Part 1

Develop a clear view of how each business drives long-term value

Divestments should be more than just one-off decisions based on short-term financial factors.

Key findings

44%of CEOs say they have difficulty explaining divestment rationale to the board and key stakeholders.

59%

of CEOs acknowledge they should provide better guidance on what they regard as core and non-core business.

Top considerations in divestment strategy:

- Have a clear view on each business’s market and underlying growth in demand, competitive advantage, alignment to the company’s vision and potential for long-term value creation from a financial, customer, people and societal standpoint.

- Pursuing divestments can help accelerate investments in technology, new products and geographies to meet customer needs and fuel new growth for RemainCo.

- Even a strong-performing business that does not fit with your corporate strategy might be tying up capital that could be better deployed on higher-impact investments. Communicating this can help rally stakeholders behind a decision to carve out or spin off a business.

Learn more about how CEOs can develop a successful divestment strategy.

Part 2

Leverage portfolio reviews to drive strategic divestment decisions

Portfolios should be reviewed at the business unit level to align with potential carve-out decisions.

Key findings

56%of global CFOs say they changed their key performance indicator (KPI) rankings in the past three years.

37%

of companies say activist activity in their sector prompted a review of strategic alternatives in the past 12 months.

Top considerations in portfolio reviews:

- Rigorously review the portfolio using a few key metrics related to how each business unit complements the enterprise strategy and contributes to total shareholder return through a combination of growth and return on invested capital.

- Take action once it’s clear a business should be divested, as the value of a business unit starved for investment can quickly erode.

- Evaluate strategic alternatives, including an asset-light approach, a staged exit or a joint venture with a strategic partner.

Learn more about how CFOs can elevate portfolio reviews to drive strategic divestment decisions.

Part 3

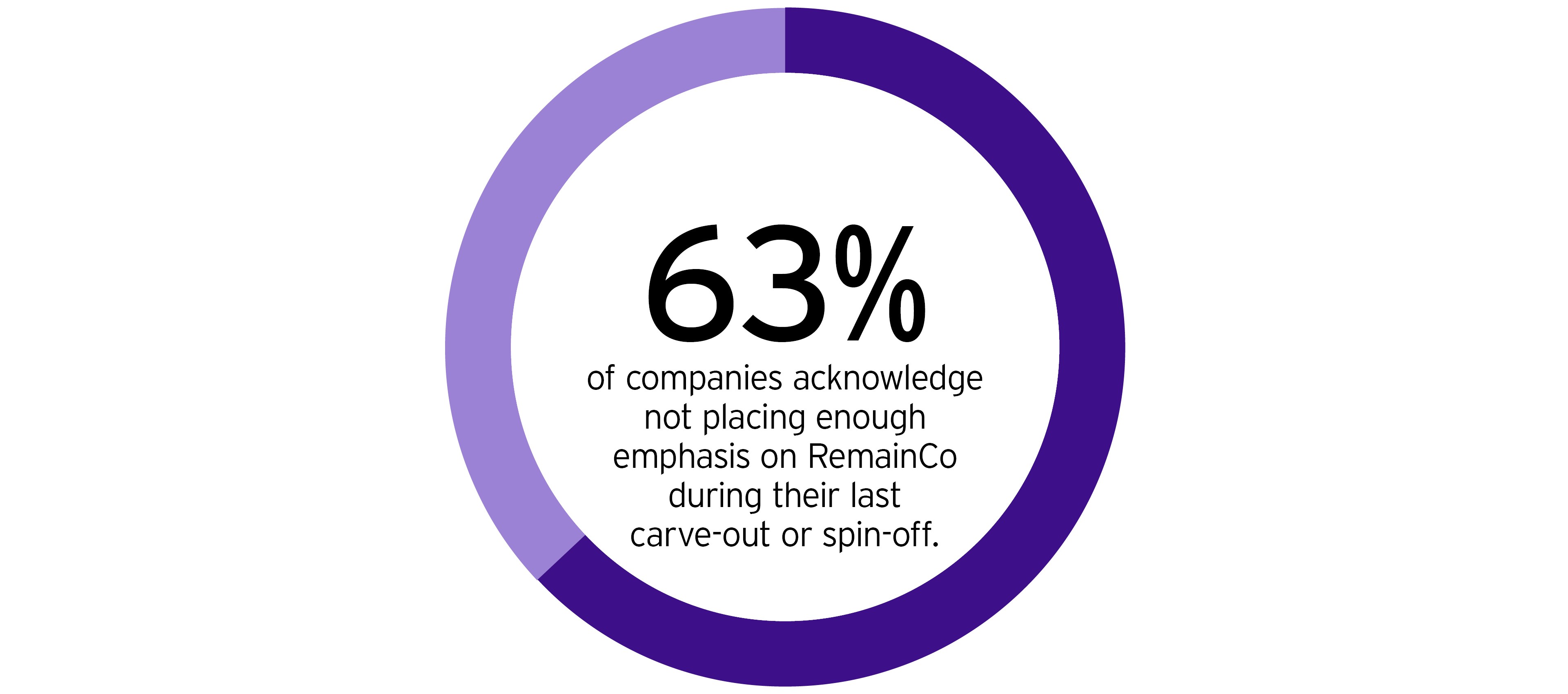

Use the divestment as an opportunity to reimagine RemainCo

A large or highly entangled divestment is an opportunity to reimagine RemainCo while the organization is primed for change.

Key findings

56%say they wish they had focused on realignment of RemainCo earlier in the divestment process.

60%

of executives failed to broaden their efforts to improve RemainCo beyond simply eliminating costs.

Top considerations in RemainCo growth opportunities:

- Divestments are a catalyst to challenge the status quo and reimagine RemainCo for the future because the organization is already mobilized for change and the operating model is being re-examined.

- Re-evaluating your purpose and vision may require a redesign of your enterprise business archetype to focus on product, market, value chain, function or a hybrid model.

- The operating model should be changed to support the new archetype. All aspects should be challenged, including processes, systems, assets, people and third-party vendors.

Learn more about why divestments should be a catalyst for CEOs to reimagine RemainCo.

Related articles

Summary

Aligning bold divestment decisions with long-term strategy can help CEOs increase stakeholder value and reimagine the remaining business. Download the 2021 EY Global Corporate Divestment Study (pdf) to learn more.