EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Generative AI set to unlock a new era in banking, transforming financial services and generating billions in value.

In brief

- Generative artificial intelligence (Gen AI) could radically change financial services, potentially generating higher value by 2030 and enhancing productivity.

- Financial institutions are increasingly exploring Gen AI applications, seeing improvements in operational efficiency and customer service.

- Even though MENA banks are ideally positioned to exploit AI, they need to address data quality and accessibility issues to fully harness this technology.

Gen AI will transform financial services, for example, with wholesale banking products and services dynamically created and reconfigured in response to individual client needs and market conditions. In many cases, entirely new products may be created on the fly. These would be supported by associated risk and credit scoring models, as well as automated front-to-back fulfilment, operational and product servicing processes.

EY analysis suggests that rethinking the traditional financial institution with Gen AI at its core has the potential to create US$200b to US$400b in value by 2030. Additionally, productivity gains could reach up to 30% by 2028, supplementing new revenue opportunities. Many of the enabling technologies required for adaptive AI powered banking already exist. These include tokenization, virtual products and digital wallets, electronic transactions, straight-through transaction processing and product accounting, as well as sophisticated cloud-based risk and financial crime detection models.

Gen AI provides the intelligent natural language orchestration capabilities that are required to fully enable adaptive banking. These capabilities include:

- Large language models (LLMs) that can interpret natural language queries and commands, and translate these into machine-executable queries and commands.

- Graph search models that are able to rapidly parse and continuously index large volumes of text and quantitative data, as well as assess end-to-end client and risk processes.

- Constructor capabilities required to create new products and process journeys, e.g., as demonstrated through natural language prompt-driven AI image creation tools like Midjourney, and code creation tools like OpenAI Codex.

Financial services players leveraging Gen AI capabilities

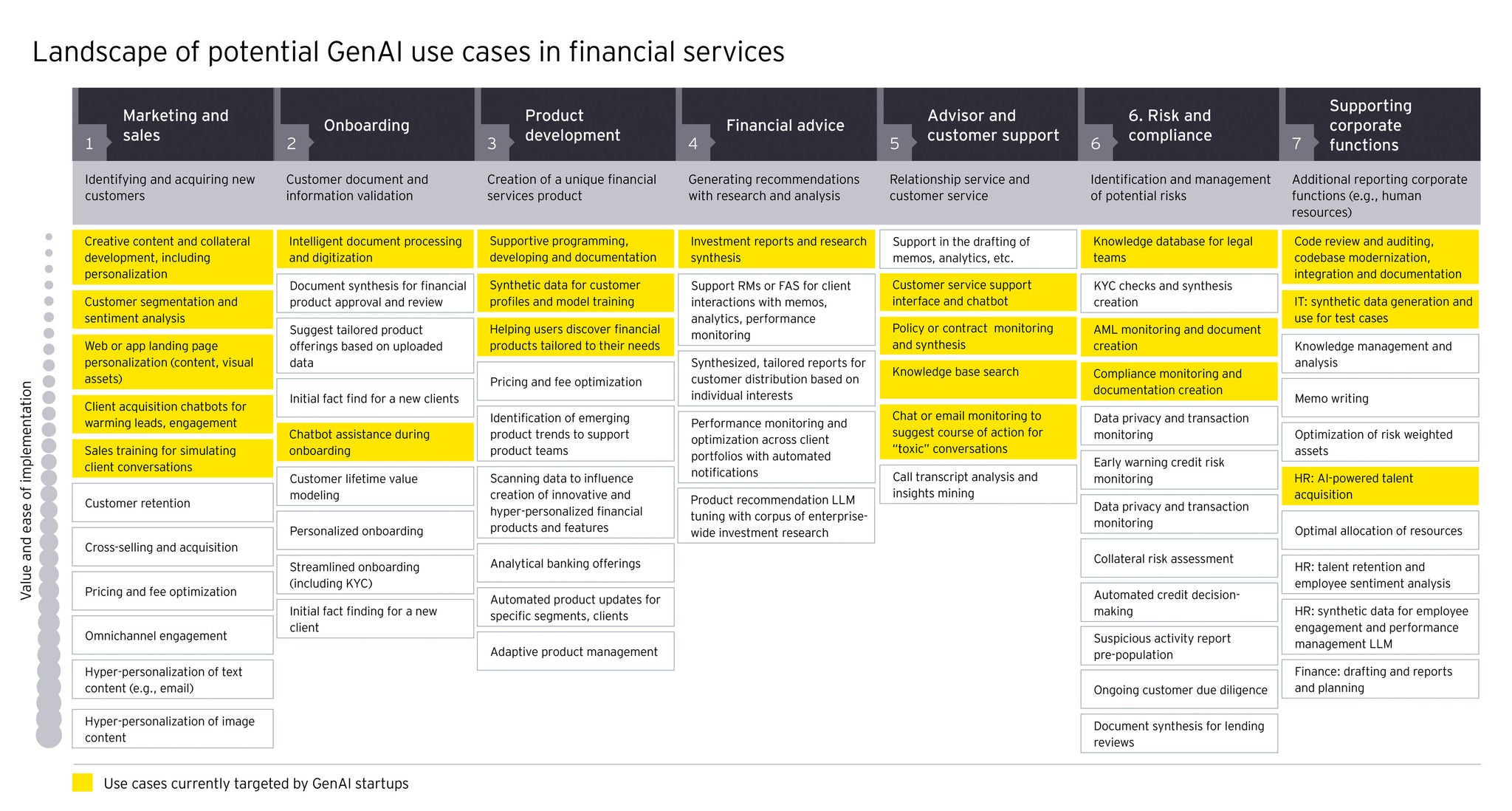

Banks, nonbank financial services players, and FinTech or Big Tech are at different stages of the journey to harnessing Gen AI capabilities. Established financial institutions are experimenting with Gen AI use cases, initially in marketing and sales, customer support, risk and compliance. They have improved product search and client service capabilities and have initiated change programs to overcome the obstacles posed by data quality issues, fragmented processes and systems, and legacy risk policy frameworks.

Some financial institutions are pressing ahead and applying Gen AI tools to assessing and adapting both risk control frameworks and processes, as well as client onboarding and service journeys. They are beginning to see early gains in operational cost reductions, significantly improved client onboarding and servicing journeys, as well as dynamic financial crime controls.

Forward-thinking technology teams in large financial institutions are also applying Gen AI solutions to harmonize legacy enterprise technologies, thereby reducing technical debt and freeing up operating costs for innovation. Large language model-powered (LLM- powered) code generation and debugging tools speed up such technology modernization efforts by identifying the underlying business logic constructs. They also help in delivering modern and scalable microservices-based designs. Low-code or no-code Gen AI platforms available in the market automatically generate documentation for the modernized codebase, as well as the API code for integration with the rest of the technology landscape. Some of the more innovative emerging Gen AI solutions also use Retrieval and Augmented Generation (RAG) to iteratively learn and adopt coding standards specific to each financial institution, based on architecture design and standards documentation.

Similarly, COOs are exploring opportunities to convert traditional cost centers such as the procurement function into revenue-enabling entities by repurposing the enhanced insights, decision-making capabilities, and automated AI agents gained from Gen AI solutions, to offer “procurement-as-a-service” to smaller supplier partners, as well as affiliates. The most innovative banks and FinTechs are exploring opportunities to dynamically reconfigure products, or to create new products on the fly, in response to evolving client needs and market conditions, with one major APAC bank recognizing that Gen AI can produce 40% of its product manufacturing requirements.

MENA banks ready to harness Gen AI opportunities

Banks across the region are uniquely well positioned to leapfrog their peers in other parts of the world in leveraging Gen AI to drive growth with adaptive new product management capabilities, while also increasing the share of risk-weighted assets (RWA) and driving down operating costs.

Sovereign funding enables these banks to focus on long-term investments and growth opportunities and many have invested heavily over the past five to seven years in upgrading their technology infrastructure. As a result, more banks in the region have adopted flexible, scalable cloud-native technologies and modular API-enabled product platforms, as well as platform-centric operating models. These banks are largely free of legacy technologies such as mainframes. They do not have mission-critical systems with a large overhang of technology debt and key man risks from a dwindling pool of resources conversant in legacy programming languages such as Common Business Oriented Language (COBOL).

Both banks and national regulators across MENA are innovation-focused, with mature regulations on cloud and blockchain technologies, thriving FinTech ecosystems, well-established national identity management infrastructure, and large pools of data available for training Gen AI models. Banks in the region have long embraced FinTech and are well positioned to rapidly incorporate innovation generated through the FinTech hubs in Dubai, Abu Dhabi, Doha, Riyadh and Cairo.

Senior executives at financial institutions across MENA want to invest but they have concerns as to where to start, unclear returns on investment (ROI), feasibility of integration with existing enterprise systems, execution capabilities in-house, LLM risks such as data privacy and security along with other concerns such as model biases, hallucinations and inability to explain with clarity. In some cases, Gen AI technology is useful in identifying the most relevant use cases to pursue. These use cases would be optimized for ROI, ensure integration feasibility, reduce compliance risks or cater to some other set of prioritization criteria.

CFOs at financial institutions also worry about the nontrivial costs of resources required to operate the better-known generalized LLM platforms. Banks are increasingly turning to smaller, more specialized domain models that can be finely tuned on proprietary data, creating a competitive edge while also being more cost-effective. These domain-specific models require fewer tokens to perform tasks, thus reducing operational costs. Additionally, most established financial institutions as well as FinTech institutions rapidly progress from initial exploration with a single LLM to a portfolio of domain-specific models tuned for specific use case categories. These categories would be based on a common substrate that both protects sensitive data and allows results to be compared on a like-for-like basis across multiple LLMs.

Data, however, is a core capability gap for most MENA banks, despite years of spend on data lakes; challenges range from incomplete and inconsistent data on customers, products and transactions, as well as disparate data sources and technologies. Focused effort is required to produce robust, augmented and synthetic data sets for customer needs profiling, product profitability analyses, risk and regulatory compliance model training. Finally, access to data remains a challenge for over 65% of financial institutions, with fragmented data ownership and governance limiting the ability to rapidly adopt GenAI and machine learning (ML) technologies at scale.

New capabilities required to deliver adaptive banking

To capitalize on the most promising opportunities from adaptive banking, banks will need several key building blocks to leverage the natural language orchestration and product manufacturing capabilities of Gen AI.

At EY organization, we have identified specific AI pathways banks and FinTechs that are taking initial steps and have captured significant lessons learned across the retail and wholesale banking, wealth management and insurance sectors. We have built these insights in EY.ai platform that combines our vast experience in strategy, transactions, transformation, risk, assurance and tax, with EY technology platforms, ecosystems and leading-edge capabilities. Finally, the EY global alliances network provides MENA financial institutions and FinTech institutions alike with access to proven Gen AI solutions from both large global technology partners, as well as innovative new startups.

Related articles

How real time payments are revolutionizing the payments ecosystem

Real time payments are transforming the payment industry but this shift from cash to digital transactions presents security challenges that need to be addressed. Read more.

Summary

Gen AI is poised to revolutionize banking by dynamically creating responsive services, potentially adding US$200b to US$400b value by 2030. Existing financial institutions are exploring AI use cases in areas like customer service and risk compliance, demonstrating operational cost reductions. However, issues including data quality and fragmented legacy systems pose challenges. MENA banks are uniquely positioned to leverage AI, thanks to substantial technology investments and robust regulatory frameworks. Yet, they too face data quality and accessibility challenges, which must be addressed to fully harness AI's potential.