The new LPF regime will provide an option for private funds to be established onshore in Hong Kong and structured in limited partnership form.

The Limited Partnership Fund (LPF) Ordinance, which introduces a tailor-made limited partnership regime for attracting investment funds to establish and operate in Hong Kong, will come into effect on 31 August 2020.

Historically a fund could be established onshore in Hong Kong in the form of a unit trust or an open-ended fund company. While these fund structures are popular for public offer or hedge funds, it is more common for private funds such as private equity funds to be established in the form of a limited partnership.

The new LPF regime in Hong Kong will provide an option for private funds to be established onshore in Hong Kong and structured in limited partnership form. The LPF regime is aimed at attracting fund managers to establish and operate investment funds onshore in Hong Kong and is a crucial piece of the puzzle in developing Hong Kong into a full-fledged fund service centre.

What is LPF? An arrangement meeting the definition of “fund” that is structured in a limited partnership form registered in Hong Kong

Who can use it? Largely, but not exclusively:

- Venture capital, private equity and buy-out funds

- Real estate funds

- Infrastructure and projects funds

- Special situations / hybrid funds

- Funds that invest in digital assets, such as cryptocurrency and virtual assets

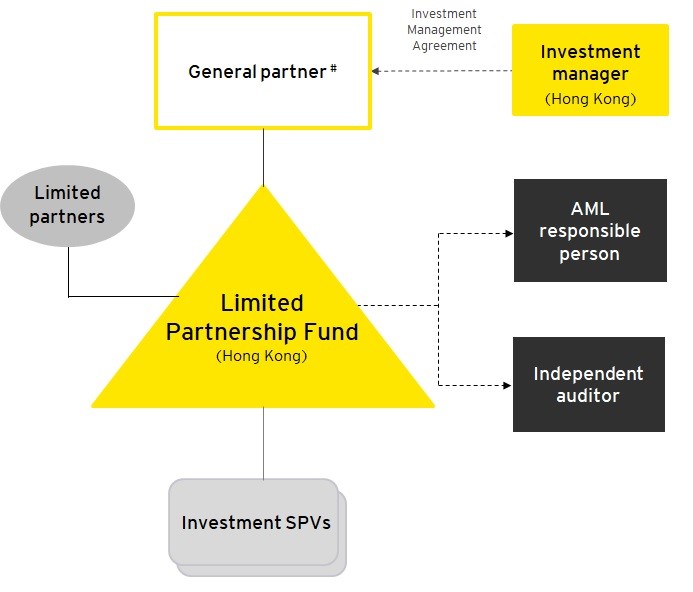

Streamlined fund structure using LPF