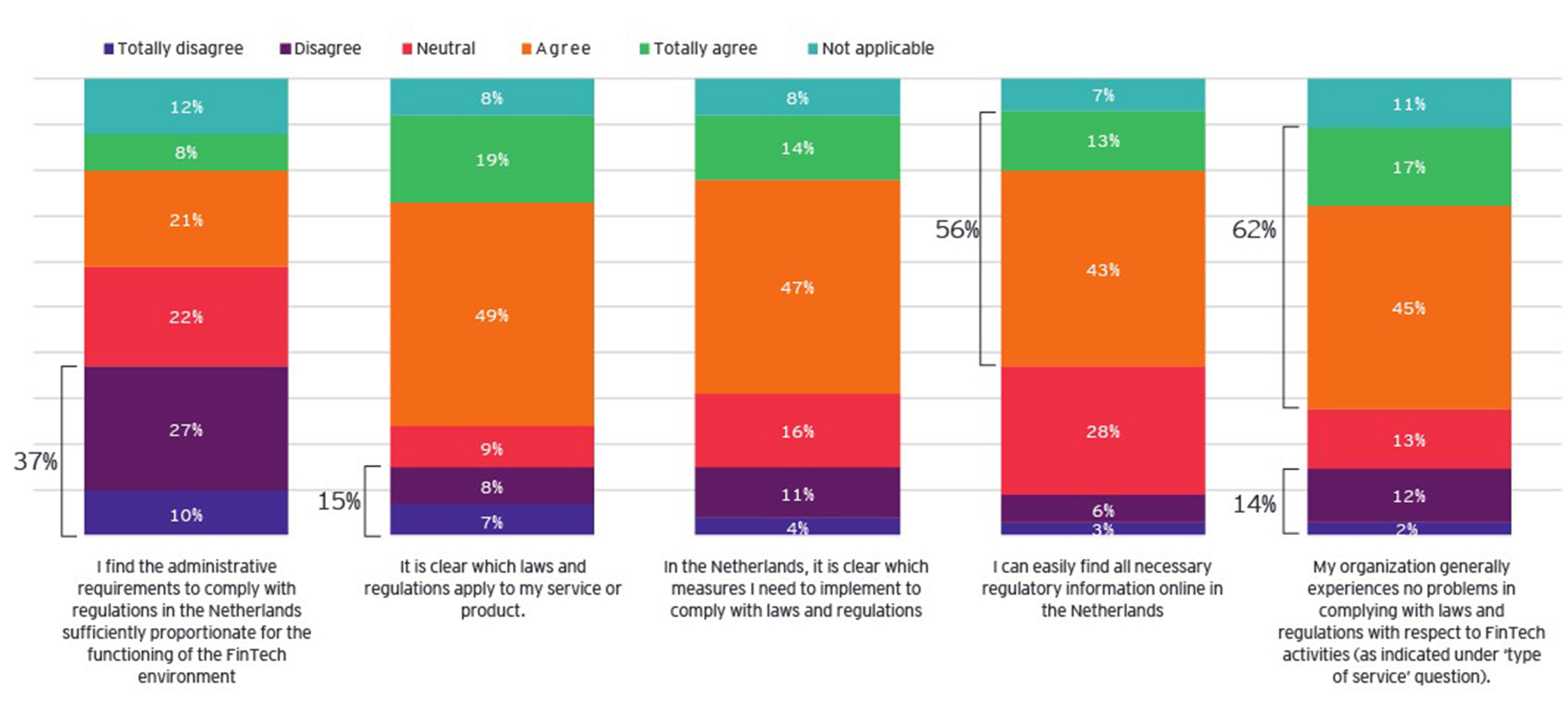

According to the FinTech Census 2023, 38% of companies find compliance with regulations challenging, while 62% do not see it as a challenge (see figure). An important reason for these positive percentages, is the information provided by the government. One example is a website of the Dutch government, which outlines how to register a FinTech company1. However, for FinTechs that require licensing (58%), the administrative requirements and associated costs to comply with regulations are often seen as disproportionate (37%).

Reframing the mindset around regulatory requirements enables a FinTech to transform a sour situation into something positive. In the context of regulations applicable to FinTechs, this approach involves leveraging the existing regulatory framework to create opportunities for both FinTechs, its customers and its employees. For example, some participants in the FinTech Census, indicated that running a licensed business can result in increased customer trust. Supervision in the Netherlands is considered to be very robust. The process to obtain a license is often considered to be quite heavy, profound and though, but at the same time seen as a stamp of approval once the license is granted. Customers feel more secure knowing that the FinTechs practices are being supervised by regulatory authorities.

Furthermore, when obtaining a license (for example PSP or EMI), FinTechs can provide a range of products and services to its clients, resulting in a competitive advantage.

- An example of an advantage is that the licensed FinTech does not need a partner to offer its services. This often results in the ability to provide a better price, faster services and a simplified payment flow due to being independent of third parties.

- In the specific case of a MiFID license, an investment firm is enabled to provide a broader range of financial services than it would be able to offer without this license, such as offering tailored recommendations based on clients' financial situation, objectives and risk profiles.

- Another opportunity lies in the passporting functionality which comes with a license. Once obtained, the license forms a gateway to grow the business in the wider EU.

Furthermore, FinTechs can take a customer-centric approach by helping their business-to-business clients understand the regulations and how they can navigate them effectively. Some FinTech Census participants indicated that they view regulations as an opportunity, as demand increases to their value-added services (e.g. regulatory reporting assistance) to assist their clients in dealing with regulatory challenges. By sharing their expertise and providing guidance, they can help their clients overcome regulatory obstacles and ensure compliance. This approach not only benefits the FinTech company itself but also strengthens their relationship with their clients, encouraging a sense of partnership and collaboration. Innovative FinTech solutions also contribute to the development of the regulatory landscape itself by sharing their expertise with their clients and use the knowledge they receive from this to further improve their regulatory footprint. This approach not only shows the FinTechs adaptability but also that they are driving positive change, where both innovation and compliance come together.

You can read the full FinTech census report 2023 here.