Chapter 1

Aligning on the need for corporate action

CEOs, boards and investors all recognize the growth imperative of acting on global challenges.

Widening income inequality, fraying social safety nets and economic insecurity due to technology change are driving populist movements. Climate change is causing new waves of immigration. Gender inequality is driving vulnerability and marginalization of populations and depressing potential economic growth. Digital technologies are creating new challenges around data ownership, privacy, ethics and trust. These challenges lie beyond the ability of any one nation or any one set of stakeholders to address.

Global challenges pose growing negative consequences for economies, businesses and societies if they are not tackled. However, there will be measurable upsides if they are addressed. For example, the United Nations reports that countries are leaving US$160 trillion in wealth on the table globally due to differences in lifetime earnings between women and men. Coincidentally, the adoption of renewable energy globally could save an equally astronomical sum—US$160 trillion in climate change costs by 2050.

Historically, most business CEOs have chosen to remain noncommittal with respect to global challenges, particularly those that are sources of political friction. Now, we have come to a tipping point of change as the CEOs of global companies, their board directors and institutional investors align on the need for corporate action and, most importantly, CEO leadership on these issues.

“Today, we are facing a whole series of global challenges: the fight against climate change and social injustice is at the top of the agenda. The challenges must first be recognized and named openly. This is the central prerequisite for us being able to find the right answers and define long-term goals,” observes Oliver Blume, CEO of Porsche AG.

The biggest risks to business and the global economy

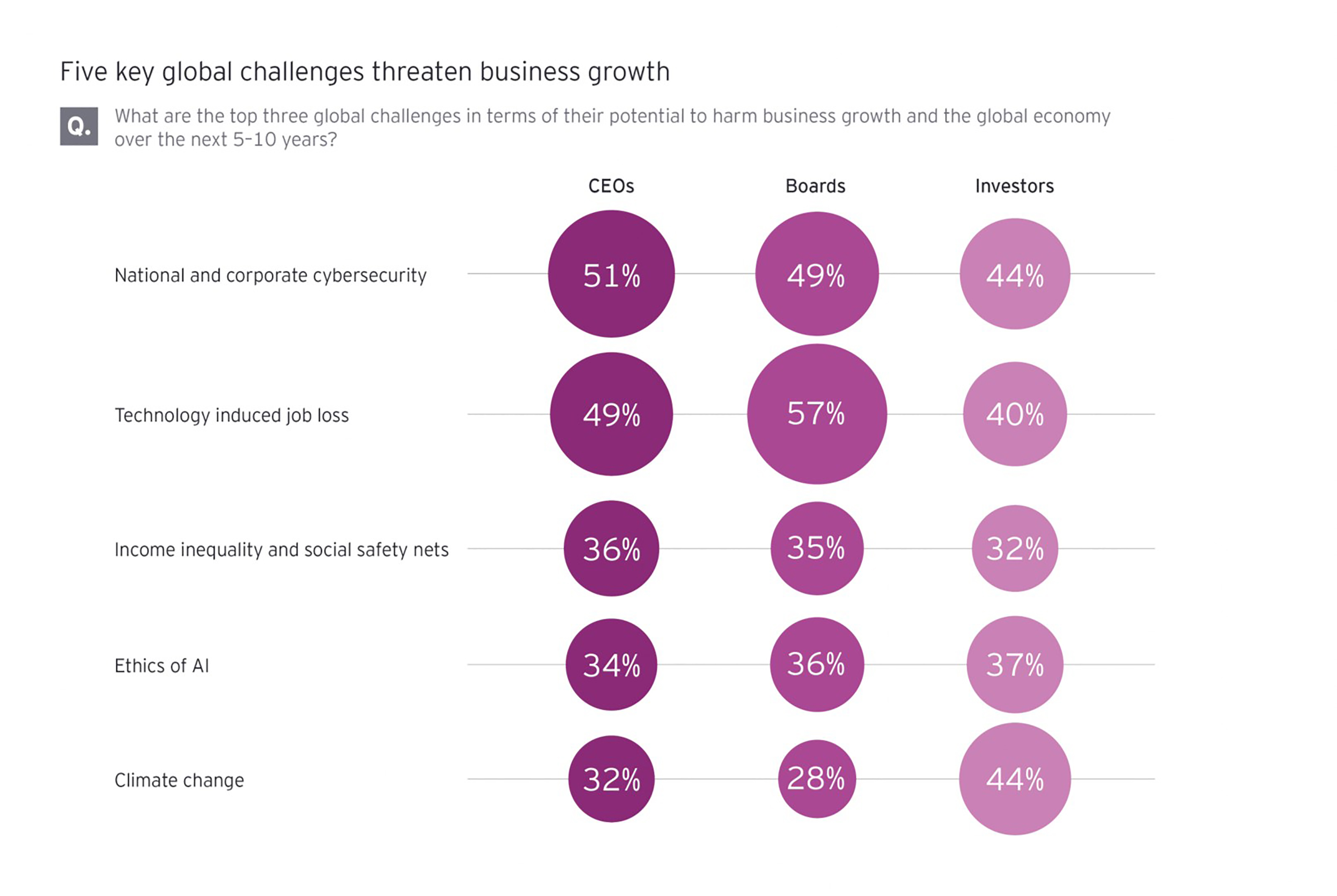

CEOs, board directors and institutional investors put two global challenges at the top of their lists of issues threatening business growth and the global economy:

- National and corporate cybersecurity

- Job loss due to technology change and the associated issues of education and reskilling

These represent immediate disruptions, which influence the future of work, consumer trust and regulation.

“Future corporate growth depends on trust, whether between corporations and customers, people and technology, or management and employees. The increasing risk of cyber-attacks and the failure to find the right balance of digital and human in the workplace damages trust in all these critical dimensions,” says Gil Forer, EY Global Markets Digital and Business Disruption Lead Partner, and EYQ leader.

CEOs also emphasize income inequality, likely influenced by the impact of this issue on their customers as well as the political volatility it is driving.

Board members prioritize the ethics of AI as they grapple with questions of bias and trust raised by this new technological capability.

Investors put climate change at the top of the list. This group has long sounded the alarm about the risk to long-term value from climate disruptions, which are becoming increasingly evident.

“Climate change, geopolitical instability and conflict, youth unemployment, lack of education, digitalization and inequality are some of the global challenges that business leaders are and will need to grapple with in the short- to medium-term,” notes Isam J. Al Sager, Group CEO of the National Bank of Kuwait.

Investors and boards are bigger champions of corporate engagement than CEOs

The majority of respondents in all three survey groups say that that world’s largest companies should be engaged to a “great” or “very great” extent in addressing the top global challenges they identified.

What’s surprising is that an even greater share of institutional investors (54%) and board directors (58%) than CEOs (51%) say that big companies should be involved in solving global challenges.

“It will increasingly become apparent that companies need to be stewards for future generations, and that boards and senior leadership, C-suite, have the responsibility of thinking hard about those issues, and then framing a set of actions that allow companies as entities and the employees as individuals to engage with them. Corporations are meaningful actors, and they can actually make a difference,” says Piyush Gupta, CEO of DBS Group, a leading financial services group headquartered in Singapore.

Michael Lamach, CEO of Ingersoll Rand, which includes brands Trane® and Thermo King®, observes: “In a lot of cases, you've got corporations stepping in sometimes where governments aren't, and I think that's a powerful thing.”

Chapter 2

CEOs: Feeling the heat

CEOs feel stakeholder pressure to act on global challenges—and see upsides.

Today’s leaders are being called upon to go further than ever before in demonstrating leadership, taking public positions on politically-charged issues, choosing strategies, setting policies, and taking proactive measures to help solve large global challenges.

“The world’s largest companies have to be engaged,” says Bala Swaminathan, Asia Consulting Board member for Westpac Banking Corporation. “It's not whether you grow or you don't grow. It's a question of whether you exist or you don't exist.”

Some of the underlying dynamics include the following:

- There is widespread perception that national governments have failed to respond effectively (individually or collectively) to global challenges. Less than half (47%) of the general population globally trust their governments to do the right things.

- Large corporations continue to gain greater and greater economic clout. In the U.S. alone, Fortune 500 revenues rose from 35% of US GDP in 1955 to 72% of GDP in 2016. Companies can exert significant influence relative to other actors both globally and locally due to their worldwide footprints and extensive resources.

- As corporations have grown more powerful, employees, customers and other stakeholders expect CEOs to lead the way in addressing growing global challenges. 71% of employees globally believe it’s critically important for their CEO to respond to global challenges, with 76% of the general population agreeing that they want CEOs to take the lead on change instead of waiting for governments to act.

“The role of companies and corporations is increasingly coming into question. Do we exist only to further the interest of our shareholders? Or do we have an agenda beyond our shareholders, to society at large, to communities, the stakeholder prism? I think that quite clearly, we need to settle down on the side of stakeholders,” says Gupta of DBS Group.

The bigger the company, the more the stakeholder pressure

The CEOs in our study feel the pressure, with 67% reporting moderate to extreme pressure from stakeholders to engage with global challenges. This figure rises to 77% for the CEOs of the largest companies, ones with US$20b or more in revenues. The figure for board directors is similarly high, with 75% saying they feel this level of pressure.

“The bigger the company, the larger and more diverse its stakeholder groups, and therefore the greater its responsibility to affect positive social change–while de-risking to ensure its future success,” notes Al Sager of the National Bank of Kuwait.

Customers are the number one pressuring stakeholder group, according to a majority of CEOs (52%). The executives also frequently cite shareholders (40%), employees (40%), and the public (39%) among the most pressuring stakeholders.

CEOs, boards and investors see more opportunity than risk in acting on global challenges

Corporate action on global challenges brings both opportunities and risks. On the one hand, making progress to solve global challenges helps to lay the foundation for long term sustainable growth and offers the opportunity to deepen relationships with customers, employees and other important stakeholders. On the other hand, not every stakeholder necessarily agrees on the correct actions to take and there are risks in execution.

Looking at the balance of opportunity and risk, the majority of CEOs see greater opportunity than risk in becoming more active on global challenges. Boards and investors are not far behind, with a plurality of each seeing a greater opportunity. None of the three groups sees greater risk than opportunity in taking action.

CEOs say that attracting the best talent is the biggest growth opportunity that comes from becoming more active on global challenges. Improving competitive position (34%) and attracting new or different types of investors (33%) are also frequently cited.

CEOs of companies with $US20b or more in revenues bring a distinctive view on growth opportunities. They say that creating new business models and services that help address global challenges is the top growth opportunity (40%), tied with attracting the best talent. Only 18% of smaller companies cite new business models and services as a top growth opportunity.

Angela Rodell, Chief Executive Officer of the Alaska Permanent Fund Corporation offers: “I look at it through a more positive than negative lens. I think about the opportunities for growth. While these challenges are really painful, the change is really painful, out of that [change] comes some really interesting ways of how we can think about where we want growth.“

Chapter 3

Investors want long-term value more than short-term returns

Investors are paying increasing attention to the corporate response to global challenges and support dedicating company resources.

Institutional investors have long been viewed as a brake on corporate actions that do not yield short term returns. Yet, in recent years the picture has started to change. The Embankment Project to identify and create new metrics to measure and demonstrate long-term value to financial markets has the support of some of the world’s largest asset owners and managers. The annual letter to CEOs from Larry Fink, the CEO of the asset management firm BlackRock, is influential in its call for company executives to focus on long term value creation.

“It is vital that companies are engaged in addressing these global challenges for the simple reason that it is essential to creating long term value. Companies have not been engaged enough in the past on long term issues,” says Mark Delaney, Chief Investment Officer of AustralianSuper.

“Companies are one of many stakeholders who operate in a world economy affected by global challenges. In our opinion, any company´s activity that contributes to a worsening in the social and/or environmental challenges will, over time, trigger a reaction from an array of different stakeholders such as governments, regulators, employees, customers, etc.,” explains Petra Pflaum, Chief Investment Officer for Responsible Investments and EMEA Co-Head of Equities, DWS Group. “This will ultimately have an impact on a company´s value creation potential.”

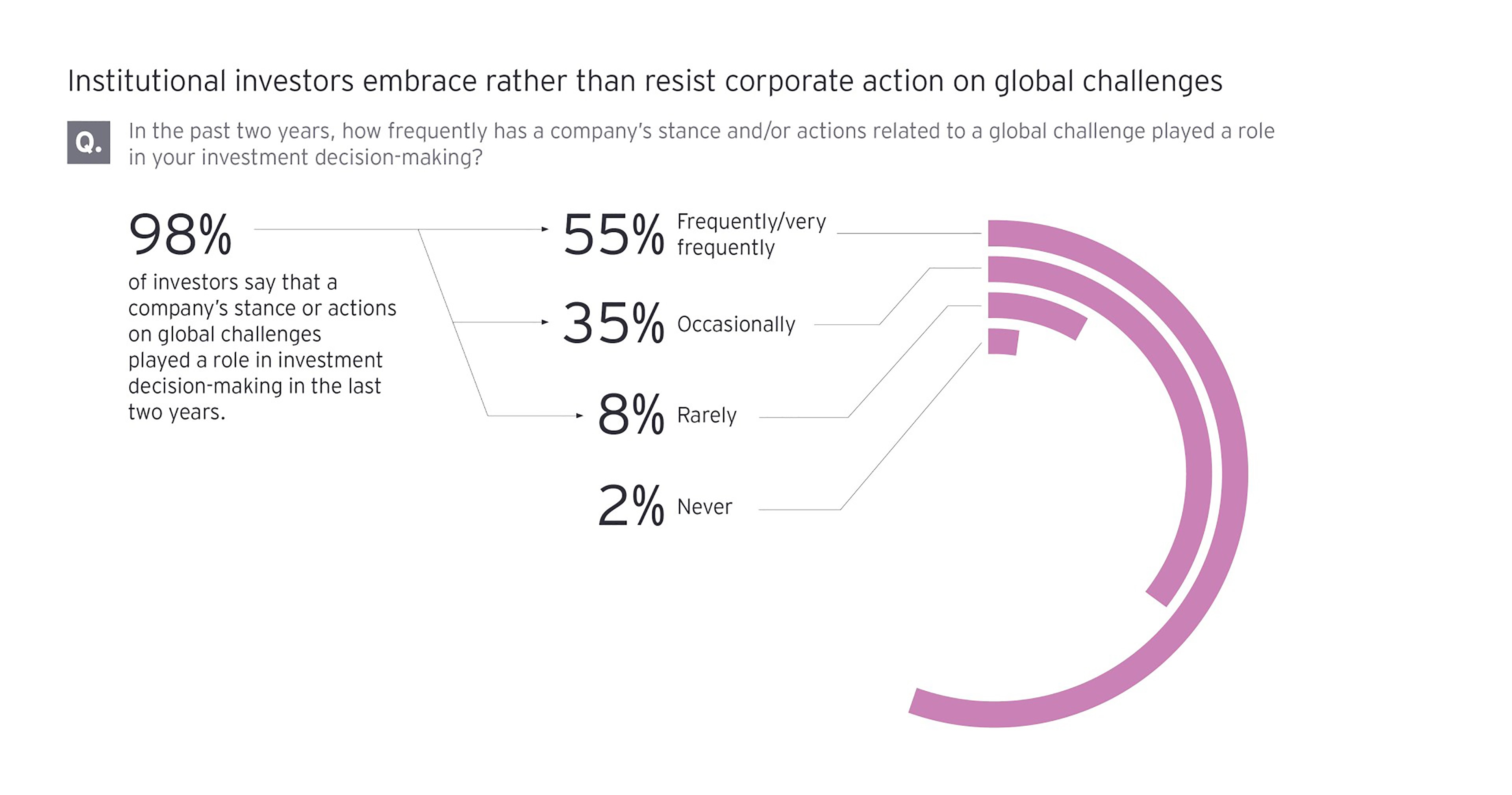

Our survey of global institutional investors supports the view that investors increasingly consider issues of long-term value creation, such as the corporate response to global challenges.

Virtually all (98%) of our investor respondents report that a company’s response to global challenges played a role in investment decision-making with some frequency in the last two years. Over half (55%) say that global challenges were frequently or very frequently a factor.

Related article

The investor focus on global challenges is set to increase. Looking ahead, 83% of institutional investors say that the corporate response to global challenges will become more important to investment decision-making over the next five years.

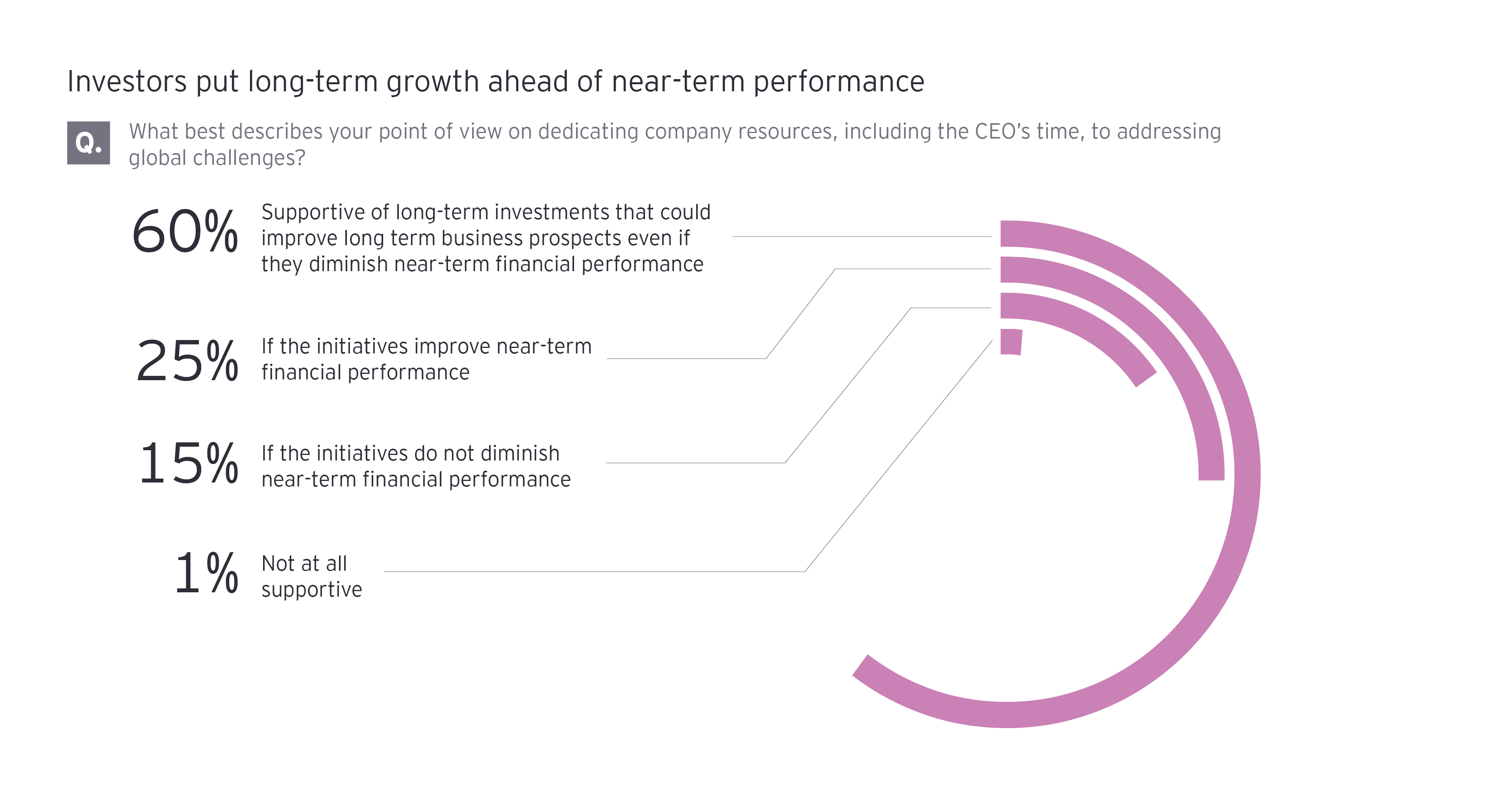

But will investors “walk the talk” by supporting corporate investment to address global challenges? Responses from institutional investors suggest that it is time to reassess the view that they prioritize short-term performance over long-term growth. The majority of investors (60%) support long-term investments to address global challenges even if near-term performance is diminished.

Even though most investors support corporate investment in addressing global challenges, they recognize that their sector could be more effective in driving progress on global challenges: 86% of respondents say that they see an opportunity in their asset classes to change investment models and practices to better align business interests with progress on global challenges.

CEOs, boards and investors foresee significant progress in the next 5-10 years in the partnerships, reporting and collaboration needed to address global challenges

Global challenges are ones that cannot be solved by any one country of set of stakeholders. CEOs, board directors and investors foresee a world in which significant progress has been made in public-private partnerships, reporting standards and cross-industry collaboration needed to address them successfully:

- 80% of CEOs say that government, business and the public will reward companies for taking meaningful action on global challenges, which means that competitive advantage can be gained through leadership on these issues.

- 83% of board directors say that public-private partnerships to address global challenges will become more common, which suggests that the ability to collaborate with different levels of government will become an increasingly important skill set.

- 84% of institutional investors believe that corporate reporting will shift to a focus on long-term strategy, growth and sustainability. This underscores the strength of the shift towards a focus on long-term value and movement away from short-term financial reporting.

Chapter 4

Your corporate action plan for growth

Action on global challenges is a new corporate growth imperative. What’s your plan?

Large global challenges pose direct risks to corporate growth. Local markets around the world continue to be disrupted by a diverse slate of challenges, including protectionist economic policies, technology backlashes and climate-driven natural disasters. It makes economic sense for businesses to be involved in and act on these issues. And the risks to growth from inaction on global challenges are only heightened in an environment where digitally-empowered stakeholders are prepared to reward corporations who lead in solving problems and punish those who do not.

To enable future growth, corporations must be proactive in formulating short- and long-term plans that demonstrably work towards solving the complex global challenges we face. CEOs and the companies that they lead can no longer afford to sit on the sidelines.

“CEOs have to get on board with the agenda,” says DBS Groups’s Gupta. “And frankly, I myself and my peers would admit that some of the bigger issues, the issues of the commons and so on, have only started getting on our radar in the last few years.”

A wave of corporate engagement on global challenges is coming as companies seek to address the threats to business and economic growth and meet stakeholder expectations for leadership on these issues. Just as important are the opportunities to enhance competitiveness by exceeding expectations to deepen relationships with talent and customers, and by developing new business models that deliver solutions to global challenges.

Action agenda

Leadership on global challenges is the new growth imperative. An action agenda must drive toward organizational transformation in response to the global challenges most relevant to your company.

Lamach of Ingersoll Rand advises: “The first thing I would tell any CEO is to find the things that align to your strategy and stick to them. I think sustainability is a lot more genuine and it carries a lot more weight when it's tied to your strategy, your business, your mission, your investments, your M&A strategy.”

1. Identify your global challenges and authentic response. Questions to ask yourself include:

- What are the most important global challenges in our operating areas? Among our stakeholders?

- How are we exacerbating global challenges, either directly or indirectly? Do we own our externalities?

- Where can we make the most impact? What are our capability gaps?

2. Align the C-suite, board and investors to a point of view and action plan on global challenges. Consider questions such as:

- What is our level of stakeholder pressure? Which stakeholders are most pressuring?

- Do the C-suite, board and investors perceive stakeholder pressure differently?

- What is the balance of opportunity and risk in action or inaction? What are the opportunities to deepen customer, employee and prospective talent relationships?

- Is there an opportunity to attract different investors?

3. Make a transformational change. You must lead on solutions; being less of a problem is no longer adequate. Making this shift requires an internal transformation that translates into external action:

- Corporate purpose must be linked to global challenges—but it can’t stop there. Purpose should lead to internal transformation so that the company’s culture and operations reflect its stance and objectives on global challenges—i.e., moving from “doing” to “being”.

- To this end, corporate strategy must integrate a short- and long-term view on the risks, opportunities and organizational response related to global challenges.

- Organizational incentives, governance and metrics must link to progress on global challenges to drive meaningful action.

- Senior leadership must “walk the talk”, authentically representing the company’s stance on global challenges.

- Select and develop metrics and narrative to express the long-term value of corporate actions to address global challenges.

The EY CEO Imperative Study shows that CEOs and the companies they lead can no longer remain on the sidelines of global challenges that threaten business growth and the economy. Nor must CEOs ask permission to be at the forefront of solutions—it’s an expectation and a new growth imperative.

Contrary to conventional wisdom, investors and boards are bigger champions of corporate engagement than CEOs. For their part, CEOs feel stakeholder pressure to act on global challenges and see more upside than risk. We have come to a tipping point of change as the CEOs of global companies, their board directors and institutional investors align on the need for corporate action and, most importantly, CEO leadership on these issues.

Summary

To enable future growth, corporations must be proactive in formulating short- and long-term plans that demonstrably work towards solving the complex global challenges we face.