EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

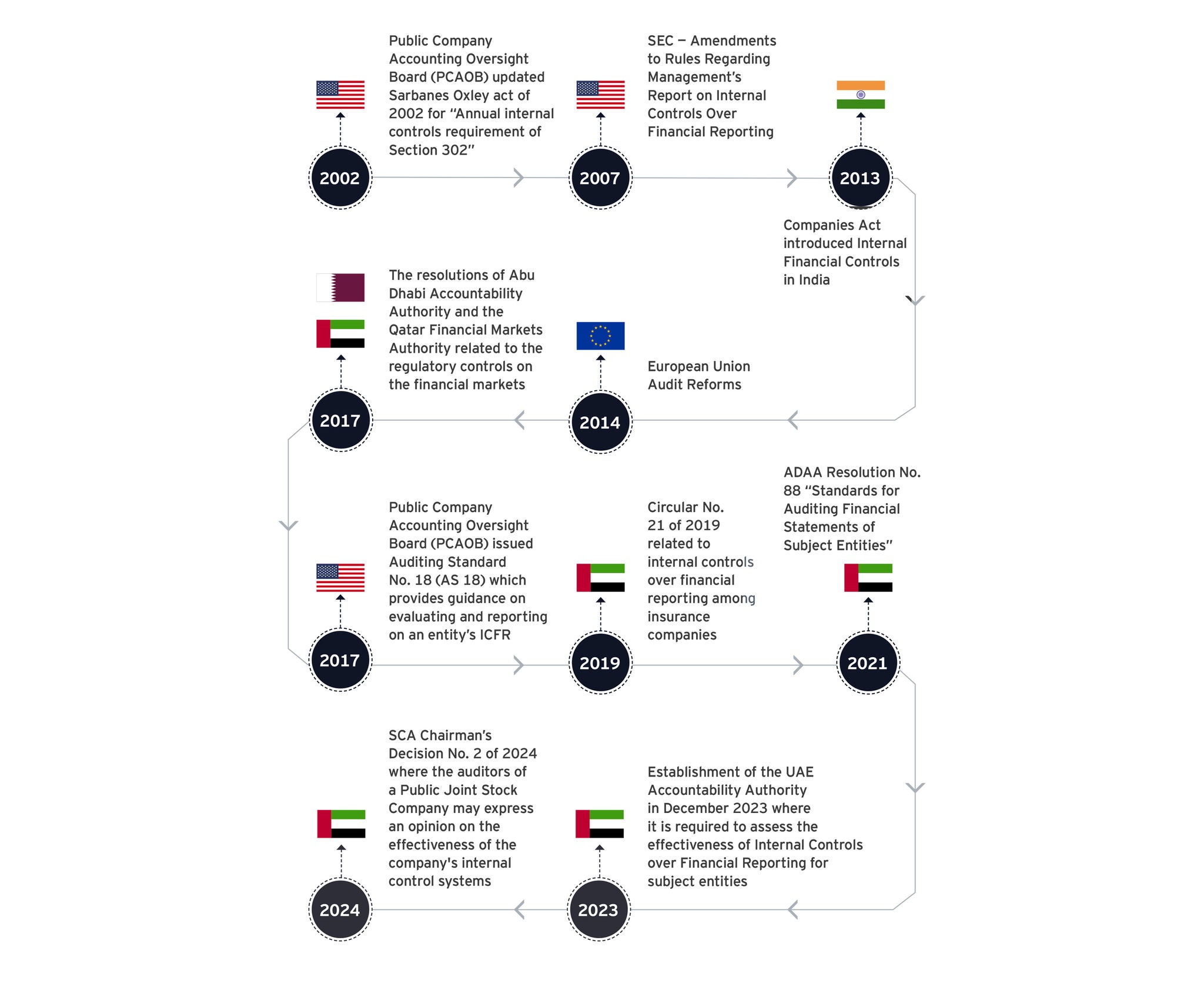

Economic and financial turbulence calls for greater transparency from governments and policymakers. In order to sustain this climate of transparency, governments are striving to implement regulations that promote accountability and effective decision-making. The introduction of ICFR in the US through the 2002 passage of SOX came in response to accounting scandals, such as those at Enron and WorldCom, which eroded public trust in internal corporate controls over financial reporting. An ineffective internal control ecosystem may prompt investors to shift their focus to countries with stronger regulatory frameworks and more transparent financial systems. ICFR stands out as a solid element of enhanced corporate accountability, transparency and accuracy in financial reporting. It represents a significant regulatory measure to protect investors and restore confidence in the financial markets.

Consider the fact that Denmark, Finland and New Zealand — recognized as the least corrupt countries in the world6 — all established a set of robust laws and regulations to enforce ICFR implementation in public joint-stock companies. This reform of their financial systems ultimately led to a revolutionary transformation in the way transparency is practiced. These measures include Companies Acts in both Denmark7 and Finland8 as well as the Public Finance Act9 in New Zealand, requiring companies, represented by their boards of directors, to establish and maintain proper internal control systems to safeguard their financial reporting processes as well as maintaining proactive initiatives to prevent fraud, errors and irregularities in financial reporting.

The observed benefits of implementing such standards in Europe and New Zealand drove governments in the Middle East, especially in the UAE, to adopt similar acts such as Abu Dhabi Accountability Authority (ADAA) Resolution No.1 of 2017, which requires all subject entities’ external auditors to issue a separate report including an assessment on the effectiveness of the internal control systems.10

Besides the government’s role in introducing regulations and driving this agenda, international organizations such as the IMF have been key players in encouraging transparency in both government and the private sector to facilitate global FDI. The IMF examines areas such as fiscal transparency, anti-corruption and rule of law, all of which contribute to providing investors access to accurate and reliable information about the country’s economic conditions, risks and potential opportunities.11 This helps countries enhance their competitiveness in the global market.

Further, ICFR is a critical enabler for governments in their privatization initiatives. ICFR can help facilitate a smoother privatization journey by enhancing credibility and reliability, ensuring regulatory compliance and creating a more attractive proposition for potential investors.

In summary, attracting FDI and nurturing economic growth and innovation hinges upon the establishment of robust regulatory frameworks that prioritize transparent and dependable financial reporting. This foundation underpins a trustworthy and credible financial environment, offering reassurance to investors who seek to expand their investment portfolio globally. Economic challenges underscore the need for governments and policymakers to enhance transparency, and the introduction of ICFR has revolutionized transparency standards. The adoption of similar measures in the Middle East, exemplified by ADAA, marks a significant step toward privatization and accountability. International organizations play a vital role in fostering transparency and attracting FDI, thus promoting global economic resilience and competitiveness through adherence to international standards and best practices. Together, these efforts pave the way for a more secure and prosperous global economic landscape.