EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

Supporting organizations with physical and transition risks associated with climate change, and assisting them with market and regulatory changes.

Read more

Conclusion

The world is at the start of a 50-year transformation in global capital flows. This will require a quantum leap in the ambition, complexity and scale of capital mobilization. COP26 has only heightened awareness that leadership from the financial industry will be crucial to galvanizing momentum among businesses, governments and other critical actors.

Faced with this challenge, it’s all too easy for FSOs to get bogged down in the detail of regulations or targets, and for the whole financial industry to get tied up in the search for common standards. It’s true that the devil is in the detail. But it’s equally vital to keep an eye on the big picture if capital is to be mobilized at the required scale.

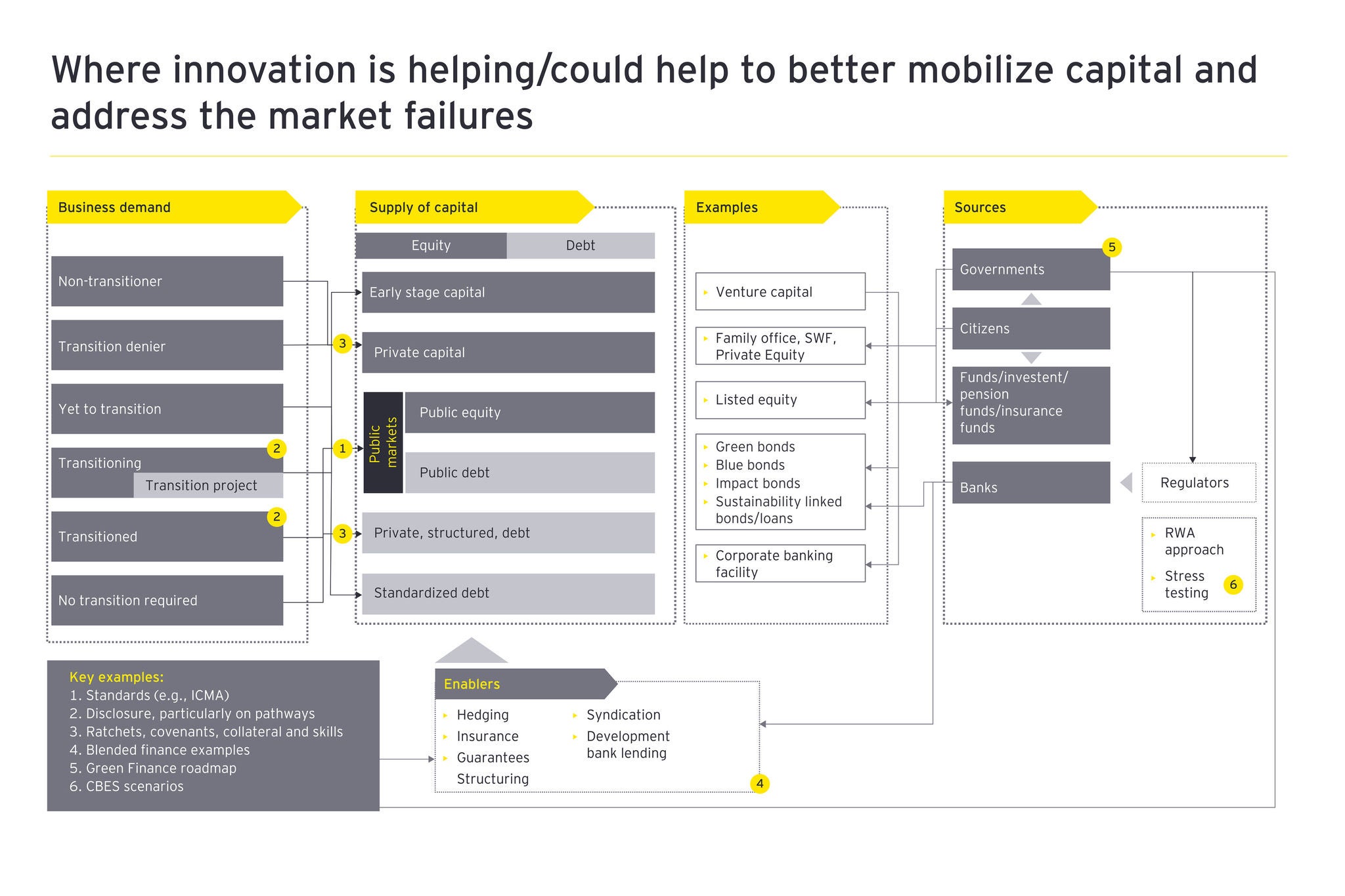

We hope this paper can provide FSOs with a simple conceptual framework for thinking about this highly complex problem. In our view, innovation is the vital ingredient for enabling the necessary level of capital mobilization. Innovation can help firms identify demand and supply signals, work with other stakeholders and make the intermediation of capital more efficient and effective.

Improving current market functions is vital, but so too is recognizing their limitations. Conventional capital mechanisms, ranging from stock markets to development finance, simply won’t be enough to solve such a systemic challenge. There is a need for a step change in engagement and collaboration between the private sector and public bodies in areas as diverse as policy, tax, regulation, investment and stewardship.

That is not to say that the financial industry should relinquish responsibility for capital mobilization. FSOs have an opportunity and obligation to demonstrate leadership, both individually and through bodies such as GFANZ, in order to orchestrate capital flows and encourage quick, purposeful action.

We, therefore, hope that our framework will help FSOs think clearly about global capital challenges, allowing individual firms to identify the role they want to play in mobilizing decarbonization capital and formulate the right strategy to achieve it.

Thank you to EY Ireland Insurance Leader James Maher and EY Global Financial Services Liquidity and Treasury Advisory Leader Peter Marshall for their contributions to this article.