Finding ways to reimagine a business-as-usual environment that minimizes disruptions for the organization requires a fine balance.

Even with all these measures, there will be businesses that will experience workforce disruptions. Labor shortages and increased costs due to mobility restrictions that various state and local government authorities have imposed will impact businesses. Companies that experience unique challenges, not covered by specific policies already issued, should seek advice from their local governments. Many governments have introduced fiscal stimulus and assistance programs for small businesses and sectors such as tourism and hospitality which have been severely impacted.

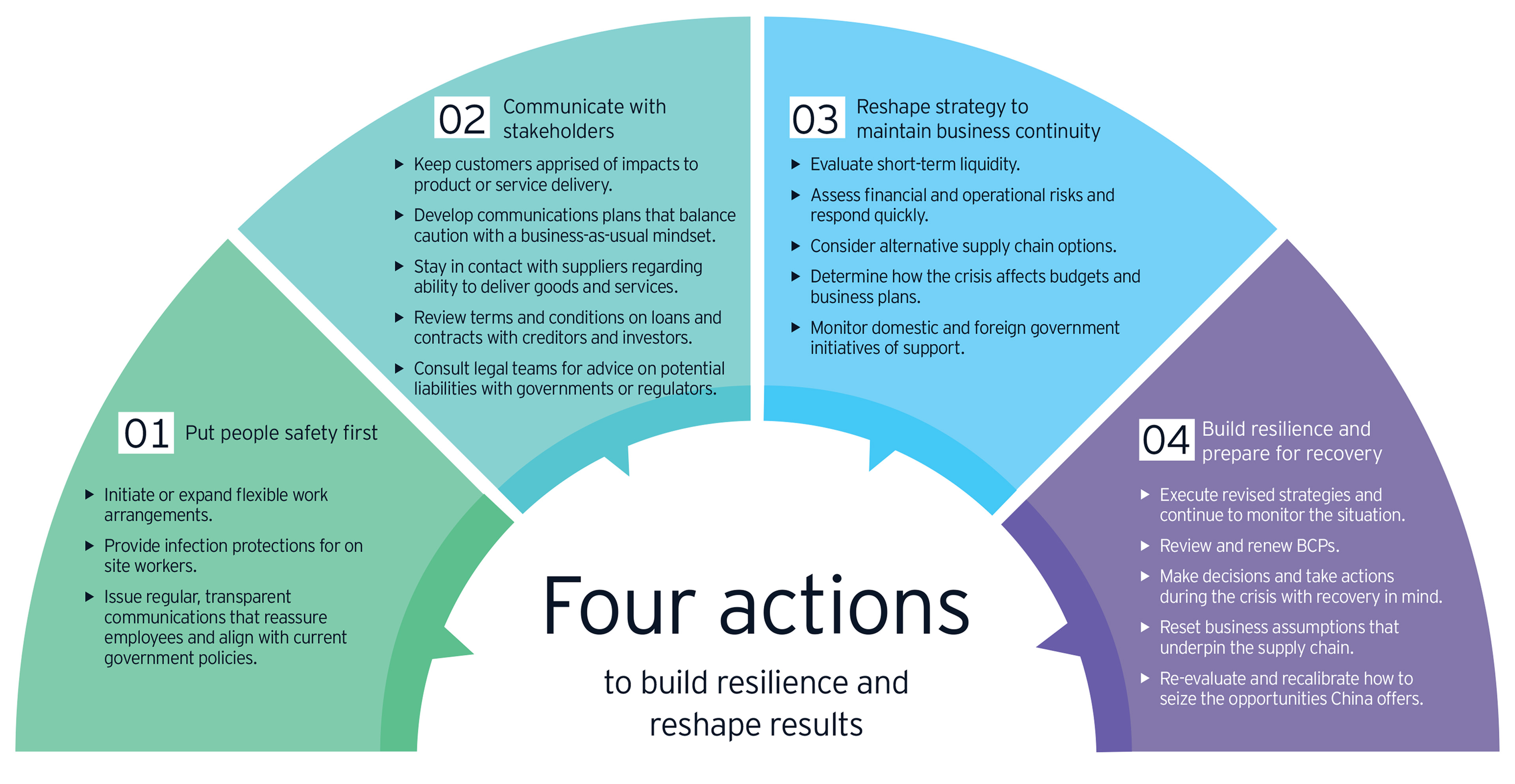

2. Reshape strategy for business continuity

Most businesses are likely to experience significant disruption to their business-as-usual operations and will face business underperformance throughout the duration of the COVID-19 crisis.. At the start of this crisis, supply chain challenges were significant for companies with exposure to China. But now the crisis has spread to Europe and the U.S, many more companies are experiencing operational disruption, as well as significant shifts in consumer demands and behavior impacting sectors from consumer and retail, to manufacturing, life sciences to automotive.

To help address these challenges, companies should:

- Evaluate short-term liquidity. Companies will want to instil short-term cash flow monitoring discipline that allows them to predict cash flow pressures and intervene in a timely manner. They’ll also want to maintain strict discipline on working capital, particularly around collecting receivables and managing inventory build-up. Additionally, it’s important to be creative and proactively intervene to lighten the working capital cycle. Throughout the crisis, companies will want to maintain regular contact with suppliers to identify any potential risks.

- Assess financial and operational risks and respond quickly. Companies will need to monitor direct cost escalations and their impact on overall product margins, intervening and renegotiating, where necessary. Companies that are slow to react or unable to renegotiate new terms and conditions may be vulnerable to financial stress that could carry long-term implications.

Just as companies need to monitor their in-house vulnerabilities, they also will need to monitor the pressures that may be impacting some of their customers, suppliers, contractors or alliance partners. In particular, companies will want to stress test any tier one and tier two suppliers that may be impacted. This is especially important for sectors such as automotive and pharmaceutical, which are highly dependent on third-party suppliers. Finally, be aware of covenant breaches with banking facilities and other financial institutions relating to impairment risks in asset values, which may impact the health of the overall balance sheet.

- Consider alternative supply chain options. Companies that source parts or materials from suppliers in areas significantly impacted by COVID-19 will want to look for alternatives. For example, a Japanese industrials manufacturer is considering moving the assembly of commercial air conditioners to Malaysia from the Hubei Province capital of Wuhan, which remains under lockdown. Similarly, a global apparel company is looking to move production of its products from facilities in Wuhan to Vietnam and Indonesia. Such quick moves will create temporary capacity to meet customer obligations. Companies that have arrangements with agile manufacturing facilities to make spot buying decisions, or have loose contractual arrangements with various service providers and logistics providers, should consider the initial disruption as well as post-crisis scenarios given the potential for demand spikes.

Organizations that operate with transparency and open communication have inherent advantages when events require quick actions to react and reshape.

- Determine how the COVID-19 crisis affects budgets and business plans. Companies will want to stress-test financial plans for multiple scenarios to understand the potential impact on financial performance and assess how long the impact may continue. If the impact is material and former budget assumptions and business plans are no longer relevant, companies should revise them to remain agile. Where the business is significantly impacted, companies will need to consider minimum operating requirements, including key dependencies of workforce, vendors, location and technology.

There is also the issue of short-term capital demands for continuous business operations. Based on the outcome of the assessment, companies may need to look at near-term capital raising, debt refinancing or additional credit support from banks or investors, or policy supports from the government. At the same time, companies will need to review overall operating costs and consider slowing down or curtailing all non-essential expenses.

3. Communicate with relevant stakeholders

Clear, transparent and timely communications are necessary when creating a platform to reshape the business and to secure ongoing support from customers, employees, suppliers, creditors, investors and regulatory authorities.

- Customers. Companies will want to keep customers apprised of any impacts to product or service delivery. If contractual obligations cannot be met as a result of supplier or production disruption, it is important to maintain open lines of communication to revisit timelines or invoke “force majeure” or “act of God” clauses. Such proactive action will help to mitigate punitive damages or liabilities associated with disrupted customer obligations.

- Employees. For employees, communications plans should try to find the balance between caution and maintaining a business-as-usual mindset.

- Suppliers. Companies need maintain regular contact with suppliers regarding their capability to deliver goods and services during the COVID-19 crisis and their recovery plans, so that the company can consider alternative supply chain options in a timely manner.

- Creditors and investors. Companies will want to review terms and conditions on loan contracts to identify sensitive debts and avoid vital technical debt breaches. These reviews will have the added benefit of giving companies a chance to proactively manage the dialogue and communications with creditors regarding any necessary amendments to existing terms or refinancing arrangements.

- Government and regulators. When communicating with relevant stakeholders, companies will want to consult with their legal teams for advice on potential liabilities and with their business units regarding how to manage communications around ongoing breaches and collection of proof, if any.

Companies have to ask themselves whether they have the right supply chain and agility to withstand a three-month disruption.

4. Maximize the use of government support policies

Central and local governments in China have released several financial, social insurance and tax-related policies to support companies. This includes the China Securities Regulatory Commission’s (CSRC) interim policy on listed companies refinancing. Recently the US, UK and many other developed nations have announced amendments to tax and financing policies.

Companies should monitor nation-wide government and organizational opportunities for support and how they may best serve the individual circumstances of their situation. It is important to note that government support may differ based on jurisdiction and sector. Companies will need to identify and understand each offer of support and determine which ones are best for their organization.

The China State Taxation Administration (STA) has published a series of policies to provide support for preventing and treating the epidemic, including:

- Exempting and refunding value added tax (VAT) for enterprises providing certain services for epidemic control or manufacturing key epidemic-related necessities.

- Offering a full corporate income tax (CIT) deduction for purchasing equipment to manufacture epidemic prevention-related supplies.

- Providing an individual income tax (IIT) exemptions on bonuses and allowances relevant personnel receive for treating the epidemic.

- Issuing other policies that encourage public-benefit donations.

Temporary social insurance contribution reductions and exemptions the STA and Ministry of Finance (MOF) have introduced also have helped to ease the burden on companies.

Other countries impacted by the crisis, including Singapore and Japan, are introducing similar government policies. Companies should monitor the availability of these kinds of programs and use them to mitigate the risks they face.

5. Build resilience in preparation for the new normal

Once companies have solidified strategies based on stress tests and communicated any new directions with relevant stakeholders, they will need to execute based on revised plans while monitoring what continues to be a fluid situation. Senior management should report any material deviation from the plan in a timely manner so that their companies can take additional action to avoid further negative impact.

Once the COVID-19 outbreak is controlled, companies will want to review and renew business continuity plans (BCP). They’ll want to assess how existing BCPs are working. If there are deficiencies, companies will want to identify root causes, whether it’s timeliness of action, lack of infrastructure, labor shortages, or external environment issues. Companies will then want to consider putting new internal guidelines in place based on lessons learned, as well as solid contingency plans to build resilience and better respond to future crises.

Financial services organizations have an ethical opportunity to develop more agile products for working capital and short-term loans to support the economy.

Plan for recovery now, not later

The COVID-19 crisis was impossible to predict with conventional wisdom and forecasting tools. However, there are many lessons companies can learn and carry forward once the crisis has passed and they’ve had a chance to analyze their response.

In the meantime, companies should be making decisions and taking actions during crisis with recovery in mind. When the crisis is over, it will be clear which companies have the resilience and agility to reshape their business strategy to thrive in the future.

Longer term, companies will need to consider how robust their business, management team and initiatives were in facing the crisis. It will also be important to consider and reset the business assumptions that underpin the supply chain and other concentrations that many businesses have been exposed to over time.

Once the situation is mitigated, companies should reevaluate how robust their business management was facing the crisis, and then analyze options to become more resilient against future disruptions.

Summary

Companies around the world are trying to come to terms with the impact the coronavirus (COVID-19) is having on their business. Although the risks are considerable, the crisis also reveals areas where companies can build resilience and reshape themselves for a post-crisis world.