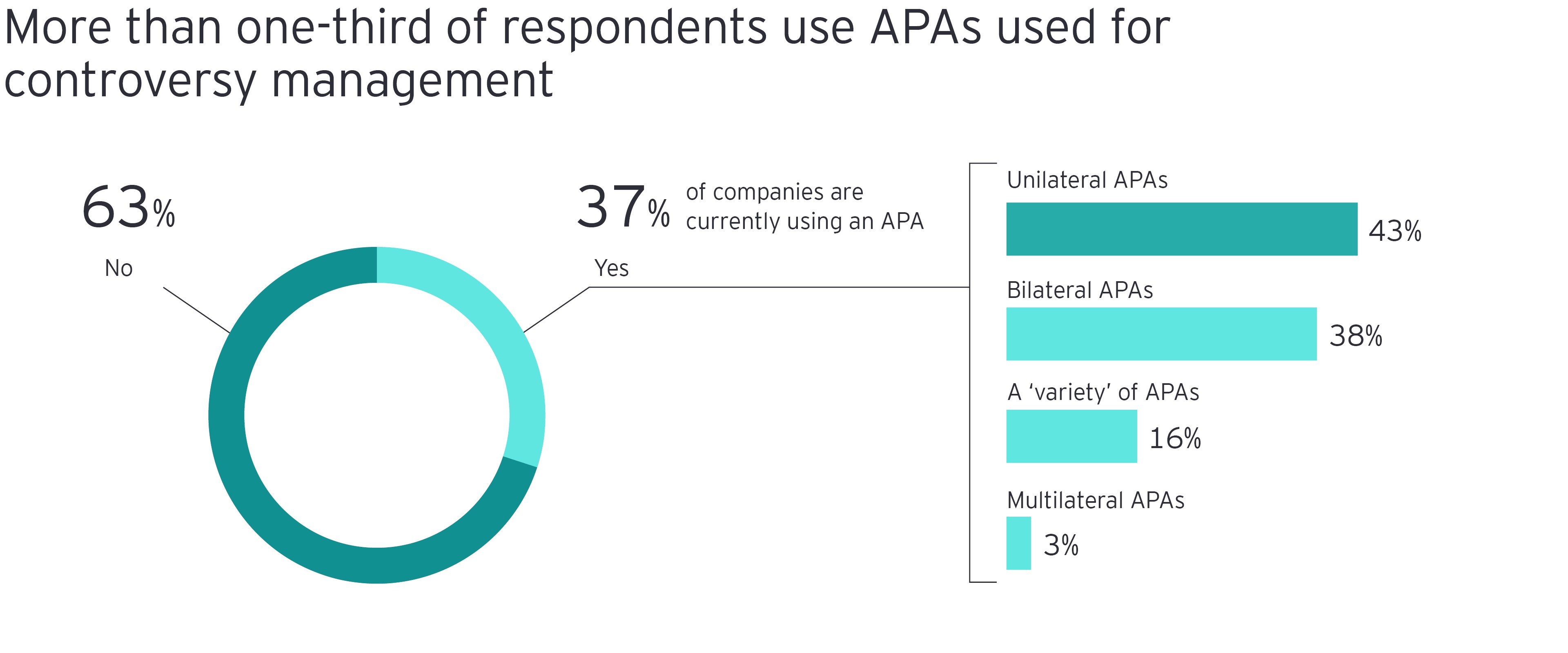

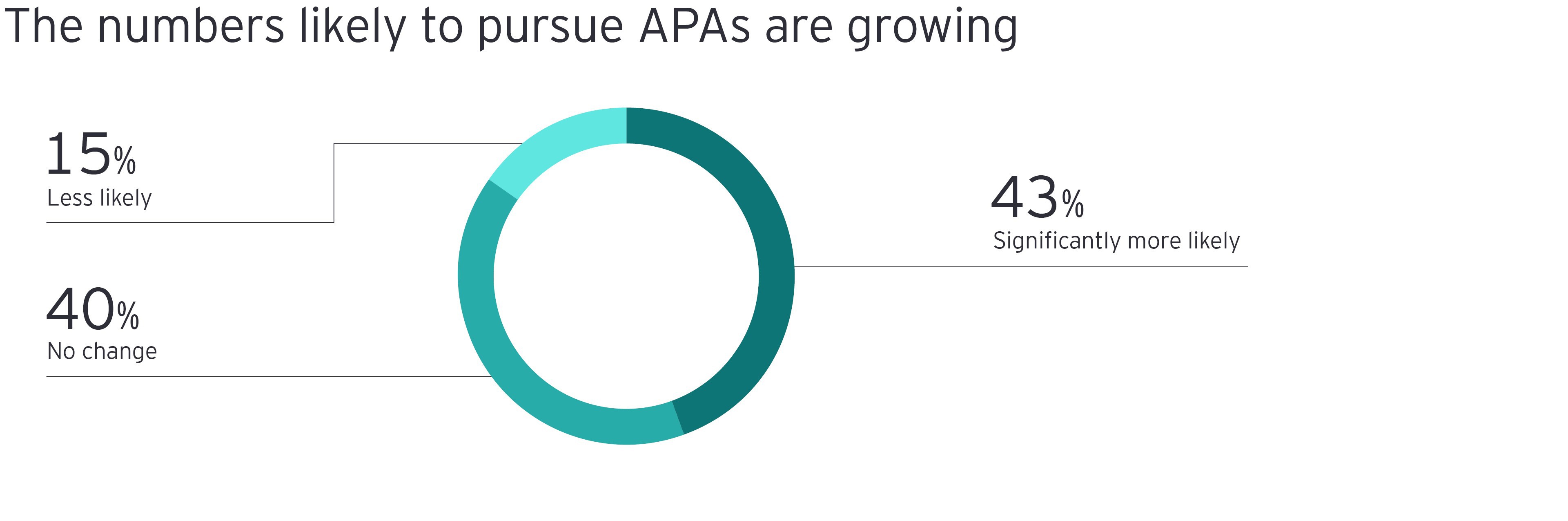

Expanded reliance on APAs as a means of reducing tax uncertainty and risk is not only evident in the survey, but also in reports published by the US Internal Revenue Service (IRS)1 According to an IRS report, taxpayers filed 203 APA requests in 2018, doubling from only 101 in 2017. By year-end 2018, 458 APA requests were pending, up from 386 and 398 pending requests at the end of 2017 and 2016, respectively. Demand is noticeably strong in terms of bilateral APA filings between the US and India, reflecting what appears to be significant improvement in cooperation between the two nations’ taxing authorities.

All of this makes complete sense to de Ruiter. “I believe what we are seeing is the recognition that given so many evolving, differing interpretations, and legislation and risk, it makes sense to use APAs to gain greater certainty.” Bear also in mind, says de Ruiter, “that with the levels of disclosure being mandated as BEPS gets implemented, companies really aren’t sharing all that much more information than they would have been required to in the first place.” So, in the end, “for a growing number of cases, the added certainty is well worth any added marginal efforts needed to secure an APA.”

Adds Fultz, “the equation swings even more in favor of the APA when you begin to think about some of the added advantages of an APA.” She adds that one benefit to consider “is that when you’re working on an APA, you elevate the discussion, because you’ll be working with resources from the taxing authorities who have more cross-border experience as opposed to merely domestic experience. You’ll be working with people who have a stronger appreciation for the issues and in some cases, not all, lack of understanding is the key hurdle to resolution.”

In addition, continues Fultz, “once you’ve completed an APA, there’s a halo effect that attaches to your operations around the world.” As Fultz explains, “when tax authorities realize you were able to successfully conclude an APA, it sends the message that you are a cooperative taxpayer and that you’re willing to explain your transfer pricing policy and follow through to demonstrate the fairness and validity of your thinking.”

Finally, adds de Ruiter, “there’s also the benefit of being able to reduce provisions for tax contingencies.”