EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

Our teams can help governments, regulators and private clients with infrastructure advisory and ESG support, aiding decisions and project development.

Read more

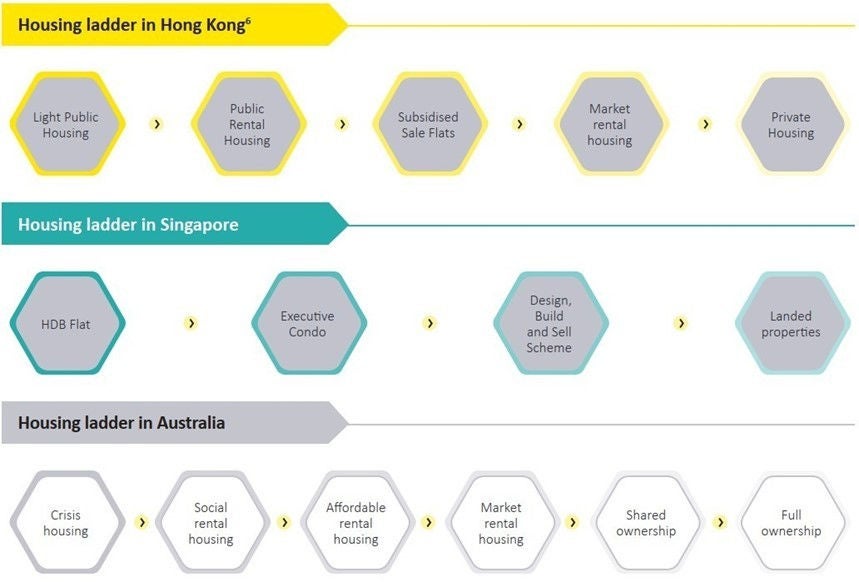

While further investigation is required to assess how and whether these initiatives could work in Hong Kong’s housing market and policy landscape, there are housing products and initiatives which have been successfully implemented in overseas markets in combating housing affordability issues.

Inclusionary zoning

Inclusionary zoning is a land use planning intervention which either mandates or creates incentives so that a proportion of a residential development will include affordable housing for low and middle-income households. Incentives under this approach are typically aimed at reducing the costs for private developers. These could take the form of (a) modifications to planning standards based on performance criteria, (b) bonus systems which relax specified development controls, and (c) planning process incentives such as fast track approvals and accelerated infrastructure provision.

Such intervention is used in several overseas markets including the UK, US and Australia, as detailed below:

- The King’s Cross redevelopment in the UK has redeveloped a previously run-down, underinvested area into a thriving community with two schools, the major rail hub connecting the UK with mainland Europe, a university, public space, restored historical buildings as well as 2,000 new flats, around 50% of which have been dedicated to affordable housing (as agreed between the private developer and London authorities).

- A Mandatory Inclusionary program was launched by the Department of City Planning in New York. Under each mandatory inclusionary housing area, between 25% and 30% of the residential floor area could be stipulated as the minimum allocation for affordable housing units for residents within a specified income threshold.

Rent-to-own

Rent-to-own (or rent-to-buy) schemes are effectively leasing arrangements in which potential homeowners commit to a multi-year lease with a future option to purchase the property.

The scheme is implemented in a number of overseas markets, but primarily in the UK. For example, a rent-to-buy program was launched by the UK government in 2015 to encourage working households to save money while they are renting to give them an opportunity to save for a sufficient deposit to buy their first home. The UK government provided £400 million in loans to housing associations and social landlords to build 10,000 new homes for potential lower income rent-to-owners. When the home is sold or moved to a market rent at the end of the lease term (at a minimum of five years), the landlord repays the UK government grant.