Chapter 1

What is NRM and what does it do?

NRM is both a capability and a function.

NRM is called different things in different organizations (e.g., revenue management, revenue growth management, price and promotion planning). Sometimes it is embedded in a team that addresses channel and customer planning or market strategy and planning.

Organizations have become preoccupied with short-term results — 55% of CP executives feel they have become too focused on quarterly performance.

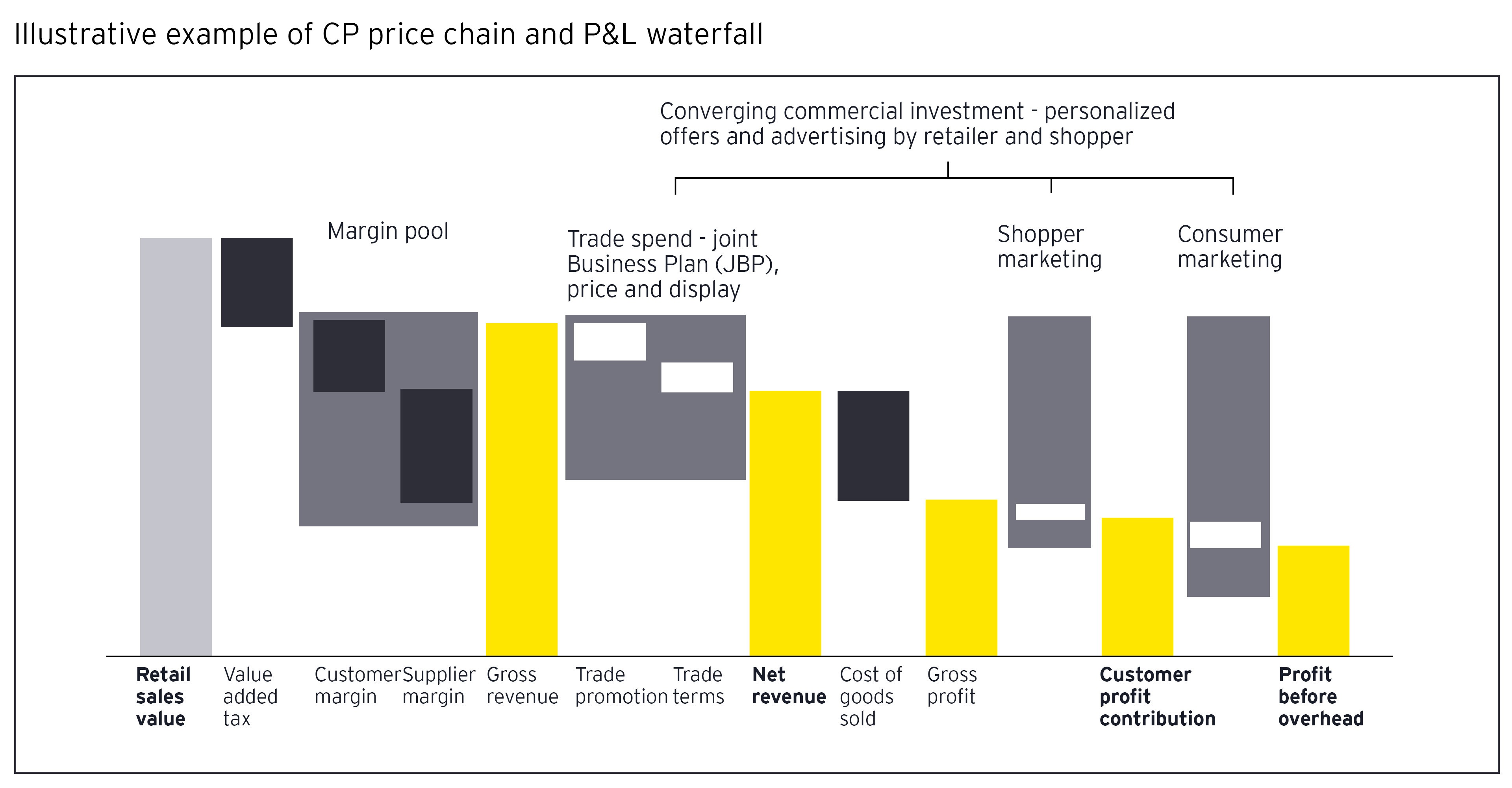

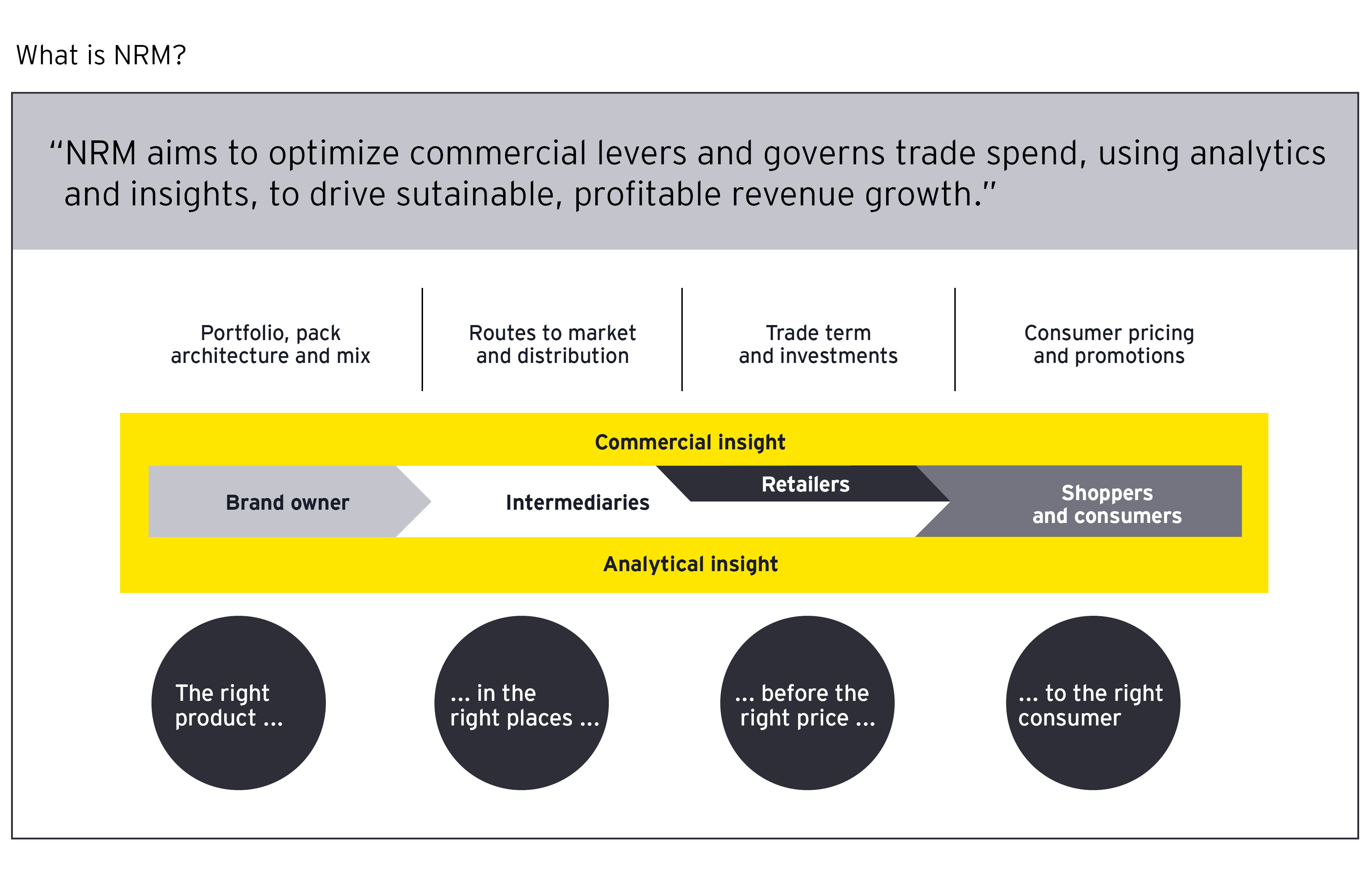

At its core, NRM aims to optimize pricing and promotions, governs trade spend, and coordinates delivery of net revenue and gross profit targets across brands and customers. NRM improves profitable growth from the existing portfolio and adapts value propositions to exploit new growth opportunities.

Optimizing promotions and related trade spend requires detailed understanding of what worked in the past and what is most likely to work in the future — by product, customer and even outlet. Too often promotional evaluation falls between the gaps in stretched sales and marketing organizations, and key account managers often roll over last year's plan and activities to "lap" the prior year's volume and revenue targets.

But many CP companies have run out of promotional runway. The decline of loyalty, price matching, discounters and online have created new levels of price transparency. Shoppers and retailers are conditioned to only buy on deal or best price. Deal effectiveness diminishes over time and promoted price becomes the new "base" price, inducing a race to the bottom that erodes margins.

NRM does not cure this promotional addiction nor reverse its trajectory — but implemented properly, it can significantly improve trade spend ROI and margins, and buy some breathing space to reorient their organizations to focus on winning with the consumer and creating long-term value.

The over-reliance on promotions has come at the expense of other commercial levers. This reflects both changing priorities of shoppers, with expanded repertoire of brands and retailers, and failure to translate and transmit brand value externally — to consumers, shoppers and trade — and internally to local sales organizations. Brand strategy has become disconnected from local execution.

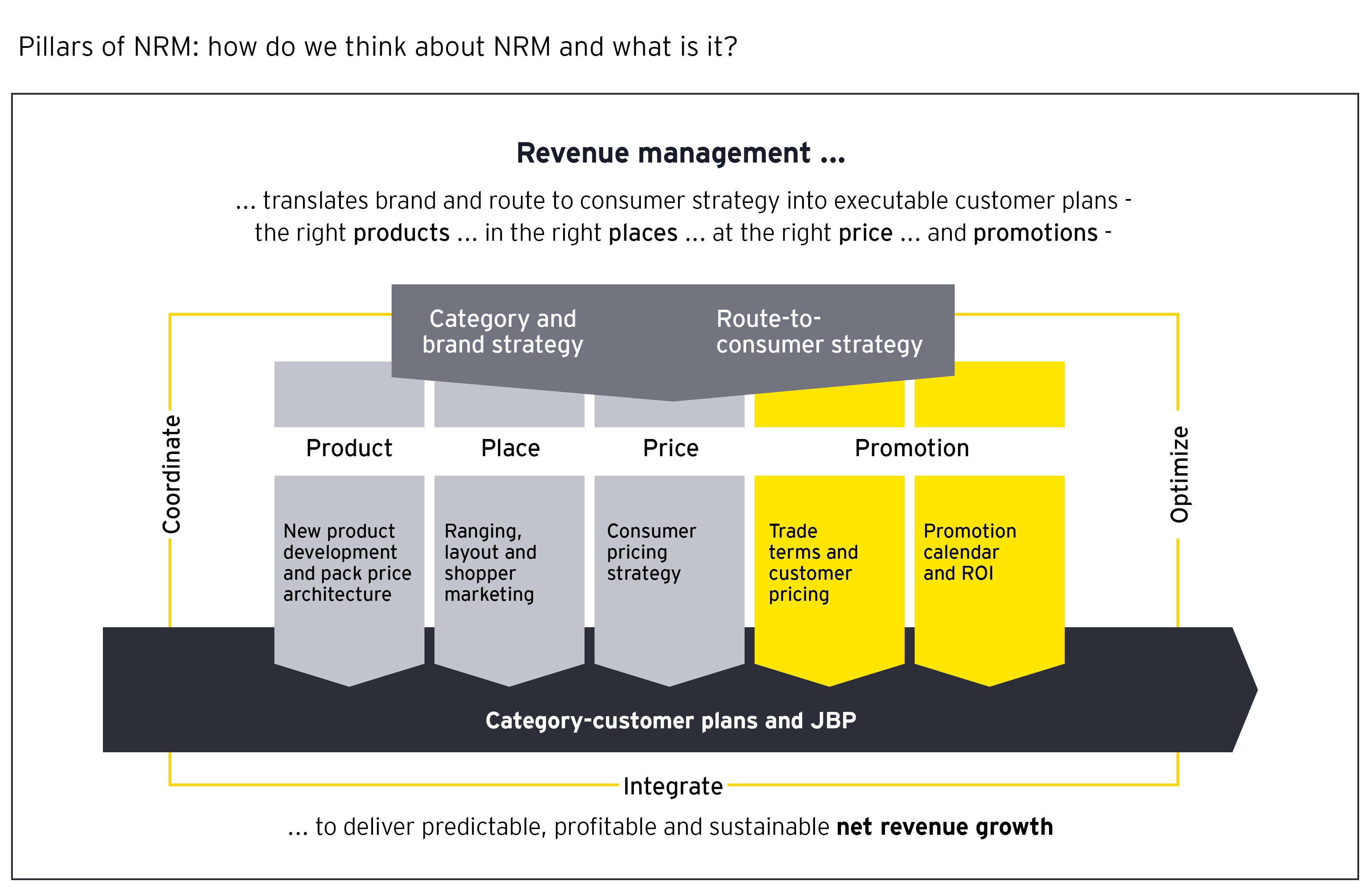

NRM unites these disparate groups through collaboration between marketing, sales and finance to coordinate commercial planning and translate brand strategy into executable customer plans to deliver net revenue and gross profit targets.

To optimize pricing and promotions, suppliers need their products in the right places, targeting the right shopper missions and consumption occasions. In leading practice companies, NRM collaborates with marketing, finance and supply chain to determine optimal assortments at channel and key customer levels to improve profit contribution relative to shopper potential and supply chain cost-to-serve. At a deeper level, price-pack architecture, promotions, shopper marketing, "perfect store" and trade-terms programs must be coordinated to deliver category and brand strategies at channel and customer levels. This all demands collaboration across finance, sales and marketing.

Chapter 2

What are the foundational enablers of NRM?

Companies must build a much deeper understanding of how retailer and shopper behaviors differ across channels, and how both channels and customers are evolving.

Without that depth of insight, it's difficult to invest in a channel or market in a way that balances short-term demands with long-term value. And it's impossible to make business decisions that take into account the opportunities for cost-efficiencies and profitable growth all the way from factory to shelf.

NRM requires a more granular, data-driven approach, more collaborative ways of working across the sales and marketing organization and a greater focus on executing strategy and long-term value creation.

NRM can offer a solution to this, but it has to be enabled by:

- Taking a more granular, data-driven approach

Visibility underpins agility — yet many leading global CP companies still cannot see the net, net prices they charge their customers or return on the billions of promotional investment they give to the trade.Rigorous and actionable promotional evaluation, trade terms governance and price-pack architecture, translating into price guidelines and thresholds to manage cross-channel conflict, demands data by product, ideally stock keeping unit (SKU), by customer and by outlet if available.

Identifying and exploiting new growth opportunities requires the ability to adapt commercial levers to different shopper segments, retail environments and channels, and supply chain challenges. In leading CP companies, NRM or equivalent functions play this role. They stitch together external shopper data (such as electronic point of sale or consumption data) with internal P&L and operational data, forming a single database to measure margin pools, promotion ROI and cost-to-serve.

This enables companies to make informed choices to balance share and margin, and manage cross-channel and cross-retailer conflict.

- Reconnect strategy and execution by joining up sales and marketing organization

Different stakeholders have different priorities. Global CP companies are complex entities. They have built deep functional specialties, but in functional silos, with their own cultures and languages.

These silos can cause duplication of tasks and shared, or blurred, responsibilities. In theory, commercial levers or marketing “P’s” (i.e., product, place, price promotions and in-store positioning) reside with marketing departments. In practice, responsibility is shared across the sales and marketing organization. Global or regional brand and category teams are now often physically separated from market-based sales teams dealing with unique local market pressures. This can disconnect strategy and execution as markets and local sales trade their way to hitting targets in any way they can — usually by pulling the promotions lever.

This is a symptom of a breakdown in the sales and marketing organizational structure. Currently, too much is expected of sales teams: besides selling, developing joint business plans and negotiating with buyers, it can seem that they are now expected to be brand ambassadors, category champions, econometricians and P&L managers. NRM provides an interface between sales and brand, category, and finance teams, enabling sales to do what they should do: sell.

NRM can help reconnect sales and marketing teams to "pull" commercial levers in joined-up ways but ultimately NRM needs to be coupled with supply chain and plugged into business-as-usual processes and governance.

Companies must build a much deeper understanding of how retailer and shopper behaviors differ across channels, and how both channels and customers are evolving.

Chapter 3

Plugging NRM into integrated business planning

An NRM capability is only as good as the portfolio and category strategies, and associated growth targets it is expected to deliver.

The days of setting "macho" sales targets are over. Internal P&L targets need to be grounded in the external realities of category growth, share position, brand role and growth intent, price elasticity, and headroom for growing penetration and distribution.

NRM should play a critical role in reconciling top-down targets with bottom-up plans, cascading P&L targets and investment across brand customer portfolios. In leading CP companies, NRM defines the "shape of plan" for key account managers that reflects P&L input and output measures — for example, budgeted trade spend against net revenue targets. NRM also provides targets that balance share, net revenue and gross profit ambitions; promotional guidelines to deliver targets and improve ROI; and the trade terms framework to govern trade spend in line with brand, category and supply chain objectives.

Deal effectiveness diminishes over time and promoted price becomes the new "base" price, inducing a race to the bottom that erodes margins.

For NRM to fulfill this role effectively, it needs to be plugged into business-as-usual processes and governance. Integrated business planning (IBP) is another hot topic as it aims to synchronize demand and supply sides to create a more agile and responsive organization, reorientated toward winning the shopper, and creating value across channels and key customers.

Chapter 4

How can organizations build NRM capability?

In a world where cost and heads are aggressively being taken out, investing in building new capability may feel counterintuitive.

Country organizations are being asked to do more with less and “decision-support” has been culled in many leading global CP companies. To efficiently build effective NRM capability requires a transformational approach and mindset.

- Establish analytics centers of excellence (CoE)

Local sales insight, relationships and field presence remain core commercial assets. But data-driven activities, such as pricing, promotional analytics and point-of-sale (POS) segmentation, can now often be better undertaken by dedicated analytics teams with real economies of scope and scale — the analytics CoE.

On- or near-shore NRM resources translate price, promotional, POS and shopper analytics outputs into practical direction and guidance that sales can execute. When consumable insights are plugged into local decision makers at the right times, above-market analytics can be both effective and efficient.

- Define the end state and codify collaborative working

Rerouting and streamlining processes through analytics CoEs require a reset of roles and responsibilities across the sales and marketing organization, and end-to-end processes spanning on-, near- and off-shore locations.

Given the complexity and scale of implementing NRM, a clear end state and compelling case for change are needed to galvanize stakeholders. That can be daunting enough for the sales and marketing organization, but NRM needs to be synchronized with supply chain to fulfil demand effectively and efficiently. Given the level of change associated with implementing NRM, some leading companies are building NRM capability as part of a wider IBP program.

IBP, as NRM, can mean different things in different organizations. For some, it is sales and operational planning by another name. But leading companies are now viewing IBP more strategically, as a means to break down functional silos and reconnect strategy with execution. In effect, IBP integrates planning processes and governance across functions, geographies and time horizons to efficiently execute strategy and deliver targets. In this way, IBP synchronizes demand and supply to create more agile, responsive and efficient organizations, reorientated toward winning with the consumer and long-term value creation.

Where to start

This can seem an overwhelming challenge, which is why a compelling case for change is needed.

- Size the global trade spend opportunity

The good, or bad, thing for NRM advocates or practitioners is that trade spend is in the billions of dollars for global CP companies. Minor improvement in ROI can drive material differences to net revenue and profit. In our experience, the case for change is compelling. But few can currently see the size of the prize — or the risk.A quick but credible global scan can reveal levels of opportunity and risk, identifying drill-sites by country, brand, channel, product and customer (depending on data granularity).

- Conduct rapid NRM capability assessment and identify pain points

Many of the pain points in organizations have common root causes. For example, “data isn’t reliable, systems and tools need too much manual entry, process timings don’t work for me or my team, too much time spent on planning and re-planning.” Rapid cross-functional interviews or surveys, desk assessments and headcount or role analysis identifies duplicated, redundant activities and creates buy-in to tackle inefficiencies and their root causes.These will span people, process and technology, and require a cross-functional response.

Widening the scope of profitable growth challenge can create complexity but also creates synergies and scale to drive transformational change.This will help codify a better business-as-usual that tackles pain points and that respects the dependencies across functions. This will require behavioral and cultural change.In the short term, however, it is advisable to focus on a region or strategic market(s) to get the details right and reflect reality on the ground. This is critical to get stakeholder buy-in.

A “narrow-front” approach concentrates the organization’s global resources and effort on making capability breakthroughs in a few, priority markets or a region to prove the concept, build the benefits case and learn lessons for subsequent roll-outs.

Conclusion

NRM can help CP organizations reconnect strategy with execution and drive sustainable, profitable growth.

Today, digitalization is transforming the way brands interact with consumers, shoppers and suppliers. The fragmentation of routes to consumer, retail environments and personalization of brand messages, propositions and services will increase the need for an intermediary, hybrid capability such as NRM. It is here to stay.

While it will demand transformational change, this is the next frontier of shareholder value creation — and survival will depend on it.

Summary

Consumer products (CP) companies risk being trapped in a race to the bottom with price and promotion tactics that neither build sustainable brand businesses nor bring shopper-relevant innovation. As a result, increasing numbers of CP companies are realizing that building net revenue management capabilities could be a more sustainable approach to growth.