EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

The most real estate sectors remain stable despite unfavorable external factors

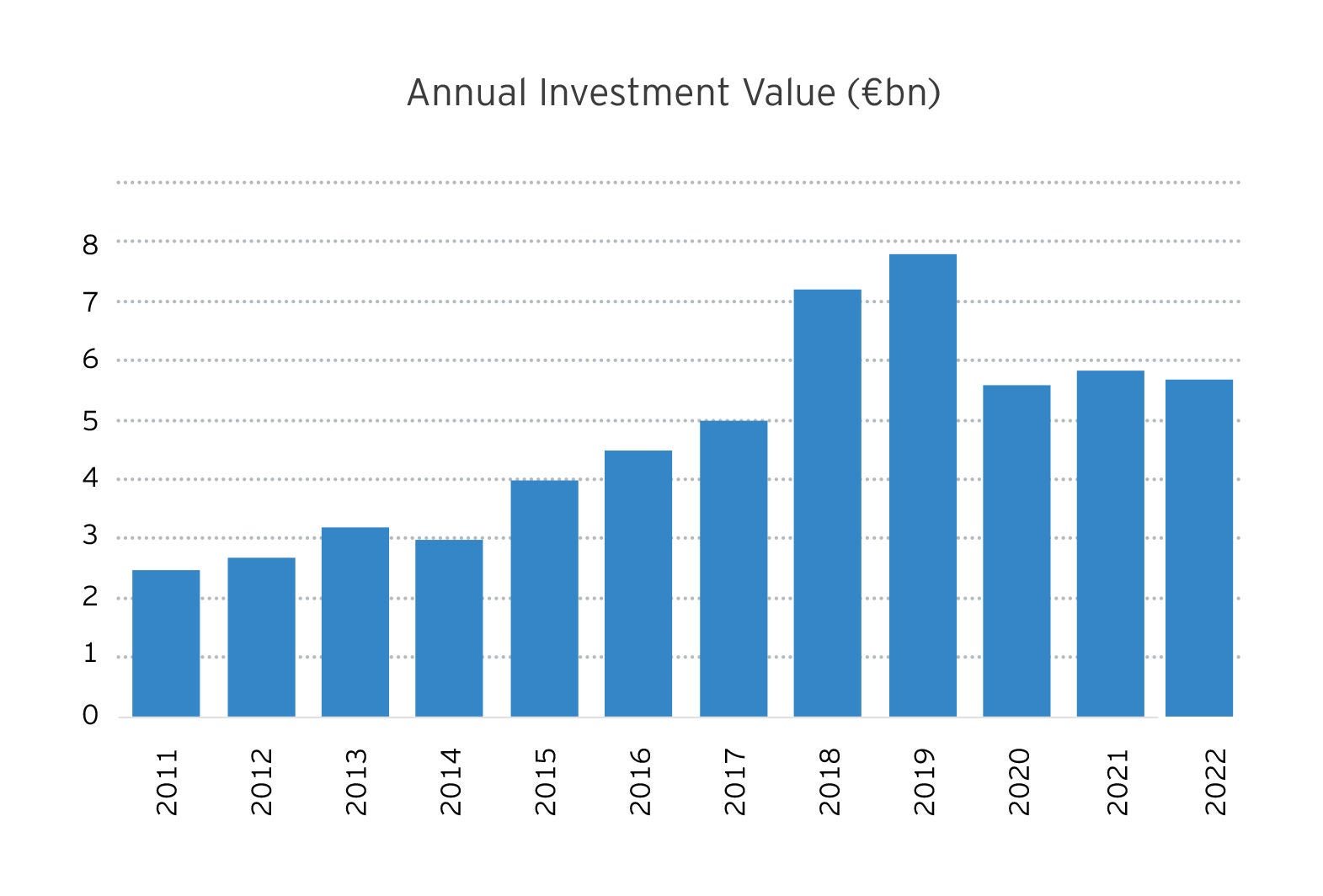

Despite the adverse external factors such as the war in Ukraine and the fallout pandemic effect on global economies, except for residential, most of the sectors of real estate market have proven resilient. Poland attracted €5.8 billion of capital. While lower availability of mortgages, caused by a raise of base interest rate and higher inflation, have stalled residential market for individuals, it put the private rented sector (PRS) in the spotlight as an alternative asset class, attracting 4% investment volume.

Adapting to an adverse reality

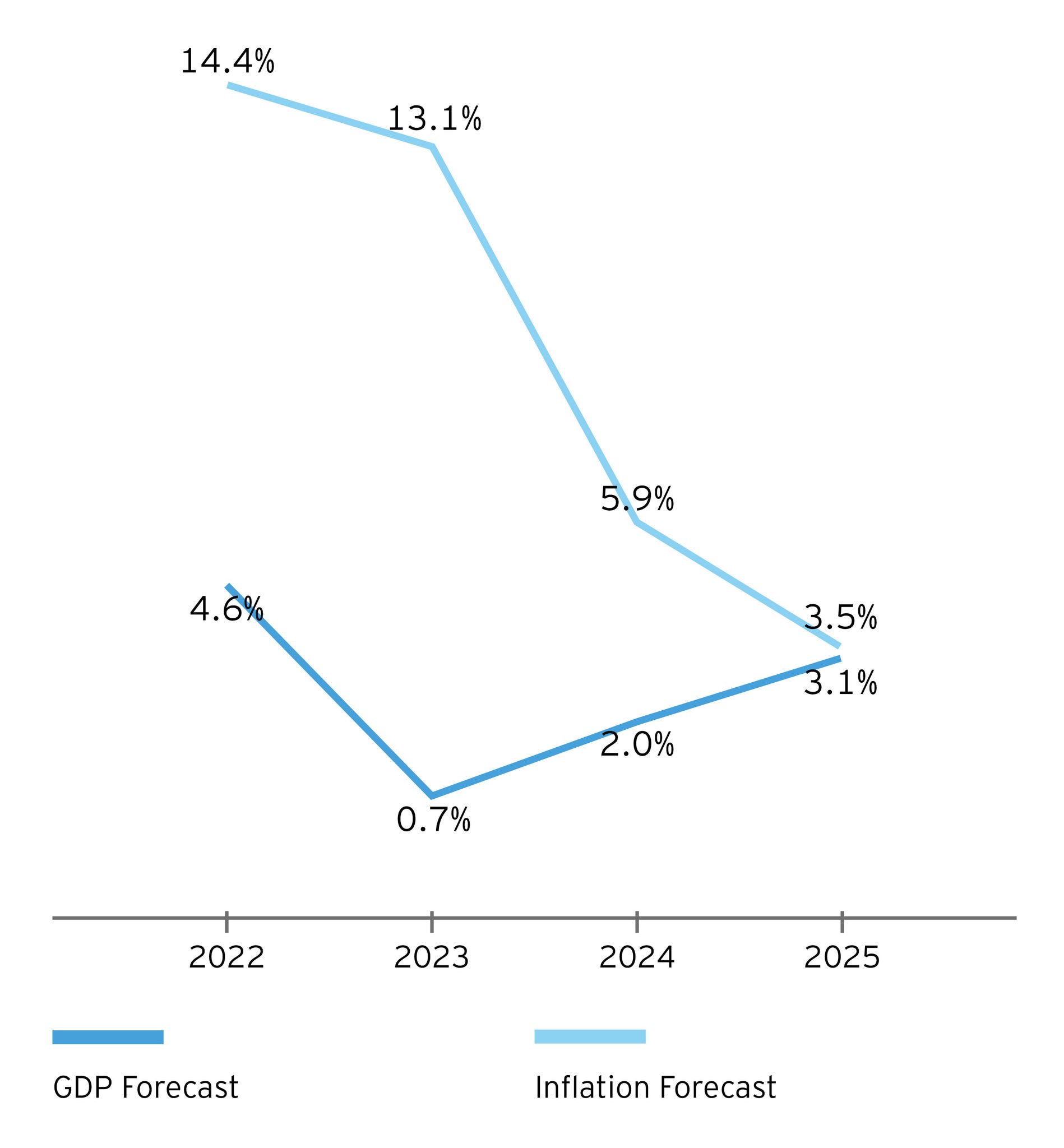

The Polish economy is in a relatively good shape, yet some funds have adopted a wait-and-see attitude. Due to external market uncertainties, exceeding 2021-2022 investment volumes may prove challenging over the course of 2023.

Implementation of a hybrid work model is well underway with a shift of office requirements towards more flexible lease terms and change of space requirements and function. Additionally, higher inflation results in high rent indexation and rising energy costs. It may also impact occupier demand.

There is a shift of demand structure for retail space with focus on convenience and mix-use. High inflation has contributed to the increase in the popularity of shopping at discounters and outlets.

Investment in green solutions

Across all the sectors, ESG is high on the agenda. With rising energy prices, it is expected that property owners will be more willing to invest in green solutions. Energy efficiency and reduced resource use and longevity decrease operational and maintenance expenses. The green buildings are more resilient to energy and utilities costs fluctuations, which is crucial in the current global energy crisis. ESG compliant properties attract a broader pool of potential tenants, increasing the demand and limiting vacancies, as well as potential investors, willing to put a higher price tag on green assets.

Key regulations shaping the market

The year 2022 has brought important changes in the Polish legal and tax system. The most notable ones include:

- Construction Law - 2022 brought a continuation of the amendments to the Law with the changes to be implemented successively by April 2023) aimed at optimization of the investment and construction process. Examples of amendments include ie. the enlargement of the catalog of construction objects exempt from the obligation to obtain a building permit and introduction of the Electronic Construction Log to record the progress of construction work and all accompanying activities in an online form.

- Development Act - as of July 1, 2022, the amendments began to apply with the most significant change being the establishment of a Developer Guarantee Fund. It shall protect funds paid in by purchasers. Developers are to pay contributions to the Fund on each of the purchasers’ payments (max. 2% for open residential trust accounts and 0.2% for closed residential trust accounts).

- Tax depreciation in real estate rich companies - from 1 January 2023 for real estate rich companies tax depreciation of real estate cannot exceed the write-offs for accounting purposes. Therefore, if a property is classified as an investment not subject to accounting depreciation but revalued periodically this would effectively decrease the tax depreciation to nil.

- Tax on shifted profits – since 2022 a new tax on shifted profits is levied on Polish entities and amount to 19% of costs incurred, directly or indirectly, with respect to payments to a related entity provided that certain conditions are jointly fulfilled.

Challenges for the real estate market in 2023

Companies are facing a storm of extraordinary events from the cost-of-living crisis and inflation, increasing interest rate, the war in Ukraine and the lingering COVID-19 pandemic. Assessing the potential effects for companies and how these should be reflected in IFRS financial statements will be critical for financial reporting.

The upcoming year is going to offer interesting opportunities in the sector but will also bring some challenges, with external market volatilities and rapidly changing demand patters. Flexibility and preparedness would be the key to success. Adopting to new normal, having ESG at the top of agenda, staying agile and viewing the sector holistically is the way to go forward successfully. The Polish Real Estate Guide 2023 provides some directions for the next quarters.

Summary

Real Estate Guide Book 2023 is a unique report created by experts from EY's Real Estate Group, focusing on key market trends and forecasts across all sectors along with a comprehensive presentation of the most important tax, legal and audit-related changes affecting real estate players. This year's edition addresses the importance of sustainability, green transformation and standards in the real estate sector. In addition, it provides guidance on priority areas and risks associated with the entire real estate cycle. We hope that the information contained in the guide will prove to be a useful reference tool on the state of Poland’s real estate market.

Direct to your inbox

Stay up to date with our Editor's Picks newsletter.