EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Since the first edition of this survey was published in 2017, Greece has been making progress in its efforts to becoming an international freight center, leveraging its strategic geographical location, a recovering economy and a friendlier investment environment.

However, this progress has been driven primarily by developments in the shipping and the maritime logistics industries, as well as in road infrastructure. More work will be needed with regard to rail and air freight transport, hinterland logistics, the third-party logistics market (3PL), customs services and, above all, the interconnectivity of these distinct nodes of the Greek transport and logistics industry (T&L).

The shipping and maritime logistics industry is steadily on the rise

Shipping is, undoubtedly, one of the strongest cards of the Greek economy, contributing around €11b – or 6.6% of the country’s GDP in 2019. The Greek-owned merchant fleet is the largest in the world, accounting for 15.6% of the global fleet in deadweight tonnage (DWT), while vessels controlled by Greeks carry 21% of global seaborne trade.

The strong presence of Greek shipping companies, and the leading position of the Greek-owned fleet in the global maritime community, have been the major drivers behind the development of the Greek shipping cluster, as one of the most significant and competitive maritime centers in the world. The majority of Greek shipowners have a ship management office or operate their business from Greece and, in spite of the growing international competition – mainly from emerging maritime centers in Asia – they still consider Greece as an attractive location for establishing their ship management offices.

Piraeus and the broader Attica region have been at the epicenter of this growth, attracting important shipping activities, including ship management companies, shipyards and shipyard subcontractors, port operators, freight forwarders, and third-party logistics providers (3PLPs).

Moreover, at a time when trade flows between Asia and Europe continue to grow year after year, Piraeus offers a highly competitive end-to-end alternative connection to the ports of the Far East, compared to North European ports, in terms of transport duration, frequency of service and cost, allowing the country to develop into a major maritime interface for Europe.

Piraeus has been one of the most rapidly growing ports in Europe and was the largest commercial port in the Mediterranean, and the fourth largest among all European ports in terms of total container throughput in 2019 and 2020, despite the pandemic’s adverse effects on global trade. The vision of turning Piraeus into the south gate of Europe is backed by a series of planned investments within the next years, aiming at improving infrastructure and achieving better integration with the railway and road networks, transforming the port into a state-of-the-art logistics hub.

Piraeus was the largest commercial port in the Mediterranean and the fourth largest port in Europe in terms of TEUs, for two consecutive years (2019 & 2020)

Significant investments are underway for the port of Thessaloniki, the primary entry port for Northern Greece and an international logistics hub for all Balkan countries, following its privatization in 2018.

The port of Thessaloniki is part of the Trans-European Transport Network (TEN-T) and is situated in proximity to the Trans Adriatic Pipeline (TAP). The master plan of the port, prepared in 2017 and approved by the European Commission, sets clear short- and medium-term priorities for the development and upgrade of Thessaloniki to a middle category European port; the main developmental actions aim at raising the capacity of the cargo terminals, as well as upgrading the sea cruise facilities and transit services capabilities.

Thessaloniki is an important node of the Trans-European Transport Network

In total, more than 25 important commercial seaports are currently operating in Greece, five of which have been identified by the EU as ports of strategic interest and key maritime interfaces of the Orient / East-Med (OEM) corridor.

More than 25 important commercial seaports currently operate in Greece – five of them have been identified by the EU as ports of strategic interest

Further privatizations or concession agreements involving some of the main regional ports are expected to lead to additional investments and a strengthening of their competitiveness and international status.

Meanwhile, similar developments beyond the ports themselves are shaping a more competitive and reliable hinterland for Piraeus and the other important Greek ports. The privatization of the Greek railway operator in 2019, is expected to lead to a faster development of the Greek railway network system and the addition of high- and ultra-highspeed trains to the lines, as well as an upgrade of the Athens–Patras route, which will make land connections with ferries to and from Italy, possible.

The Greek third-party logistics market still faces many challenges

The 3PL market in Greece faced significant challenges as a direct result of the severe downturn of the Greek economy from 2009 onward. Though it had been rebounding since 2014, the market has yet to completely recover to numbers before the financial crisis, with the turnover of the Greek 3PLPs recording a compound annual growth rate (CAGR) of -2.06% between 2008 to 2019 (but with a +3.55% CAGR since 2014).

The contraction of consumption and production, along with the slow growth of international trade, put a lot of pressure on Greek manufacturers and traders to lower their costs, without reducing performance and service levels. However, they have also become more positive toward outsourcing their basic logistics operations, allowing reliable 3PLPs, which have invested in service quality and innovation, to expand their market share and improve their performance. The Greek 3PL market grew by 4.6% in 2019 and is expected to grow by an annual average rate of 2.8% in the medium term (up to 2023).

Greek 3PL companies provide a full range of supply chain services, with a significant part of their income coming from warehousing and distribution activities, as well as from the organization and management of road transportation. The sector mostly comprises of medium- and small-sized companies, that operate in a highly competitive environment.

The Thriasio Logistics Center headlines a series of major logistics projects in the country

The most important logistics markets have developed around Athens and Thessaloniki and are closely linked to the country’s main international maritime interfaces: the ports of Piraeus and Thessaloniki.

The construction of the new intermodal freight and logistics park in the Thriasio Pedio plain, near Piraeus, will significantly enhance the port’s hinterland and will also facilitate the potential development of new operations and added-value logistics services. When fully developed, Thriasio will be one of the largest dry ports in Southeast Europe.

In addition, the logistics center to be built at Gonos, a former military camp in Thessaloniki – currently at the pre-feasibility stage – is expected to provide additional storing capacity to the port’s terminal and greatly enhance its potential.

The growth of the supply chain industry has also triggered the development of supply chain business parks, with the first two major investments implemented at the Oinofyta industrial zone and at Igoumenitsa in Western Greece.

A comprehensive and modern road network leads the growth of road freight transport

Road transport in Greece suffered a dramatic reduction between 2009 and 2015 – however, the international freight component of the road freight market has been growing steadily since its record low in 2011, boosted by the expanding international trade through Greek ports – primarily Piraeus. The further increase of international trade volumes transshipped via Greece and the recovery of the Greek economy, can be expected to further boost road transport activity in the coming years.

Greece has one of the most developed road networks in Southeast Europe, consisting of more than 2,145 km of highways and motorways. In terms of tonnes of commercial road transport, Greece ranked 11th among EU countries in 2019, with 354m tonnes, compared to Germany’s 3.2b tonnes.

In 2018, the Greek road transportation industry accounted for 30% of enterprises in the transportation and storage services sector. The industry consists primarily of small companies and owner-driver haulers, that provide low-margin traction services to medium or large national and panEuropean logistics providers. The hire and reward transportation sector had a share of 26% of the total road freight transportation activities in 2019 (in terms of tonnes-kilometer), significantly below the EU average. The market is characterized by low margins, largely due to its high fragmentation and reliance on small providers (1.5 trucks per provider, on average).

Increased international air freight transport through the Greek airports, presents significant opportunities for the country

Greece has a total of 45 airports – of them, 15 are international, 26 domestic and four are municipal. The “Eleftherios Venizelos” Athens International Airport (AIA) is, by far, the predominant Greek airport, in terms of both freight volumes and passenger traffic, emerging as an important passenger and logistics hub for Southeast Europe.

The 40-year concession of 14 regional airports starting in 2015, has led to major investments for their renovation and further development, a process completed in January 2021. More than 30m passengers passed through the 14 airports in 2019, the last year before the collapse of the tourism industry worldwide, which led to a 69.3% decrease in passenger traffic in 2020.

Air freight transport in Greece has a share of ca. 35% of international trade in terms of value, but only 1% in terms of weight. However, air cargo transportation is rapidly expanding, with international intra-EU and extra-EU transport in Greece growing by 10.1% and 5.9% respectively, between 2017 and 2018. This may lead to significant opportunities for Greece to emerge as Southeast Europe’s gateway for air cargo traffic, providing a real alternative to congested hubs worldwide.

In 2019, air freight carried through Greek airports reached the pre-crisis volume of 2008, after suffering a 44% drop during the Greek financial crisis. International air freight transport accounts for around 90% of the total, with extra-EU traffic surpassing intra-EU for the first time in 2018, and outbound freight transport gradually increasing from 40% in 2008 to 57% in 2019. More than 88.3% of the total air freight in 2019 passed through the “Eleftherios Venizelos” Athens International Airport.

Οutbound freight transport increased from 40% in 2008 to 57% in 2019

A much improved legal and regulatory logistics framework has borne fruits, but there is still road ahead to catch up with the competition

In recent years, the T&L industry has worked closely with the public sector to develop a long-lasting transformational plan to support the sustainable development of the logistics market and international trade. This resulted in a comprehensive legislation reform in 2014, with a new law providing a holistic regulatory framework, facilitating investments and reducing red tape in logistics installations permits.

Partly as a result, Greece has been gradually improving its international ranking with regards to trade facilitation, trade competitiveness and logistics performance. However, in most of these indices, Greece continues to lag behind its main trading partners and competitors.

Greece’s five Free Trade Zones, as well as customs warehouses operated by 3PL providers and freight forwarders, provide clear benefits to importers and shippers, in terms of improved cash-flow and greater flexibility and transparency. Meanwhile, an increasing number of 3PLs, airlines, and shipping companies in Greece, have been certified as Authorized Economic Operators (AEOs), thus enjoying benefits throughout the EU, easier access to simplified customs procedures and a more favorable position to comply with the new security requirements.

Conclusions and recommendations

In order to increase its attractiveness as an international freight center or a leading regional logistics hub, Greece will need to focus on four priorities:

- Improve connectivity with global trade lanes and other hubs, primarily, but not exclusively, by leveraging the Greek shipping ecosystem.

- Improving its port and logistics infrastructure, with investments in logistics parks needed to match the progress made in port infrastructure.

- Strengthening its financial ecosystem to provide top-level financial and business services.

- Upgrading technology, innovation and human capital, to allow the development of new business models and enable the required transformation of supply chains.

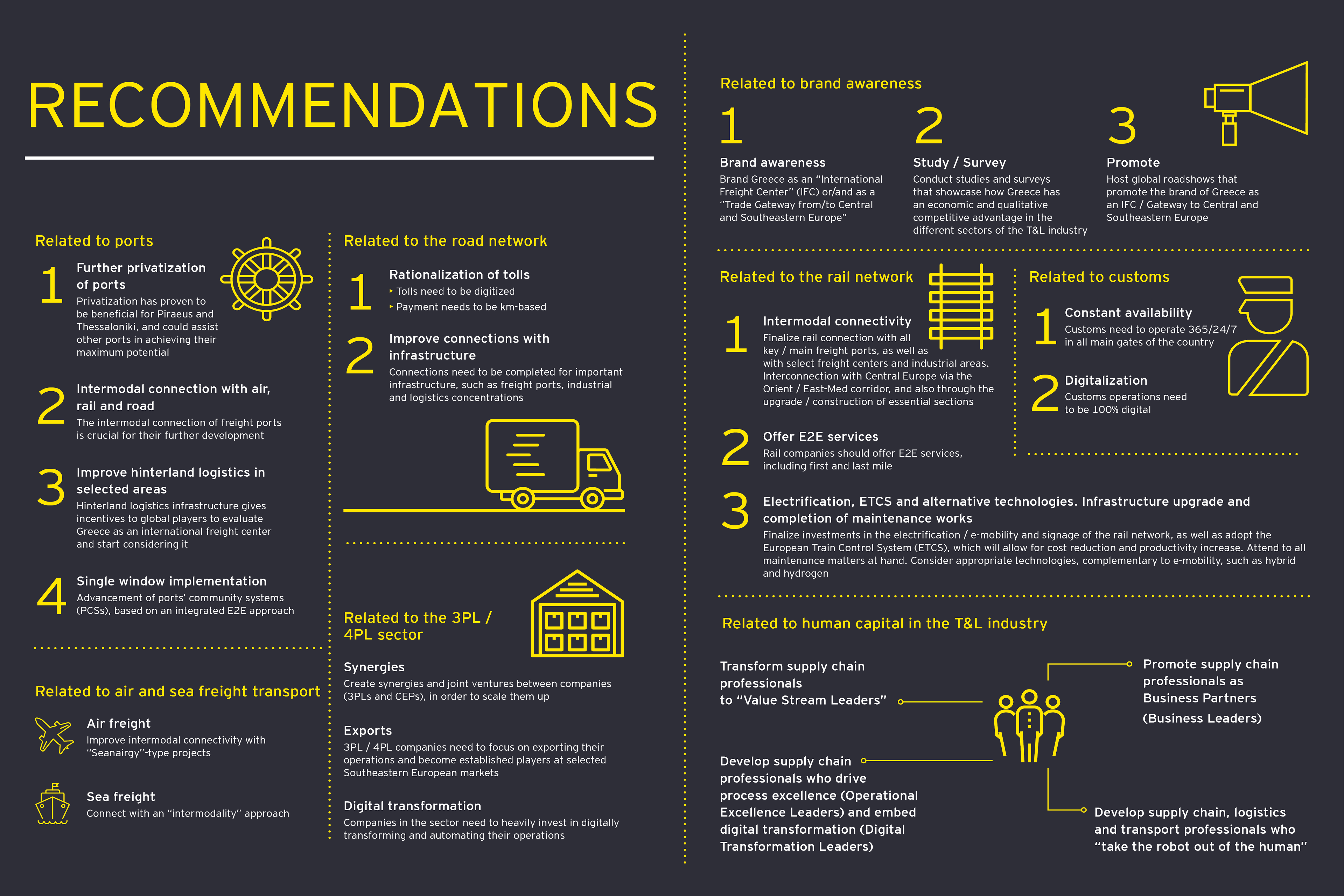

To materialize on the above, the EY report presents a series of area-specific recommended actions, with regards to:

- The ports

- The road network

- The 3PL / 4PL sector

- Air and sea freight transport

- The rail network

- The customs

- The human capital in the T&L industry

- Brand awareness

Download the full survey

Summary

Greece, leveraging its strategic geographical location, along with increasing investment in upgrading its transportation and logistics infrastructure, has gone a long way toward developing its position as a global logistics hub, over the past years. However, there is still room for improvement for the country to achieve “excellence”. The second edition of EY’s report, Greece: International Freight Center, examines the role of Greece as a competitive intermodal corridor for the European seaborne trade with Asia.