Banks and financial institutions (FIs) have long struggled to get one, clear, consistent view of their customers’ data. And while many have invested in single customer view (SCV) programs and systems, issues around data quality and shareability across the organization remain. But what if putting customers in control of their own data exchange could solve the problem and bring broader benefits?

Fragmented information across the business

Sometimes simple things cause major problems. When customers contact their bank to update their addresses, they expect the change to be communicated to those in charge of their everyday current account, their business loan and corporate credit cards. But despite — or perhaps because of — the proliferation of digital systems, many banks and FIs still struggle to ensure that even the most straightforward changes to customer data are replicated across the business.

Apart from giving customers a poor experience (which may encourage them to switch FIs), the issue is increasing banks’ operational costs, threatening data quality and know-your-customer (KYC) compliance, and leaving them unable to leverage an accurate, unified customer profile to up-sell and cross-sell products effectively.

And, as data protection regulation evolves, an inability to get a firm view of how customer data is protected, managed and shared could cause serious and expensive breaches. Developing a consistent, auditable and robust data exchange process is a critical imperative for every bank and FI today.

A new approach to data exchange

To do this, many organizations have implemented SCV technology systems. But to date, most SCVs have yet to deliver on their promises. These systems are usually expensive, yield only limited-time savings, require specific skill sets to operate, and create yet another data store to be managed. And critically, SCVs are technology-led, with little or no interaction with the customer.

Engaging customers in the collection and sharing of their data builds mutually beneficial engagement with FIs, helping them move beyond complying with regulatory requirements such as General Data Protection Regulation (GDPR) to embrace the real potential of an application programming interface (API) connectivity to build better, more profitable customer relationships.

With this in mind, EY is seeing a growing need for financial institutions to adopt a new customer centric approach to data exchange - a platform that provides a secure and traceable exchange of customer information, controlled by the customer, which can be implemented directly into an organization’s online channel.

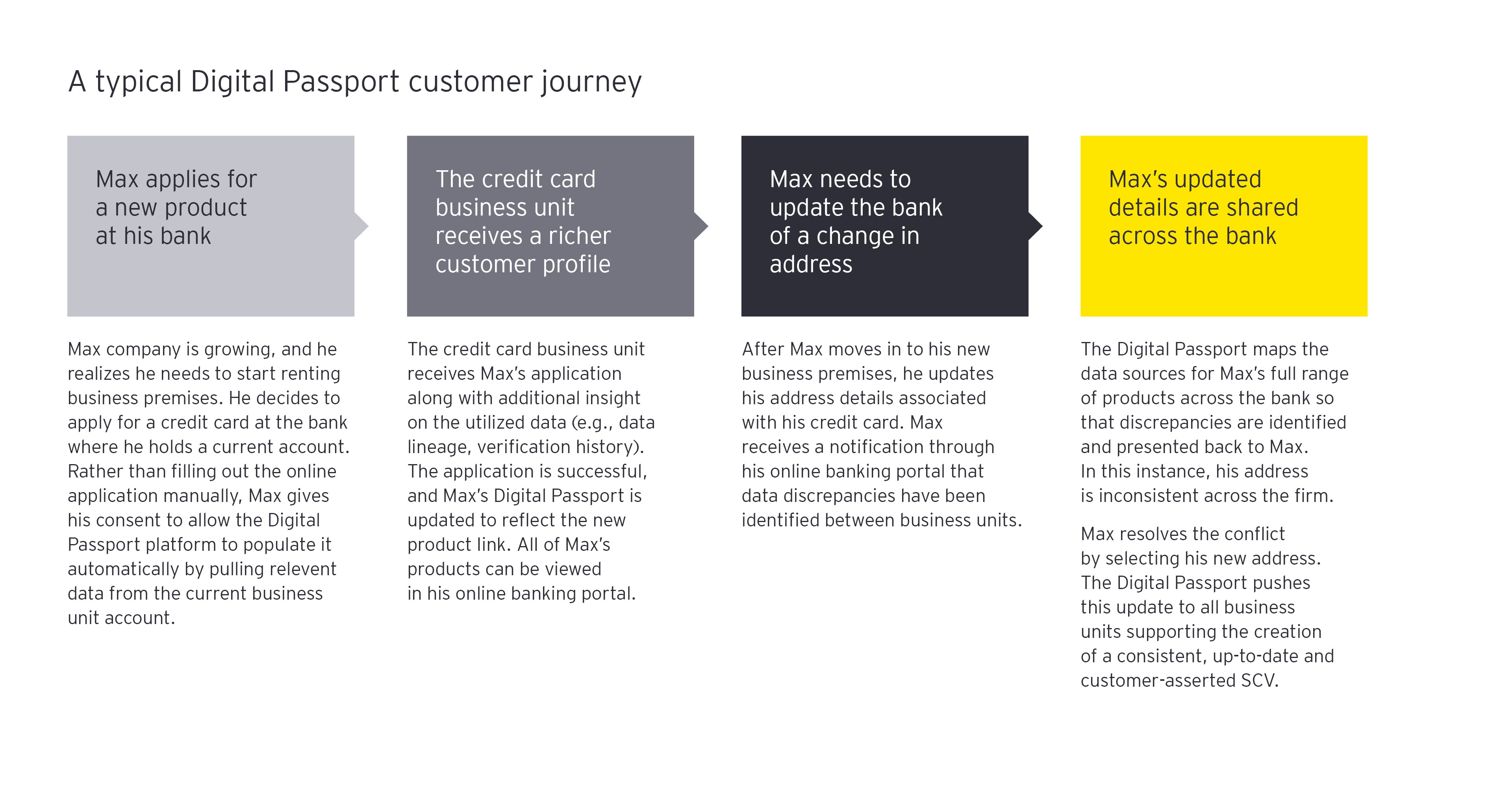

The below graphic illustrates how a customer-driven data exchange platform could serve small businesses, such as one owned by Max: