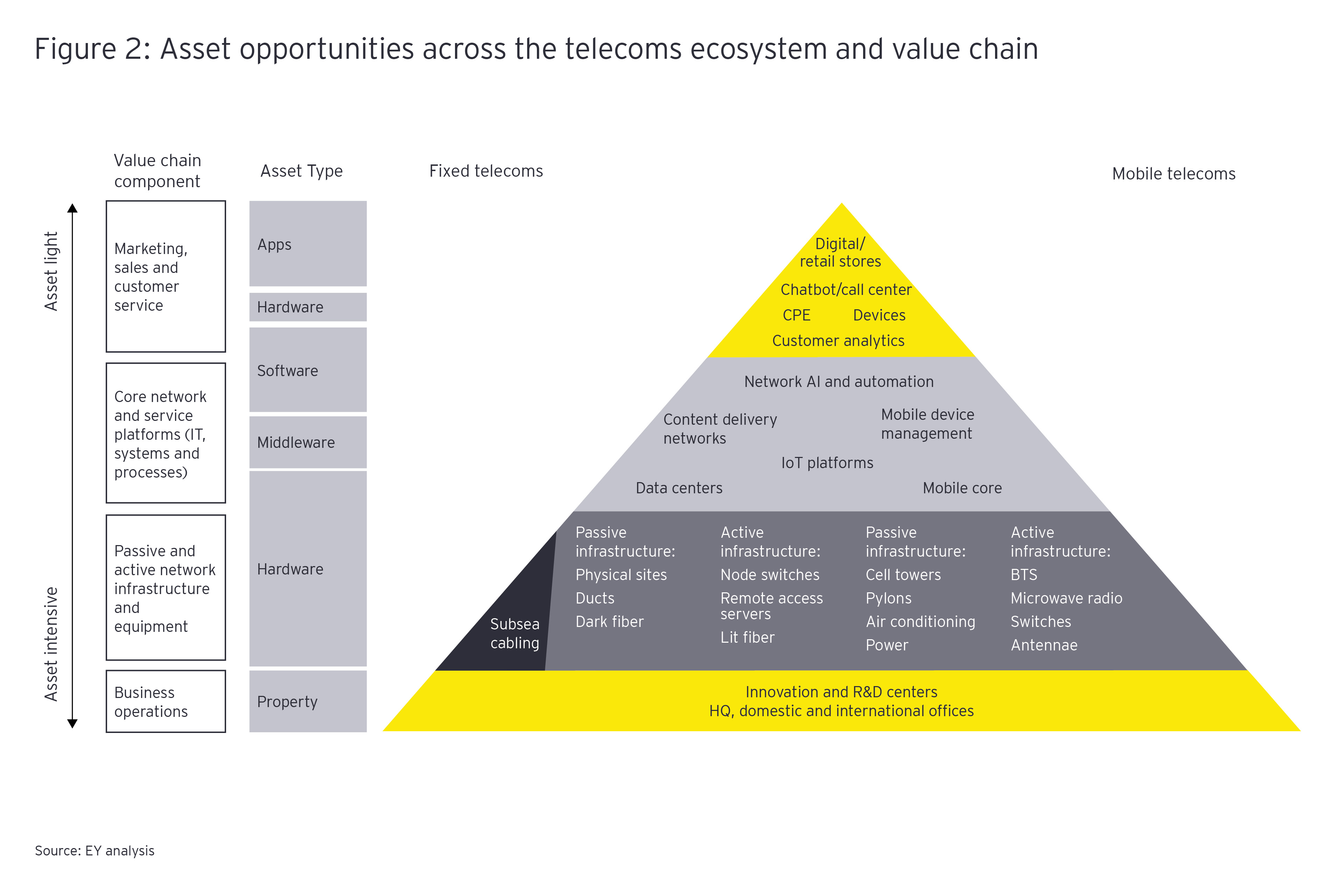

Already, a wide array of participants are acting to unlock value in various parts of the ecosystem. US telcos led the way on divesting datacenters, with European incumbents following suit. Cable providers and tech companies are using mobile virtual network operators (MVNOs) for asset-light entry into consumer mobile. In passive infrastructure, operators are spinning off tower assets alongside TowerCo sale-and-leasebacks; in active infrastructure, network sharing agreements are expanding to 5G cloud cores and rural 4G. And the tech hyperscalers now own or lease more than half of global undersea bandwidth.

These targeted actions are generating value in their own right. But the key to a successful asset-right strategy is to adopt a holistic view across the entire portfolio and landscape, taking account of the linkages and interdependencies between different assets. For example, if you’re an integrated incumbent, what’s your strategy for mobile? Could you divest your passive infrastructure or partner with the hyperscalers? Perhaps more importantly, how would selling off your datacenters affect your 5G and edge cloud strategy?

Aligning the enablers and outcomes

To reach the right answers to such questions, telcos must first gain a clear view of what’s driving asset-right strategies and what outcomes they’re looking to achieve. In terms of enablers, the key elements to take into account include supply-and-demand factors such as policy and regulatory evolution and anticipated retail and wholesale demand; the availability of potential strategic partners across the industry, as well as financial and public sectors investors; and the wide range of transaction structures and monetization options in the table, from outsourcing to partnership, and from JV to spin-off, sale-and-leaseback – all with their own timing and interplay considerations.

Commercial terms are also key, especially with arrangements such as sale-and-leaseback – including clauses such as exclusivity periods and anchor tenant commitments. Last but not least, asset-right can tie into organizational and process redesign, such as new information sharing mechanisms or the separation or retirement of IT systems. These issues may come more into play in datacenter deals.

With these levers fully understood and coordinated, what benefits can operators plan to get out of their asset-right strategy? These range from relatively simple outcomes such as debt reduction to more far-reaching ones such as increased management focus on innovation. Overall, we would highlight five benefits in particular:

- Revenue opportunities: freeing up more management focus on new customer needs and offerings

- Innovation: leveraging collaboration and greater management focus to develop new products and improve time to market

- Complexity reduction: reducing operational complexity and increasing strategic predictability

- Cash and margins: improving earnings before interest, taxes, depreciation and amortization (EBITDA) margins

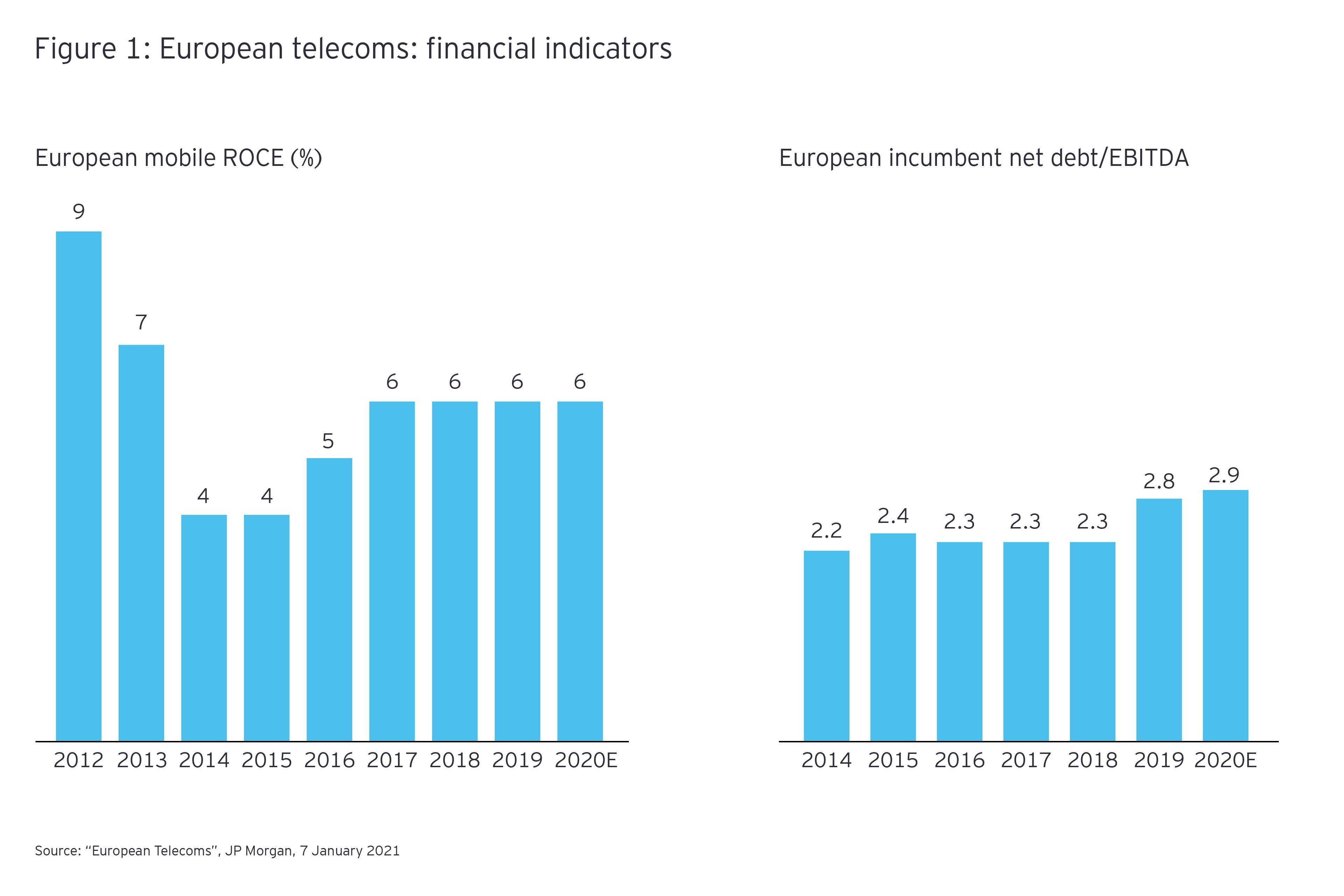

- Asset leverage: driving higher returns on capital employed (ROCE)

Time to revisit your strategy – and keep revisiting it

Given the industry landscape we’ve mapped out, we think revisiting their asset strategies isn’t an option for telcos. It’s a commercial and strategic imperative – and one that they should pursue as a matter of urgency, before others steal a march on them by snapping up the best opportunities.

To get in position for this rethink, an operator needs to gain a holistic view of the ecosystem and options, understand the dependencies, and take a measured and methodical approach to reshaping its asset portfolio. But this isn’t a one-off fix. So operators have no room to relax – but instead must remain more alive than ever to the changes coming down the line in the years up to 2025.

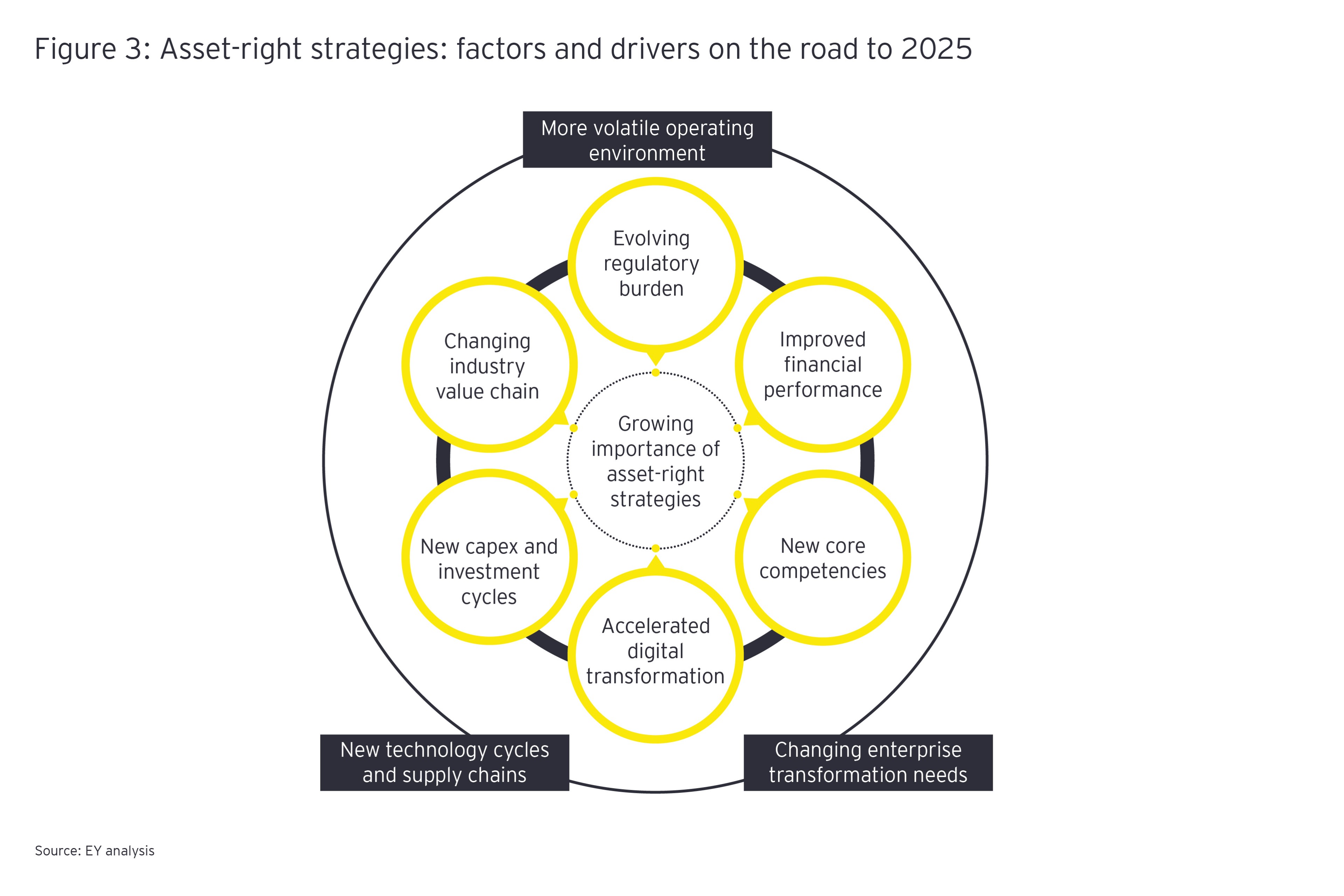

Together, these changes will make asset-right strategies even more pivotal to success. And as Figure 3 shows, the three key dimensions of change will be:

- A more volatile operating environment: including fast-changing market conditions, shifting regulatory obligations (including around the digital divide), and competitors in one part of the value chain becoming collaborators or co-investors in another. Given the potential interdependencies, how will you strike the right balance between different asset approaches across your business?

- New technology cycles and supply chains: concepts such as private and municipal networks are complementing traditional wide-area deployment models, and fixed-mobile convergence is evolving in new ways. Is your asset strategy granular enough to accommodate emerging business models and attuned to capitalizing on technology cycles?

- Changing enterprise transformation needs: while going asset-right is important across multiple domains, so is the need for investment in key areas of the business – from organizational redesign to network functions virtualization to skills. How will your asset-right strategy dovetail with your organization’s broader transformation?