On 28 October 2024, the Minister for Finance and Employment (the ‘Minister’) Hon. Clyde Caruana delivered the Budget Speech for 2025. This note summarises salient tax measures.

Income Tax – Local

Increase in deduction for school fees

As from 2002, the Income Tax Act began to contemplate a deduction for school fees paid in respect of children attending a registered kindergarten or a school named by the Minister. The tax deduction is capped to the lower of the amount actually paid and a fixed amount. In 2002, 2005, 2007, 2011, 2012 and 2019 the fixed amount was revised. The Minister announced that the fixed amount will be revised once more as follows:

- From €1,600 to €3,500 per year for every child attending kindergarten

- From €1,900 to €4,600 per year for every child attending primary level education; and

- From €2,600 to €6,500 per year for every child attending secondary level education.

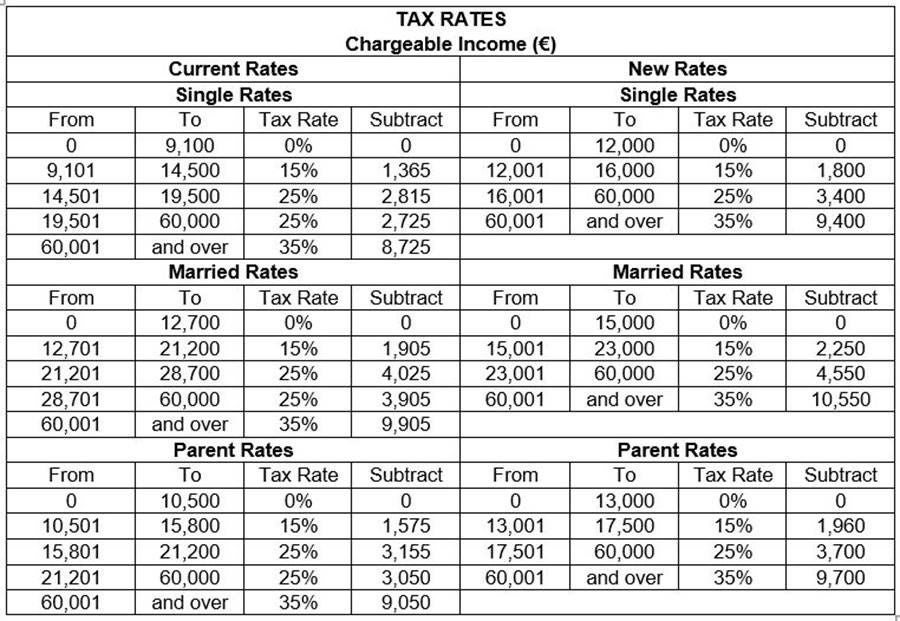

Revision of tax bands

The Minister announced a revision of the tax brackets applicable to individuals eligible to apply the Single Rates, the Married Rates and the Parent Rates. The last major revision of the tax bands had occurred in 2016. As of next year, the scope of tax-free bracket and the scope of the 15% and 25% rates will be revised as follows:

Taxation of pension income

Recent budgets reduced taxation on pension income by exempting from tax a portion of such income.

In particular, Legal Notice 98 of 2022 (as amended by Legal Notices 220 of 2022, 48 of 2023 and 5 of 2024), exempted from tax a portion of the pension income derived by an individual who is at least 61 years and who remains active.

In 2024, the exempt portion amounted to 60% of the pension income. The Minister has confirmed that this will be increasing to 80% of the pension income during 2025, in line with the existing provisions.

Furthermore, pensioners born prior to 1962, and which had they remained in gainful employment would have had income exceeding the maximum pensionable income of €23,500 will benefit from an adjustment in their pension in order to reduce the inequality created by the 2006 pension reform with the category of pensioners born in or after 1962.

Voluntary Occupational Pension Plan

Through Legal Notice 228 of 2017 (as amended by Legal Notices 114 of 2019 and 3 of 2021), tax credits of 25% of qualifying contributions, capped at €750, were introduced to both a qualifying employer and a qualifying employee on Voluntary Occupational Pension Plans.

All employers must provide the opportunity to new employees to invest in such occupational pension plan, however the employer has no obligation to contribute to the plan. While the employee may opt out of investing in such occupational pension plan, any contributions would qualify to a tax credit of 25%, capped at €750.

In-Work Benefit

The basis of the calculation of the In-Work Benefit will change in a way that the net employment income which previously excluded the social security payments paid by the applicant will as from next year also exclude the tax payments made by the applicant. The net income from employment refers to all income derived from gainful occupation including salary, overtime, commissions, fringe benefits, etc less the amount paid as social security contributions.

Tax credit for parents of children with a disability

Parents of children with a disability will as from next year benefit from an increase in the tax credit of €250 from €500 to €750. This scheme will also be extended to parents who do not suffer taxation or who are not in employment or who are in receipt of social benefits.

Deduction for donations to certain voluntary organisations

Donations by companies to voluntary organisations of a social nature, environmental and animal welfare will be benefitting from a maximum tax credit of €500.

Extension of Relief from Income Tax and from Duty on Documents and Transfers on Certain Property Transfers Rules

The reliefs contemplated in the Relief from Income Tax and from Duty on Documents and Transfers on Certain Property Transfers Rules, (S.L. 123.203) will be extended for another year. These rules provide that transfers of properties built over 20 years ago, and which have been vacant for more than 7 years and transfers of properties situated in Urban Conservation Areas will not be subject to duty and Property Transfers Tax on the first €750,000 transfer value. Furthermore, first time buyers acquiring these properties will also receive a grant – of €15,000 if the property is situated in Malta or €40,000 if the property is situated in Gozo.

Income Tax – International

Pillar 2

The Minister highlighted Malta’s decision to defer the introduction of Council Directive (EU) 2022/2523 of 14 December 2022 – more commonly known as the Minimum Corporate Taxation Directive. By way of recap, the Minimum Corporation Taxation Directive seeks to impose a minimum tax of 15% on certain profits of multinational groups (‘MNEs’) – and large-scale domestic groups in the case of the Minimum Tax Directive – which have an annual revenue of €750 million or more via an Income Inclusion Rule (IIR) and the Undertaxed Profits Rule (UTPR) and an optional qualified domestic top-up tax.

The Minister mentioned that due to the uncertainties which still surround the Minimum Corporate Taxation Directive and the Organisation for Economic Co-operation and Development (‘OECD’)’s GloBE Rules, it would be prudent for Malta to apply a cautious approach.

The Minister also declared that Malta is still engaged in extensive discussions with the European Commission in relation to the introduction of measures and incentives in the form of grants and Qualified Refundable Tax Credits compatible with rules imposed by the European Union and the OECD.

Coincidentally, earlier today, the European Commission adopted a new proposal for a Directive amending the Directive on Administrative Cooperation (2011/16) (DAC), also referred to as DAC9, with an objective to simplify and rationalise the compliance requirements of businesses allowing the MNEs to file one centralised top-up tax return for the entire group instead of individual filing at a country level. To achieve this, DAC9 provides for the set-up of a system for tax authorities for information exchange and a standard information form for MNEs to report certain tax related information.

Highly Qualified Persons Rules

The Minister announced that the Highly Qualified Persons Rules will be extended. As a recap, The Highly Qualified Persons Rules, (S.L.123.126) were originally introduced as a scheme to attract highly qualified persons occupying ‘’eligible offices’’ with companies licensed and/or recognised by Competent Authorities regulating specific sectors.

Duty on Documents and Transfers

Extensions of First Time Buyers’ and Second Time Buyers’ Schemes

The First Time Buyers’ Scheme, contemplated in rule 3 of the Exemption of Duty in Terms of Article 23 Order, (S.L. 364.12) will be extended for a further year. This scheme provides for an exemption on duty which would otherwise have been charged on the first €200,000 transfer value upon the inter vivos acquisition of the first immovable property, which property is to be used for residential purposes. The Minister also declared that the €10,000 grant, payable to First Time Buyers over a period of 10 years, will continue to be granted in 2025.

The Second-Time Buyers’ Scheme, contemplated in the Duty on the Acquisition of the Second Immovable Property to be used as Sole Residence (Exemption) Order, (S.L.364.17) will be extended for a further year. This scheme provides for a refund of duty paid on the first €86,000 of the transfer value of the newly acquired property for individuals who transfer their first residential immovable property and acquire the second one within a 12-month period.

Extension of the reduction on duty on documents and transfers of Family Businesses

The Minister for Finance and Employment has announced that the beneficial rate of duty of 1.5% on donations inter vivos of family businesses to descendants and family members will be extended. This beneficial regime was originally introduced in 2017 via the Duty on Donations of Marketable Securities and Immovable Property used for Business (Exemption) Order, (S.L. 364.15) and has since been extended on a yearly basis.

Value Added Tax (VAT)

VAT refunds on restoration costs

The VAT refund scheme on restoration costs as per Government Notice No. 1,604 dated 10 December 2021 published in Government Gazette No. 20,748 will be extended for another year. In terms of this scheme VAT refunds capped at €54,000 (€300,000 X 18%) may be claimed with respect to restoration and finishing costs incurred on specific types of property, namely properties built over 20 years ago, and which have been vacant for more than 7 years or properties situated in an Urban Conservation Area or new properties built according to approved criteria.

VAT refunds on bicycles and pedelec bicycles

The VAT refund scheme associated with the acquisition of bicycles and pedelec bicycles as per Government Notice No.1,480 dated 18 December 2020 published in Government Gazette No. 20,541 will be extended for another year.

VAT exempt sanitary products

The VAT rate on sanitary products will be reduced, with such products becoming VAT exempt.

Social Security Contributions

Individuals who successfully complete a drug rehabilitation programme and find a stable employment could qualify for a two-year social security contributions credit.

Other measures

Vision Malta 2050

Malta will be launching ‘Vision Malta 2050’, a comprehensive vision that sets Malta’s strategic direction for the upcoming decades and aims to ameliorate citizens’ qualify of life. The strategy will primarily address emerging challenges like climate change, core technology, demographic changes and global market dynamics.

Innovation and start-ups

It was announced that work is ongoing on the European Digital Innovation Hub, a project creating a community of start-ups and SMEs that may benefit from mentorship, pre-accelerator and incubation services, and access to a High-Performance Computer.

The Minister also highlighted the renewal of the Seed Investment Scheme, which grants incentives to those wishing to invest in local start-ups. Furthermore, 2024 also saw the incorporation of Malta Government Venture Capital Limited, which will benefit from a fund of up €10 million to be invested in equities of new companies.

Malta will also be focusing on strategic measures boosting research, innovation and social inclusion, including the research and innovation focused Xjenza Malta, the programme FUSION, programmes under Horizon Europe and the European Space Agency, and calls for projects under the National STEM Community Fund.

Financial Services sector

Malta is looking at introducing legislation to ameliorate Malta’s offering within the Financial Services sector, with particular focus on family offices, aircraft leasing, fintech and artificial intelligence.

The Minister also announced that in 2025 Malta will be passing legislation concerning Limited Partnerships with the aim of promoting these new sectors in Malta.

Food producers and retailers

Besides announcing the creation of an Authority for Food Safety, the Minister announced that in the aim of reducing food waste, food producers and retailers will benefit from measures incentivising them to donate or sell at a reduced rate food nearing its expiration date.

Carbon-free economy

Residences investing in renewable energy and devices that improve efficiency in energy and water usage will continue to benefit from a number of incentives for another year. These include schemes for the installation of photovoltaic panels and renewable energy storage, installation of water pump heaters and solar water heaters, and the restoration of wells of old houses and devices for the purification of water.

Transition to clean energy

The Minister announced that, for another year but subject to new conditions, people buying electric vehicles, including motorcycles, will benefit from a cash grant ranging from €2,000 for motorcycles and €8,000 for cars and small vans.

Individuals scrapping old vehicles will keep on benefitting from a cash grant of €1,000, with grant increasing to €2,000 for vehicles registered in Gozo. Furthermore, individuals who ordered electric vehicles until 28 October 2024, but which will not be registered by 2024, will still be eligible for the current benefit of €11,000.

Other Developments

Besides the measures addressed by the Minister above, other notable developments are the following:

Transfer Pricing

Earlier this year, the Malta Tax and Customs Administration (‘MTCA’) published Guidelines in relation to the Transfer Pricing Rules (‘the TP Guidelines’) with an objective to clarify and throw light on certain key aspects to assist taxpayers to adhere to their obligations under the Malta Transfer Pricing (‘TP’) Rules.

Material alteration:

Since, the arrangements entered into prior to 1 January 2024 and which are not materially altered on or after the said date would be grandfathered (albeit to a limited extent) under the Malta TP Rules and would be covered for financial years commencing on or after 1 January 2027, the TP Guidelines have clarified on what could be constitute a “material alteration”.

The TP Guidelines clarify that a thorough case-by-case analysis would be essential to determine whether an alteration is material having regard to the substance of the alteration, the functions performed, assets employed, and risks assumed by each of the parties to the arrangement (rather than its legal/contractual form).

The TP Guidelines further clarify that alterations to minor administrative details in the agreement or unilateral operational changes in the way in which the obligations under the agreement are met or a transfer of domicile or residence into/or outside Malta should not regarded as material. However, changes like a change in the consideration (including a change in the method of determining the consideration), a change in the functions of the parties (which could impact their risks and thereby their remuneration) and a change in the duration of the agreement could be treated as examples of material alterations.

TP Methods:

The TP Guidelines clarify that the method to be applied to determine the arm’s length price/value (‘ALP’ or ‘ALV’) in relation to a particular transaction should be in line with the OECD Transfer Pricing Guidelines (‘OECD Guidelines’) – including where reference to the application of other methods is concerned, and would depend upon the facts and circumstances of the case (without any priority being assigned to any method per se). The ALP for low value adding intra-group services could be determined in accordance with the OECD Guidelines and EU Joint TP Forum guidelines using the simplified approach.

Records to be retained:

It has been clarified that the TP documentation needs to be retained and only submitted to the MTCA upon a specific request made in this regard by the MTCA and further the MTCA shall retain the right to call for any other information, documentation, backup records, etc. as the case may be in relation to the arrangements under review for a more thorough and in-depth examination. The documentation should be maintained in accordance with the OECD Guidelines and submitted to MTCA within a reasonable time frame.

The Master File and Local File shall include the information outlined in Annex I and Annex II respectively to Chapter V of the OECD Guidelines and shall be made available either in English or Maltese upon a request made by the MTCA and further should be retained in accordance with the applicable specified timelines.

IFRS 17

On 25 October 2024, the MTCA has published a ‘Guidance Note in relation to the Taxation of Insurance Businesses Following the Adoption of IFRS 17 Insurance Contracts Rules’. The Guidance Note is intended to insurance undertakings adopting International Financial Reporting Standard 17 titled "Insurance Contracts" (‘IFRS 17’) and which will become subject to new rules that will be issued in terms of article 27(8) of the Income Tax Act, (Cap. 123).

Malta recognises the one-off transitional impact that taxpayers adopting IFRS 17 may be subject to and therefore, through the Guidance Note, it provides taxpayers with the option to elect to spread the tax impact of any gains arising from the adoption of IFRS 17 (‘Adoption Gain’) in the first year of implementation thereof over a maximum period of five years. Such election must be made through the completion of prescribed form accessible from the MTCA’s portal and the submission thereof to the designated email. Where the year of assessment 2024 is concerned, such an election must be submitted by 15 November 2024 and when completing such a form taxpayers must, inter alia:

- report the total Adoption Gain;

- specify the tax payable on the Adoption Gain; and

- indicate the number of years (capped at 5 years) over which the Adoption Gain is to be spread.

Only taxpayers which are fully compliant with all Maltese tax obligations may apply for such an election.

Taxpayers which make such an election must pay the annual portion of the tax due on the Adoption Gain by the following 21 December. To put this into perspective, the tax due on the portion of the Adoption Gain attributable to the year of assessment 2024 must be paid by 21 December 2024. Furthermore, where the said year of assessment 2024 is concerned, the deadline to make such a payment for companies with an 18-month tax settlement date falls on 30 June 2025.

Finally, the Guidance Note also clarifies that the above only applies to any tax arising on the Adoption Gain and does not extend to any other chargeable income earned by the insurance undertaking. Moreover, the MTCA will also be publishing a further guidance in relation to the taxation of insurance business once the aforementioned rules have been issued.

Contacts

Dr. Robert Attard, Partner

robert.attard@mt.ey.com

Silvio Camilleri, Director

silvio.camilleri@mt.ey.com

Bernard Bonnici, Director

bernard.bonnici@mt.ey.com

James Bonavia, Director

james.bonavia@mt.ey.com

Saviour Bezzina, Senior Manager

saviour.bezzina@mt.ey.com

Mit Gaglani, Senior Manager

mit.gaglani@mt.ey.com

Keith Caruana, Manager

keith.caruana1@mt.ey.com

Rachel Zampa, Senior

rachel.zampa@mt.ey.com