Greece's attractiveness as an investment destination continues to strengthen, despite the downturn at a European level.

The EY Attractiveness Survey Greece 2024, now in its sixth edition, has become a benchmark for monitoring the attractiveness of the country as an investment destination, as well as a measure of the progress made in recent years.

Greece's strongest performance in FDI, for two years in a row

Despite investments in Europe decreased by 4% in 2023, with a cumulative decline of 14% since 2017, Greece attracted a bigger number of FDI. The EY European Investment Monitor recorded 50 FDI projects for 2023, marking the strongest performance for the country since the database was created in 2000 and placing Greece in the 19th place among the 45 countries surveyed.

Cumulatively, the FDI projects over the past two and three years represent 25% and 33%, respectively, of all investments recorded since 2000. Investments made since 2019, the first year after Greece's exit from the bailout programme, account for 49% out of the total.

The qualitative composition of investments continues to improve, with a significant amount directed toward knowledge-intensive and high value-added activities, as well as sectors critical for the transformation of Greece’s economic production model. Key sectors include software and IT services (ranked first, though with a reduced share of 24% from 40% last year), professional services and business services (16%), and transportation and logistics (16%).

Investment plans at an all-time high

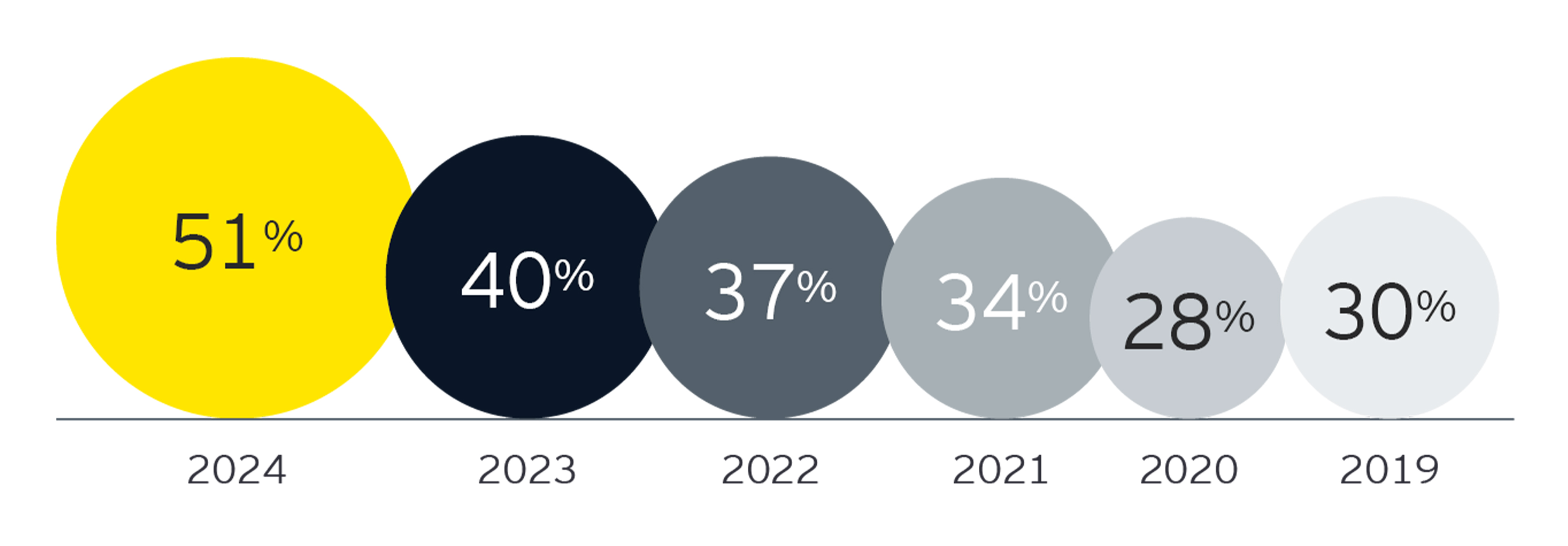

One out of two respondents (51%) indicated that their companies plan to establish or expand operations in Greece over the next year. This marks the highest performance for this critical indicator, which stood at 30% in 2019, the first year the survey was conducted for Greece. Among very large enterprises (revenues > €1.5 billion), the percentage is even higher (65%) while, among companies already established in Greece, it reaches 70%.