Chapter 1

Biopharma deals: volume over value

Biopharmas showed a preference for late-stage assets in priority therapy areas as high-target valuations increased dealmaking risks.

Biopharmas proved resilient in 2020, navigating the COVID-19 turbulence by pivoting quickly to developing therapies and vaccines to remedy the pandemic. “The entire industry is experiencing that a new level of speed is possible if you really want to get something done. There is an enhanced awareness of threats to mankind and society, and of the need for biotech … to meet significant future challenges,” says Stefan Oschmann, CEO, Merck KGaA headquartered in Darmstadt, Germany.

Our focus was and is to be an active player in providing solutions to the COVID-19 pandemic across all our businesses.

That ongoing resilience helped the biopharma industry deliver better-than-expected overall performance. In the early days of the pandemic, many Wall Street analysts warned that the wholesale shift to remote work would stymie research and endanger clinical development timelines. There were also concerns that drugs, especially newly launched therapies, would see major revenue slowdowns as patients postponed doctors’ visits unless necessary.

However, while there have been delays in certain clinical trials, and some physician-administered products are struggling, the industry has, at least on paper, weathered the pandemic much better than was originally predicted. Robust supply chains and quick pivots to COVID-19-linked products, especially vaccines, have helped big biopharmas such as Pfizer and AstraZeneca limit the near-term sales impact caused by the virus. As a result, growth gaps, defined as the difference between companies’ revenue growth and the overall industry’s sales expansion, shrank in 2020 from US$60 billion to less than US$35 billion.

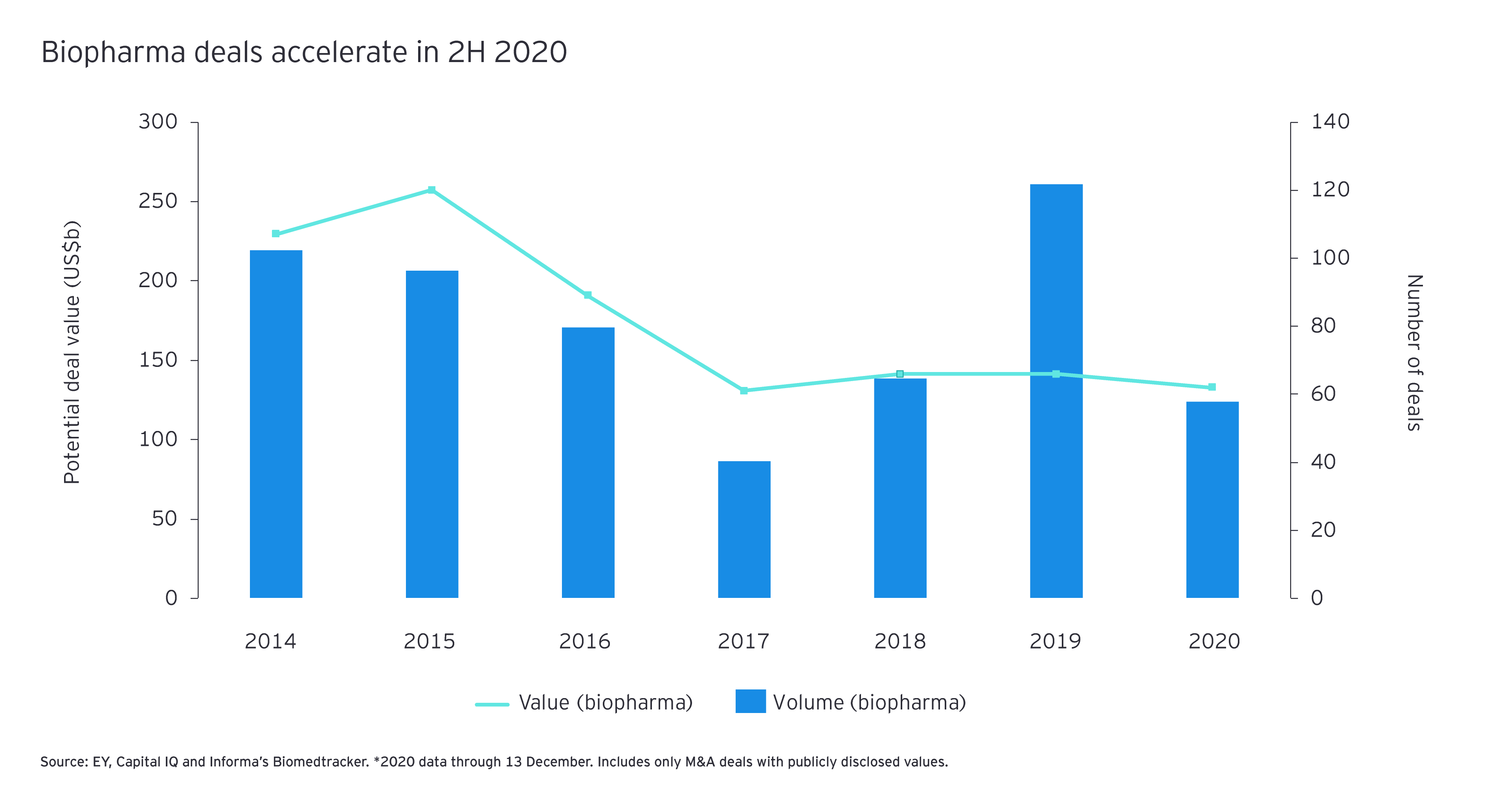

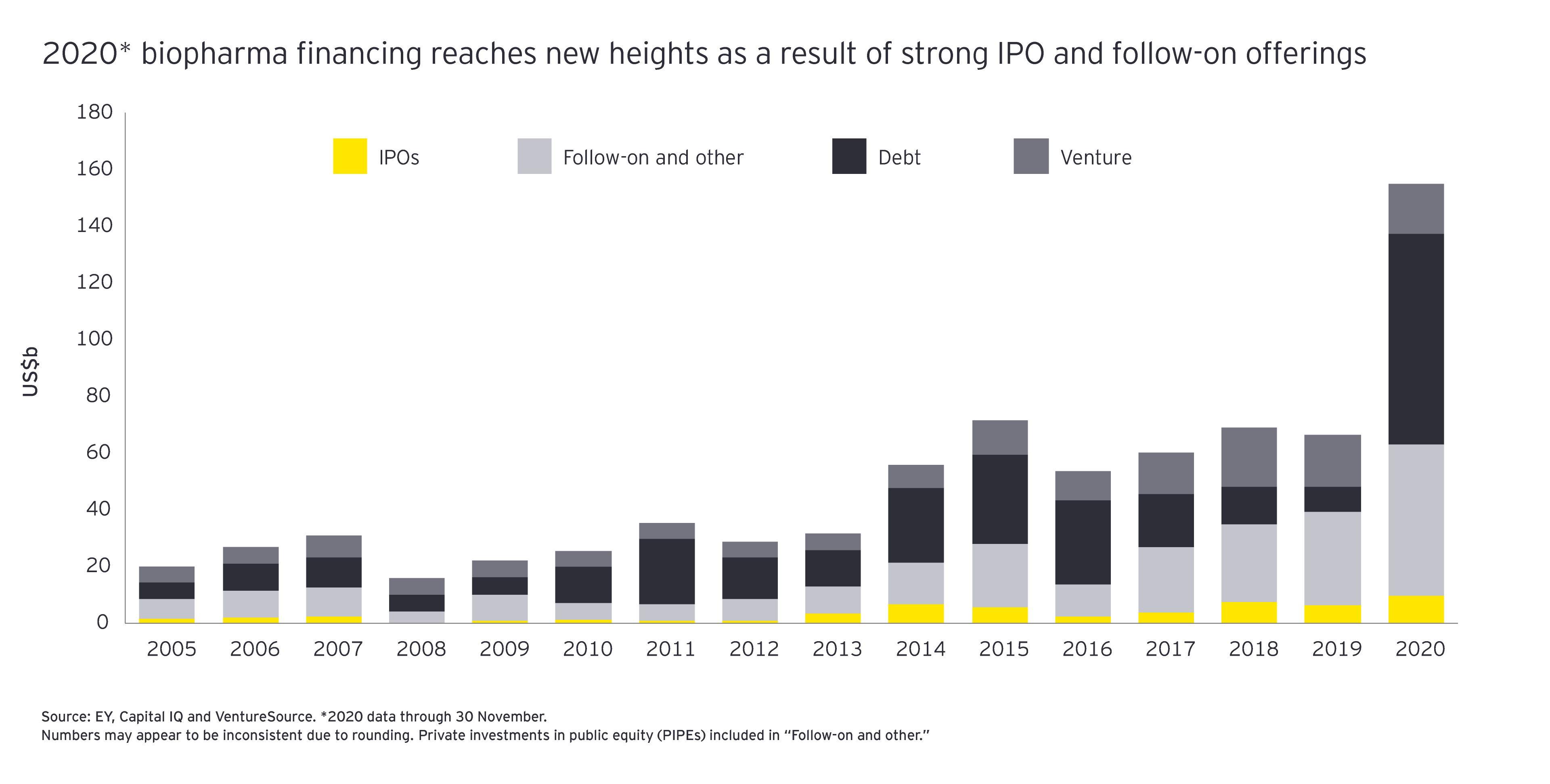

That decline in the industry growth gap likely decreased the pressure on certain biopharma buyers to do M&A and shifted the emphasis from acquiring near-term growth to partnering for future capabilities. Although the year’s M&A volume remained consistent with 2019, biopharma deal value dropped 51% year on year. AstraZeneca’s purchase of Alexion, which gives the UK biopharma a significant foothold in the rare disease space, and Gilead Sciences’ purchase of Immunomedics were the year’s two largest transactions, driving 50% of the biopharma annual M&A deal value.

Sky high valuations and strong public markets also contributed to the decline in overall deal value. For most of the year, target companies had access to significant liquidity and were negotiating deal terms from a position of strength. Indeed, on average in 2020, publicly traded biopharmas were purchased for a 74% premium relative to the trading price of their shares one day prior to a deal’s announcement.

Such high premiums make acquirers nervous, as they make it more challenging to deliver a return to shareholders. Having spent so much to acquire an asset (or assets), there is little room for error clinically or commercially if the buyer organization wants to recoup its costs and deliver revenue growth. Moreover, this concern only applies in situations where buyers and sellers can mutually agree on what the assets are worth. In many cases, the valuation gap – the difference between how buyers and sellers value the same asset – is just too high to bridge.

“These climbing valuations, combined with the very significant premium expectations in the biotech C-suite and board room, can make the path to an acceptable clearing price extremely challenging to impossible,” says Bristol Myers Squibb’s Mily. The upshot? “It is very tough for deal parties to arrive at any consensus on asset values, which is why there are so few bidders in the recent biotech M&A processes. In such conditions, arriving at any consensus on value is very tough.”

One-day deal premium

74%The average biopharma deal premium in 2020, which declined only 7% despite the market volatility.

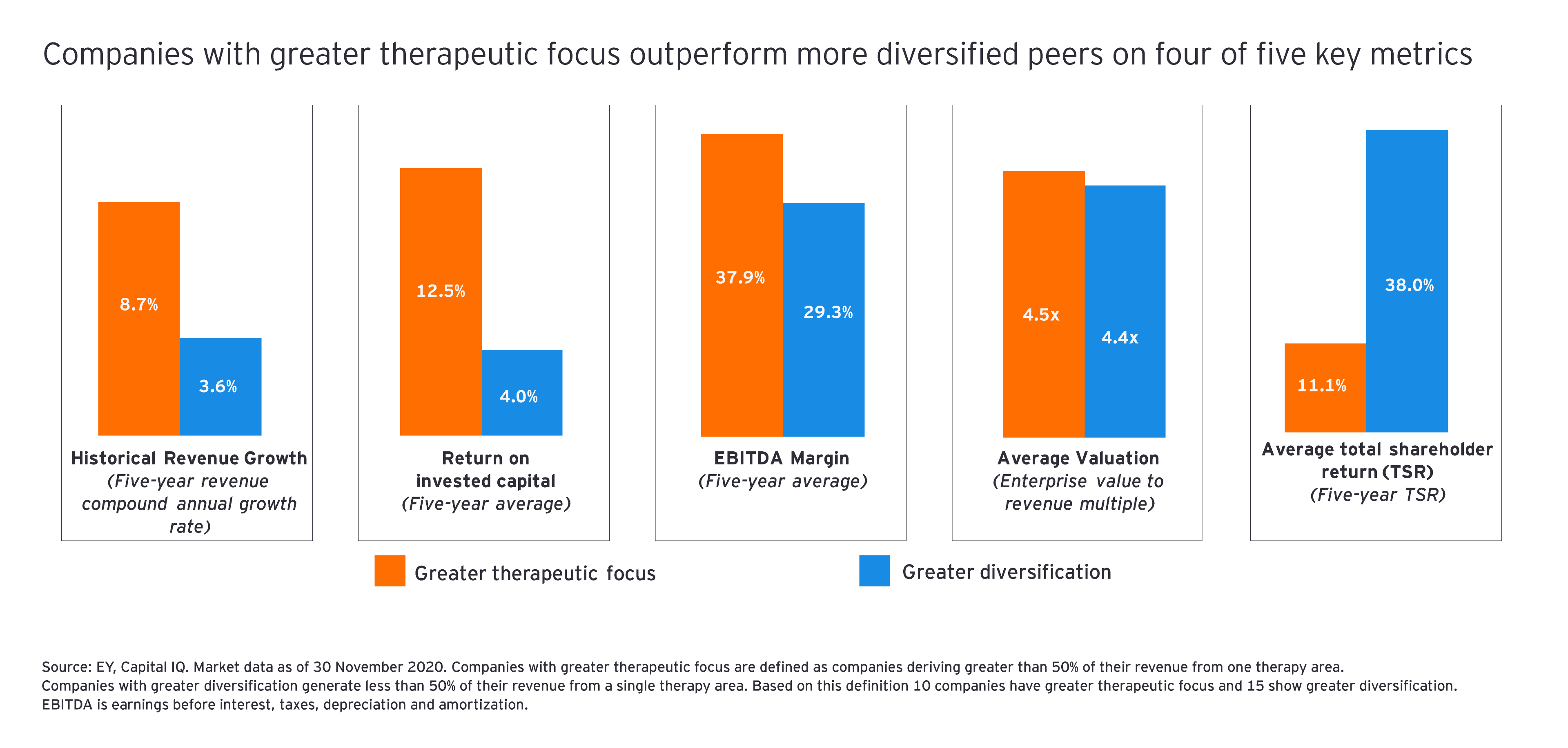

With deal premiums still rich, it’s hardly surprising that acquirers focused on bolt-on deals in therapeutic areas of interest. Johnson & Johnson’s acquisition of Momenta Pharmaceuticals and Bristol Myers Squibb’s purchase of MyoKardia were examples of the trend. One reason such focused dealmaking continues to be the industry modus operandi is its link to operational performance. Data originally published in the 2019 EY M&A Firepower report highlighted the link between therapeutic focus and operational performance.

Current data continue to support that thesis: when we analyzed the financial results of 25 top biopharma companies across five operational and financial metrics, we found that the 10 companies with greater therapeutic focus outperformed the 15 more diversified companies. The only metric in which companies with greater diversification outperformed organizations with greater therapeutic focus was average total shareholder return.

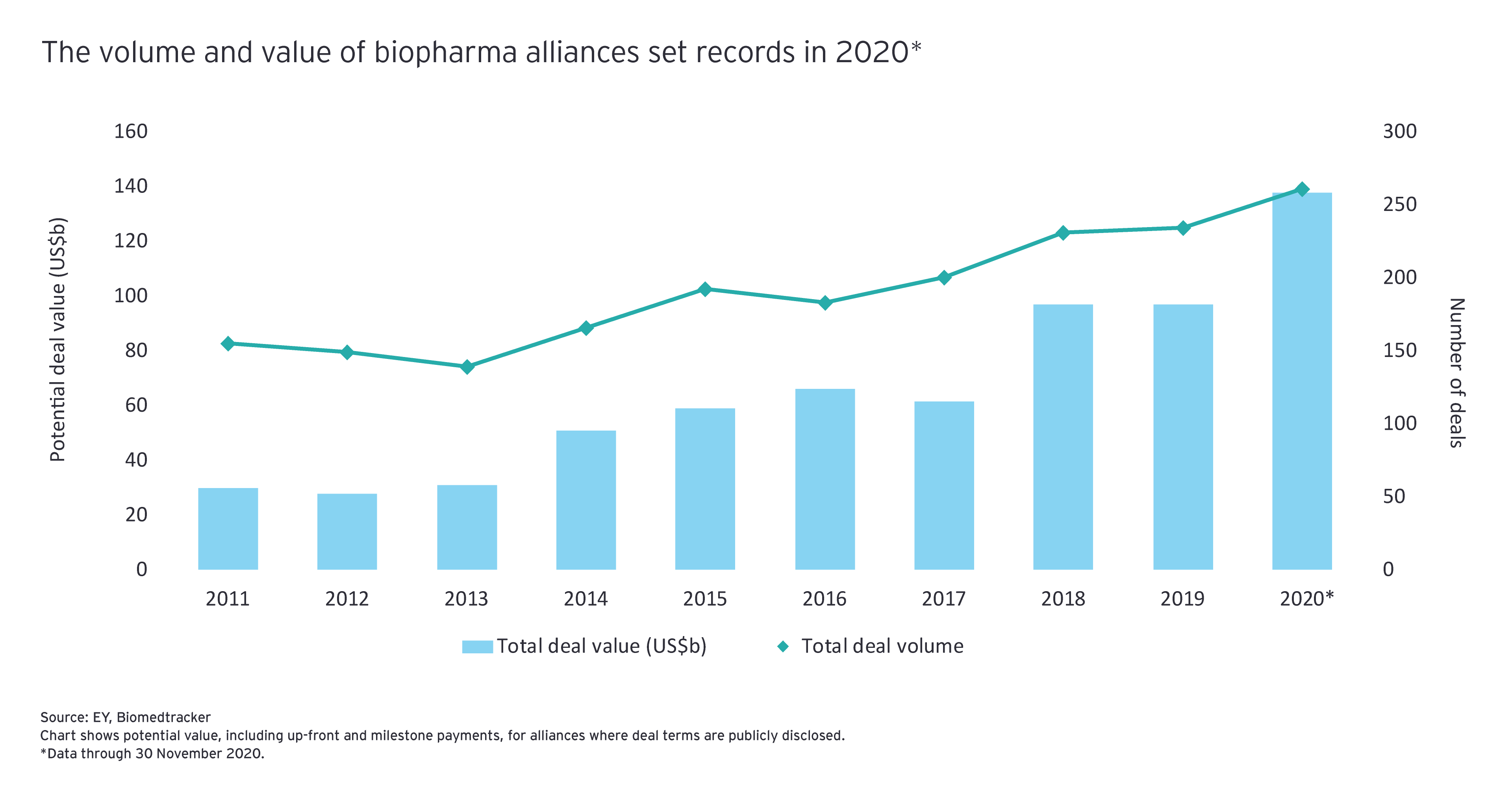

M&A is not the only lever biopharmas can use to achieve focused growth. Alliances are another mechanism for enabling affordable access to future innovations. In terms of both volume and value, biopharma alliance activity in 2020 was off the charts: through 30 November, buyers signed 261 partnerships worth close to US$140 billion in upfront and milestone payments.

Those numbers suggest that when it comes to the choice of alliances versus M&A, many biopharma dealmakers believed that alliances were better suited for the current climate. In an interview with EY, John Young, Pfizer’s Group President and Chief Business Officer, said, “We are generally seeking out early- to mid-stage clinical assets in our core therapeutic areas, where the potential for value creation is significant.”

Our investment in, and expanded relationship with, BioNTech is a great example of how long-term collaboration can result in value to both parties.

Pfizer’s expansion of its 2018 alliance with mRNA vaccine developer BioNTech was an example of how biopharma majors preferred to collaborate rather than make outright purchases in 2020. So too were Merck & Co. Inc.’s and Biogen’s respective alliances with antibody conjugate drug developer Seagen and neurology-focused Sage Therapeutics. Including the milestone payments, those collaborations come with M&A-sized deal values. Even still, the upfront price tags were a fraction of what it would have cost to buy the partners outright.

In 2021, biopharmas will continue to need to acquire decisively but with financial discipline. As a result, buyers are more likely to prefer deal structures that mitigate their monetary risk, with an emphasis on bolt-ons and alliances that combine milestone and equity payments. Megadeals will continue to be the less attractive option due to their larger integration and operational challenges unless there is no other way to provide needed near-term revenue.

One major wildcard: if clinical trial delays increase or sales slow more than is currently predicted, actual growth gaps may be larger than our current estimates. Those accelerating growth gaps will create more urgency for acquisitions that add near-term revenue growth, which historically are deals that command higher premiums.

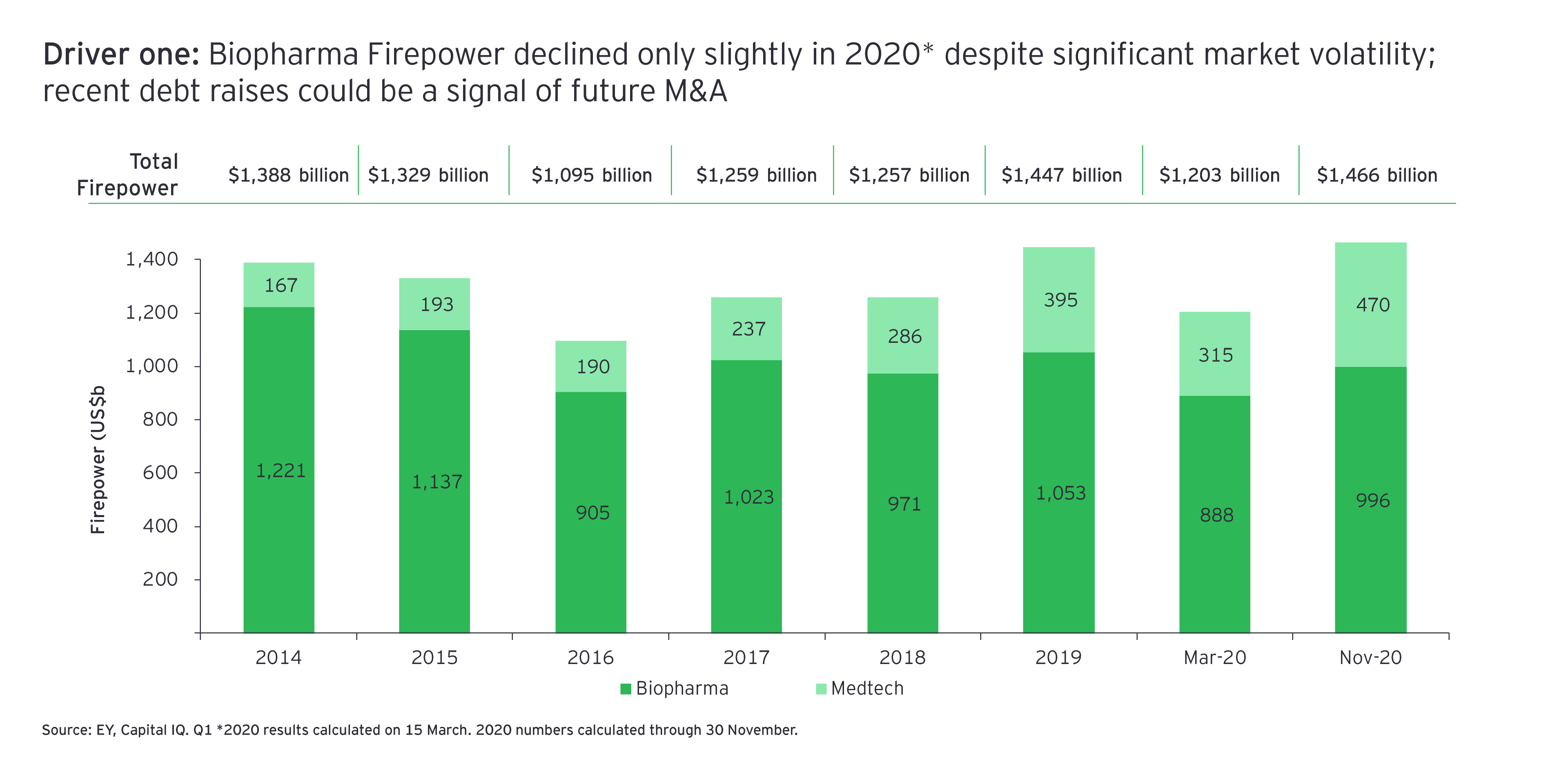

Doing such deals will require biopharmas to deploy significantly more of their Firepower than they used in 2020 – just 12%, compared to 20% in 2019. Companies will also have to distance themselves from their historical capital allocation patterns. Even factoring in 2019’s mammoth M&A spending, the top 25 biopharmas by revenue returned nearly US$200 billion more to their shareholders than they spent on M&A during the 2015-2019 time period. One area where biopharmas may want to consider additional investment: digital and data-centric skills necessary to deliver remote health care at scale.

Chapter 2

Medtech deals: value over volume

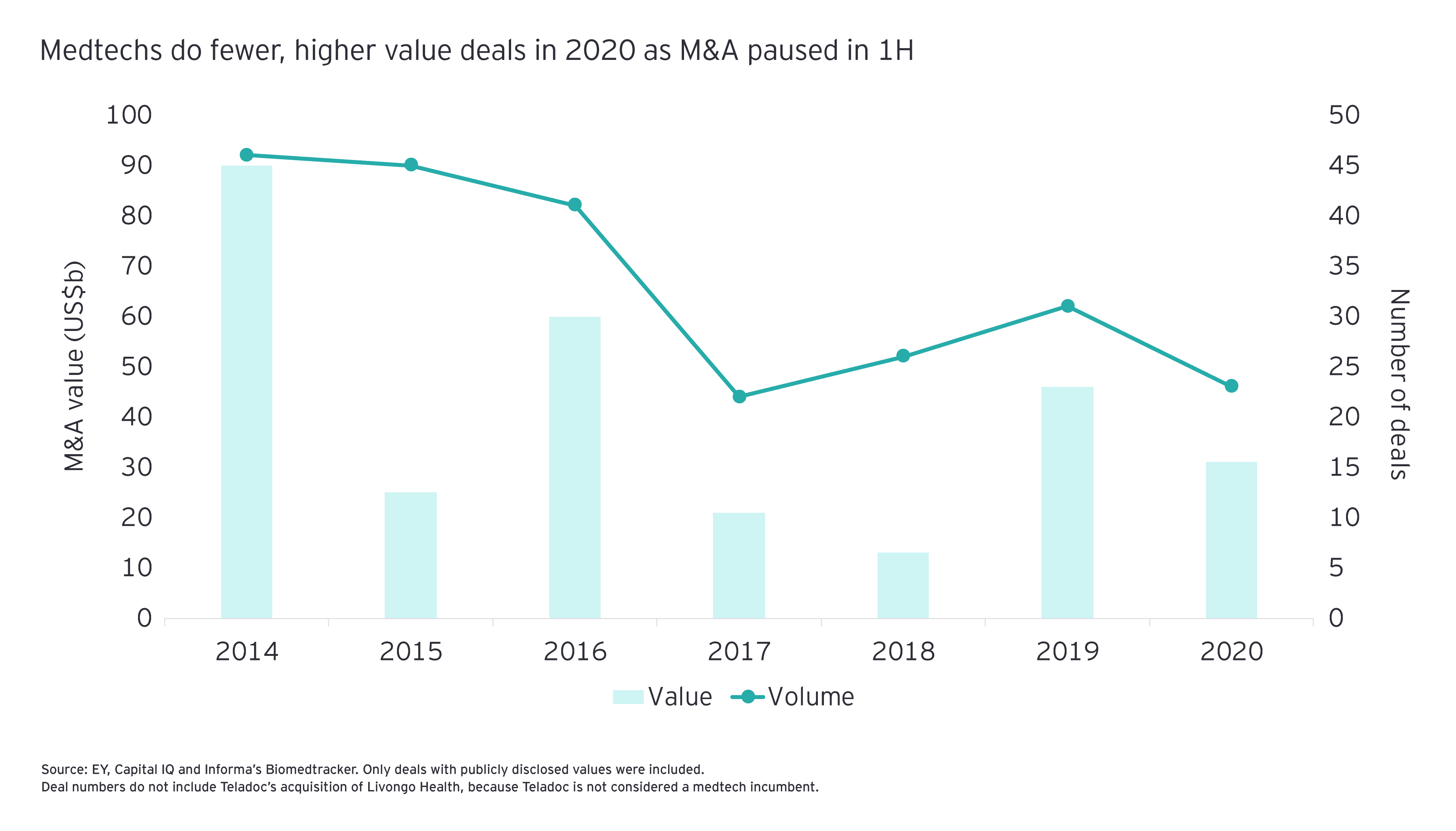

In 2020, medtechs deals were fewer in number but larger in size. Many increased their leverage, signaling an active 2021.

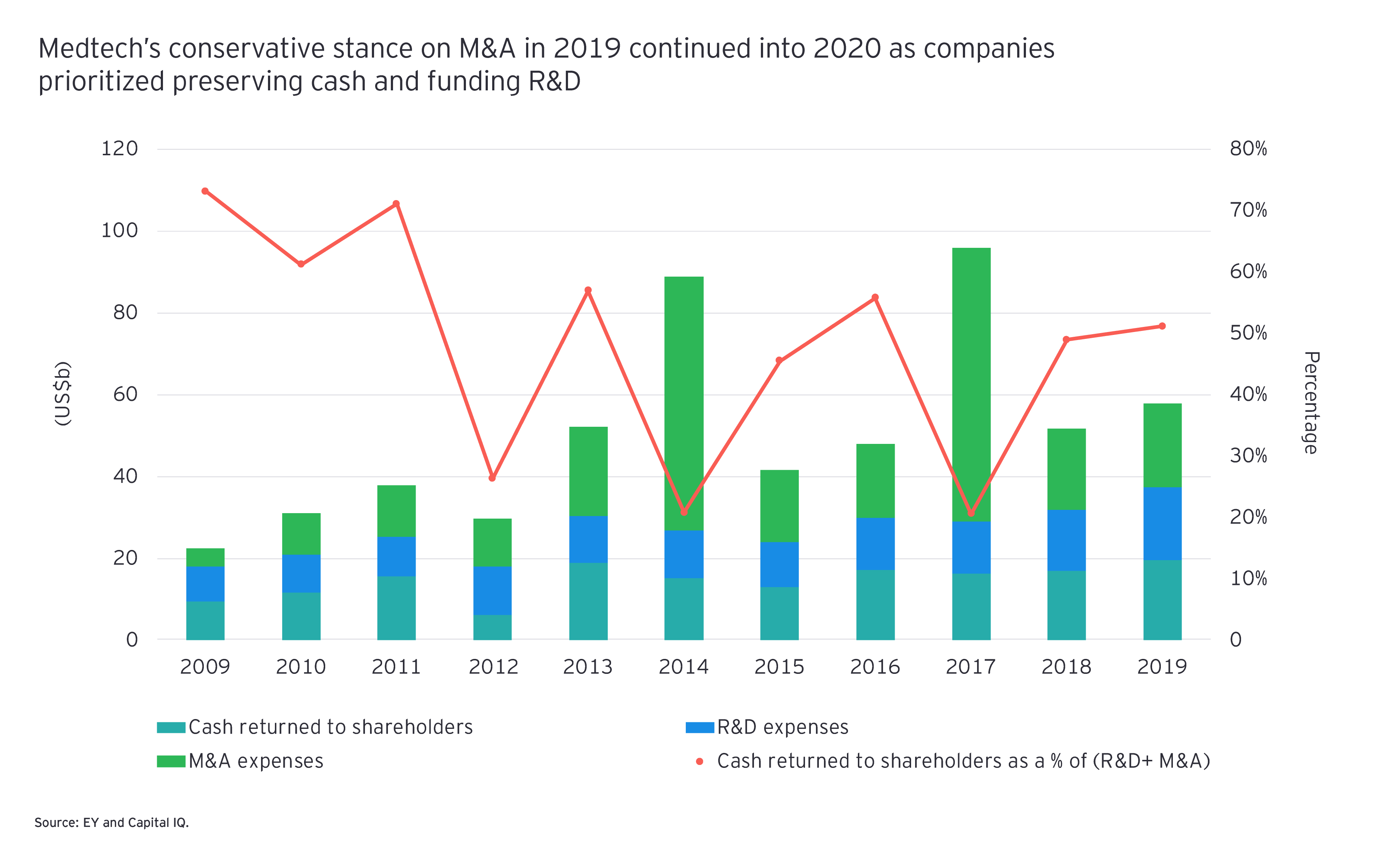

In 2019, medtechs took a conservative stance on M&A, preferring to return more cash to shareholders over doing deals. The dearth of M&A observed in 2019 continued in the first six months of 2020 as COVID-19 disrupted all aspects of dealmaking, from relationship building to the execution and closure of transactions.

But perhaps the industry will look back on the first half of 2020 and see it as the calm before the storm. Indeed, if the uptick in deals announced in the second half of 2020 continues to be a trend, 2021 could finally be the year that medtechs unleash their collective dealmaking power. Two of the year’s largest life sciences deals showcase the potential. In August, Siemens Healthineers inked a US$16.4 billion megadeal, acquiring Varian Medical Systems. In late September, Illumina announced it planned to spend US$8 billion to acquire 100% of GRAIL, a leader in liquid biopsy that it originally spun out in 2017.

Certainly, medtech’s fundamentals suggest the time is right for M&A to take center stage. The industry’s Firepower for deals expanded 41% in 2020 and is at an all-time high. During the year, the industry’s commercial leaders took advantage of the strong public markets to raise significant amounts of capital, primarily in the form of debt and follow-on offerings. At the same time, medtechs as a group only deployed 7% of their Firepower through 30 November 2020. The result: major medtechs have significant capital reserves to direct toward acquisitions in 2021 – if they choose to use it.

COVID-19 and the uncertainty it created for medtech acquirers likely triggered this race for capital. As the surge in the novel coronavirus resulted in deferred or cancelled procedures in the US and Europe, the industry’s growth suffered. Indeed, at the top 35 medtechs, growth gaps increased by US$9 billion to US$29 billion. With elective procedures resuming in the second half of 2020, companies seem to feel less pressure to preserve cash and more urgency to use their capital reserves for acquisitions. That attitude could shift as the COVID-19 cases surge in different geographies, however.

As with biopharma, M&A can help individual medtech companies close their growth gaps. Although valuations for target companies have remained strong, there are signs that smaller medtechs could soon be facing liquidity challenges. In the first half of 2020, a slowdown in venture capital investment and IPOs created new challenges for early-stage device companies. Venture and IPO investment levels rebounded in the second half of the year, but the pressures of an uncertain global economic climate may still push smaller players to entertain acquisitions, even on less favorable terms. If this rush for the exits materializes, medtech leaders may find themselves in the enviable position of having cash to spend in a buyer’s market.

Medtech growth gap

US$29 billionThe medtech industry’s growth gap increased 45% in 2020 as procedures were delayed or canceled.

Historically, one of the challenges for medtech buyers has been identifying innovations with significant market potential. This is certainly the case in therapeutic devices, where decades of investment have delivered cardiovascular and orthopaedic products that are hard to improve upon, creating reimbursement hurdles for newer solutions.

However, opportunities are emerging in other medtech fields. Look at diagnostics: in 2020, diagnostics companies have been at the forefront of combating the pandemic while also enabling care outside of traditional bricks-and-mortar channels. As remote diagnosis, triage and care becoming an increasingly vital part of health care, medtechs have a strong incentive to build out or add these offerings to their portfolios. This move toward remote care is just part of the broader shift in health care that the events of 2020 have accelerated, and which medtechs and biopharmas alike will need to respond to in 2021.

Chapter 3

Looking ahead to 2021

In the next year, there will be a continued need to create focused business models.

Across multiple industries, the pandemic has slowed growth and created new financial and operational pressures that were ultimately reflected in the year’s overall drop in life sciences M&A activity. Yet, while COVID-19 caused many acquirers to tap the brakes, it has simultaneously accelerated the broader transformation of health care.

The potential to use digital technologies and data analytics to deliver more convenient, affordable and better health care has been trumpeted for years. But it took a global health crisis to demonstrate just how quickly health care delivery can move from its inconvenient, discontinuous, analog roots to a more convenient, seamless, digital experience. The rapid adoption of virtual care in the first half of 2020 is just one example of the health ecosystem’s evolution.

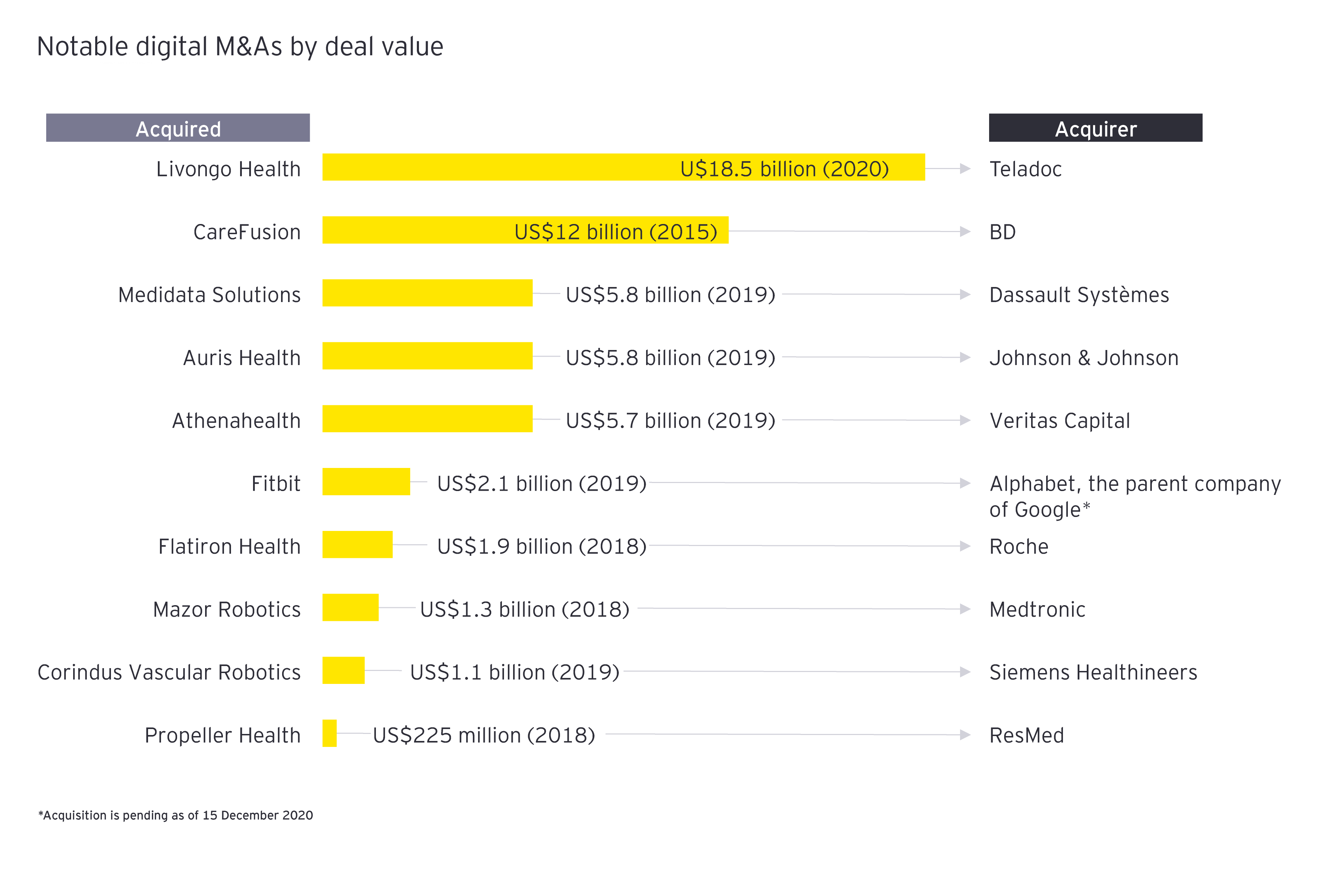

Teladoc’s acquisition of Livongo Health, a start-up developing personalized disease management tools, is another. It was one of the biggest deals of the year at more than US$18 billion, and as such, validation that the convergence of digital technologies and more traditional diagnostics and devices will permanently alter health care.

It was therefore notable that the buyer was squarely in the health services space, not a traditional biopharma or medtech. To really position themselves for future growth, life sciences companies must continue to invest in technologies that complement traditional product-centric definitions of innovation, including data analytics, user-centered design and product personalization.

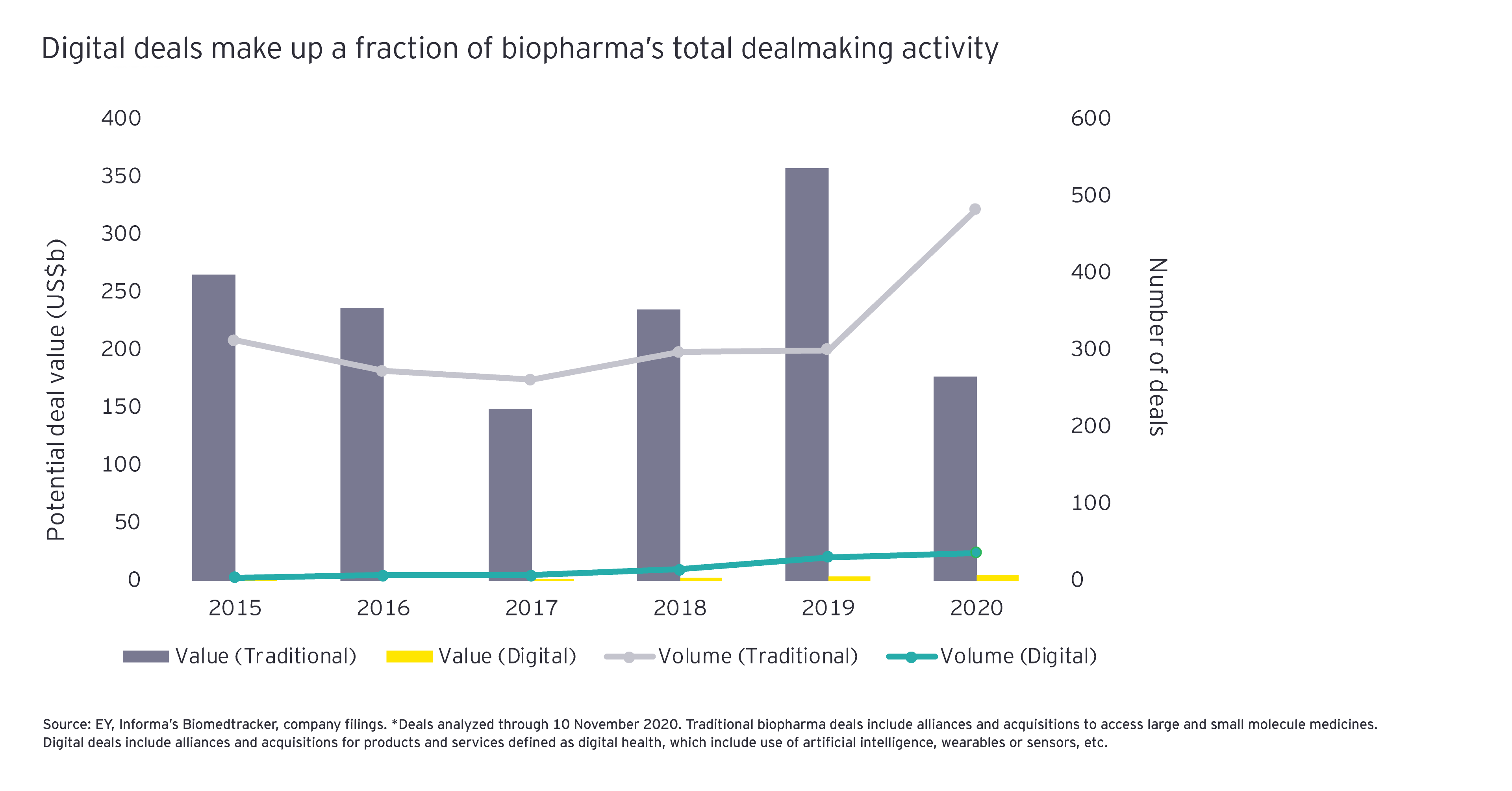

As life sciences companies revisit their business strategies in 2021, we expect many to look more carefully at their digital dealmaking in the wake of Teladoc/Livongo. Certainly, it won’t be hard for 2021 dealmaking in this arena to exceed the 2020 numbers, where biopharmas showed a decided preference for traditional forms of innovation.

Just as “resilience” quickly became the watchword in 2020, expect “focus” to be a top contender in 2021. One of the most lasting effects of COVID-19 may be the need for business capabilities that can support the delivery at scale of remote care. But making the necessary investments in those capabilities requires biopharmas and medtechs alike to be choosier about where they place their strategic bets. To outperform, companies won’t be able to sell products in disparate therapy areas across a range of business models that span delivering truly breakthrough innovations to more affordable and personalized management of chronic disease. It will be difficult to find sufficient human and financial capital to invest in capabilities that yield the differentiation so important for outperformance.

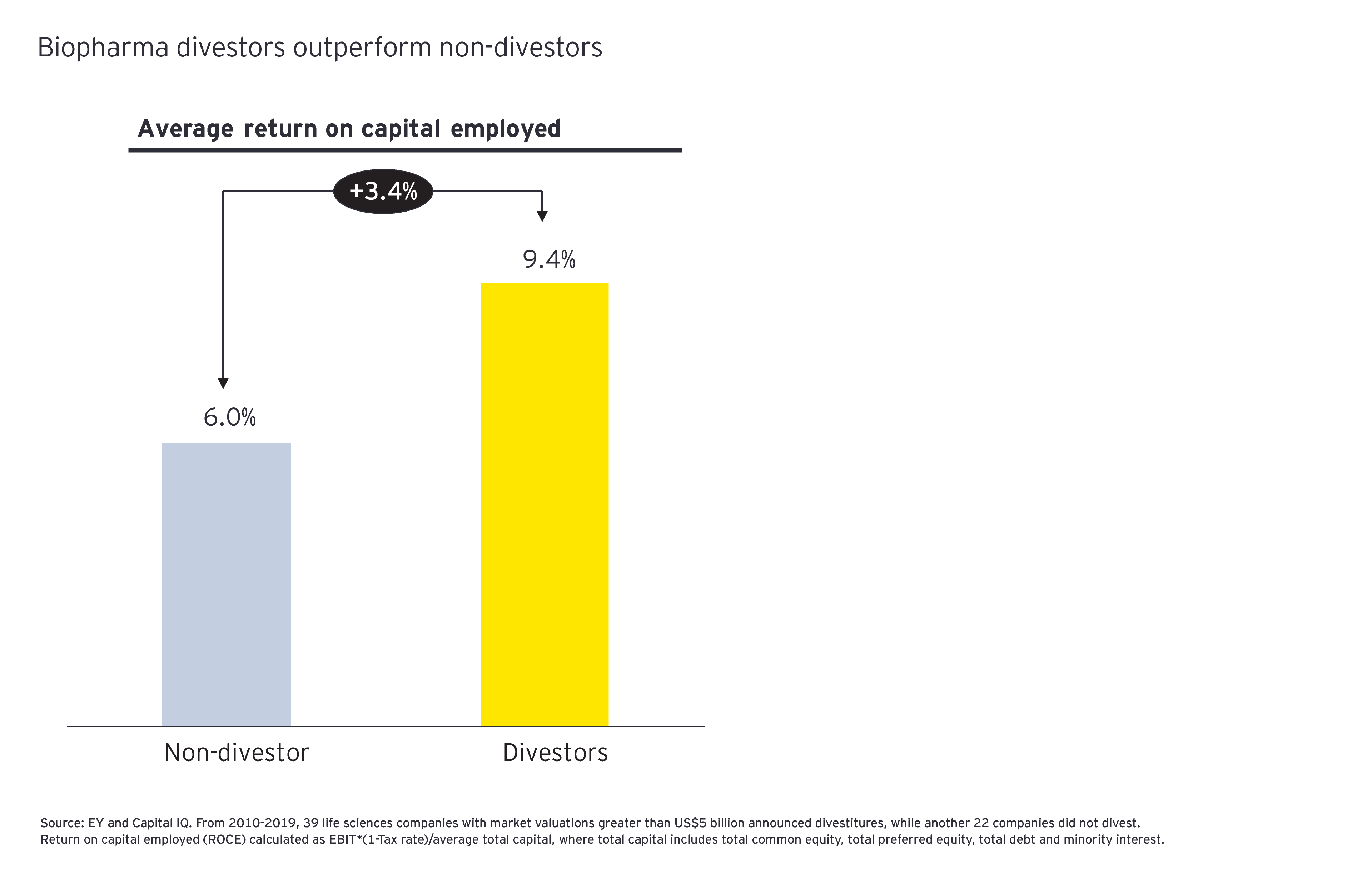

This prioritization has important M&A implications in 2021. In addition to focusing on products or services that add therapeutic depth, companies may also want to ensure that these assets align with the company’s chosen commercial model. Before doing so, divesting or spinning out businesses that no longer align to the business strategy may take on greater urgency. Our analysis suggests that when biopharma companies divest proactively, they not only gain focus but boost operational performance.

Moving forward, there is no doubt that M&A will continue to be an important tool as biopharmas and medtechs reposition themselves for the future. As the specter of COVID-19 recedes, companies will need to disproportionately invest in data and capabilities that allow them to meet the demands of the ecosystem’s diverse and more demanding customers, especially payers and individual patients. Biopharmas and medtechs that delay investments in skills that enable more convenient and seamless care may find it difficult to compete with technology and consumer companies that see health care as prime segment for growth.

Summary

In the unfavorable environment created by the COVID-19 pandemic and related economic challenges, biopharma acquirers moved to alliances and smaller, bolt-on deals in therapeutic areas. Medtechs focused on areas targeting the health care system’s evolving needs in diagnostics and personalized medicine capabilities.

These trends suggest that 2021 will likely be an active year for deals, at least in terms of overall volume.