EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

EY Nexus for Banking

Products to transform banking

EY Nexus features a constantly evolving suite of technology components that are quick to build and easy to adapt. These components fit seamlessly into existing systems and channels to address key customer needs. You can also evolve your products and services using the core EY Nexus platform, which is a versatile, cloud-ready framework with ready-to-use building blocks of technology assets that sits within a curated partner ecosystem.

Explore our case studies

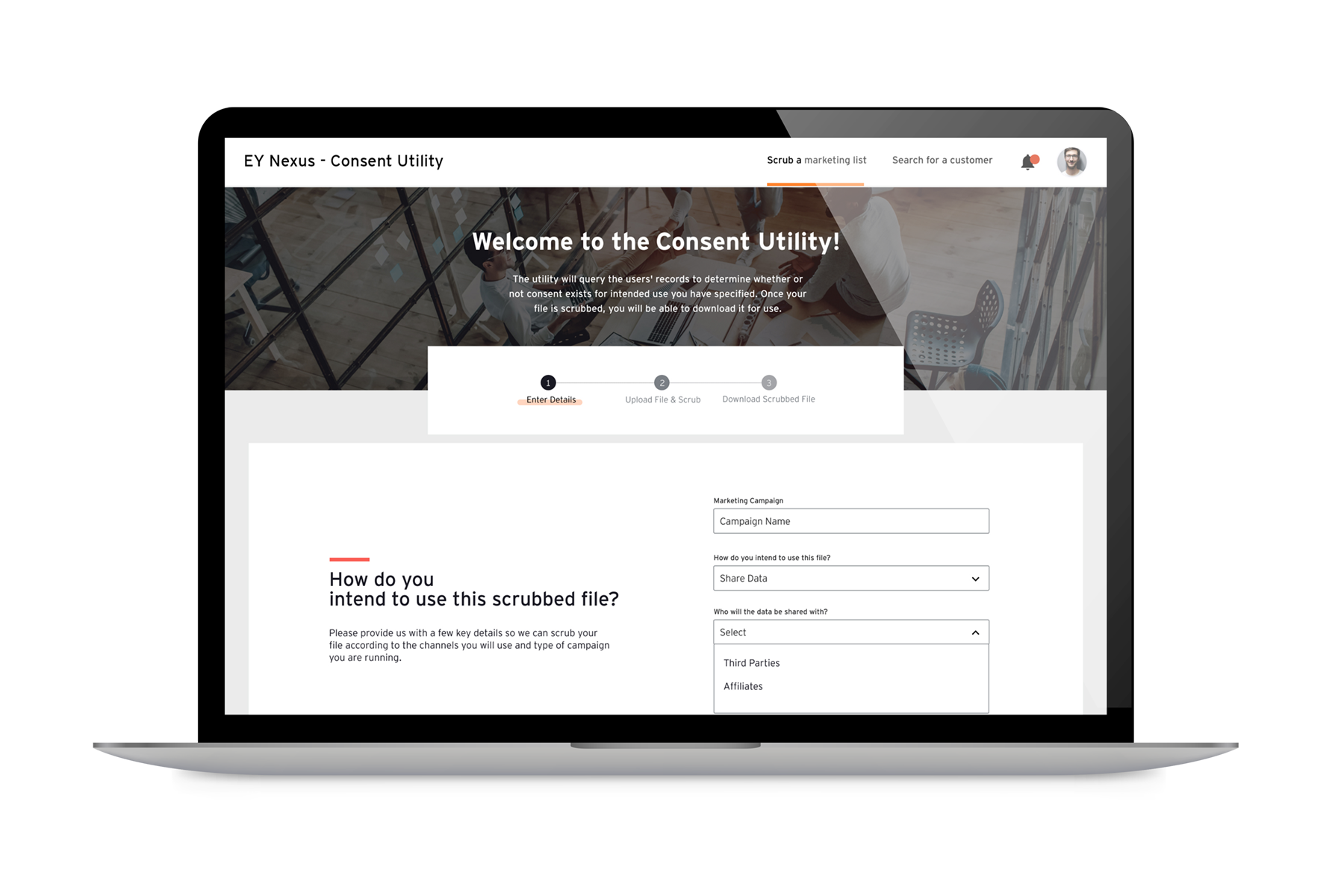

How privacy and consent built customer trust for a financial institution

EY Nexus for Banking helped a financial institution with a privacy initiative that uses transparency to build trust and brand loyalty. Read the case study.

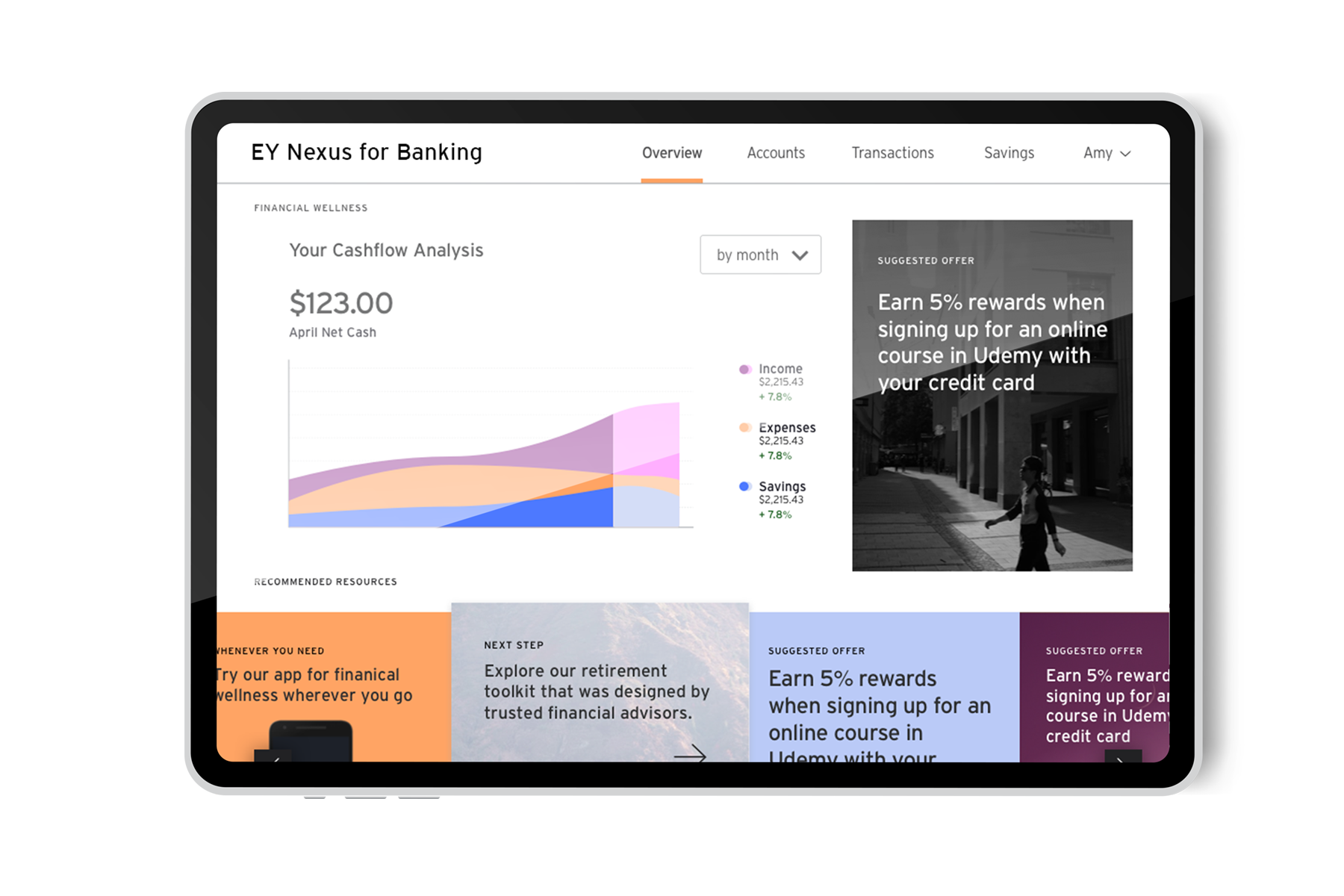

Why real-time customer journey curation is the future of banking

EY Nexus for Banking platform was key to transforming one traditional bank into a future-ready, digital bank of tomorrow.

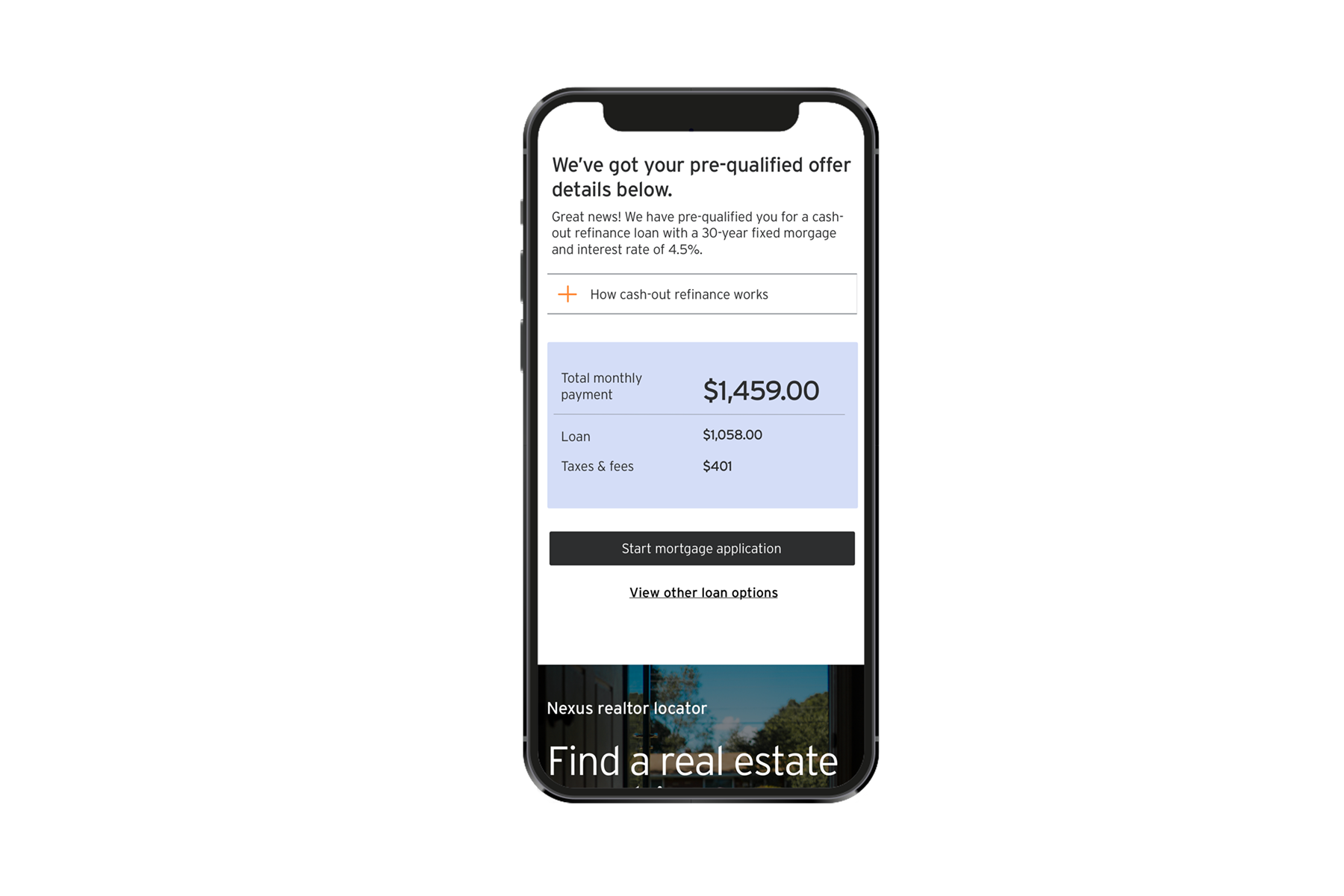

How to transform product development to outperform the competition

EY Nexus is a cloud-based platform offering access to the most advanced technologies to launch new products, businesses and services.