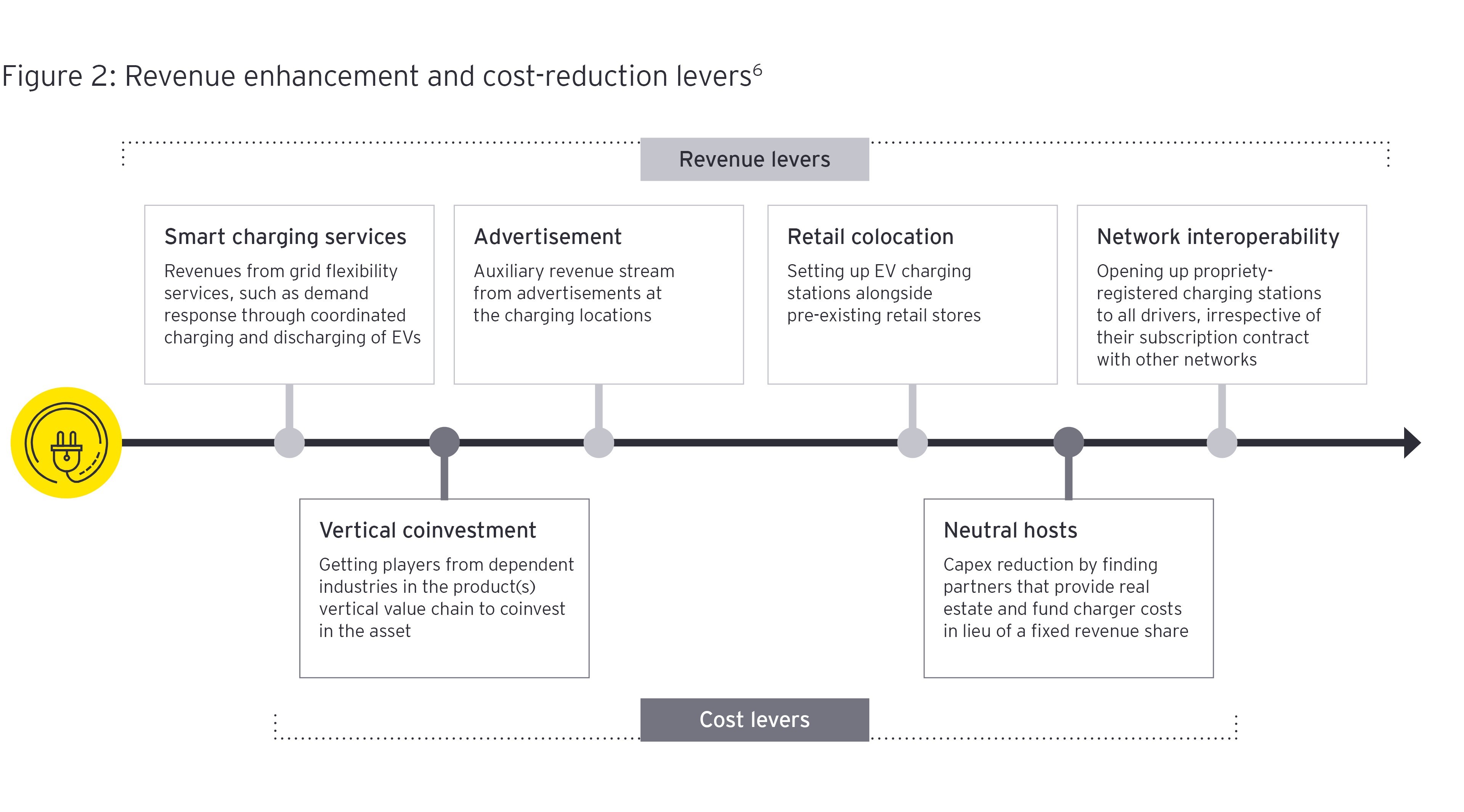

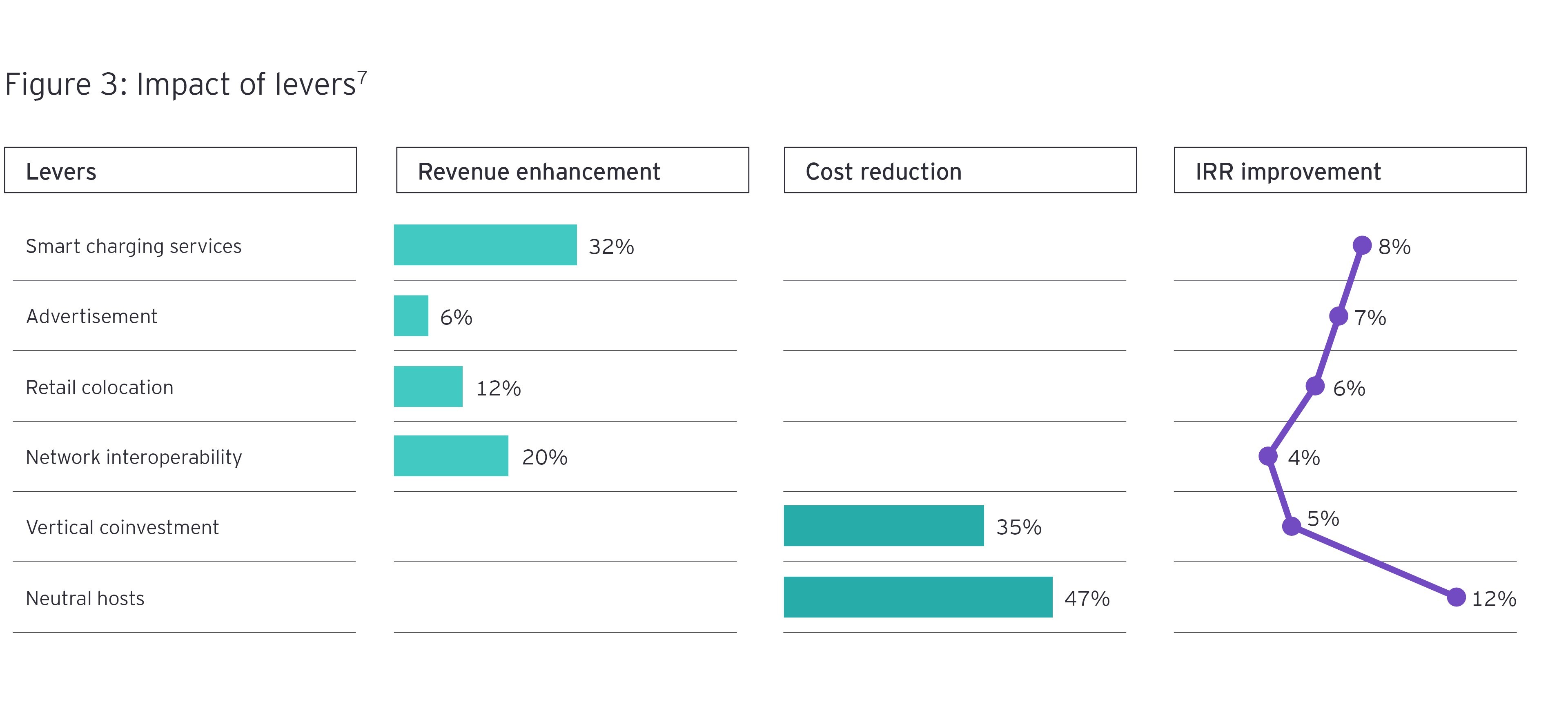

It’s critical to understand the levers that can increase revenues and reduce costs to make the business case more appealing to mainstream debt investors.

Hurdle? What hurdle?

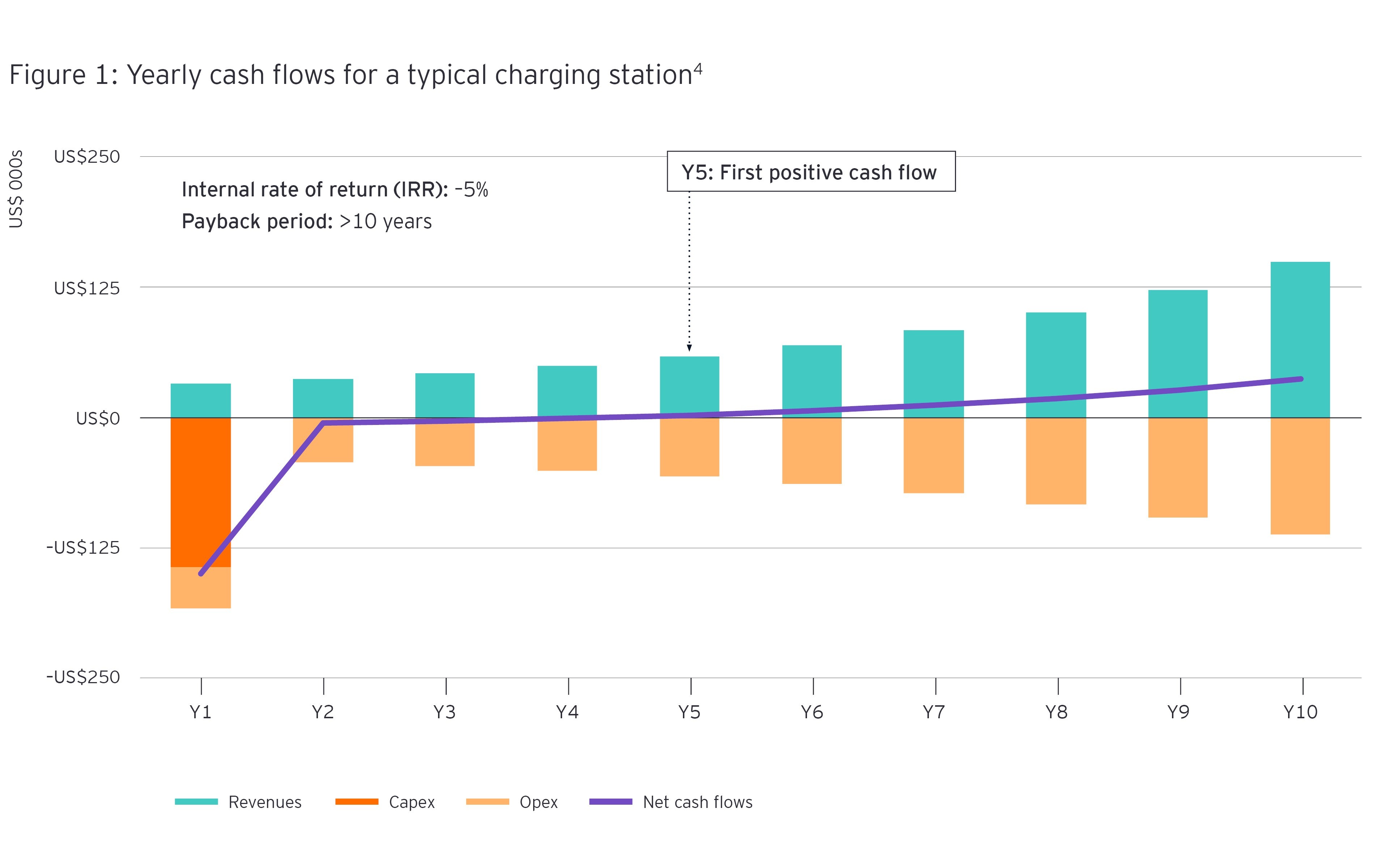

Too often, infrastructure is cited as the hurdle to accelerated EV rollout. However, probing the scarcity of debt financing for public infrastructure investment and implementing work-around solutions can lower risk and make the business case work for mainstream investors.

Changing the business case will change the outcome. Only then will US$13b of funding be forthcoming, accelerating the scale-up in public charging infrastructure, giving drivers confidence in EV range and, ultimately, contributing to a reduction in carbon emissions from transport.

Summary

It’s not a “chicken and egg” situation anymore. Most people acknowledge that without proper charging infrastructure, EVs won’t take off in the way they need to. The challenge is that the business case for investment does not stack up. It takes too long to achieve a return, and the risks are considered too high. Understanding how to reposition the business case, and which levers to pull, can unlock investment channels to accelerate infrastructure rollout. And that’s a trigger in the global journey toward decarbonization.