EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Related articles

Prepare now for the new era of selective globalization

Exploring scenarios for the world in five years reveals divergent paths for geopolitics, economic policies and company strategies. Learn more.

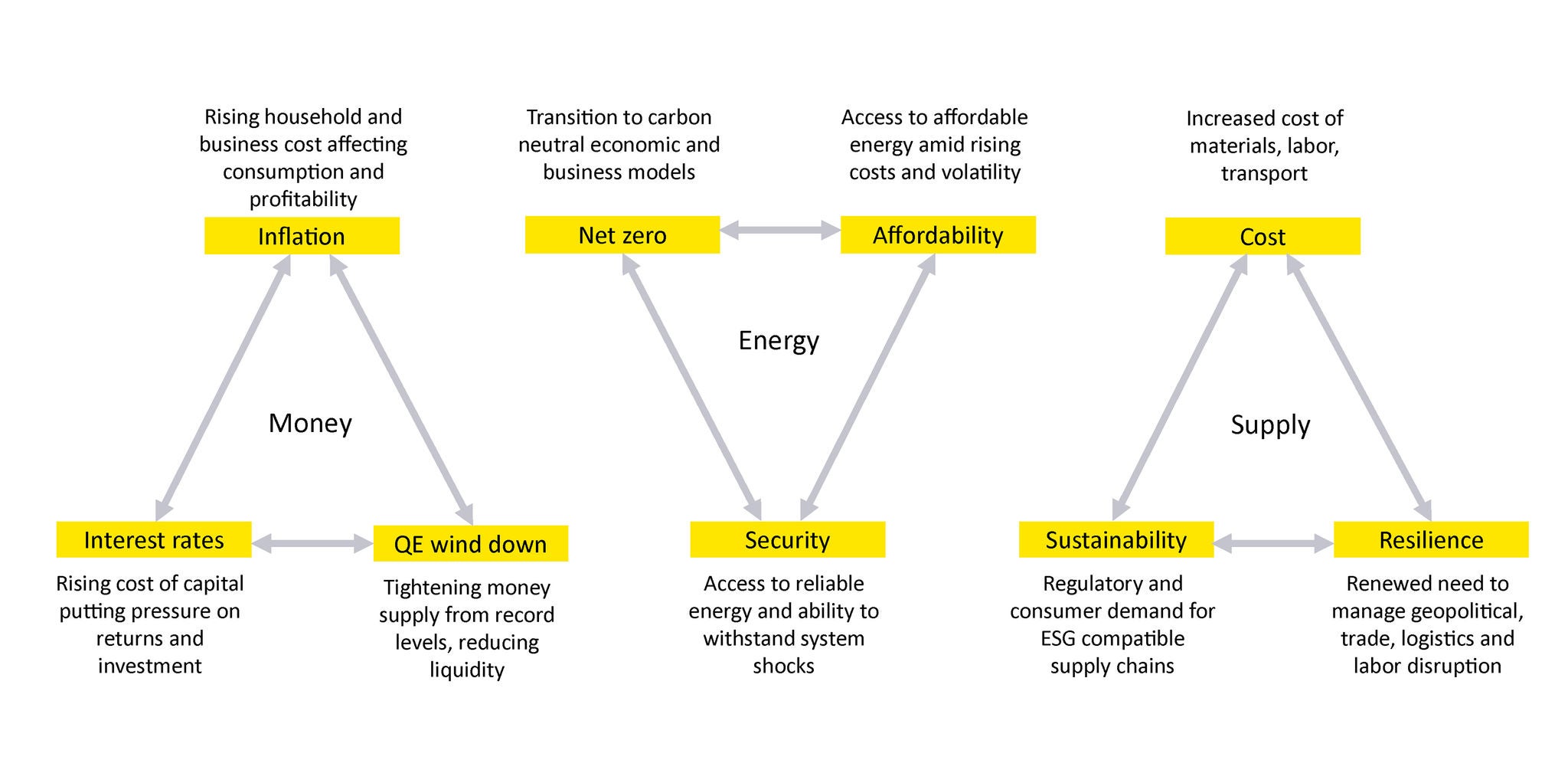

Adding to the urgency is that all elements are impacted by cost, affordability and inflation. Given continued uncertainty, there are four key areas that FIs should be reviewing and updating:

- Strategy: e.g., if valuation multiples fall and/or potential targets become distressed, where would we look to acquire scale or capabilities?

- Propositions: e.g., should we launch new products and services to cater for recession-specific demands?

- Operating model: e.g., are we getting an adequate return on all current investments and projects?

- People: e.g., how will our workforce support customers though a recession? How do we provide an empathetic front-line experience?

2. Prepare for the next: a future geopolitical framework

The geopolitical orthodoxy is likely to change dramatically. Institutions need to plan for the impact on their business and operating environment, such as on supply chains. To help plan for this, EY teams have developed four potential scenarios:

- Globalization lite: akin to the pre-COVID-19 pandemic status quo, a reduction in international tensions, dynamic GDP and low inflation.

- Friends first: supply chains, trade, and investment favoring “friendly” countries, including a gradual divergence of “the West” and China, coupled with still positive GDP growth and higher but bearable inflation.

- Cold War II scenario: a sharp economic and financial decoupling between China and the West, with intensified confrontation. Economic growth is low and inflation is high.

- Self-reliance reigns: similar to the 1930s, a retreat from globalization and international cooperation, major economies turning inward, accompanied by weak economic conditions and high inflation.

Each scenario impacts economic growth potential and inflation, and leads to different levels of access to markets, investors and clients. It could also undermine the viability of some cross-border businesses. Ultimately, it could make current business footprints and operating models significantly more costly to sustain.

In response to these risks, management teams and boards need to act to ensure:

- Resilience by de-risking their current business and operating model.

- Agility by ensuring they will have the flexibility to adapt in a timely manner and can continue enhancing their capabilities.

- Growth by adapting business portfolios to focus on areas where they have the greatest advantage, and seizing opportunities to scale or specialize.