On 27 July 2021, the Rules on Amendments to the Rules on Recognized Interest Rate were published in the Official Gazette of the Republic of Slovenia, which entered into force the following day, i.e. on 28 July 2021.

In scope of the implemented changes, it is now allowed for the Slovenian taxpayers to use the credit rating of the group of companies to which the taxpayer belongs for the purpose of calculating the recognized interest rate for loans between related parties.

More specifically, after the above-mentioned changes in Article 5 of the Rules on the recognized interest rate, new (fourth and fifth) paragraphs were added:

"(4) A taxpayer who does not have his own credit rating and belongs to a group of companies may use the credit rating of the group of companies to which it belongs for the purposes of determining the mark-up on the credit rating.

(5) With regard to the other methodology referred to in the third paragraph of this Article, which can be uniquely translated into a credit assessment according to the Standard & Poor's methodology, the translation table set out in the Annex, which is an integral part of these Rules, shall be used."

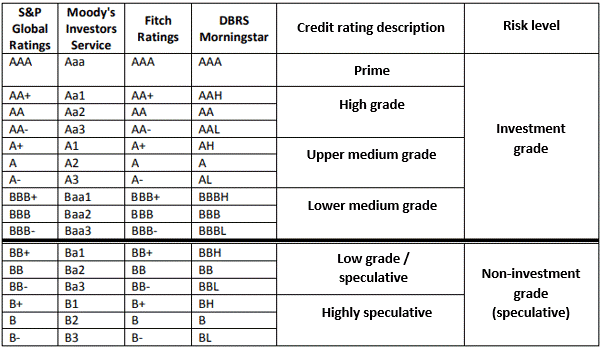

As follows from the new fifth paragraph, from now on the Rules on the recognized interest rate are also accompanied by an orientation table, which serves to help translate the various designations of credit ratings as used by the largest credit rating agencies. The attachment is included below:

Source: Rules on Amendments to the Rules on Recognized Interest Rate (Official gazette of the RS, no. 123/21)

The amendment represents a welcome step in the right direction of bringing the tax rules for financial transactions closer to the real market conditions prevailing in recent years. In any case, when applying the new rules, we would like to point out that the latter can in principle only be applied to new transactions concluded or executed after the announcement of changes. However, for all existing financial transactions that were concluded during the previous rules, it is still necessary to follow the rules in force at the time of concluding each individual transaction.

How can EY help?

In EY we advise our clients among others also with questions regarding corporate income tax and transfer pricing. Our team of tax and legal experts is at your disposal in case you need additional advice regarding the amendments affecting reimbursements of work-related costs.