Historically, two- or three-wheeled vehicles have been the predominant mode of transport across the ASEAN-6. Electrification of this segment has been the fastest as electric cycles, scooters and motorcycles are relatively affordable and less reliant on specialist charging infrastructure whose availability varies considerably within the region.

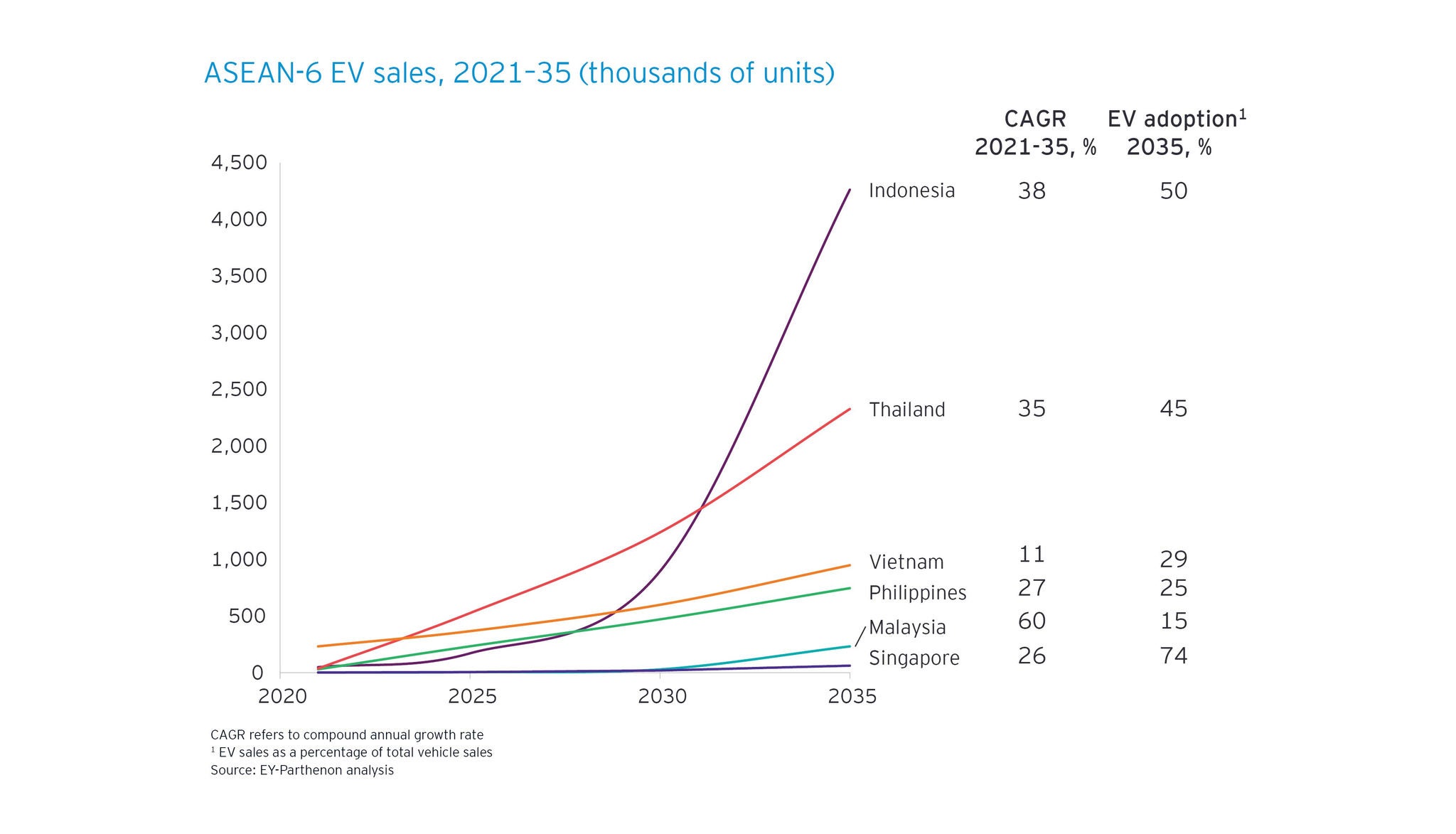

As the affluence of ASEAN-6 consumers grows, sales of electric passenger cars may begin to challenge the dominance of two-wheelers. It is estimated that cars will account for about 80% of ASEAN-6 EV sales value by 2035. An increasing push for fleet electrification by regulators is also expected to drive EV sales growth of taxis, buses and other commercial vehicles across Southeast Asia.

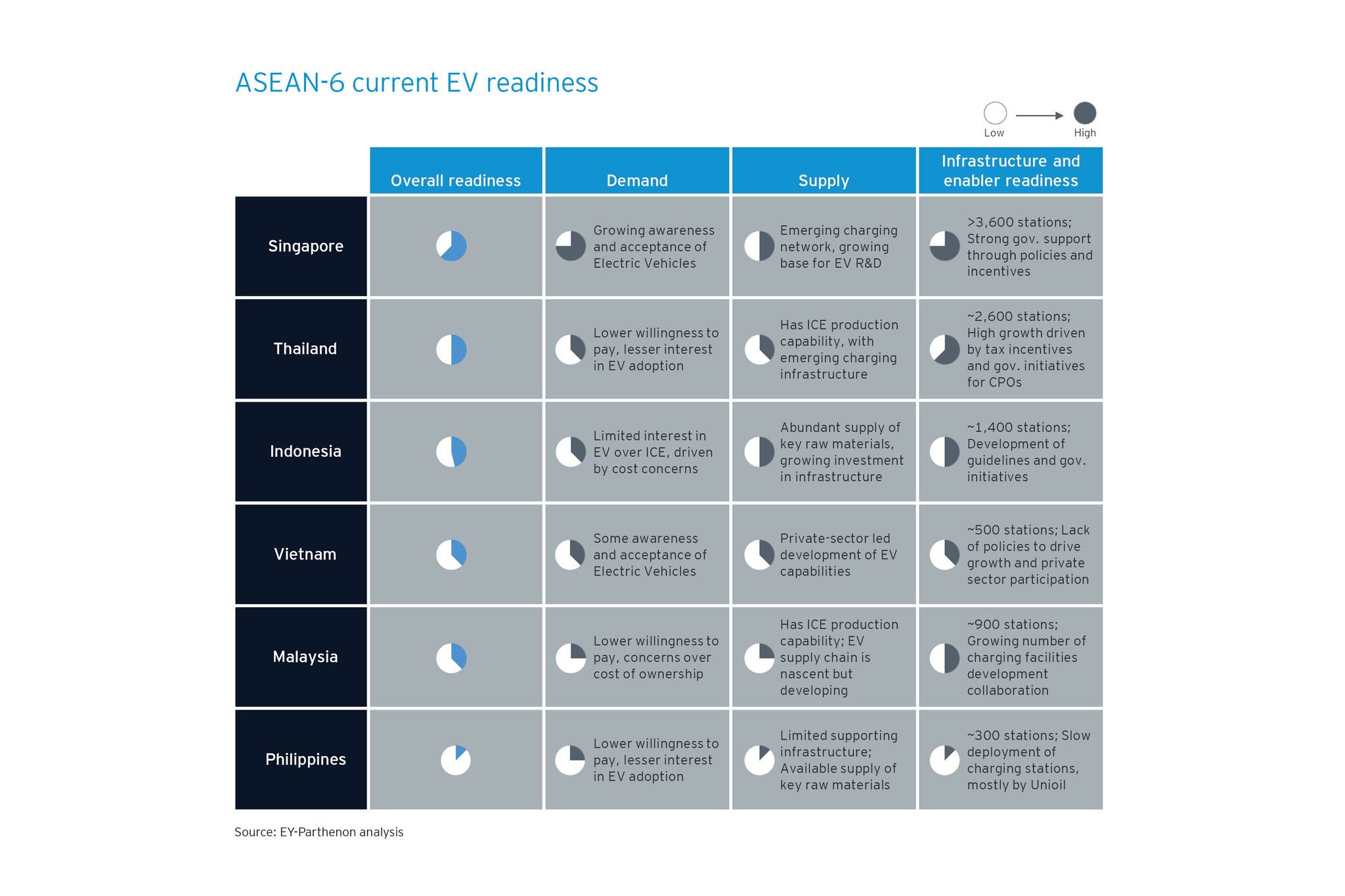

Varying EV readiness and market opportunities across ASEAN-6

ASEAN-6 countries differ in their “EV readiness” or preparedness in making the EV transition and meeting national goals in this process. Market opportunities will therefore vary across the region and businesses should consider demand-side, supply-side, and infrastructure and enabling factors that impact EV readiness. A look at these factors reveals that cost, availability of charging infrastructure and EV supply chain readiness are key ASEAN-6 challenges in EV adoption.

Demand-side factors have impacted consumer awareness and acceptance of EVs across the ASEAN-6 to various extents. They include financial and tax incentives for end users, such as rebates or subsidies at the point of sale to enhance the appeal and affordability of EVs for consumers. Preferential road access for EV users can make it more convenient to own and operate EVs. Such access may include financial and nonfinancial incentives, such as discounted or free parking, toll road discounts or exemptions, and dedicated parking spaces for EVs.

Supply-side factors aim to boost production capacity. They include financial and tax incentives for EV manufacturers (such as grants or loans to stimulate investments in the EV value chain), tax exemptions or adjustments to boost local production as well as support for R&D and training. Governments can also reduce barriers to entry, such as relaxing foreign ownership restrictions to encourage manufacturers and operators to enter the market.

Infrastructure and enabling factors include government support for the capital or operating costs of building out charging infrastructure and regulatory measures, such as limits and penalties to drive the replacement of internal combustion engine vehicles with EVs.

By considering these factors, companies will better understand the overall EV readiness in each ASEAN-6 country that impacts local opportunities.