EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Climate change and sustainability services

Our multidisciplinary teams can help companies understand the risks and opportunities arising from climate change and sustainability issues.

Our latest thinking

How can investment in EHS drive corporate success?

New EY study explores links between companies’ EHS function maturity and their financial, social and regulatory performance. Read more.

Why should financial institutions be on a mission to reduce emissions?

Accelerating decarbonization is urgent. Learn why private sector institutions must play a key role in addressing the current shortfalls in climate finance.

How to accelerate transition finance for net zero

Learn why FIs need to operate iteratively to effect transition finance at pace and scale in a complex ecosystem.

Why there can be no ESG without EHS transformation

By leveraging the learnings and practices of EHS professionals, business leaders can accelerate ESG performance. Learn more.

How can better sustainability reporting mobilize companies and capital?

The EY Global Institutional Investor Survey examines how better ESG data and reporting can accelerate sustainability outcomes. Learn more.

How motor racing is accelerating toward action on climate change

Learn how EY has helped Extreme E turn its sustainability ambitions into action in this case study.

How can corporate reporting bridge the ESG trust gap?

The EY Global Corporate Reporting and Institutional Investor Survey finds a significant reporting disconnect with investors on ESG disclosures. Learn more.

How can sustainable finance transform 2050 pledges into real-world impact?

Financial institutions need a framework that allows them to anticipate seismic economic transformation and adapt their strategy accordingly. Learn more.

How will understanding climate risk move you from ambition to action?

The fifth EY Climate Risk Barometer shows an increase in companies reporting on climate but falling short of carbon ambitions. Learn more.

Why transition pathways are critical to net-zero success

Sector-specific transition pathways are critical to the financial industry’s ability to turn climate ambition into climate action. Learn more.

Four steps financial institutions can take on the path to net zero

Innovative decarbonization strategies linked to clients’ transition pathways are becoming vital to success. Learn more.

Five priorities to build trust in ESG

ESG investing is at a critical moment. As historical levels of capital are fed into ESG funds, questions emerge on how useful ESG data is. Find out more.

Does the need for energy security challenge the quest for net zero?

The power market is in flux and gas prices are high, but can green technologies and alternative fuels offer energy security? Read more in RECAI 59.

Why biodiversity may be more important to your business than you realize

Businesses should act now to measure and mitigate their impact on biodiversity.

How can boards strengthen governance to accelerate their ESG journeys?

With an increasing focus on sustainability, European boards must address ESG factors to unlock new sources of value creation. Find out how.

How financial services can mobilize capital to deliver net zero

Learn how financial services firms can mobilize the capital flows needed to deliver net zero.

Is your ESG data unlocking long-term value?

Better environmental, social and governance (ESG) insight and data analytics could be critical to delivering long-term value. Find out more.

What to watch as global ESG reporting standards take shape

The launch of the International Sustainability Standards Board is a significant development in the transition toward a green economy.

How investors can help finance a green recovery

Investors are pursuing green recovery opportunities, but a long-term strategy could be needed to avoid a market bubble. Find out more.

Where are wealth and asset managers on their sustainability journey

The industry has both a responsibility and an opportunity to play a pivotal role in enabling the transition to a more sustainable future. Learn more.

Why climate change creates a need for better nonfinancial disclosures

There is an urgent need for the audit of the future to provide a better assessment of the climate risks faced by businesses. Learn more.

How the EU’s new sustainability directive is becoming a game changer

Learn how the EU Corporate Sustainability Reporting Directive will change your sustainability reporting.

Why there are growing calls for global sustainability standards

Find out why now is the time to establish globally consistent standards for the reporting of nonfinancial information.

Why economic revival should be based on green growth

Climate-friendly investment projects are widely available and could help to stimulate a green recovery in a post-COVID-19 world. Learn more here.

Why ESG performance is growing in importance for investors

The post-pandemic investment landscape is set to place greater value on environment, social and governance (ESG) disclosures. Find out more.

Why your climate action today may impact your lending terms tomorrow

The cost of finance is becoming more closely linked to ESG performance as companies face increased pressure to address climate action. Learn more.

Why it’s important to measure and report long-term value

The Embankment Project for Inclusive Capitalism is working to improve the way that businesses measure and report on the value they create.

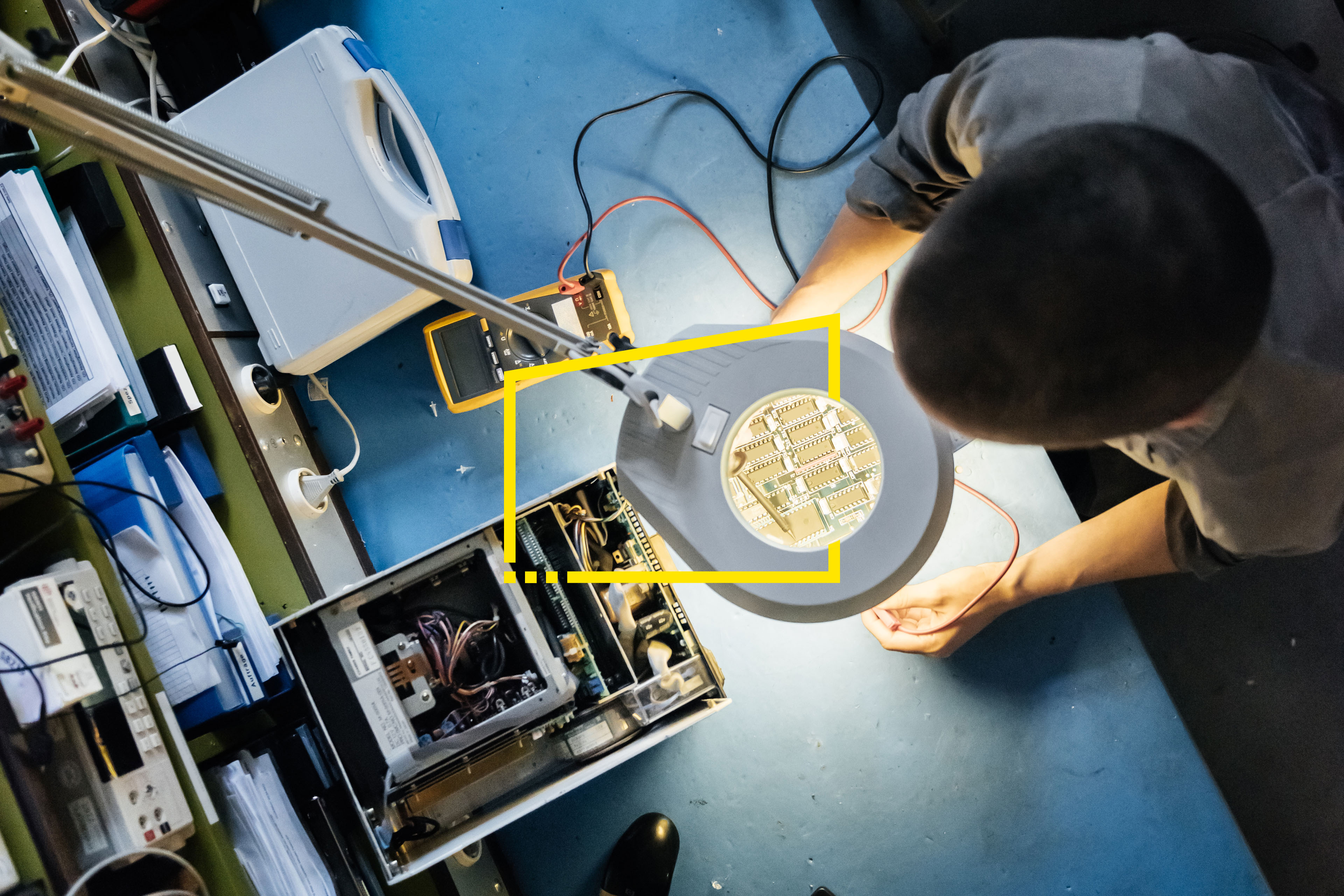

Is it time to reassess your EHS capabilities?

As humans and machines start working side-by-side, traditional environment, health and safety (EHS) models no longer capture every risk.

How can the EU Green Deal redefine sustainable growth globally?

The circular economy will help the EU boost its competitiveness and change the world for better.

Next up: Stéphane Germain – protecting earth’s environment from space

EY Presents Next Up: Builders of a better working world. Learn more.

Is modern slavery a risk to your value chain?

Effective management of issues relating to modern slavery and human rights has become an urgent business priority.

How to support better environment, health and safety outcomes

Organizations can improve productivity by better managing environment, health and safety risks. We explore ways to climb the maturity curve.

How to improve the business with an EHS data analytics strategy

Data and analytics are important to lead environmental, health and safety programs that may help strengthen the reputation of the business.

Direct to your inbox

Stay up to date with our Editor's picks newsletter.

How EY can Help

-

Supporting organizations with physical and transition risks associated with climate change, and assisting them with market and regulatory changes.

Read more -

EY teams can help address ESG and sustainability issues, investor concerns and improve ESG performance. Find out how.

Read more -

EY CCaSS teams can help reduce the risk of EHS incidents and support decision-making to improve outcomes associated with EHS. Find out how.

Read more -

Through enhanced corporate reporting, EY can support finance teams to meet demands for high-quality enhanced financial and nonfinancial information.

Read more

The team

Careers at EY

At EY, you’ll have the chance to build a career as unique as you are, with the global scale, support, inclusive culture and technology to become the best version of you.