Respondents commented that firms have no liquidity headroom after exposure to market headwinds for an extended period, or restricted (or more costly) access to new financing.

Some bankers expected refinancing transactions to turn into restructurings driven by factors including:

- Companies with deteriorating financial performance facing liquidity pressures and high leverage levels that make refinancing challenging.

- No state support is available to improve credit standing.

- Repayment of new COVID-19 loans adds to pre-existing loans.

- Banks and other lending institutions are increasingly cautious and have stricter rules for new money lending.

- Difficulties in establishing normalized cash flows, considering adverse market events in recent years, add to the uncertainty of credit analyses.

- High interest rates reduce debt capacity.

On the positive side, declining inflation may encourage central banks to consider reducing interest rates, thus increasing economic activity. However, it takes time for this to turn into improved financial performance and liquidity for businesses.

Restructuring activity in sectors

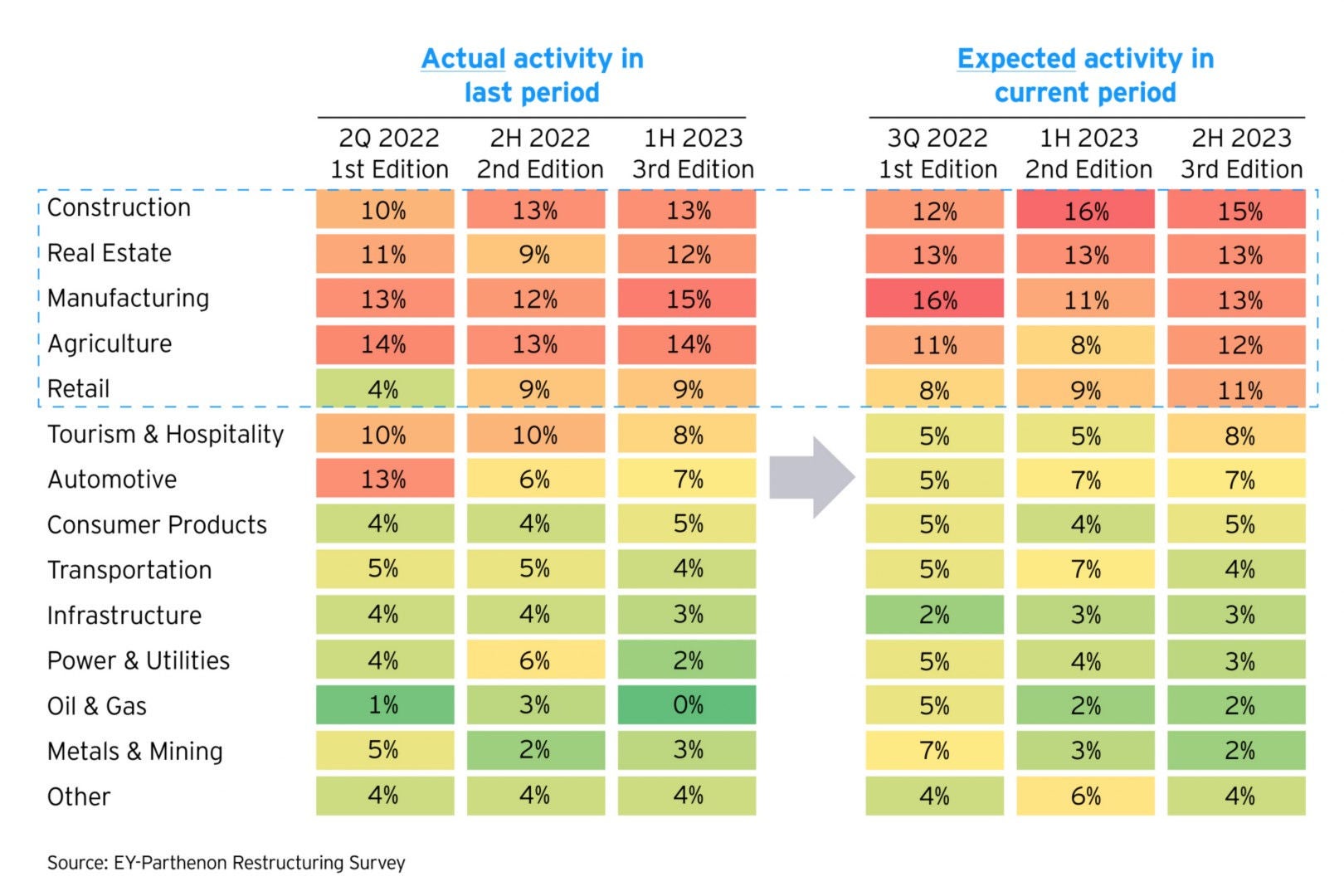

From a sector perspective, construction, real estate and manufacturing consistently have had the highest restructuring activity across all three survey editions.

The construction and real estate sectors have suffered the negative impacts of rising interest rates, reducing both demand and asset values, operating cost-side pressures (including materials, energy, and wages) and workforce shortages. The collapse of the Signa Group in Austria with debts of around EUR 14.4b marks one of the largest situations in recent years.

Manufacturing firms typically operate cost and capital (thereby financing cost) intensive. Therefore, any increases in such cost components will have even more adverse impacts on these companies. Another pressure point stems from reduced consumer demand. Firms manufacturing discretionary products appear particularly vulnerable. Cost-passthrough to the end-customer (an extremely popular and successful tool of companies in the post COVID-19 period) is becoming increasingly difficult or even impossible. Massive de-stocking, another significant trend in this sector, adds up to a reduction in demand and contributes to the overall suite of pressures for firms in the sector.

Restructuring activity in the retail sector has also been steadily growing with each survey edition and will continue in the future.

Separately, high leverage (for example companies post leveraged buyout (LBO) transactions) under the current high interest rate environment represents a sector-agnostic pressure point and an indicator of potential capital structure pressures.

These perspectives align closely with the market insights and current restructuring experiences of the EY-Parthenon team in the Region.

Top 10 sectors with highest restructuring activity