“Fostering customer loyalty creates a sustainable competitive advantage”

Assistance and reassurance

What we’re hearing – and implicitly know – is that each and every financial services provider should communicate empathically, taking the feelings of the customer into account. We see how financial services organizations have been challenged to provide their client base with assistance and reassurance. Although the survey was held at the start of the pandemic, we have been in regular contact with financial services providers since then, listening to the challenges they face every day. The pandemic has made it indisputably clear that communication must form part of a dialogue to strengthen the relationship between customer and company.

Critical components of compelling communication

While the COVID-19 communication study investigated the critical components of compelling communication by financial services providers, a key objective was to inspire these companies to improve their communication strategies and strengthen their relationship with customers. We assessed the messaging from 10 financial services organizations that provide a mix of services from (private) banking to insurance in The Netherlands, Finland, the UK, Australia and New Zealand, and we got results!

A long-term personal connection

Scanning the key findings of the study, we learned that financial services organizations across the board are well positioned to inform their customers, but less able to assist or create a connection with them. Around the world, at a time when we are witnessing bank branch closures and the uptake of online channels at an unprecedented pace, we believe that financial services providers should grasp this opportunity to bolster their ability to create a long-term personal connection in a digital setting.

Channeling technology

We’re not underestimating how hard this is to achieve, but technology has taken great strides and customized interactions using advanced analytics, machine learning, artificial intelligence, digital virtual assistants and IoT tooling. These resources are here to stay. So the next step is to help financial services providers to channel this technology in such a way that they create that personal and empathic connection with clients.

Infographic – how we went to work

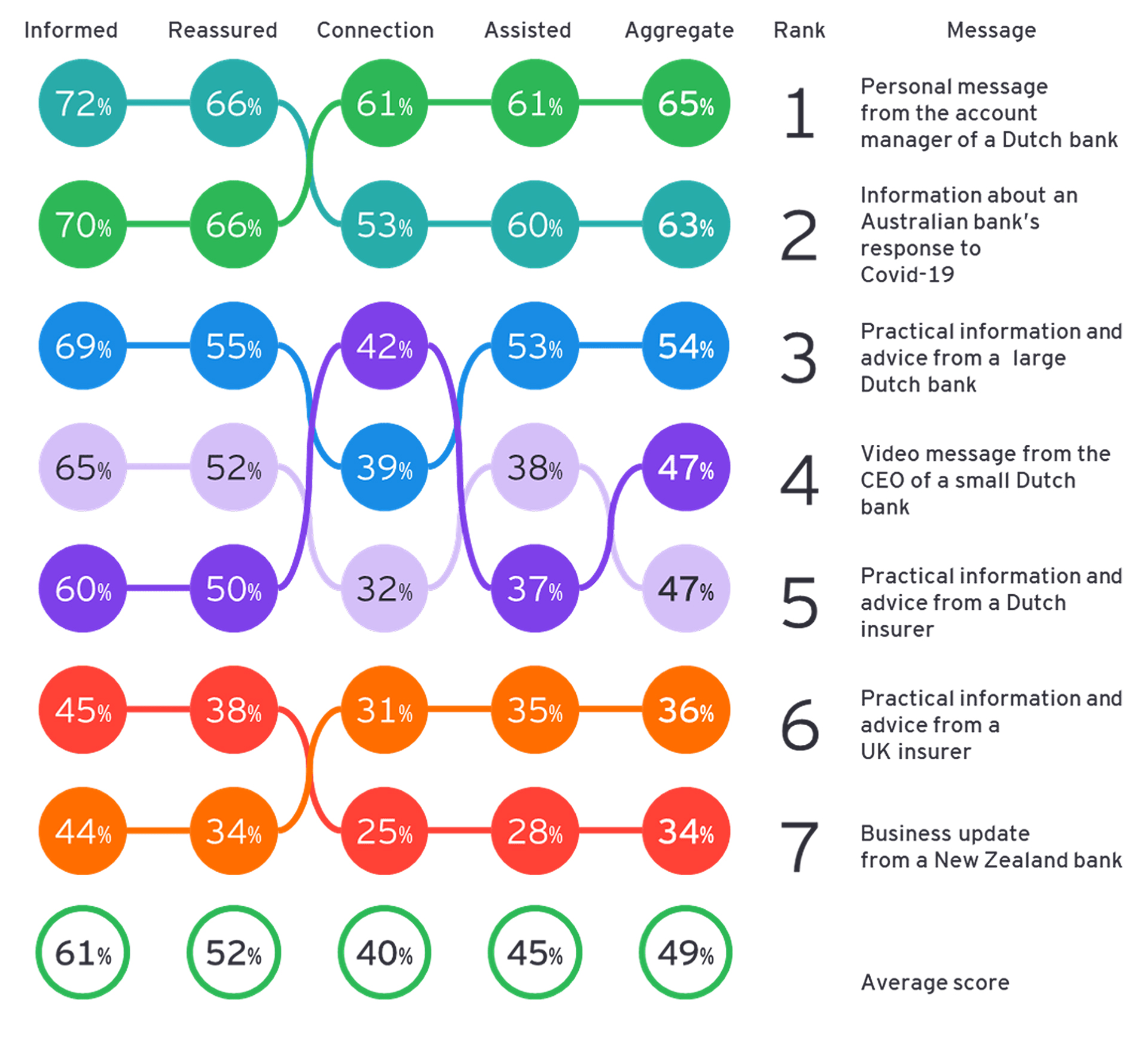

We asked respondents to rate seven proactive communication messages from financial services providers, based on the extent to which they felt informed, reassured and assisted by the message. We also asked respondents whether receiving this communication improved the connection they felt with the organization.

Proactive communication

Respondents were asked to rate seven proactive communication messages from financial services providers, based on the extent in which they felt informed , reassured and assisted by the message. Next to this, respondents were asked whether receiving this communication improved the connection they felt with the

organization. Across the board, financial services organizations are well positioned to inform their customers (61% felt informed), but less able to assist their customers (45% felt assisted) or create a connection with their customers.

Related article

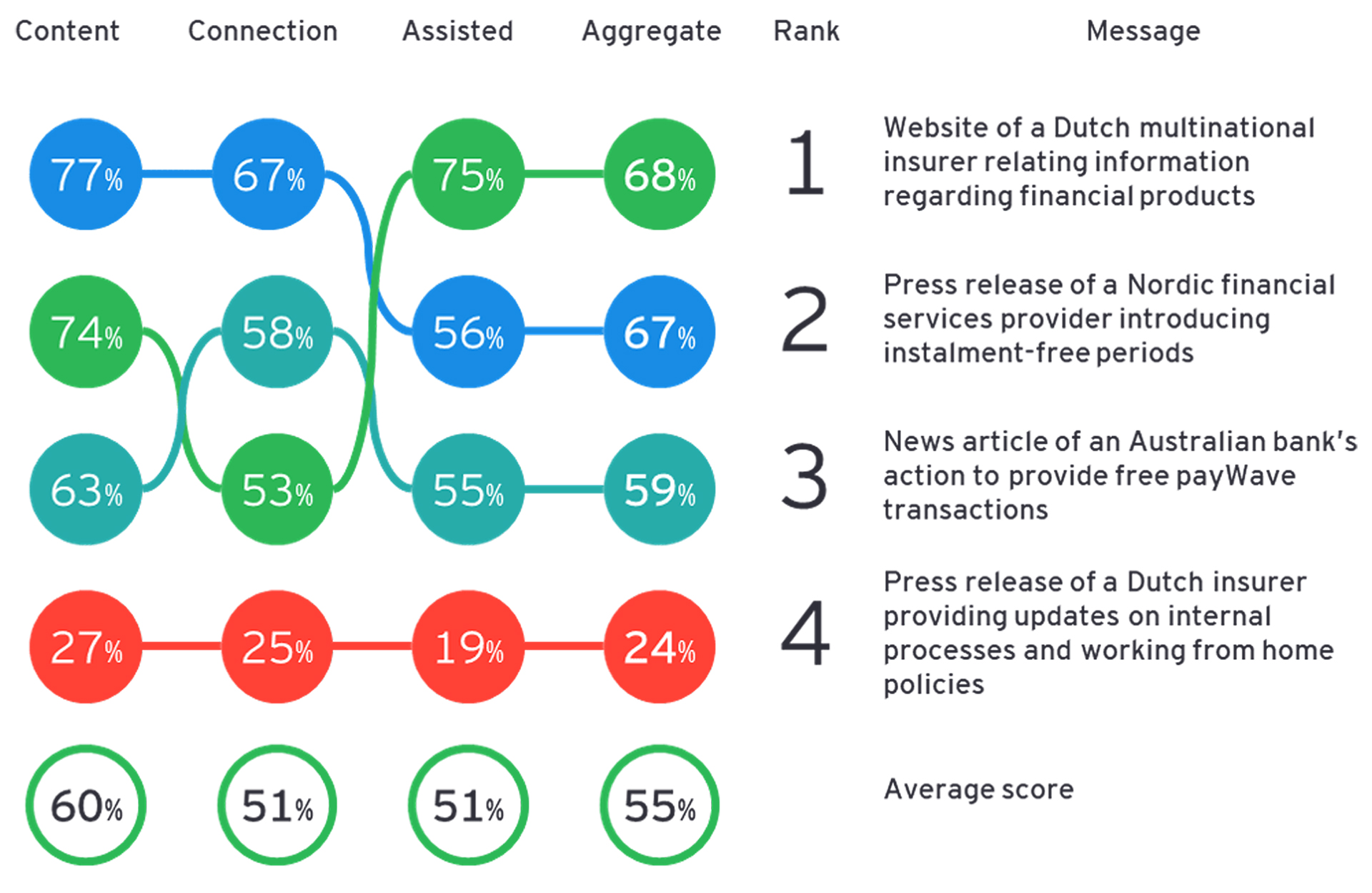

Reactive communication

Respondents were asked to rate four messages containing reactive communication which were relating to the topic of dealing with the COVID 19 situation (e.g. website content or press releases). Respondents were asked whether they valued the content if they would have been a customer. Next to this, respondents were asked

whether receiving this communication improved the connection they feel with the organization and if it made them feel assisted. Similarly to the proactive communication, overall financial services providers found it challenging to create a connection (51% felt a connection) or provide (51% felt assisted).

Communicate proactively!

The study also revealed a yawning gap in the way customers appreciated proactive and reactive COVID-19 communication. Clients tell us proactive communication customized to their situation, displaying a genuine interest in the challenges they face, helped them to feel informed, reassured, assisted and connected, offering thoughtful, practical solutions like personalized contact opportunities for reaching the account management team.

Content must evoke emotion

On the other hand, reactive communication – one-size-fits-all website content, for example – scored significantly lower than proactive communication on all four counts. Although financial services and products are complex, they are of unprecedented importance to customers and need to be shared in a way that clients recognize their added value and business benefit. It’s simply that this domain knowledge is not relevant to a customer’s specific situation here and now and therefore fails to elicit the sense of being informed, reassured, assisted and connected. The explanation for that: The content does not evoke emotion!

Six key recommendations

- Keep it personal

- Make it customer-centric

- Address both short and long-term concerns

- Customers value proactive communication

- Improve your emotional connection

- Measure and understand your customer experience

We are keen to point out that the advent of COVID-19 has dramatically changed the landscape for financial services providers – and will continue to impact the way they do business for a long time to come. We’re here to help.

Summary

To receive your own copy of the full EY COVID-19 communication study, please drop us a line with your contact details. We would also be pleased to provide you with a digital report.