capacity for the Ministry of Finance’s staffs, especially the Corporate Finance Department in charge of SOEs. EY Vietnam has been providing technical assistance in developing critical circulars and decrees on supervising SOE operating efficiency. The firm also provided technical assistance in the drafting of the corporate finance supervisory manual 2016-2017, an indispensable handbook for SOE leaders and the Ministry of Finance.

Most recently, EY Vietnam has partnered with the Ministry of Finance to conduct a survey on the implementation of the Law on Management and Utilization of State Capital Invested in the Enterprise’s Manufacturing and Business Activities (Law 69/2014/QH13). The EY team designed the survey to uncover implementation challenges from the perspective of companies and agencies representing the state interest in SOEs. The survey was later used as crucial input for amendments.

The Ministry of Finance chose EY Vietnam for its track record in implementing SOE reform projects. Furthermore, EY Vietnam has been directly assisting in the independent transformation of numerous SOEs in a fiercely competitive and volatile market.

EY Vietnam expert presenting in the seminar on the Law on Management and Utilization of State Capital Invested in the Enterprise’s Manufacturing and Business Activities, 2021

Another Ministry of Finance project EY Vietnam was engaged in involves advisory for the preparation of a pro forma document for financial information disclosure prior to an initial public offering (IPO). The statement would help regulatory authorities and investors better understand the financial health of prospective companies, especially companies that have just been the subject of M&A or a spin-off.

While popular in markets like the US, Europe and Singapore, the pro forma statement is a relatively new concept in Vietnam and there is currently no legislation guiding its implementation.

A pro forma statement could bring some much-needed transparency to the Vietnam market, as numerous companies carry out restructuring prior to an IPO or listing on the domestic stock exchange. Currently, if a company submits its financial statements to the State Securities Commission for approval, the submitted financial information may not fully reflect its financial status.

Recognizing the complex issues surrounding pro forma statements, the Ministry of Finance has appointed EY Vietnam to utilize its extensive local and global experience to assist in the development of this document.

Once guidance is issued on the preparation of pro forma statements, disclosures in the stock market will be more transparent and the market will operate more efficiently. This will facilitate the management of listed companies by the State Securities Commission of Vietnam. While introducing additional tasks before an IPO, applicants are set to benefit from stronger investor confidence in their operations and financial status.

The project on the implementation of Law No. 69/2014/QH13 and the pro forma statements are two of the latest GPS-related projects delivered by EY Vietnam.

Traditional financial statements do not fully reflect the financial position of a company which has previously been involved in M&A or spin-off and is now about to go public. A pro forma statement would provide regulatory authorities and investors with a more well-rounded view of the company's performance and prospects.

Carrying the torch in GPS

In addition to finance-related advisory, EY Vietnam’s GPS division is also present in areas like infrastructure development and energy through its partnership with the Ministry of Transport and Ministry of Planning and Investment.

To boost the government's efforts to mobilize resources for infrastructure investment, EY Vietnam supported the Ministry of Transport to develop a policy framework for public-private partnership (PPP) in transport projects in 2015. Between 2017 and 2019, EY Vietnam, with funding from the World Bank, also supported the Ministry of Planning and Investment in submitting a PPP bill. The resulting PPP Law has set the foundation for Vietnam to attract private capital into transport infrastructure development in Vietnam.

EY Vietnam professional presenting at the seminar hosted by the Ministry of Finance on the application of financial report standards in Vietnam, 2020

EY Vietnam professional presenting at a seminar under the project on supporting SME access to the global supply chain, 2021

Fully evaluating the existing legal framework for PPP projects required EY Vietnam to collaborate with regional EY experts, as well as local and international law firms. Based on the insights gained, EY compiled a set of recommendations to the Ministry of Planning and Investment and the Government of Vietnam to accelerate Vietnam’s PPP program.

The Law on Public-Private Partnership Investment was adopted by the Vietnamese National Assembly in June 2020, creating a strong legal corridor to attract private investment into essential infrastructure projects and contribute to the country’s economic development.

EY Vietnam's success in advising the Government on policy changes has been instrumental in building trust in our capabilities. The market has come to trust that we can adjust EY Global knowledge and experiences to the particulars of Vietnam.

Scientific seminar on a legal corridor for digital banking in Vietnam, hosted by the State Bank of Vietnam, 2017

The PPP project demonstrates EY Vietnam’s efforts to support the development of an effective legal framework to optimize the workings of the country’s economy in key areas such as infrastructure and energy. This important bill is of strategic significance for EY Vietnam and the firm’s contributions have inspired trust and confidence from regulatory authorities. The bill also added to the image of EY Vietnam as a reliable advisor in legislative projects. It is rare to find a member of the EY Global network that has engaged at such high levels with regulatory authorities and helped draft laws of such importance.

EY Vietnam's success in advising the Government on policy changes has been instrumental in building trust in our capabilities. The market has come to trust that we can adjust EY Global knowledge and experiences to the particulars of Vietnam.

Part 3:

Facilitating investment – Perfect match

Paving way for indirect investment | Integrated services

Paving way for indirect investment

On 18 May 2021, Masan Group and a consortium led by the Alibaba Group and Baring Private Equity Asia (BPEA) announced a contract for the acquisition of 5.5% in The CrownX, a Masan subsidiary, through private placement for a total cash consideration of US$400 million.

This strategic partnership will accelerate Masan’s transformation of The CrownX into a “Point of Life”, a one-stop-shop to serve consumers’ everyday needs, either offline or online. Masan’s top priority is to modernize Vietnam’s grocery markets and develop an unparalleled customer experience.

This deal received effective support from EY Vietnam's Strategy and Transactions (SaT) team in financial and tax due diligence of Masan’s two key areas, FMCG and retail.

This is just the latest in thousands of successful M&A deals over the past 20 years in which EY Vietnam Strategy and Transactions (SaT) played an integral role behind the scenes.

Records show that foreign investors and investment funds began noticing Vietnam in the 2000s after the launch of the domestic stock market and the first trading session on 28 July 2000.

In the beginning (1998–2002), EY Vietnam mainly provided services related to financial due diligence (Finance DD) and tax due diligence (Tax DD), competencies that have since been substantially extended.

EY Vietnam organizes annual seminar on M&A in the Republic of Korea

M&A activity heated up in Vietnam between 2007 and 2017. The market bustled with deals and hit a peak of US$10 billion in value in 2017, according to the Vietnam M&A Forum Research Team. This was a time of growth for local enterprises and the stock market grew richer in options for investors with stakes not only in equitized SOEs but also in private companies. The M&A wave during this peak period was due to Vietnam’s economic restructuring drive, especially SOE equitization, the restructuring of the national banking and financial system, and the tackling of non-performing loans. Furthermore, the legal framework was carefully adapted to evolve with the economy.

Vietnam’s competitive advantages include its geostrategic location, stable political system, young labor force, surging disposable income, and lower costs of living. The country will continue to be an attractive investment destination for multinational conglomerates. Euromonitor International forecasts Vietnam to be one of the most vibrant and promising M&A markets in the world, with an M&A investment index reaching 102 points, second only to the US (108.9 points) in 2020.

In the early days, M&A deals came mainly from companies and investors from the Asia-Pacific region, especially Japan, South Korea, Singapore, as well as private equity funds. Now, however, there is also significant appetite from local corporations and domestic investment funds.

We do not wait for the clients, we strive to be proactive in approaching and communicating with investors and large investment funds across the world to connect them with opportunities in Vietnam.

To tap the market opportunities with a strong movement of M&A, EY Vietnam determined to actively approach the market since 2000s. EY Vietnam and EY professionals in Asia Pacific have become the keynote speakers at seminars, events and investment promotion sessions in countries with major investment and trade relations with Vietnam such as Japan and South Korea, Singapore, Hong Kong. Meanwhile, EY Vietnam, in collaboration with domestic regulatory agencies has co-hosted a series of seminars to bring the image of Vietnam – an attractive investment destination to foreign investors. In specialized journals on domestic and foreign investment, EY Vietnam has been providing sharp M&A analysis in Vietnam to potential investors.

EY Vietnam speaker at a seminar on M&A

In addition to expanding in scale, EY Vietnam’s M&A team has diversified its services to meet the increasingly complex needs of clients. Its due diligence services now cover finance and accounting; tax; legal; recruitment; IT; regulation and compliance; synergies; and cybersecurity. The SaT team also supports foreign investors with valuation services (Valuation); integrated M&A services (M&A lead advisory); and strategic consultancy (Strategy).

Supplying these services is a team of consultants with multiple years of international experience and deep knowledge of the local market, as well as a team of economic specialists. The team has grown 5 times over the past 20 years to meet the increasing workload and professional challenges. The team can now support clients in everything from financial appraisal, taxation, personnel, trade, big data analysis and legal to consulting and handling issues arising before, during and after a transaction.

Integrated services

The deal between Mitsui Co., Ltd. (Mitsui) and Minh Phu Seafood Corporation (Minh Phu Seafood) is a prime example of the integrated due diligence advisory service provided by EY Vietnam. Major Japanese group Mitsui intended to make a strategic investment in Vietnam's leading shrimp producer, Minh Phu Seafood in 2019.

This was an integrated consulting project, delivering multiple due diligence reports on tax, finance, regulatory, market, HR, and commercial services. The research produced by EY Vietnam helped Mitsui's management get a clear picture of the local and international seafood industry, and to understand Minh Phu Seafood’s capacity.

Simultaneously, EY Vietnam facilitated negotiations between the two companies and advised on the preparation of the sales and purchase agreement. As a result, Mitsui acquired a 35.1% stake in Minh Phu Seafood in May 2019. What is more, the deal helped optimize the operations of Minh Phu Seafood and gave it access to the sales network established by the Mitsui Group.

Foreign capital inflows not only offer financial strength for local enterprises, they also help improve their corporate governance and scale. By taking the initiative and making strong investments in training and capacity building, EY Vietnam has become a reliable supporter of foreign investors looking to acquire shares in local enterprises.

Seminar “Capital raising in the new normal” organized by EY Vietnam in 2021

In each of the past four years 2018– 2021, EY Vietnam has supported nearly 100 deals with a total annual value exceeding US$1 billion. In 2021 alone, the firm supported M&A transactions worth about US$1.6 billion. EY Vietnam stood behind many prominent deals, including Warburg Pincus’ investment of US$100 million in Momo e-wallet, the GIC acquisition of a more than US$500 million stake in Vingroup, a US$400 million investment of a consortium of Baring and Alibaba in CrownX, as well as CrownX receiving US$350 million in investment from a group of TPG, ADIA and SeaTown.

When foreign corporations invest, they bring more than just capital to a local enterprise. They bring invaluable support for restructuring and can help reduce personnel costs, expand the market, and improve the distribution system. Embracing foreign capital is the fastest way for local enterprises to achieve advanced corporate governance standards and international best practices. We hope that the M&A deals we advise will generate long-term value for local businesses and lay a solid foundation for sustainable development.

In each of the past four years 2018– 2021, EY Vietnam has supported nearly 100 deals with a total annual value exceeding US$1 billion. In 2021 alone, the firm supported M&A transactions worth about US$1.6 billion. EY Vietnam stood behind many prominent deals, including Warburg Pincus’ investment of US$100 million in Momo e-wallet, the GIC acquisition of a more than US$500 million stake in Vingroup, a US$400 million investment of a consortium of Baring and Alibaba in CrownX, as well as CrownX receiving US$350 million in investment from a group of TPG, ADIA and SeaTown.

EY Vietnam speaker at an economic forum

Vietnam remains an attractive investment destination with its young demographics, rising per capita income and strong consumption power. M&A activity will likely continue to accelerate in the future across industries such as finance and banking, retail, consumer goods, food and beverage, real estate and healthcare. In addition, the M&A scene is expected to see greater involvement by local enterprises.

It is also worthy to note the rising trend of Vietnamese enterprises "setting sail into the ocean" with outbound investment deals and listings on prestigious stock exchanges.

In the short term, foreign investors may find it difficult to simply come to Vietnam and look for investment opportunities. In the new normal, EY Vietnam will develop new due diligence services to create a comprehensive picture of a seller's operating performance, supporting investors with no boots on the ground.

Local businesses proactively looking for partnerships can rely on these reports and share them with potential investors to answer most regular questions that investors are interested in. Businesses can also take the opportunity to provide a clearer and more comprehensive view of their strengths and potentials to investors. Clear figures in a transparent document will facilitate transactions, saving the parties both time and money.

In addition to financial, tax and legal, other factors like environmental protection, workforce management, anti-corruption and money laundering will also need to be considered. In addition, with the technology boom, evaluating deals will require a lot of technical expertise (big data, data analytics). EY Vietnam is mobilizing its extensive resources and consulting experience to prepare to meet these requirements.

Signing an M&A transaction is not an end but the beginning of a long-term growth story. Investors have paid dear and have high expectations from the deal. Local enterprises need careful planning to turn those expectations into reality.

Part 4:

A "mission" to raise the bar for Vietnam

From vision to commitment | Restructuring for opportunities | Striving for new heights | The entrepreneurial bravery

From vision to commitment

In 1990, Vietnam passed its first two laws on private enterprises, including the Law on Companies and the Law on Private Enterprises. Before that, the private sector had to navigate an ambiguous legal landscape and deeply ingrained social stigmas. These two laws provided clarity for the private sector and gave it a framework where businesses could grow. In 1999, under the leadership of Prime Minister Phan Van Khai, also known as the "Prime Minister of enterprises", the Law on Enterprises was amended to create an institutional breakthrough for private enterprise's development growth.

In the first 20 years of opening, Vietnam has reported resounding success. According to the General Statistics Office, the country’s GDP surged an average 7.56% a year between 1991 and 2000.

As the economy expanded, EY Vietnam sought to do the same. After seven years of supporting the FDI sector, Cuong Dinh Tran, then Senior Audit Manager, proposed expanding the firm’s clientele to local companies in 1999, with the ultimate goal of raising Vietnamese enterprises to international standards.

At the time, there was virtually no demand among domestic clients for EY Vietnam or foreign auditing firms’ services. However, EY's leadership believed that the firm’s presence in Vietnam was a commitment for the future and that it was our mission to sharpen the competitive edge of local companies.

The Securities Center of Ho Chi Minh City (the predecessor of the Ho Chi Minh City Stock Exchange – HOSE) opened the first trading session in July 2000, marking the birth of the Vietnamese stock market. Few people know that the EY Vietnam team was quietly supporting the bid of Refrigeration Electrical Engineering JSC (REE), the first company to be listed on the local stock market.

As the first company to go public, REE faced a host of difficulties in equitization and preparing for the IPO. The workload was daunting, from setting up a dedicated team to reviewing and completing operational, governance and control procedures to preparing financial statements and performing audits before listing, as well as conducting compliance reviews in relation to the numerous regulations on listing.

While around the world, companies might have been listing their shares for hundreds of years, there was no precedent in Vietnam. EY Vietnam's professionals held discussions with REE's management about global practices and ways they could be applied in Vietnam’s incomplete legal system, with adjustments to a nascent stock market.

Apart from helping REE successfully conduct its listing in Vietnam, EY Vietnam also supported it in converting the bonds issued for Platinum Victory Pte Ltd, a fully-owned subsidiary of Jardine Cycle & Carriage, one of the companies on the Singapore Exchange with the largest market capitalization in 2015.

From the very early stage, REE has grown from strength to strength and developed from an SOE to one of the top 30 companies in terms of market capitalization.

REE is a prominent example of a local company and an SOE that has been supported by EY Vietnam in a transformation over more than 20 years. The REE project was also the beginning for EY Vietnam’s journey to assist domestic companies of all colors and the stock market in remodeling their operations.

REE used to be an SOE with a complex organizational structure and corporate governance system. We highly appreciated our cooperation with EY Vietnam, who not only helped REE become the first listed company on the Vietnamese stock exchange but also supported our subsequent development with professional services. I have the highest regard for the people at EY and their working style, dedication and responsibility. EY will always be a trusted partner to REE.

Restructuring for opportunities

According to a recent report by Forbes, the 100 largest family businesses in Vietnam contribute 25% of its GDP. Many of them are among the 50 most trusted listed companies whose stocks are considered blue chips. Family businesses will continue to be the engine of the private sector and a vital part of the Vietnamese economy.

As the private sector assumes its role in the national economy, many private companies and family businesses have begun to consider restructuring and adopting international financial reporting standards to enhance their position in the local market while approaching foreign investment.

Sun Group, a family business founded in Da Nang 15 years ago, is now one of the largest real estate developers in the country with over 50 subsidiaries and 50,000 employees. Its core business lines include developing luxury complexes comprising of resorts, parks and premium condotels. Its large scale necessitates leading-class management to sustain the meteoric rise of this company.

To enhance its strategic business planning and meet customer demands, Sun Group has been working with EY Vietnam since 2019 to reinvent its business structure.

In 2019-2021, the two sides rolled out a variety of initiatives from appraising the company’s equity to developing an optimal organizational structure for the group. Currently, our cooperation is still undergoing to standardize Sun Group’s business model to enable the group to live up to its sustainability ambitions while supporting other strategic objectives.

Restructuring a business takes a great deal of time and effort. However, EY professionals helped Sun Group open up to new perspectives while conducting the project. We were able to look at our business from a completely different angle. They helped us identify the most suitable business model for the time to come. Sun Group highly appreciates the professionalism and commitment of EY’s well-versed and experienced EY people.

Our work with EY since 2019 has never failed to meet or exceed our expectations. We are looking forward to our continued cooperation with EY Vietnam to enhance our business with well-rounded solutions while helping us remain compliant with local and global regulations.

A project of Sun Group

The greatest challenge in any restructuring project is aligning the efforts of company leaders. The restructuring, meaning operating in a more transparent manner, incur significant expenditure for consulting and compliance with international standards. Keeping the new business model consistent is also a big hurdle. However, once leaders are aligned on the same business goals and are determined to make it work, nothing is truly impossible.

Restructuring a business – in other words, developing effective corporate governance in accordance with international standards – has become an irreversible trend in Vietnam. Although financial reporting rules may be less complicated for private companies than listed companies, even though, these organizations are facing substantial pressure from their banks, investors, suppliers, partners, customers, as well as their employees. Every step of every facet of a company’s operation now needs to be guided by a clear and conscientious corporate governance system and backed by reliable financial reporting implemented to global standards.

Following this vision, many large domestic private companies have started to implement innovative business solutions to renew their business model. Their transformation is the first step toward bigger ambitions: to raise capital from strategic investors or even file for an international IPO.

Striving for new heights

The Vietnamese economy has continued to grow as it integrated deeper into the world economy. In 2006-2007, the country achieved more than 8% year-on-year growth, a dream figure across the world. Vietnam's accession to the World Trade Organization (WTO) in 2007 greatly boosted export growth and foreign investment inflows. Vietnam has come into its own as a promising destination for big investors who would bring the resources needed to sustain the country’s rise.

Meanwhile, many domestic companies reported double-digit annual growth. To finance their ambitions to expand and seize the abundant opportunities, many local companies were looking to make international capital calls. From this point, international capital was a key driver of production and business development.

EY Vietnam is proud to be accompanying domestic businesses, including leading corporations such as Vingroup, in their endeavors to attract foreign investors and access the international capital market.

Vingroup, formerly Vincom, was the first Vietnamese company to successfully access the international convertible bonds market in October 2009. Vincom's bonds were officially listed on the Singapore Exchange on 16 December 2009 and raised US$100 million from foreign investors for Vincom Retail.

From 2013 to 2015, US private investment fund Warburg Pincus also made a substantial investment in Vincom Retail, which owns, manages and operates Vingroup’s shopping malls and had a total valuation of US$300 million at the time. Later on, in 2017, Vincom Retail made another splash when selling shares worth US$743 million to numerous US and non-US foreign investors.

Vinhomes, one of the country’s largest real estate developers and a subsidiary of Vingroup, launched its IPO in Vietnam by selling US$1.35 billion worth of shares to several US and non-US foreign investors in 2018. To this day, this is the largest IPO event in the history of Vietnam stock market.

Now, VinFast (Vingroup’s automotive arm) is getting ready for an IPO in the US by the end of 2022, gradually realizing its dream by listing in one of the largest stock markets in the world.

Vinfast automobile exhibition overseas (Source: Vinfast)

Vingroup is a true Vietnamese pioneer that has always aimed for the highest international standards. We are the first Vietnamese company ever to issue convertible bonds with a total US$100 million on the Singapore Stock Exchange in 2009. We are also preparing for an IPO for VinFast in the US. To take on the world’s largest and most demanding market, Vingroup must undergo intensive preparation for this upcoming IPO. EY Vietnam, as our trusted, well-versed partner, has assisted throughout various listings and capital transactions since the early days. We appreciate and respect the knowledge, dedication and determination of your global and local experts. Your support has been essential for us to win international customers and affirm our position in the global market. Vingroup’s success can serve as a model for local businesses aspiring to conquer the global market.

Vinfast vehicle production line (Source: Vinfast)

Vingroup is just one large corporation within the sea of organizations EY Vietnam has supported in accessing international capital. The list features prominent names from many different fields including Hoang Anh Gia Lai Group, Techcombank, Mong Duong Finance Holdings B.V. and AES Mong Duong Power Co. Ltd., just to name a few.

EY Vietnam is believed to have conducted the highest number of cross-border investment deals in Vietnam so far. In addition, the firm also leads in serving IPO-ready companies through the delivery of audits and the issuing of Comfort Letters so that they can offer their equity to foreign investors.

Corporate restructuring and capital raising are now an urgent need to allow companies to adapt and develop in a dynamically changing local and global business environment. To assist local companies in "cleaning up their financials" before selling assets to foreign investors, EY professionals have provided not only advice but also supported them to review their ownership structure and quality of assets. These reviews allowed companies to build more transparent and simple ownership models with more streamlined value chains and higher-quality assets.

Playing “matchmaker” between local companies and foreign investment funds is no simple task, as institutional investors such as banks and investment funds have extremely stringent requirements for financial disclosure, governance and internal control.

Each engagement, particularly an IPO, involves coordination with numerous parties such as institutional investors, equity issuers and underwriters like Credit Suisse or JP Morgan, consulting organizations, international law firms and regulators. Proper coordination ensures that the financial statements and prospectus meet key requirements in finance, commerce, legislation and transparency.

EY Vietnam has also established close relations with financial institutions, banks and capital instrument underwriters, as well as leading corporations and stock market regulators at home and abroad. As a result, EY professionals have deep and timely insights into investors' preferences, market movements and legislation on the stock and corporate bond trading.

Foreign capital not only helps local companies grow, it also facilitates the evolution of corporate governance to align better with the requirements of foreign investors. This can make local companies more resilient, raise their position in the market and allow them to compete with foreign corporations as Vietnam integrates deeper into the world economy. We always strive to help local companies reach the highest standards, even meet the IPO requirements in the US, one of the most demanding markets in the world.

The more successful international fundraising projects the EY team delivers, the more trust the firm inspires in the business community. In Vietnam, EY brings to the local market not only its international expertise but also numerous internal expert groups such as audit, tax, asset valuation, business and financial instrument valuation, accounting and restructuring. To learn best practices and expertise from teams with a longer history, EY Vietnam has been closely coordinating with experts from EY Asia-Pacific and the EY Global network.

The entrepreneurial bravery

To ensure the development and success of EY Vietnam and its clients, services need to be closely aligned with the needs of each economic development stage.

Therefore, each year, EY Vietnam conducts a general research to assess the market needs shaping the future of each economic sector. The firm has been using these findings to adjust and invest in existing and new services to enhance the capacity of its staff to meet the evolving requirements of clients.

Over the past years, EY Vietnam has heavily invested in developing corporate consulting, particularly restructuring, and consulting to improve corporate governance and financial, IT and risk management.

Amid globalization and growing competition, Vietnamese enterprises should strive to meet international standards to sustain commercial growth and create added value. This is a key objective of Vietnam’s economic restructuring. The ultimate goal of the EOY award co-organized by the Vietnam Chamber of Commerce and Industry and EY Vietnam is to encourage entrepreneurship among Vietnamese.