EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

The social and economic changes in Qatar have got foreign investors’ attention and resulted in positioning Qatar as an attractive investment destination.

The past two years have been turbulent and challenging globally, from both economic and social perspectives. Qatar has also faced challenges but has shown resilience and resolutely navigated unique as well as challenging regional and global events.

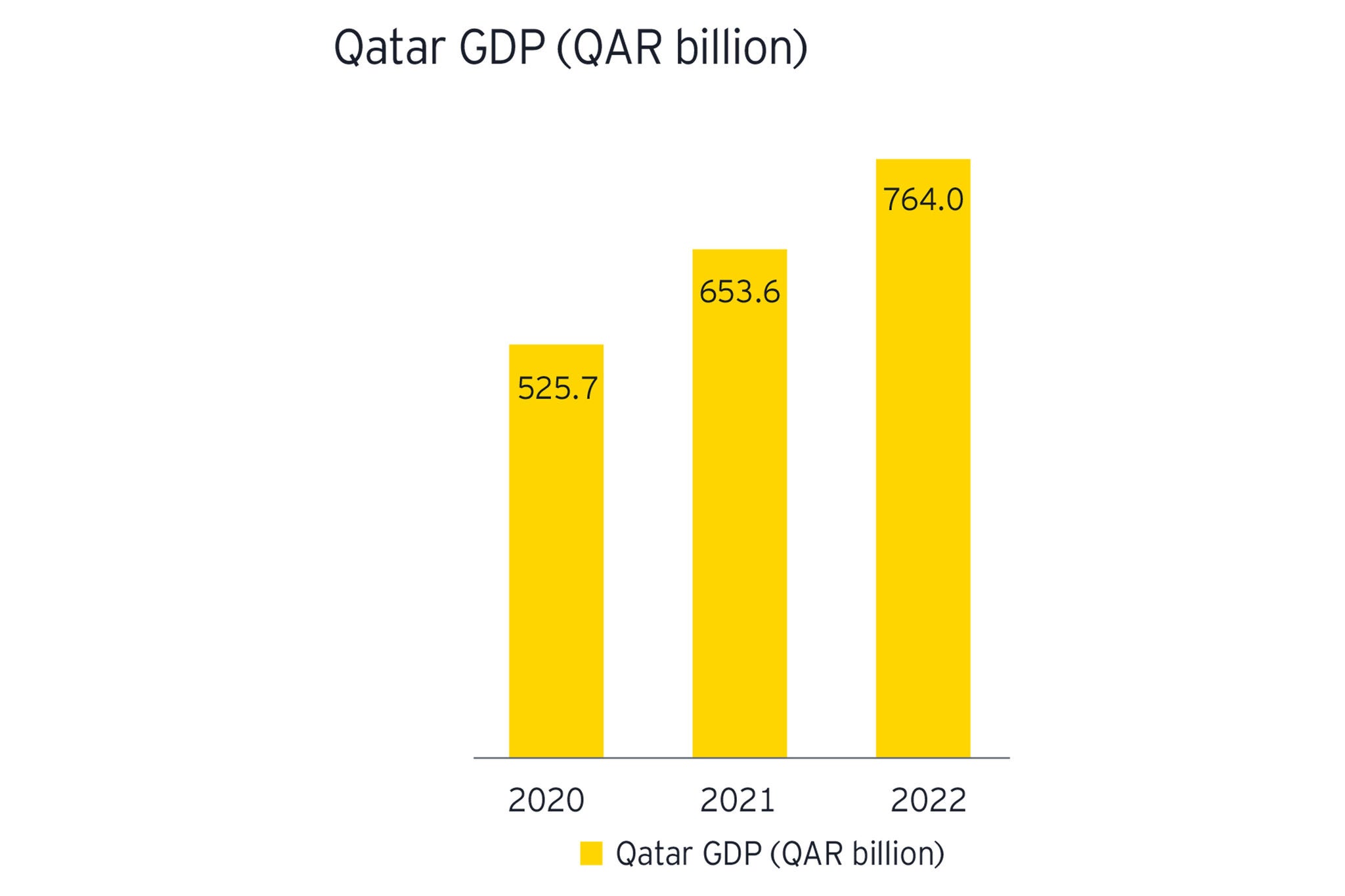

On the social and public health front, Qatar brought the COVID-19 pandemic under control through an efficient and agile vaccination program. On the economic front, Qatar maintained balanced growth rates of its GDP in 2021 and 2022. This was achieved through the economic policies adopted in line with the Qatar National Vision 2030 to develop a diversified and competitive knowledge-based economy. Looking ahead, Qatar’s economy holds the promise of many more opportunities.

Qatar is soon to be on the world stage with the long-awaited prestigious football tournament, the recently announced North Field South (NFS) expansion underway, a new global sporting event on the horizon with the recent award of the 2030 Asian Games, and the strategic national goal of diversifying the economy away from hydrocarbons. Foreign direct investments (FDIs) in Qatar have exhibited a significant compounded annual growth rate (CAGR) of 32% in projects, 28% in jobs and 19% in CapEx.

As we turn our gaze toward the future of the Qatari economy, EY Consulting LLC is leveraging its network to provide thought-provoking insights about the economic and investment outlook of executive decision makers in some of the leading businesses in Qatar. This study is based on extensive one-on-one discussions EY have had, from Q4 2021 to Q1 2022, with executive decision-makers across the largest businesses in Qatar.

Economic outlook

According to the interview, executives were overall bullish with around 82% expecting the economic growth of the coming five years to meet or exceed forecasts.

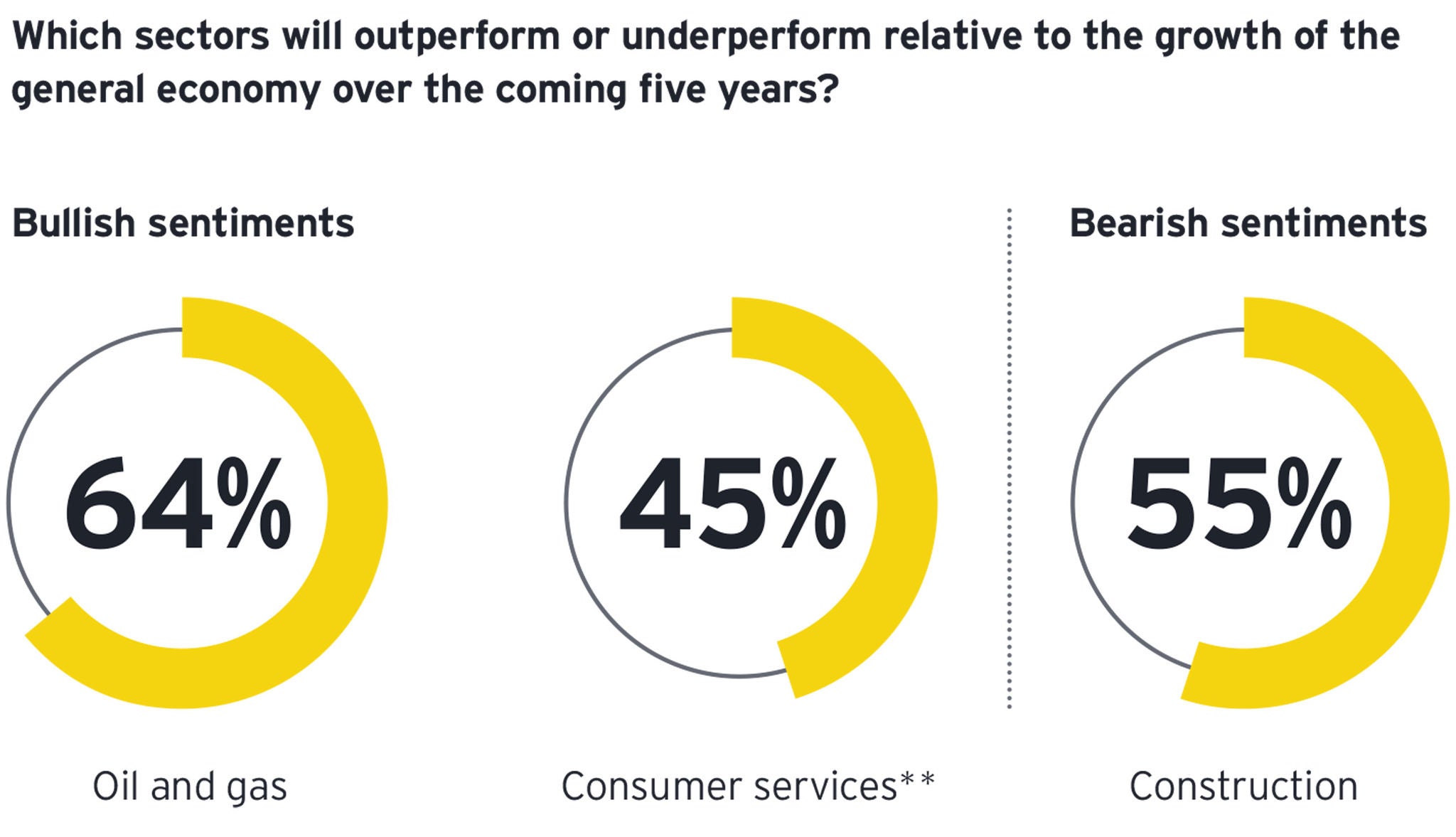

Oil and gas and consumer services had the highest bullish sentiments, with respectively 64% and 45% of interviewees expecting the sectors to outgrow the general economy over the next five years.

Around 55% of interviewees had bearish sentiments relating to the growth of the construction sector, especially since most of the mega projects will be either complete or nearly complete in the coming months. New mega projects such as the Sharq Crossing, the planned airport expansion and the development of the Lusail City project, may help alleviate some of the worries surrounding the sector’s prospects.

Investment sentiment

Nearly 60% of interviewed executives indicated that their investments have managed to yield positive returns in the past 12 months (Q3/Q4 2020 to Q3/Q4 2021), through a period which still had many imposed restrictions from the COVID-19 pandemic, indicating business and consumer activities in the country were largely resilient.

Interviewed executives were highly optimistic regarding investment performance over the coming 12 months, with 91% indicating that they expect their investment performance to improve relative to the previous year’s performance. Around 64% of interviewed executives indicated some difficulties in access to capital. However, some recent initiatives indicate that regulators are taking steps to improve capital accessibility.

All interviewed executives indicated that Qatar was and will remain the highest priority investment destination in their capital deployment strategy.

Some of the interviewed executives indicated a shift toward geographic diversification outside of the GCC region, with the share of executives indicating that the second highest priority destinations are within the GCC dropping from 73% to 45% in favor of developed and developing countries, respectively, when comparing historical vs. future capital deployment preferences.

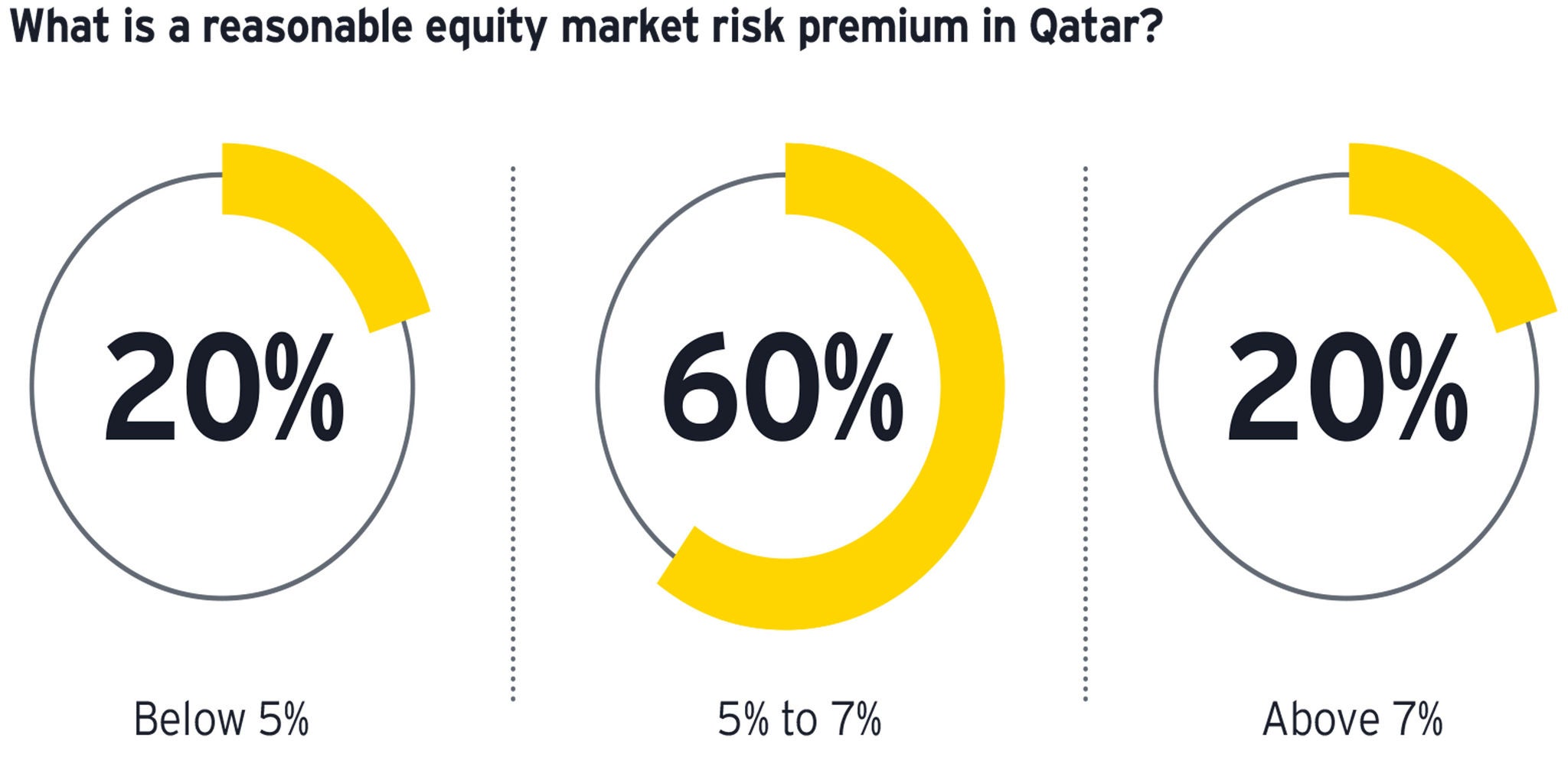

Around 60% of interviewed executives indicated that an equity market risk premium ranging from 5% to 7% is the most reasonable for equity investments in Qatar. Recent developments indicate that the government has taken some steps to improve the regulatory frameworks and processes, evident from the recent development of the single window platform for business formation, as well as the recent introduction of the public private partnership (PPP) law. Additionally, more developments in this area are expected as the government continues progressing toward digitizing its processes.

The prestigious football event of 2022

Around 55% of interviewed executives indicated that they have invested in projects specifically to capitalize on the opportunities presented by the major sports event of 2022. Half of these investments went into tourism, hospitality and real estate. Nearly 82% of interviewed executives believe that hosting the distinguished sports event would make a “strong” to a “very strong” impact in shifting the global perception of Qatar as a global tourism hub, ultimately resulting in improved tourism flows and spending. In terms of near-future impacts post the event, 45% of interviewed executives believe that real estate prices will decrease due to decreased demand and the level of real estate supply available in the market. It is worth noting that if this correction takes place, it may present opportunities for other sectors to capitalize on lower rents and potentially cheaper labor when accommodation allowances follow suit.

Conclusion

The stable and buoyant Qatar economy has been growing at a fast pace. Leading global businesses choosing Qatar as their business hub exemplify the achievement of the country in enhancing its position as a key business destination in the region. Recent initiatives, mega projects and exciting events showcase how the country is growing in terms of both socially and economically.

Related articles

How sports events can transform the Saudi Arabian economy

Saudi Arabia is experiencing a unique socioeconomic transformation in which sports take center stage in the Kingdom’s massive diversification efforts.

Prepare now for the new era of selective globalization

Exploring scenarios for the world in five years reveals divergent paths for geopolitics, economic policies and company strategies. Learn more.

How can your digital investment strategy reach higher returns?

The 2022 Digital Investment Index reveals that companies struggle with digital strategy and measuring returns on their technology investments. Read more.

Summary

The strategic initiatives and projects bolstered the resilience of the Qatari economy and aided in its sustained growth. The first edition of the investment outlook publication aims at providing insights into the investment and economic sentiments in Qatar.