Chapter 1

FDI in Europe in 2022

External shocks slowed down investment.

The complexity of the macroeconomic environment has knocked back FDI growth across Europe.

If Europe is to capture the pent-up demand and deferred plans, it will be essential to build a compelling business case for global investors in the context of competition from the US and China.

Throughout 2022, businesses around the world announced 5,962 greenfield and expansion projects in 44 European countries. That is a year-on-year increase of just 1%, compared with 5% in 2021. The number of announced projects remains 7% lower than in 2019, immediately before the pandemic, and 10% below the peak of 2017.

This is not entirely surprising considering a backdrop of the wide-ranging consequences of the war in Ukraine affecting Europe, including weak economic growth, supply chain disruption, rising inflation and soaring energy costs. Yet, given hopes that 2022 would be the year when pent-up demand would boost investment, it is still disappointing.

Drop in FDI-created employment

Alongside the headline number of investment projects, the Europe Attractiveness Survey monitors another crucial dimension of FDI: the number of jobs that it supports.

On this measure, the impact of the geopolitical, energy and economic crises facing Europe during 2022 is clear: The announced jobs created by FDI projects dropped 16%. The fall is indicative of investors' caution in the face of uncertainty across Europe's markets — and, for some, the need for workforce rationalization. The countries that saw the highest levels of job creation were those that combine wage competitiveness with good availability of skills, including Serbia, Spain, Hungary and Romania.

Our survey finds that 29% of businesses have postponed planned investments as a direct result of the energy crisis. Some of those planned investments may be delivered during 2023 but, with 17% saying they relocated production outside Europe, it seems likely that at least some potential investment has gone elsewhere.

The FDI picture varies considerably across Europe

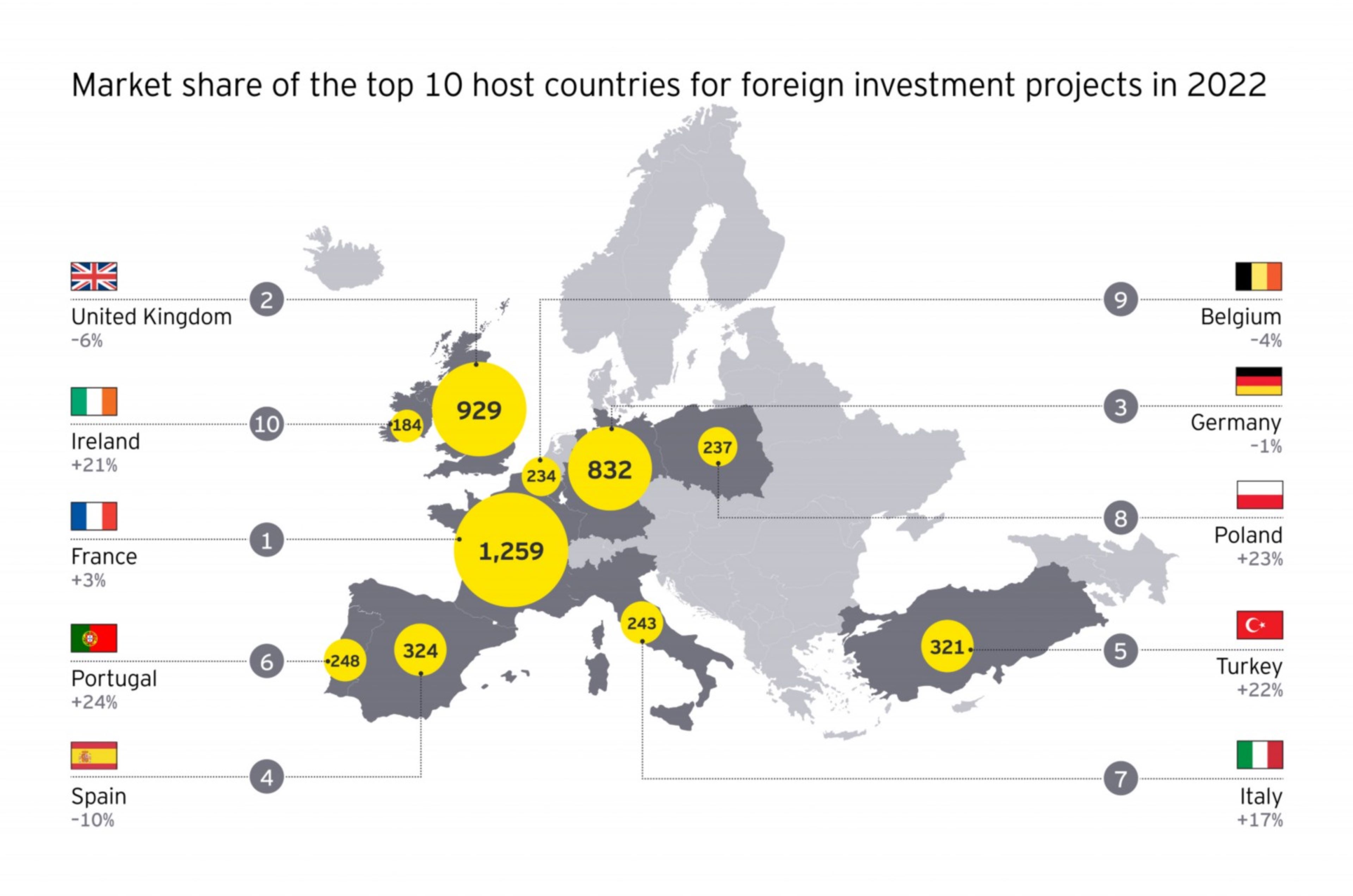

France, the UK and Germany continue to attract the bulk of FDI flows, accounting for 50% of total projects. But in 2022, their performance was muted: FDI projects edged up 3% in France, but were down 1% in Germany and 6% in the UK.

The groundwork for France’s performance was laid many years ago by President Macron’s series of business-friendly reforms, from which it is now reaping the benefits. The UK is impacted by concerns about trade restrictions and labor shortages, which are in part caused by Brexit. Despite a robust German industry, foreign investors are deterred by its tight labor pool and high-carbon energy mix.

However, in France, FDI creates fewer jobs in total and on average than in the UK because of higher wage costs and more restrictive labor regulations.

Other FDI destinations in Western Europe had contrasting fortunes. For instance, companies have reduced the pace of their investments in Belgium and Spain, countries which had already rebounded strongly in 2021 after the worst of the COVID-19 crisis. Meanwhile, Ireland, among others, recorded a substantial increase, partly reflecting its agile, pro-business agenda and appeal to large US corporates.

One of the most striking features of the 2022 data is the growth of FDI projects in several Southern, Central and Eastern European states, including Italy (+17% vs. 2021), Poland (+23%), Portugal (+24%), Romania (+86%) and Turkey (+22%). This is at least in part due to the reconfiguration of global supply chains and an inclination toward cost-competitive European locations for manufacturing and back-office operations.

Digital and technology sectors are attracting FDI

Reflecting the digitalization of our economies and the ongoing shift to Industry 4.0, the biggest sector for FDI projects in 2022 was software and IT services, up 8% — double the rate of growth in 2021 — and accounting for 20% of total projects. It was followed by business services and professional services, up 27%. However, in all other sectors, there were fewer back-office, contact center and headquarters projects, reflecting the reconfiguration of work in the hybrid era.

2022 was a mixed year for advanced manufacturing and mobility production in Europe. While new factories or factory expansions accounted for 29% of FDI, that number was down 1%, affected brutally by rising energy costs, supply difficulties and the general slowdown of the European economy.

There were some eye-catching announcements by businesses over the last year. Significant future-oriented industrial investments include Volkswagen and SEAT’s €10 billion plans for an electric vehicle battery gigafactory in Spain, and Merck’s €440 million investment in new life sciences facilities in Ireland. Services projects included Dutch company Avit’s new center in Portugal and Bosch’s engineering center expansion in Romania. New R&D centers were announced by US firm Intel in France and by Chinese automaker GAC Group in Italy, while US data specialist Immuta and Singaporean state-owned investment company Temasek respectively announced new headquarters in London and Paris.

Chapter 2

Will investment increase in the year ahead?

A large number of foreign businesses say they plan to invest in Europe.

Many of the factors that influenced the disappointing trajectory of FDI in Europe in 2022 continue to shape the environment. Geopolitical tensions have been rising worldwide, such as between the US and China. Discussions about the new era of globalization have become commonplace. The US IRA has been grabbing the attention of many businesses and reshaping the transatlantic competition for inward investment.

But there are other reasons to be optimistic about the future for FDI in Europe:

- The cumulative potential of pent-up demand: The expected post-COVID-19 bounceback may not be lost — it might just be deferred, delayed by the war in Ukraine and its wider economic effects.

- Supply chain redesign: For many businesses, “nearshoring” or “friendshoring” remains a work in progress, with 52% of companies creating more regionally based supply models, 47% nearshoring closer to customers and 46% reshoring activity back to their domestic markets. Sourcing or building production and logistics capacity takes time.

- Transformation: Businesses are deeply engaged in the transformative challenges confronting Europe, including digital transformation and the transition to net zero, which will require bold strategies and ambitious investments.

It is encouraging that an all-time high 67% of the businesses we surveyed have “plans to establish or expand operations in Europe over the next year,” a metric that has rebounded sharply since the pandemic and is up from 53% a year ago.

These plans for activity appear to be shared across many industries. The prospect of new investments by chemical and pharmaceutical companies will contribute to increasing European independence in these strategic sectors, while the service industry seems to be actively searching for a new footprint, especially in Southern and Eastern Europe.

However, sentiment is weaker among companies headquartered outside Europe: Only 53% report plans to expand or establish operations, compared with 77% of European-headquartered executives. While 60% of FDI projects in 2022 originated with European-based companies, that gap shows that Europe’s political and business narrative needs to be strengthened, and its call for a European “industrial sovereignty” could be clarified among overseas investors.

Another differentiator is company size: Fewer SMEs say they have plans to invest (56%) than larger firms (79%). Governments and multinationals must support their subcontractors and business partners, which employ about 100 million people, account for more than half of Europe's GDP and play a key role in creating value across all sectors.

R&D is a top priority for inward investment

Businesses’ perceptions of the three-year outlook for Europe are relatively stable, despite recent challenges. Sixty-seven percent expect Europe’s attractiveness to increase over the period, slightly more than in 2022 and 2021.

Encouragingly, 64% of executives expect to increase their European footprint in R&D over the next three years, while the strong dynamics of the commercial and business services activities reflect Europe’s economic power. The implications of the focus on R&D will need to be considered carefully, however. Developing technology tends to create a small number of high-value jobs, while building technology delivers the jobs. As recent geopolitical events have shown, there are strategic advantages in being able to do both, although financial considerations typically drive manufacturing to lower-cost countries.

In that regard, it is potentially concerning that just 33% of respondents plan to increase their investment in manufacturing. To prevent Europe from losing out on the global reshaping of supply chains, and ensure it builds the industrial capacity needed to reach net zero, this proportion surely needs to be higher.

Chapter 3

Will investors commit to transformative projects?

The challenges ahead demand bold strategies and ambitious investment.

Europe is at a critical juncture in its race for cross-border investment. If planned activity translates into real investments, it will boost confidence in the continent’s economic potential and have lasting significance for prosperity.

In the drive for greater inward investment, the challenge is to strengthen Europe’s appeal and sustain its standing as a leading economic force.

For EU Member States, an important part of the recovery equation could be the EU Resilience and Recovery program. Designed to deliver a post-pandemic economic lift via support for digital, renewables and skills development, this funding — along with the Green Deal Industrial Plan — could materially change how Europe’s economy evolves. Its impact, however, will be influenced by developments beyond Europe, including the effects of the IRA in attracting investors to the US.

Europe still has significant advantages. In a world defined by uncertainty, many businesses are attracted to robust economies and large, resilient markets. With more than 500 million consumers and more than 20 million companies, Europe remains a formidable economic force. Now, it has an opportunity to capitalize on its strengths while attracting the investment that will fuel the industries of the future. Our findings clearly show that foreign investors are already involved in this strategic process, with the bulk of FDI allocated to the digital economy and advanced manufacturing.

The challenges ahead

Though our 2023 Europe Attractiveness Survey shows that foreign investment into Europe leveled off in 2022, we remain concerned about Europe’s weak manufacturing performance, which was flat after a strong comeback in 2021, despite the needs of companies embarking on supply chain reconfigurations.

Hanne Jesca Bax, EY EMEIA Markets & Accounts Leader, says: “In the drive for greater inward investment, the challenge is to strengthen Europe’s appeal and sustain its standing as a leading economic force. Meeting that challenge will be crucial if Europe is to seize the opportunities that lie ahead.”

In the second stage of the 22nd Attractiveness Survey report, we unpack investor thinking on future investment in Europe. We will also outline the policies needed to drive inward investment that will be critical for Europe's digital and green transformations.

Related articles

Summary

Though the recent geopolitical and macroeconomic uncertainty has disrupted investment in Europe, the outlook for 2023 is more optimistic. Europe’s policymakers and the business community should make the most of that opportunity in 2023 and beyond.