EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

The entertainment sector is a major contributor to GDP, job creation, economist dynamism and cultural exchange.

In brief

- The entertainment sector, from sports, media and gaming to theme parks and theatrical events, is a major contributor to various economic developments.

- Government support of the entertainment sector is predicated on its economic and societal dividends.

- There are focus areas that could help MENA achieve its goals for the creative and cultural industries.

Globally, the cultural and creative industries accounted for US$3.4t, or 4%, of global value-added in 2019. In the US, arts and cultural economic activity accounted for 4.3% (US$919.7b) of GDP, while, in Europe, it represented 4.4% (EUR643b) of EU GDP in 2019. In some emerging economies, creative industries make a larger than average contribution to growth, accounting for 7.4% of Indonesia’s GDP, for instance, and employing 14.3% of the workforce.

Government support of the entertainment sector — through subsidies, incentives or direct investments — is predicated on its economic and societal dividends. Its financial contribution covers direct spending on events and performance, indirect spending on suppliers, vendors and business services and “adjacent” spending like merchandise or tourism. Socially, the sector improves the quality of life and helps countries to project “soft power” and find their voice in the international arena.

With strategic government investment, distinct heritage and cultures, and an engaged population, the MENA region holds the foundation for a growing entertainment sector. But to truly thrive, governments who have shown strong support for the sector to date now need to calibrate their interventions to focus on helping the private sector take the lead.

Chapter 1

Drivers of MENA’s entertainment growth

There are five growth drivers of MENA’s entertainment industry: government backing, a rich cultural heritage, theme parks, a thriving gaming and esports sector and high revenue-grossing box office entertainment.

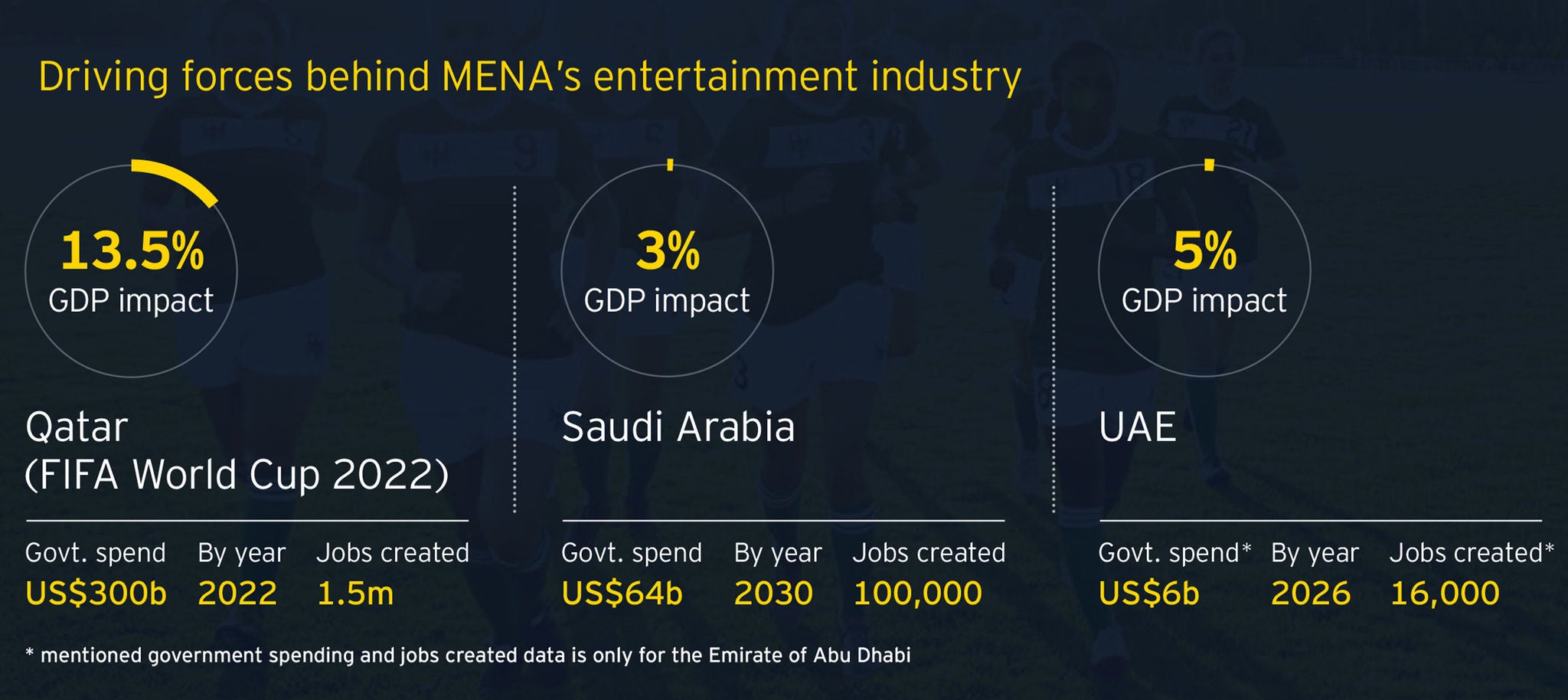

Government backing

MENA governments have demonstrated strong support for entertainment as part of their broader economic transformation strategies to build non-oil sectors and nurture industries with high job creation potential.

Rich heritage and culture

Every nation must harness its history and culture and MENA countries are drawing inspiration from their past as they build their entertainment industries of the future. Saudi Arabia is promoting their rich heritage and culture through various investments like Al Ula, Diriyah Gate, Amaala, Al Soudah, Dadan, etc., while the UAE has the Saadiyat Cultural District as well as several platforms including Sikka Arts Festival, Dubai Festival for Youth theater, and Emirates Airline Literature Festival.

Gaming and esports

Due to the high number of active and paid gamers in Saudi Arabia and the UAE, the MENA region has one of the fastest-growing gaming industries internationally. The Middle East's gaming market generated an estimated US$3.4b in sales in 2021, an increase of 19% y-o-y. In 2021, the gaming industry in Saudi Arabia brought in about US$0.9b in revenue, compared to US$0.5b in the UAE.

From leisure gaming to competitive sports and virtual reality games, the market is currently changing. Over the past five years, video game sales have nearly doubled. The biggest market is mobile gaming, which is supported by robust internet and smartphone infrastructure in Saudi Arabia and the UAE.

Theme parks

The MENA region is developing world-class themed entertainment destination parks, leveraging cutting-edge technology including augmented reality (AR) and virtual reality (VR). Major upcoming projects in the region include: Six Flags at Qiddiya, The Rig, SEVEN’s entertainment destination, Yas Island and Kuwait Entertainment City.

Box office entertainment

Box office revenues in MENA reached an estimated US$800m in 2021 and are expected to surpass US$1b by the end of 2022. Saudi Arabia has emerged as the fastest-growing market in the region, with box office revenue totaling US$238m in 2021, an increase of 95% over US$122m in 2020. The country has surpassed the UAE, which achieved box office revenue of US$130m in 2021. The total number of screens in the Middle East is expected to increase from 2,100 in 2021 to 3,100 by the end of 2024, with the most incremental growth coming from Saudi Arabia.

Chapter 2

Realizing entertainment’s potentia

A greater participation from the private sector and a shift in government attention from financing to broader ecosystem support are essential.

This chapter outlines four key focus areas which could help the region achieve its goals for the creative and cultural industries: empowering the private sector, nurturing the domestic workforce, coordinating national efforts into a coherent regional strategy, and adjusting to the opportunities and constraints of this sector in a post-COVID-19 pandemic world.

Empower the private sector

Top entertainment markets share a common characteristic: a thriving private sector, from large corporates to start-ups, freelancers and creative industry entrepreneurs. Governments are an important source of financial and policy support but ultimately, they act as a catalyst for the private sector.

Currently, MENA’s entertainment private sector is growing, but could, with the right support, expand into a leading role. To help the private sector achieve that role, governments should focus on improving digital infrastructure, introducing measures that incentivize SMEs to adapt to structural changes, including shifts in consumer behavior and seize new opportunities.

For the Middle East entertainment sector to mature and achieve its potential, the private sector needs to play a more prominent role.

Nurture the workforce

Staffing is a bottleneck for the entertainment industry currently, especially in large-scale projects and events. Despite a relatively young population, with around 400,000 new entrants to the job market every year, there are limited incentives to enter the private sector due to wage differentials and skill-set requirements. In Saudi Arabia, for instance, around half of locals are employed in the public sector, which commands an average of 55% higher pay than the private sector.

Entertainment companies are also struggling to hire foreign talent and staff due to logistical hurdles, exacerbated by the COVID-19 pandemic restrictions. Both Saudi Arabia and the UAE governments have launched initiatives to build the workforce and human capital, including academies and scholarships. Governments need to work more actively with the private sector and academia to build an ecosystem to qualify and train more talent across the value chain.

Competition vs. collaboration

Major MENA cities such as Riyadh, Dubai, Abu Dhabi and Doha are vying to establish themselves as the premier hub of economic activity in the region. Saudi Arabia’s US$800b project to double the size of Riyadh is, for example, a challenge to Dubai’s status as the primary business center. From January 2024, the Saudi Arabian government will no longer sign government contracts with foreign companies that base their Middle East headquarters outside of the country.

The challenge, in economic policy and entertainment, is balancing healthy competition that encourages investment and an improving environment, vs. an unproductive competition that cannibalizes on each other’s efforts. One helpful approach in entertainment is to regionalize events and entertainment and work to support tourism across multiple destinations to encourage tourists to broaden their interest in the region.

There are signs of such coordination efforts. The UAE hosted the 22nd session of the Conference of Arab Culture Ministers in collaboration with the Arab League Educational, Cultural and Scientific Organization (ALECSO) in December 2021. The conference discussed a comprehensive plan for Arab culture and its modernization while promoting cultural cooperation among Arab nations. The main discussions of the conference centered on unifying Arab efforts in various cultural fields and the development of cultural and creative industries in the region. Similar collaboration efforts should be promoted across other fields, including media, entertainment, and sports both regionally and at the country level. The companies can also work together to form regional industry associations which can help coordinate international regulatory affairs as well as help exchange information, experiences and ideas of common interest.

Adjust to post-pandemic realities

Entertainment was hit hard by the pandemic and despite the resumption of entertainment activities, the recovery might take longer than anticipated as audiences cautiously return to live in-person events. In addition to health rules, limited attendance, and social distancing norms, venues and park operators have implemented innovations like virtual queues, mobile food ordering and contactless check-ins to enhance safety and improve customer experience. This has led to the proliferation of virtual platforms not just as a medium to entertain but as an interactive arena for audience engagement. As with so many other parts of the economy, the pandemic has permanently changed working norms.

Although some innovations were the need of the hour and carried out purely from a health protection standpoint, they are likely to stay, as they offer improved convenience and better customer experience. The pandemic has, for instance, fast‑tracked innovations such as cloud-based solutions, digital payments and AR/VR, aimed at enhancing the customer experience. Guest expectations will rise as they start looking for new attractions and operators should plan and budget for reinvestment accordingly.

Young, tech-savvy consumers expect high-quality attractions with a strong technology component. In the future, attractions will need to design their offerings, differently. The use of apps, radio frequency identification (RFID) tags and enterprise software programs allow for rich data collection which can improve everything from ride maintenance to experience personalization. Attractions and amusement park operators need to use enhanced technologies such as data analytics and predictive algorithms creatively to meet rising demands, if they are to maintain occupancy and offer the best guest experience. Music venues, festivals and venue operators are expected to push ahead with creative audience layouts such as boxed seating and car-park concerts to encourage attendance, while also promoting interactive options for fans who are not yet comfortable coming out for an event.

Conclusion

Leading MENA governments have lent sizeable financial and institutional support to their entertainment industries, which they rightly see as essential to economic diversification, job creation and cultural enrichment. To compete with global entertainment hubs and shift into a higher gear, the sector needs to transition to a private sector‑led approach. Governments have an opportunity to shift focus from financing projects to nurturing the ecosystem through capacity-building, incentives and business climate reforms, and regional collaboration to help entertainment become a driver of economic and social progress.

Related articles

Is the digital home immune to the cost-of-living crisis?

Despite financial pressures, few households are economizing on digital home services. Read more.

How sports events can transform the Saudi Arabian economy

Saudi Arabia is experiencing a unique socioeconomic transformation in which sports take center stage in the Kingdom’s massive diversification efforts.

Summary

The MENA region has the fundamentals for a vibrant and growing entertainment sector. But to keep up the momentum, governments need to gauge their interventions to focus on helping the private sector take the lead. According to EY research, there are five growth drivers of MENA’s entertainment industry. Apart from that, there are key focus areas that could help the MENA region achieve its goals for the creative and cultural industries.